Permanent Establishment (in Model Agreements and DTAAs)

Capital Gains

Royalty

Fee for Technical Services

Tax Information Exchange Provisions

Tax Credit / Refund Provisions

Fixed Place PE

Agency PE

Service PE

Loading...

Loading...

Global corporate compliance market is huge and growing very fast

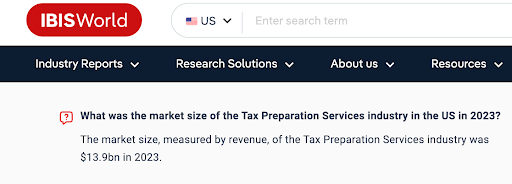

Here is the US tax preparation industry market size:

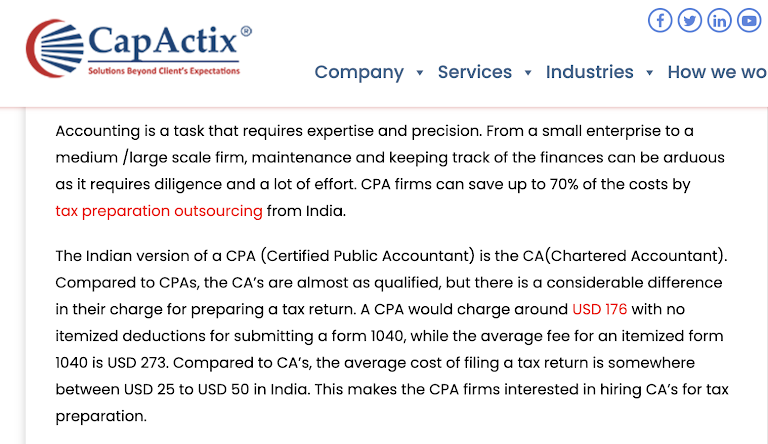

Indian CAs and CS can do this work, due to a massive cost advantage.

Big Four and some CAs sitting in Gujarat, Maharashtra or Rajasthan who have set up their own KPOs, but they are only able to serve the top 5% of the US market.

The remaining 95% of the startups and SMEs are not being served by such professionals.

As an Indian CA/CS you have a massive cost advantage.

It’s a game changer for Indians CA CS from developing countries, because we have a massive cost advantage over the rest of the world.

As a compliance professional you can jump into the remote version of Silicon Valley that exists on the internet today. You could be part of the virtual Wall Street ecosystem, without having to worry about a visa!

Even lots of companies and startups have a standard CPA or corporate secretary and will take you onboard to reduce their costs.

Where needed, your clients will engage external CPAs or corporate secretaries to review your work and still save tons of money.

If you can earn 10 dollars per hour, and work for 200 hours in a month, you will be able to earn USD 2,000 - would you like to earn this kind of money?

This is only 8 hrs/day of work, for 25 days in a month!

This is a very cost effective proposition for foreign clients because minimum wages for even unskilled labour - a courier delivery boy, or someone who wants to work in a McDonalds, is higher than USD 10/hr!

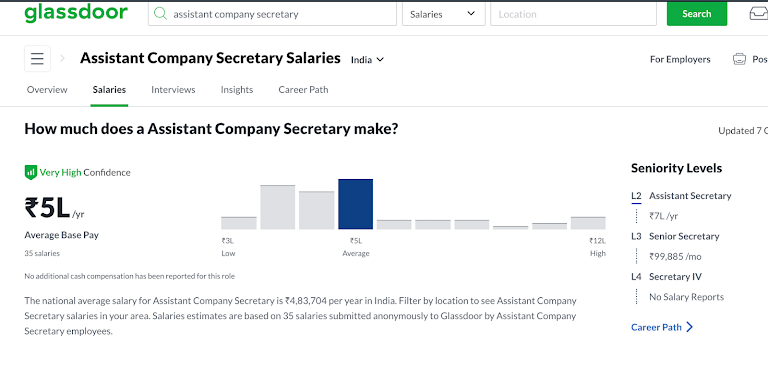

You will understand when I show you how much Company Secretaries and CPAs earn in the USA compared to India:

Average earnings of a young CS in India:

Average earning of a CPA:

Average salary of a Chartered Accountant in India:

But I don’t know US tax and compliance work - How difficult is it to learn US law and compliance?

Turns out that it is not very difficult, and we have already been training several CAs and CS on it.

Btw, it is easier to do compliance filings in the US than in India because more information is digitally and openly available.

Imagine that you are running a law firm or a CPA firm.

You have hired 10 such CPAs.

All these people are working remotely anyway.

Now you realise that you can hire a good CA / CS from India, who may have worked in a Big Four or top CS firm, for USD 2000 per month, and provide to your teams of US CPAs as a paralegal resource or as an assistant to increase their productivity.

Do you think you will try it? Is it a good idea?

Does this make sense to explore at least?

What if you realise that your competitors are already doing this and by not doing it you will become uncompetitive?

imagine another scenario.

There is a startup in a Silicon Valley garage.

It is going to be the next big thing.

It gets into a premium accelerator. It’s getting interest from investors. Raises a seed round.

Investors are expecting them to run a tight ship, and hire a compliance professional.

The CA/ CS will bill them at least USD 50,000 per year.

They also have an option of hiring an Indian CA CS CMA to help them with a part of the work and drastically reduce that 50k bill to around 10k.

Also they are already used to hiring Indian techies remotely.

Will they say no to hiring a remote paralegal or virtual assistant who is conversant with US law but costs 1/5th?

What would you do if you were a startup CEO in the same situation?

A US CPA / corporate secretary costs an arm and a leg, but you can hire someone at 1/10th the cost from another country where CAs and CS are not as expensive, who knows transfer pricing, tax litigation work , can make business, corporate and tax filings.

A unique opportunity is brewing. It’s incredible and unprecedented.

Never in history before you could sit in India and work for fast growing US startups. It is incredible.

Big 4 accountancy firms as well as all other accountancy firms are always prepared to employ qualified and capable tax lawyers

Access study materials via our online portal & via our anroid & iOS apps.

You will receive hard copy study material delivered to your address.

Two practical exercises every week, each followed by written feedback.

Live online classes based on exercises, allowing questions and feedback.

Classes held after work hours, typically on Sundays or after 8 PM on weekdays.

Live doubt clearing for support and one-on-one sessions with mentors.

Note: This is an indicative list of our guest faculty members and not an exhaustive list. We may change the faculty members at any point based on availability.

If you take this course, follow it diligently for a month, attend all classes and do all the exercises but still do not find value in it, or are not able to understand or follow it or not find it good for any reason, we will refund the entire course fee to you. It is a 100% money back guarantee with only one condition, you must pursue it properly for a month. If you don’t find it valuable after that, get your entire money back.

We are the only organization in India which teach this kind of comprehensive corporate taxation course. Many employers, law firms and companies are happy to recruit our high performing students. If you do well in your exercises and classes, we can help you to get jobs, internships and assessment internships in good law firms, with renowned lawyers as well as in various companies.

Permanent Establishment (in Model Agreements and DTAAs)

Capital Gains

Royalty

Fee for Technical Services

Tax Information Exchange Provisions

Tax Credit / Refund Provisions

Fixed Place PE

Agency PE

Service PE

Mauritius for investment and financing transactions

Singapore

Dubai

Cyprus

International cooperation under DTAAs

Tax Information Exchange Agreements (TIEAAs)

Case study of Switzerland’s secrecy norms under DTAAs

Comparable uncontrolled price method (CUP)

Resale Price Method

Cost-Plus Method

Transactional net Margin method(TNMM)

Profit Split Method

Above prices are inclusive of all applicable taxes and charges.

Standard

Standard

Printed study material (by courier)

1 online live class/ week

2 practical or drafting exercises per week

Get digital access to entire study material

Access on LMS, Android & iOS app

Instructor feedback on assignments

Unlimited doubt clearing sessions.

Instructor led course with online live classes

Online exams (give exams as per your convenience on given time slots)

Certificate (by courier)

CV enhancement

Coaching for professional networking

Training for writing and publishing articles

Internship & Job Support

Interview preparation guidance

Access to updated content online for 3 years

Top students are recommended to law firms and companies (as applicable)

+91 80474 86192 / +91 9818678383

+91 80474 86192 / +91 9818678383

ADDICTIVE LEARNING TECHNOLOGY LIMITED

ADDICTIVE LEARNING TECHNOLOGY LIMITED

Hi! Get the Free Course Study Materials in your email inbox!

Hi! Get the Free Course Study Materials in your email inbox!

![]() 7th to 9th June, 2024, 7 to 10 PM IST

7th to 9th June, 2024, 7 to 10 PM IST

We will let you know when we take more enrollments.

International Opportunities in Contract Drafting

7th to 9th June, 2024, 7 to 10 PM IST

International Opportunities in Contract Drafting

7th to 9th June, 2024, 7 to 10 PM IST