Introduction

Have you ever been to a European country on a tour?

And at that time, have you wondered what it would be like to live and work in that country?

European countries are known for their work life balance, unlike the US. Europe also affords a really huge market, considering that the European Union (EU) is an economic and political combination of 27 countries.

But it’s not like you can board a plane and land straightaway in Europe to live and work there, right?

In order to secure any kind of work in a European country, you would need to have some qualifications and work experience that they recognise. Unfortunately, the standard specialisations in law that you would find in India aren’t something that are a skill shortage in these countries.

If you want to survive there, you would need to know the laws of these countries themselves. For this, you would probably need to study a Masters programme in these countries, right?

This is not something that everyone can manage. For one, even the second tier universities in relatively cheaper countries in Europe can be expensive for an Indian student. Consider University of Barcelona, Spain, for example, which is ranked 30 in the list of top universities in Europe (see here) can cost up to EUR3300 (approximately INR 290000) for a masters degree spanning one year.

Secondly, the costs of living in these countries can be killing, at approximately EUR 750 - 1100 per month, depending upon the country and the place where you are living.

And yet, even that is not enough, because the local lawyers would anyway be better at the local laws than you. And they would have worked for a European employer or a client.

So how do you crack this?

Actually, the pandemic already did something to change the situation.

It is the “death of geography”, as a leading newspaper in India calls it.

During the period when the pandemic cast complete terror, many organisations moved their processes online because they had to. These organisations do not have intentions to move functions which can be managed online back to the brick and mortar form anytime soon. They found that it is possible to manage these efficiently and cost effectively online and more importantly, they are not eager to leave their functioning vulnerable to take a hit again.

The internet does not have geographical borders. Cloud based systems can be equally available to someone in Europe as they would be to someone in the US, India, Singapore or Australia. Consequently, work which can be delivered by someone in Europe can be delivered by someone in India, provided they know how to do it.

At least, the industry seems to think this.

This is why you can see that the list of remote jobs and freelancing paralegal opportunities has consistently kept on increasing on job portals and freelancing sites such as UpWork, Fiverr and Freelancer.

European countries, which are fabled to be traditional, have also begun to adapt to remote or “homeworking” or “home based” legal jobs.

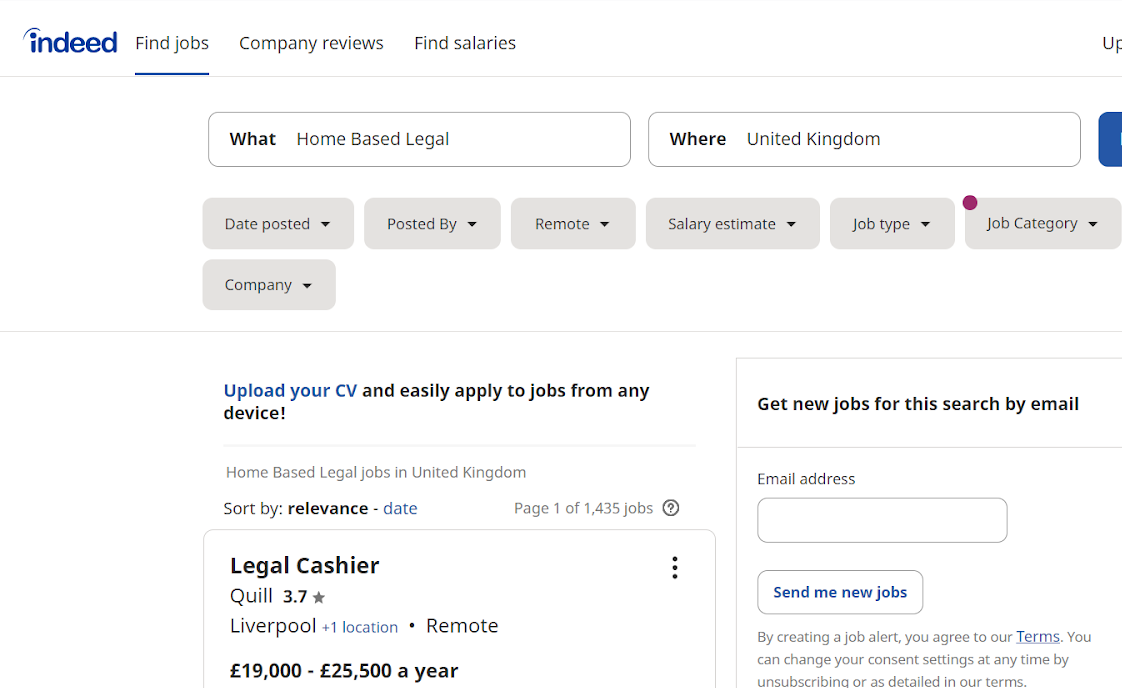

For example see here:

A search for ‘Home Based Legal’ jobs in the United Kingdom, gives over 1400 jobs as a result, just on one website - Indeed.

You already have the advantage of talent arbitrage, because a lawyer in India would cost far less than minimum wage regulated European countries.

Specialisation I: Business Laws and Commercial transactions

No business in the world can afford to exist in complete ignorance of the applicable law. Conversely, no lawyer in the world can be really successful without understanding what businesses want.

This is universal.

Although the usual belief is that law is local and lawyers in one country cannot understand the law and legal systems in another, there is no reason why legal work which is based on business functions and objectives cannot be undertaken internationally.

Let’s pause for a moment and think here: do the objectives of businesses and founders change, depending upon the geography? Don't the majority of businesses in the world aim for profit and / or growth?

Don’t the founders of for-profit businesses aim to maximize profits, without falling prey to faulty processes and hefty fines?

Aren’t the lawyers supposed to guide the founders how to achieve this?

If this is the objective of a lawyer, he or she should be able to undertake any legal function which does not require a physical presence, for any business in the world.

The style of drafting contracts may differ, but the negotiations of terms remain the same globally. If you’re drafting a shareholders agreement, to a large extent, the commercial intentions of the founders and investors remain the same, be it India or Europe or US or UK. And the commercial intentions are what get boiled down into terms.

Corporate Governance principles remain the same everywhere. You can find multinational companies having internal policies applicable to all of their subsidiaries throughout the globe.

But for this to materialize, it is essential that a lawyer understands the way a business operates, the organs of a business, its assets, its objectives and transactions very well.

Specialisation II: International trade and taxation

Right from the birth of a business, you would find its management conscious of one thing. If you mention this, you have a businessman’s immediate attention.

This one thing is taxation. Taxation is what allows you to get to the chest of founders and management, irrespective of whether it is a small startup or a large multinational corporation.

While startups may struggle with the applicability and timely compliance, multinationals will struggle with structuring their taxes to minimise the dent that such taxes cause in the distributable profits of the company.

According to this IMF article, tax havens collectively cost governments amounts between USD500 billion and USD600 billion in lost corporate tax revenue. American Fortune 500 companies alone held an estimated USD2.6 trillion offshore.

Governments compete to reduce tax rates and invite more investment and increase employment in the country, and this allows multinationals to “structure” their taxes with having a base in one country, having assets in another and having markets and customers in yet another country.

Obviously this kind of planning is not easy.

It needs a detailed study of international taxation mechanisms, particularly the ‘charging events’ and also needs a knowledge of the tax laws of multiple countries.

A need to possess knowledge about international taxation is of even greater significance where international trade is on an increase. The provision of services over the internet has skyrocketed. Consider how many of you began to use Zoom, MS Teams, Google Meet or Webex in 2020-2021 (all examples of SaaS).

In this research by a Forbes Councils Member, the SaaS revenue is projected to be USD369.4 billion in 2024.

And it’s not just SaaS. As the world becomes more borderless by the day, international trade is only ever going to increase in other spheres. Along with using Zoom, you would easily find people who have ordered something or other through AliExpress. It most likely does not come from a supplier in your country.

There are many people who successfully initiated dropshipping businesses in 2019, and while the euphoria around it might have receded, it’s still projected to increase in size, given that people have and want more and more choice in products now.

These kinds of businesses which are international right from the start will need more and more professionals who understand international trade and taxation.

Why does a degree from a Polish university make sense?

Poland has emerged as the new outsourcing destination with banks, law firms, professional services companies, multinational financial institutions and global conglomerates looking to move more complex tasks out of their head offices to Central Eastern Europe. With Poland's (cities like Warsaw, Wroclaw, Krakow, Gdansk) proximity to western capitals, EU membership, large talent pool and lower costs, it has now become the financial hub. With Brexit, companies are looking at other cost friendly options which would grant access to the EU's single market.

Law Firms are also shifting base to Poland so as to have access to the EU's legal and regulatory framework. Poland is now beginning to pose a challenge to India as the financial services industry’s preferred location for back-office functions.

Poland's experienced professionals, deep and rich job market, predictable employment and labour laws, low labour cost, flexibility in work organisations and strategic location have made it a true leader in the European SSC/BPO sector. For western companies, the attraction of outsourcing to Poland is the chance to cut costs without cutting expertise.

Deutsche Bank, State Street, Toshiba, Sony Pictures, Bayer, ThyssenKrupp, Arla, Wipro, Staples, PwC, Lufthansa, Thomson Reuters, Cognizant, Jones Lang LaSalle, HSBC, Credit Suisse, Goldman Sachs, UBS, RBS, JP Morgan Chase & Co, BNY Mellon, ABSL, Royal Dutch Shell, Amazon, Procter & Gamble, Citi group, Accenture, Hewlett-Packard, Infosys, IBM, Motorola, CapGemini, Dentons Law Firms, Linklaters (law firm), Baker McKenzie (law firm), DLA Piper (law firm), White & Case LLP (law firm) are few companies/firms who have offices in Poland and have generated close to 300,000 employment opportunities.

With Poland becoming the new hub for shared service centers, there will be huge demand for people who have studied from a university there, especially people with knowledge of international business laws, commercial transactions, international trade and taxation. Europe is a promising destination for law graduates to pursue international law, especially international trade law, mostly because of the significance of the region and its contribution to international trade. An LL.M from Warsaw would open a host of opportunities for graduates looking at the above scenario.

If I were to just stay in India, how important is the knowledge of international business laws and commercial transactions or international trade and taxation for the management of an Indian organisation?

Considering the accessibility of markets, many businesses will look outside of their countries for markets, for capital, for affordable talent etc.

This has already started to happen.

You can find businesses being initiated in a country with the sole objective of serving customers in another country, without having any regards to the local scenario.

Have a look at the top 10 Indian startups listed here. Out of 10, barring Udaan, Agnikul Cosmos and Playment, 7 have already expanded outside India or founders have been publicly quoted stating they have expansion plans. Playment was recently acquired by TELUS, a Canada based company in July 2021. Almost all of them have or had foreign investors.

Consider the Indian unicorns which have lined up for an IPO in 2021 and you will find that a majority of them already have global operations and almost all have foreign investors.

This kind of surge in cross border operations will necessitate lawyers who are aware not only of the local laws applicable to a business, but also the laws of other countries to which these businesses plan to expand.

The signs are very clear. If you want to score with these companies, you will need to be equipped with knowledge of international trade, business laws and international taxation. Local knowledge will give you a limited scope.

The more multi-jurisdictional legal knowledge a lawyer has, the more they will be in demand.

What kinds of jobs can I secure in the field of international business laws and international taxation?

We will let some job advertisements speak this for themselves.

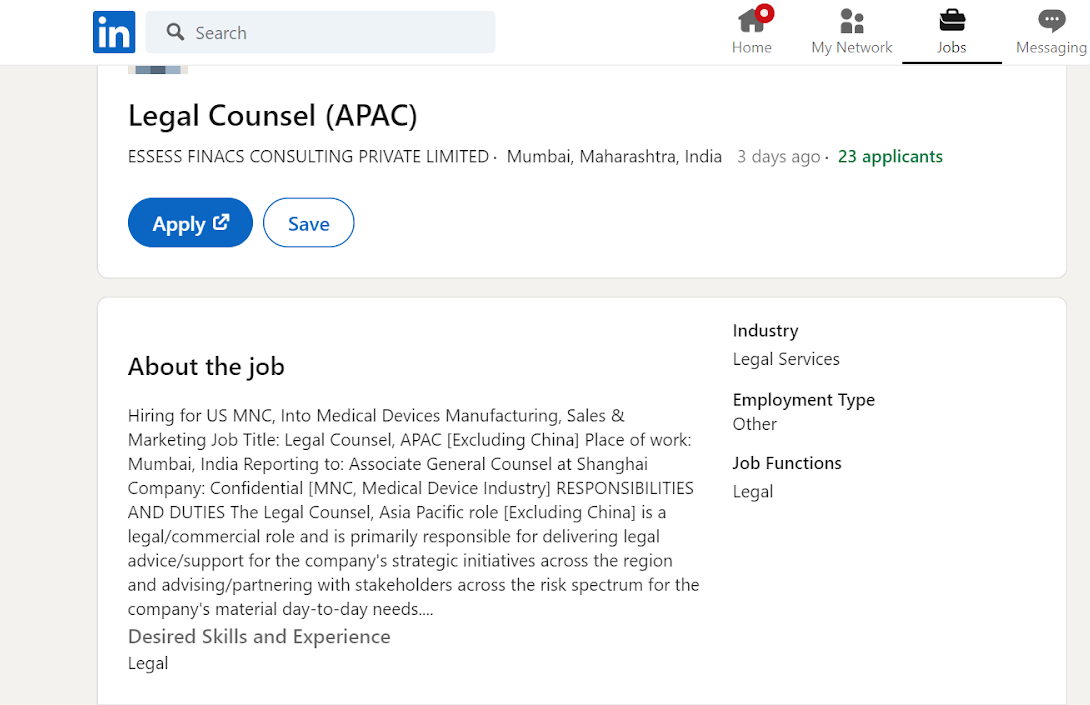

Have a look at this job role:

The hiring is by a US company, the position is based in India and the role is reporting to the Associate General Counsel at Shanghai.

Here is another one:

Responsibilities involve working with outside counsels and one of the required qualifications is that you have worked in a multinational set up with operations in other countries.

This is a specialised position with Accenture based in Mumbai, and reporting to the Director of Legal Services - Trade Compliance, Americas and APAC. It specifically requires ensuring compliance with international trade control requirements, regulations and Accenture policies.

Here is a Lead tax specialist role from GE Healthcare. GE expects the incumbent to be able to be involved with all indirect tax matters “around the world”.

Given the trend we mentioned, knowledge of international business, trade and tax laws will increasingly become a requirement for in-house legal roles. And this will not be just the case for India. Multinational companies across the globe will need lawyers who have multi jurisdictional business law skills.

Is a Masters degree useful to me if I am a local practitioner?

Not an ordinary masters degree maybe, but one from an international university and one reflecting knowledge in international business laws is.

It brings instant reliability to your profile if you quote a degree from an international university, especially if you are serving clients which either have multinational operations or are looking to expand internationally.

About Warsaw Management University

The Warsaw Management University is one of the oldest universities in Poland. About 80,000 Polish and international students have graduated from it since its foundation 20 years ago.

Collegium Humanum – Warsaw Management University is an international private university with its seat in ul. Moniuszki 1A, 00-014 Warszawa, has been authorized by the Minister of Science and Higher Education, as a higher education institution with the name Warsaw Management University.

The UNIES Business School has been founded by cooperation agreement of CH Warsaw Management University (Poland) with UNIES EWIV (Germany). UNIES Business School of CH-Warsaw Management University has become a Business School of WMU for the delivery of WMU´s undergraduate and postgraduate programmes of studies in the international market at offshore-campus and training centres in Asia, Africa and Europe.

Collegium Humanum is a member of the Business Graduates Association, which is an international membership and quality assurance body of world-leading and high-potential Business Schools who share a commitment for responsible management practices and lifelong learning, and are looking to provide positive impact on their students, communities, and the economy as a whole.

Since 2020, Collegium Humanum has been a signatory to PRME (the Principles for Responsible Management Education),an international forum of leading business universities from around the world operating under the auspices of the United Nations, whose aims are to shape global attitudes of social responsibility among future leaders across business, politics and other dimensions of public life.

The School is offering a one month immersion program too, at an additional cost.

How is this course different from other LLM programs?

How can you help businesses and clients after you obtain an international LLM degree?

Here are 7 ways in which you can help businesses and international clients with the following after you complete this course:

Advise on market entry/expansion strategy

This is the first question faced by an entity planning to go international - where to begin from, what destination to select based on specific objectives. As someone who is trained in different aspects of international business laws, you will be able to inform an employer or a client about which country will offer the most suitable legal environment keeping their objectives in mind. You will also be able to inform them about multiple entry options and the legal formalities required for their selected option.

Incorporate entities in multiple countries and determine corporate governance structures

When you have an idea of the different business structures available in a country, the procedure to incorporate entities in that country and also determine the corporate governance structures that can be applied not only for the holding company, but also the subsidiaries in different countries, this would be invaluable information for an employer or a client.

It will also give you an edge over consultants who can take the benefit if you are unaware how easy or difficult the procedures in that country are.

Negotiate, draft and review contracts for multiple transactions

Transactions are at the heart of any business. When you understand a business’s source of income and its transactions, you would be able to negotiate and review contracts for that business much better. With a Masters degree which gives you an all round view of multiple business aspects, you will understand the transactions much better.

For instance, you will have the knowledge of what representations and warranties should be asked for, in an investment contract with a company having significant intellectual property, because you will understand how the monetisation and protection of intellectual property works.

Help companies with their data protection compliance

This is going to be a highly demanded skill, considering the explosion of cloud based and SaaS companies during and post the pandemic. More and more countries are strengthening their data protection laws and if you can develop a company’s systems and processes to ensure compliance with these, it can make you a very desirable candidate for multinational companies.

Help companies with cross border mergers and acquisitions

Here’s a Bloomberg report which talks about cross border M&A breaking records for the first quarter of 2021. As geographical barriers thin down, these transactions are only going to increase. Anyone who is skilled in how M&A transactions work, especially cross border mergers will thrive.

Help companies with securing finance for international trade and completing customs and border protection related procedures and documentation

As e-commerce businesses thrive and international trade expands, there will be a consistent requirement for trade financing and consequently, professionals who understand how imports and exports work and are regulated in different countries will also be required.

Given that we have twice been hit by pandemic waves, customs and border protection regulations will likely be tighter around imports from other countries. For example, as of July 2021 there are quite a few countries which wouldn't accept post from India. However, they will accept couriers from DHL. Why? Because multinationals like DHL are well aware of the safety requirements for packages being shipped to these countries. Knowledge of customs clearance requirements helps. Do you think companies like DHL would benefit from having professionals who are aware of such requirements and formalities? Definitely.

International tax structuring for multinational companies

The Double Irish Dutch Sandwich or the Single Malt tax structures (now redundant) weren’t the only tax structures to be used. There are probably many more like these, waiting to be discovered by the Governments of the relevant countries. Whoever thought of these structures must have had the thorough knowledge of the tax laws and charging events of multiple countries. Do you think multinational companies would want such people who can help them structure their transactions to save millions of dollars in tax in many countries perfectly legally? It’s a no brainer.

Potential Employers and Clients

- Multinational companies

- International law firms

- Startups with global expansion plans

- Practically, everyone entering into a cross border contract or transaction

Training Methodology

Online 24/7 access

Access to primary study material through an online learning management system, Android and iOS app

Practical assignments for every subject

This will involve practical assignments involving real-life application of the concept that you have learned in the core subjects to a complex problem. You should be able to present/ showcase it to potential recruiters.

MCQs

Multiple choice questions - conceptual and scenario-based to ensure that you have grasped the concepts in every module and apply them to scenarios.

Live Online Classes

Three hours of live video-based online class every week on the course curriculum and assignments.; You can ask questions, share your screen, get personal feedback in this class.; Additional optional sessions for networking (including with your peers), placement support, securing remote work, building your brand, learning writing skills, etc., may be organised. (Recordings will be available for those who miss attending a session live)

Convenient Class timings

Classes are held after regular work hours. Typically classes are kept on Sunday or 8-9 pm [IST] on other days. Classes taken by faculties outside India may need to be changed depending upon time zones

Live Doubt Clearing

You can ask questions, get your doubt cleared live as well as through online forums.

Immersion

An immersion program at the campus of Warsaw Management University/neutral venue can be offered to the candidates looking at the demand for the same from the students. The fee for the same will be in addition to the tuition fee.

Client opportunities and Recruitment Support

(This is independent of industry projects which are a part of the curriculum.)

LawSikho team will help you secure remote freelancing opportunities for tech, legal and managerial projects related to the skills you learn in this program and local internship, job and client opportunities in startups and companies.

Many employers, law firms and companies are happy to recruit our high performing students. If you do well in the program, we can help you to get jobs and internships with startups, large companies and in law firms.

Focus on opportunities will be in tech, managerial, legal and business roles for startups and companies.

Our placement support services include sharing opportunities, improving your CV, your social media presence, building your track record and preparing for interviews.

Course plan

The degree awarded will be Master of Laws from Collegium Humanum, Warsaw Management University.

The course fees are 11,624 USD.

It is a 15 months course that can be completed within 30 months to be eligible to receive the completion certificate (Degree).

Law courses from CH-Warsaw Management University are accredited by the Ministry of Science and Higher Education, Poland, Agency for Quality Assurance and Accreditation, Austria and Apsley Business School, London, UK.

Money back guarantee

If you take this course, follow it diligently for a month, do all the exercises but still do not find value in it, or not able to understand or follow it or not find it good for any reason, we will refund the entire course fee to you. It is a 100% money-back guarantee with only one condition, you must pursue it properly for a month. If you don’t find it valuable after that, get your entire money back.

Sample Degree Certificate

Syllabus

The Master of Laws program with specialisation in Business Laws and Commercial Transactions consists of 21 subjects which comprise 12 core subjects, 9 specialization subjects and a dissertation.

It is mandatory to submit a final project/thesis in order to graduate.

The Master of Business Laws and Commercial Transactions degree is granted to participants who achieve 90 ECTS (European Credit Transfer System)- this program has 90 ECTS.

25 learning hours correspond to 1 ECTS credit point. The total amount of learning is at least 50 hours for each module.

Subject-wise Division of Credits

Total credits common subjects: 40 ECTS

Thesis (focussed around specialisation): 12 ECTS

Specialisation 1: Business Laws and Commercial Transactions

Specialisation 2: International Trade and Taxation (38 credits)

Core Subjects

Subject 1: Introduction to Legal Systems Across the World and Hierarchy of Courts (4 Credits)

- Legal systems around the world - common law and civil law

- How are international disputes resolved: Framework and mechanisms

- Overview of courts system for commercial disputes in different countries

- US

- UK

- Europe, with focus on Germany, France and Netherlands

- Canada

- Brazil

- India

- UAE

- Singapore

- Japan

- Hierarchy of courts for commercial disputes

- Specialized commercial courts/ commercial divisions

- Availability of small claims courts and fast-track procedures

- Caps

- Procedural Simplifications

- Can Parties Represent Themselves

- Availability and criteria for pretrial attachment of movable assets

- Automatic & Random Assignment of Cases to Judges

- Evidentiary weight of a woman’s testimony

- Case management

- Timelines for following processes under civil procedure laws

- service of process;

- first hearing;

- filing of the statement of defense;

- completion of the evidence period;

- filing of testimony by expert; and

- submission of the final judgment

- Restrictions on number and circumstances of adjournments

- Public availability of performance measurement reports to monitor progress of cases and compliance with timelines

- Use of pretrial conferences for case management

- scheduling (including the time frame for filing motions and other documents with the court);

- case complexity and projected length of trial;

- possibility of settlement or alternative dispute resolution; exchange of witness lists;

- Evidence;

- jurisdiction and other procedural issues; and

- narrowing down contentious issues

- Availability of electronic case management systems for various processes

- access laws, regulations and case law;

- access forms to be submitted to the court;

- receive notifications (for example, e-mails);

- track the status of a case;

- view and manage case documents (briefs, motions);

- file briefs and documents with the court; and

- view court orders and decisions in a particular case

- Automation of court proceedings

- Possibility of electronic filing procedures without in-person interaction

- Electronic service of complaint on the defendant

- Electronic payment options for court fees

- Public availability of judgments rendered by local courts

- Which alternative dispute resolution methods are used to resolve international disputes?

- Which resources can you use to find out about legal systems in a country?

Subject 2: Advanced Contract Drafting (8 Credits)

- Contract Anatomy - Introduction to parts of a contract

- The different parts of a contract, and the sequence in which different clauses customarily appear in a contract

- The categories to which each clause in a contract pertains

- The Definitive Contract Drafting Checklist

- Title, recitals, definition and interpretation clauses

- The relevance of the introductory parts of a contract

- How are introductory clauses drafted

- Representations and Warranties clauses and covenants

- What are representations and warranties and why are they required?

- Tips and strategies in drafting representations and warranties clauses

- The consequences of false representations

- What are covenants?

- Conditions Precedent, Conditions Subsequent and Completion

- The concept of conditions precedent and the relevance of the conditions precedent clause in a contract

- Conditions subsequent and completion

- The consequences of breach of conditions precedent and conditions subsequent clauses

- How to draft the conditions precedent, conditions subsequent and completion clauses

- How to Draft Obligations and Payment Clauses in Any Contract

- The relevance of the obligations and payment clauses

- How payment and increment clauses are drafted

- The consequences of default in payment

- How should consideration clauses be drafted?

- Term, termination, renewal and survival clauses

- How to decide the ‘term’ of a contract and draft the ‘term’ clause

- How termination is connected with the term of the contract and how to draft termination clauses

- The different methods by which a contract can be renewed

- Which obligations under the contract continue to be applicable even after termination?

- Assignment and Change of Control Clauses

- Which rights in an agreement can be assigned and which ones can be retained

- How anti-assignment clauses work

- The significance of the ‘change of control’ clauses and how these work

- Is revocation of assignment possible?

- Confidentiality, non-compete, non-solicit and exclusivity clauses

- The concept and the need for confidentiality, non-compete, non-solicit and exclusivity clauses

- How to draft an effective confidentiality clause

- In which situations can a non-compete clause be enforced?

- Cases where non-solicit and exclusivity arrangements are used

- What are non-circumvention clauses?

- Waiver, Variation and Severability clauses

- What are ‘no-waiver’ clauses?

- Why are variation clauses required?

- What are severability clauses used for?

- Indemnity and Limitation of Liability clauses

- The concept of an indemnity clause and the reason why it is required in a contract

- Situations when an indemnity clause can be triggered

- How to draft an effective indemnity clause

- Difference between an indemnity and a guarantee

- The effect of Limitation of Liability clauses

- Notice and communication clauses

- Drafting a notice as per the notice clause

- Why it is important to provide for a receipt mechanism in a notice clause

- Breach and enforcement related clauses

- The concept of breach and what kinds of scenarios amount to a breach

- Consequences of breach which can be specified in a contract

- Legally permissible remedies in the event of a breach

- Whether to draft a breach clause as a general or specific clause

- Types of liquidated damages clauses which are permitted under Indian law

- What care should you take while drafting a breach clause

- What is the difference between a breach and an indemnity claim?

- How to quantify damages for infringement or other breaches

- Governing Law in international contracts: How to choose the applicable governing law?

- The relevance of the Governing Law and jurisdiction clause

- Learn how the Governing Law and jurisdiction clauses should be drafted

- What do you need to take care of in order to ensure enforceability of contracts in accordance with the relevant law?

- Does it require execution in a particular manner?

- Does it require approval from a specific authority in accordance with the law?

- Legalisation requirements - stamping, notarisation, apostille

- Reasonability in clauses

- Appropriate choice of governing law

- Ten contracts which are universally used in business transactions and how to draft them

- Confidentiality Agreements / Non-disclosure Agreements

- Employment Agreements

- Lease Agreements

- Licensing Agreements

- Power of Attorney Document

- Sale / purchase Agreements

- Distribution Agreements

- Loan Agreements

- Joint Venture Agreements

- Website Development Agreements

- Different types of notices/letters which can be used in international contracts

- Notice of claim in a works contract

- Notice to cure defect

- Notice of breach

- Notice invoking force majeure

- Notice to commence negotiation

- Notice claiming service credit

- Notice claiming indemnity

- Notice of commencement of arbitration

- Letter of renewal/ extension

- Letter of waiver

- Addendums / Novation Agreement / Amendment agreement

- Notice demanding payment

- Response notice rejecting claim of service credit

- Response notice rejecting force majeure invocation

- Response notice denying indemnity

- Response notice denying payment

Subject 3: International Contract Negotiation (2 Credits)

- Basic principles of International trade and commercial law and how international contracts work

- Introduction to Negotiation

- The key concepts of negotiation;

- How to use power in negotiations;

- How to strategically prepare for a negotiation;

- The fundamental negotiations strategies and tactics;

- Negotiating to win

- The art of persuasion: framing to achieve a desired effect and outcome;

- Managing diversity: negotiating with people whose cultures, backgrounds and expectations differ from your own;

- Conducting virtual negotiations.

- Common negotiation techniques and pitfalls

- Hostage negotiation techniques and business applications

- Negotiation case studies

- Negotiation as a method of dispute resolution

Subject 4: International conflict management: Mediation, Conciliation, Expert Determination and Anti-Suit Injunctions (4 Credits)

- Introduction to international Conflict Management

- Various definitions of conflict

- The Cognitive, Emotional and Behavioral levels of conflict management

- The determinants of conflict on the example of the Wheel of Conflict

- The four personality types and their influence on conflict occurrence, development and resolution.

- Individual conflict management strategies

- The importance of verbal, non-verbal and para-verbal communication and the factors influencing conflict;

- How to manage diversity in conflict situations;

- Alternative Dispute Resolution: the multiple roles of the lawyer as a mediator in the face of conflict.

- Introduction to Mediation/Conciliation

- Definitions and difference

- Advantages over other ADR

- Importance and expected/ objective role in ADR to resolve disputes

- Recognition and enforcement of dispute resolved in mediation

- International Commercial Mediation & Conciliation (Recent Trends)

- Singapore Convention on Mediation

- UN Model Law on International Mediation and Conciliation

- Transactions/ disputes most suited for mediation

- Psychology for mediator and conciliator and Advocates

- Institutional mediation/ conciliation and procedure

- Procedure for mediation in SIAC, HKIAC, DIFC, LCIA, AAA

- Mediation-arbitration combinations: Arb-med, Med-arb and arb-med-arb and how these are used effectively by lawyers

- When mediation can be chosen

- Steps to be taken for mediation with respective institution

- Can these institutional facilities be used only for mediation and not for arbitration or are they always used in conjunction with each other?

- Enforceability

- Costs of mediation

- Credit of fees to arbitration procedure in case mediation/conciliation fails.

- Expert Determination

- Sectors where expert determination clauses are relevant

- How to draft expert determination clauses

- When and how to use anti-suit injunctions

- How does an anti-suit injunction work?

- When should you use anti-suit injunctions

- Anti-suit injunctions in the context of international contracts

Subject 5: International Commercial Arbitration (8 Credits)

- Introduction to International Commercial Arbitration

- Why is International Commercial Arbitration a preferred mode for dispute resolution in international transactions?

- Legal work in international commercial arbitration for in-house counsels, corporate lawyers, arbitration lawyers and litigators

- How to navigate the domestic and offshore legs of International Commercial Arbitration

- What you need to know about foreign law to be effective in international commercial arbitration

- How to brief offshore counsel with respect to arbitration proceedings

- How international commercial arbitrations can be institutionalised and what are the important organisations in this area?

- Ad hoc v International Arbitration

- Seat and Venue in Arbitration

- What are the key considerations in selection of the set of arbitration rules that will govern a dispute between contracting parties?

- How do these vary in case of ad hoc arbitration vis-a-vis institutional arbitration?

- UNCITRAL Arbitration Rules

- How to draft an Arbitration Clause in International Commercial Arbitration?

- How to apply the seat and venue consideration and remove uncertainty while drafting an effective and predictable arbitration clause.

- Case studies of some well drafted and not so well drafted arbitration clauses.

- Arriving at a Model Arbitration Clause for International Contracts and how to modify it as per applicable factual situation

- Components of clauses in International Commercial Arbitration.

- Institutional Arbitration Model Clauses for SIAC, HKIA, DIFC-Dubai, LCIA and AAA.

- Pathological arbitration clauses.

- Important components of an arbitration clause.

- Why do clauses say ‘without reference to conflict of laws rules’?

- Importance of ‘good faith’/ reasonable endeavor requirements.

- Choice of law

- How to Select an Appropriate Institution for International Commercial Arbitration?

- How to answer common questions that every client faces about selection of seat, selection of arbitral institution and choice of law

- Special emphasis on following Arbitration Institutions

- International Court of Arbitration

- London Court of International Arbitration

- Singapore International Arbitration Centre

- Hong Kong International Arbitration Centre

- International Centre for Settlement of Investment Disputes

- Implications of choice of contract law of Singapore, UK, US, Canada and India

- UK contract law for international arbitration lawyers

- US contract law for international arbitration lawyers

- Singapore contract law for international arbitration lawyers

- Canadian contract law for international arbitration lawyers

- How to Draft a Statement of Claims

- How to define the dispute

- Quantification of Damages

- To what extent are liquidated damages valid?

- What if the amount of liquidated damages specified is very high?

- Is there some prohibition against inclusion of penalty clauses?

- Are indirect and remote damages enforceable?

- Is there a duty of the party suffering loss to mitigate damages?

- Are punitive damages, if agreed contractually, valid?

- Types of reliefs

- Monetary compensation

- Punitive damages/ penalties

- Interpretation of contracts

- Restitution

- Is declaratory relief relevant?

- Interest

- Costs

- Do national laws constrain this?

- How to define the statement of defense in international commercial arbitration

- Top strategies to rebut claims made in the statement of claims in the statement of defense

- How to review foreign laws and international conventions for challenge procedures

- Common grounds for challenge

- Challenge to enforcement of foreign awards in India

- How to obtain anti-arbitration injunctions in the jurisdictions above

Templates

Letter to invoke arbitral proceedings before LCIA, ICC, SIAC

Notice of commencement of arbitration

Statement of claim

Statement of defence

Subject 6: International taxation and transfer pricing work (4 credits)

- Sources of international taxation and DTAAs

- Structure of DTAAs

- What is Permanent Establishment?

- Does international tax law apply to you if you don’t have an office offshore

- Do commissionaire arrangements constitute a permanent establishment?

- How does foreign tax credit work?

- Controlled Foreign Corporations and POEM Rules

- Safe Harbour Rules

- Tax structuring, Base Erosion and Profit Shifting (BEPS)

- Transfer pricing - introduction and basics

- Transfer pricing compliance, disputes and penalties

- Transfer pricing methods: an overview

Subject 7: Foreign Investment (FDI and Portfolio Investment) and Exchange Control Framework of 10 most important global economies (4 credits)

- Regulation of foreign direct investment in major global economies?

- Investment in capital (unlisted incorporated entities, unincorporated businesses)

- Investment in property in a country

- Regulation of foreign portfolio investment (investment in listed equity) in major global economies?

- Investment in foreign exchange derivatives

- Is investment in cryptocurrency regulated under exchange control laws?

- How is foreign exchange inflow on account of business expenses regulated?

- Types of foreign investment in debt and how it is regulated

- Long term and secured lending

- Investment in short term debt and money markets

- Investment in long term and short term debt instruments

- Regulation of outbound investment and outflow of foreign exchange

- On account of expenses

- On account of investment in capital

- On account of investment in property

- On account of investment in debt

- Creating contingent liability in foreign exchange

- Provision of guarantees

- Underwriting securities

- Difference between investment by entities and investment by individuals

- Prohibited sectors for investment

- Setting up offshore entities

- Permitted banking accounts in foreign exchange

- Compliance requirements under exchange control laws

Subject 8: How to enter a foreign market - international business expansion and market-entry work (4 credits)

- Entry methods

- Amazon selling

- Distribution of products by engaging distributors or agents

- Setting up local subsidiaries and direct outlets

- Collaborations or joint venture arrangements

- How does dropshipping work?

- How to carry on a dropshipping business on Shopify and Oberlo

- When is the right time to expand into a foreign market?

- Factors determining the decision whether to enter a foreign market

- How to decide the right method to enter a foreign market

- Roadblocks you are likely to face while entering a foreign market

- Managing a multinational business - governance issues

Concentration/Specialization I: Business Laws and Commercial Transactions

Subject 1: Business Structures and formation in 10 major economies (4 credits)

- Available business structures

- Unincorporated

- Sole proprietorships

- Partnerships

- Incorporated

- Limited liability partnerships

- Unlisted companies / corporations

- Listed companies / corporations

- Choosing the best structure for different purposes

- Taxation and international tax structuring

- Investment and raising capital

- Expansion

- Ring fencing

- Acquisitions

- Rules for selecting names of incorporated entities

- What are the decisions you are required to take before you incorporate?

- Ownership

- Type of instruments

- Amount of capital required

- Mode of remittance of capital

- Exchange control laws

- Management

- Requirements to have resident directors

- Auditors

- Compliance

- Process of incorporation

- Where can you incorporate online?

- Issues in incorporating and managing a company from another country

- Evidence or proof of incorporation

- Commencement of business

- Upon incorporation or completion of additional formalities

- Basic tax registrations required

- Basic business licences required

Subject 2: Corporate governance and management practices for closely held and listed companies (4 credits)

- Corporate Governance in startups and unlisted entities

- Functioning of an entity in line with its vision

- Transparency between founders

- Is the management working towards the organisation’s interest?

- Reporting by next level management to owners

- Entity’s responsibility to investors, lenders and customers

- Entity’s responsibility to regulators - compliance and record keeping

- Corporate Governance in listed entities

- Focus on maximising shareholder value

- Disclosure requirements

- Decision making levels

- Internal policies

- Documented processes

- Managing information and insider trading processes

- Succession planning

- Business continuity planning

- Reputation management

- Corporate social responsibility

- Decision making levels in companies / corporations

- Committee structures

- Mandated by law

- Formed as per business requirements

- Board of directors / governing body

- Composition - legal requirements, expertise, experience, diversity

- Two-tier boards

- Rotation or reappointment requirements

- Chairpersons / Managing Directors

- Performance Evaluation

- Succession

- Composition - legal requirements, expertise, experience, diversity

- Management at one level below the board / CXOs

- Meetings as decision making mechanisms

- Statutory requirements

- Best practices

- Terms of reference

- Reflection of decisions: Resolutions, Consents

- Communication of decisions

- Internal policies, reporting and escalation mechanisms

- Statutory requirements

- Data protection policies

- Anti-corruption and bribery policies

- Anti-sexual harassment policies

- Diversity policies

- Whistleblowing mechanisms

- Insider trading policies

- Non-statutory policies

- Code of conduct

- Social media policies

- Leave policies

- Policies related to remote working

- Shareholder communication mechanisms

- Annual / Special / Extraordinary / Class meetings

- Investor conferences / Roadshows

- Annual Reports

- Company websites

- Emails

- Corporate Social Responsibility

- Non-profit structures within the group

Subject 3: International intellectual property work: registration, prosecution, licensing, enforcement and disputes (4 credits)

- International Intellectual Property agreements and treaties

- Trade related intellectual property rights agreement (TRIPs)

- Berne Convention

- Paris Convention

- Madrid Protocol

- The Patent Cooperation Treaty

- Different types of intellectual property recognised across the world

- Trademarks

- Patents

- Copyrights

- Designs

- Trade Dress

- Trade Secrets

- Geographical indications

- Plant variety protections

- Conducting searches in intellectual property offices around the world and creating watchlists

- USPTO

- UKIPO

- EUIPO

- Intellectual property office of Singapore

- Search best practices and drafting search reports

- How to create a ‘watch’

- Registering your intellectual property internationally

- Trademarks

- Types of trademarks

- Application procedures and stages

- Patents

- Types of patents

- How to draft claims and specifications

- Filing patent claims and applications

- Copyrights

- How to register your copyrights

- How to register other types of intellectual properties

- Designs

- Trade Dress

- Trade Secrets

- Geographical indications

- Plant variety protections

- Can you file applications online?

- Cost of registering intellectual property

- Intellectual property prosecution

- How to respond to office actions / objections?

- Opposition and grounds of opposition

- How to draft notices of opposition

- How to reply to notices of opposition

- Filing the responses with an intellectual property office

- Methods of commercialization of Intellectual property

- Means of monetization of original copyrightable works

- Assignment of trademarks and licensing through various modes and methods

- Means of commercialization of patented inventions

- Important features of Intellectual property licensing and the indispensable clauses

- What are the scenarios in which IP licensing would be viable?

- Which rights would be transferred and which ones retained?

- Important points to be considered during an IP licensing deal

- What are the important clauses to be dealt with?

- Important clauses of intellectual property assignment

- What are the scenarios in which IP assignment would be viable?

- Can the assignor retain any rights in the IP pursuant to the assignment?

- Important points to be considered during an IP assignment deal

- What are the important clauses to be dealt with in such agreements?

- How is the change in ownership to be recorded with the intellectual property offices?

- Difference in assignment process for trademark, patent and copyrights

- How to draft an invention assignment agreement between employers and employees

- What is an inventions assignment agreement?

- Why is it important for companies to have an inventions assignment agreement?

- Challenges of such agreements

- How to avoid pitfalls in an inventions assignment agreement?

- What is franchising and how should franchise agreements be drafted?

- What is franchising?

- When are franchising agreements to be entered into

- What is a pre-sale disclosure document

- How are intellectual property rights of the franchisor to be dealt with in a franchise agreement

- Key clauses in a franchise agreement

- Infringement of intellectual property and litigation

- Which courts are competent to try intellectual property disputes?

- Grounds on which infringement can be claimed

- Who can initiate a suit?

- Defences available to an infringer

- Remedies available against infringement

Subject 4: Managing an International Workforce - How to Navigate the Employment Law Framework Across Jurisdictions, Work with a Remote Workforce, Handle Immigration and Issue ESOPs Internationally (4 credits)

- Deciphering the employment law framework of a country

- Employment laws for manual labour / middle management / top management

- Employment laws based on business sectors

- Manufacturing

- Finance

- Intellectual property heavy sectors

- Sectors relevant from a public interest perspective such as medical and education

- Employment laws applicable to private sector / public sector undertakings

- Areas of relevance for organisations employing manual labourers

- Factories and facilities within factories

- Who can be employed as labourers - age restrictions, contract labourers

- Health and safety concerns, accidents and protection in hazardous industries / businesses

- Industrial disputes and trade unions

- Retrenchment

- Areas of relevance for organisations involving employees engaged in office work

- Social security payments - pensions / provident funds / gratuities

- Insurance of employees

- Leave and work hours

- Protecting confidentiality and intellectual property

- Appropriate internal policies and codes of conduct

- Performance management

- Dismissals and disciplinary proceedings

- Applying taxes on payments

- Employing women: what organisations should consider

- Diversity and women representation in management

- Anti-sexual harassment policies

- Maternity leave policies / childcare facilities

- Other forms of leaves such as period leaves

- Legal concerns in managing a remote workforce

- Remote hiring, background checks

- Data protection and protecting intellectual property

- Performance management

- Enforcing internal policies

- Managing reputation on social media

- Managing surprise exits and dismissals

- How do multinationals manage cross border movement of workforce?

- Global mobility programmes

- Deputation

- Secondment

- Work permits and visas

- Transfer permits

- Common incentive mechanisms used throughout the globe

- Performance bonus

- Profit participation

- Employee Stock Options

- Employee Stock Purchases

- SARs / Phantom Stock Options

Subject 5: International data protection and privacy law (4 credits)

- Why is data sought to be protected?

- Different types of data

- Personal data and its subcategories

- Transaction-related data and preferences

- Business entity-related data

- Economy related data

- Sensitive and non-sensitive data

- Anonymized data

- Ownership and collection of data

- How do businesses get access to data

- Generating data v. collecting data

- Controllers, processors and sub-processors

- What rights do consumers have over data collected from them?

- Role and principles for obtaining consent in data collection

- What is data sovereignty and data localisation?

- Can governments collect and control citizens’ data?

- Open source databases and data in the public domain

- Data commodification: under what conditions can you buy and sell data?

- Managing data transfers

- What is data localisation and what are issues with cross-border data transfers

- How do multinational companies deal with cross-border data transfers

- What are the laws governing data transfers in different countries

- International agreements: EU-US Privacy Shield

- Terrorist Financing Tracking Program (TFTP)

- European Commission’s Standard Contractual Clauses(SCCs) for transfers between EU and non-EU countries

- Case Study: Having your own internal data transfer network: Liink by JP Morgan

- Data retention and managing data graveyards

- What is big data and for whom is this relevant?

- Anonymised, pseudonymised data and encrypted data

- Data sets, data collection points and processes in specific industries: BFSI, Retail, E-Commerce, Healthcare, Education, Software, Consulting, Real estate, infrastructure and smart cities, Media and entertainment, Law and justice, Pharma, Advertising, Supply chain and logistics, Security and defence, Agritech, R&D

- Consequences of data protection violations

- Exorbitant Domestic and Cross border Fines

- Third party indemnity claims

- Reputational consequences

- Inability to secure new business

- Data protection laws and notification requirements in the US and Canada

- Federal level laws relating to data protection

- The Privacy Act

- Gramm-Leach-Bliley Act

- COPPA

- HIPAA

- Important State laws relating to data protection

- California Consumer Privacy Act / California Privacy Rights Act

- Virginia Consumer Data Protection Act

- New York Data Security Act

- Data protection laws and notification requirements in Europe and the UK

- The General Data Protection Regulation

- Applicability

- Data Transfers

- Rights of data subject

- Consent requirements

- Compliance requirements

- The UK Data Protection Act

- Data protection laws and notification requirements in the APAC region

- The Personal Data Protection Act of Singapore

- The Personal Data Privacy Ordinance of Hongkong

- Data Privacy Act 2012

- Data protection laws and notification requirements in in the Middle East and India region

- Data protection laws in the UAE

- The Personal Data Protection Bill of India

- How to draft Data Processing Agreements and Addendums

- Common Data Protection Agreements and review work

- Outsourcing (Controller-Processor) Agreements

- How to review terms and conditions of use of websites

- How to review privacy policies so they are compliant with data protection laws

- Reviewing and updating templates

- Addendums

Subject 6: Technology Law Related Work: Contracts and Policies, Blockchain and Cryptocurrency Work (6 credits)

- Operative clauses of technology contracts

- Obligations and payments clauses

- Software license-related clauses, technology services obligations or combination of license and services

- Representations and warranties clauses

- Term and termination clauses

- Important boilerplate clauses in tech contracts

- Indemnification

- Limitation of Liability

- Governing law and jurisdiction

- Dispute resolution

- Technology contracts related to software and how to draft them

- Software development agreement

- Service level agreements

- Master service agreement

- Software as a Service agreement

- Different types of licenses in technology agreements

- Based on the property

- Trademark licensing

- Patent licensing

- Trade secret licensing

- Based on the period of license

- Perpetual

- Subscription

- Fixed duration

- Use time / Aggregate use time

- Depending upon number of users / manner of use

- Floating license

- Metered License

- Feature license

- Project based license

- Academic license

- Depending upon exclusivity

- Exclusive

- Non-exclusive

- How to draft Licensing Agreements

- Type of license

- Obligations and payment clauses

- Right to sub-license

- Dispute resolution

- Reporting the licenses to the USPTO

- What are technology transfers and different types of technology transfers

- Process of transferring technology

- Types of technology transfers

- Licensing

- Franchising

- Joint Venture Agreements

- Co-branding arrangements

- Vertical and horizontal technology transfers

- How to draft technology transfer agreements

- What is the technology being transferred

- Scope of transfer in terms of territory and exclusivity

- Mode of transfer

- Payment for the transfer of technology

- Confidentiality, non-compete, non-solicit

- Duration or term

- Governing law and dispute resolution

- Introduction to Blockchain & Cryptocurrency

- Introduction to concepts of blockchain and cryptocurrency

- How is cryptocurrency regulated across the world?

- How are cryptocurrency taxed?

- What are the different licensing and ownership requirements for businesses and individuals respectively involved in transactions?

- How to assist businesses setting up a crypto exchange, crypto wallets or offering coins or tokens

- What does a crypto exchange or crypto trading business do?

- How does a crypto business make money

- How to start a crypto business

- Opening a legal entity and registering for taxes

- Opening banking account

- Obtaining business licenses

- Getting office and insurance

- Creating a website

- Blockchain Regulations & Compliances

- What are the different kind of compliances to be undertaken by businesses

- To trade in cryptocurrency

- To accept payment in different crypto currencies.

- What are the implications of non-compliance with federal and state regulations?

- What are the different licensing requirements for cryptocurrencies?

- What is the legal structure of tokens and how are they different from other securities?

- How to draft AML/KYC/CFT Policy and ensure compliance with regulations?

- Agreements with developers, designers, freelancers, advisors and business partners.

- How to draft & negotiate a Token sale agreement?

- Bounty Agreements

- How to structure a Bounty Program

- How to draft a Bounty Agreement

- How to ensure compliance with SEC’s guidelines.

- Blockchain token audit

- Security Token Offering

- Structuring & restructuring an STO

- Investment Agreement for STO

- Compliance Risk Management and Audit

- What are the different kind of compliances to be undertaken by businesses

- Litigation and disputes for a crypto company

- Regulatory actions for non-compliance

- Disputes in relation to securities

- Contractual breaches

- Intellectual property infringements

- Tax disputes

- Anti-money laundering disputes

Subject 7: International Investment Contracts and Institutional Finance (4 credits)

- Share acquisitions and investment transactions

- Stages of raising investment

- Different types of investors: angels, venture capitalists, private equity investors, strategic and financial investors

- Key interests of an investor

- Ability to exit

- Returns on investment - dividend or interest

- Capital appreciation at the time of exit

- Ability to control decisions

- Founder stake and interest

- Information availability

- Tax impact of the investment transaction

- Corporate law issues in investment transactions

- Form of business entity and ability to invite investment

- Determining amount of capital and eligibility of entity to issue that amount

- Determining type of instrument

- Completing issuance or transfer process

- Altering constitution documents

- Compliance requirements for the transaction

- Step by step process of an investment transaction

- Identifying target / investor

- Preliminary meeting

- Signing term sheet

- Due diligence exercise

- Approving and executing transaction document

- Transfer of money

- Post transaction compliance

- Transaction documents for share acquisitions and their terms

- Investment Agreements

- Simple Agreement for Future Equity

- Share Subscription Agreements

- Share Purchase Agreements / Share Transfer Agreements

- Shareholders Agreements

- How to draft Shareholders Agreements

- Representations and warranties

- Conditions precedent, completion or closing and conditions subsequent

- Management related clauses

- Board composition and decisions

- Voting rights at board meetings

- Observers and information covenants

- Clauses related to share transfers

- ROFR / ROFO

- Drag Along / Tag Along

- Lock-ins

- Veto rights

- Clauses relating to further issue of capital

- Clauses relating to conversion

- Clauses relating to pre-emptive rights

- Clauses relating to affirmative voting rights

- Governing law and jurisdiction clauses

- Dispute resolution clauses

- Different methods of raising debt

- Direct lending from financial institutions - short term and long term

- Issue of debt instruments - debentures and bonds

- Other instruments not convertible into equity

- Money market instruments

- Inter-corporate borrowings

- Credits for specific purposes

- Types of institutional credit facilities

- Working capital facilities

- Fund based

- Non-fund based

- Term loans

- Other credit facilities

- Typical issues of external commercial borrowings

- Exchange control laws

- Exchange related risks and hedging

- Interest rates prevalent in different countries

- Ability to liquidate the security upon non-repayment

- Ability to repatriate sale proceeds

- Ability to enforce landing agreements in local courts

Subject 8: Cross-border M&A and Competition Law (4 credits)

- Types of M&A structures and how to choose an optimal structure

- Asset acquisitions

- Business transfer and slump sale

- Share acquisitions

- Demergers and hive offs

- Special kinds of M&A transactions

- Leveraged acquisitions

- Acquihire arrangements

- Joint venture structures

- PIPES transactions

- Major concerns in cross border M&A and how to deal with these

- Designing the structure - forming acquisition companies

- Exchange control laws

- Taxation concerns - dealing with capital gains

- Technology transfers

- Cultural challenges on integration

- Employment challenges for a cross border employer

- Competition and antitrust issues

- Dealing with multiple acquirers

- Conducting cross border due diligence

- Defining the depth of due diligence

- Using external consultants / firms in another country

- Setting deadlines

- Deciding the terms based on the reports

- Asset and business transfers and related transaction documents

- Negotiating terms of asset purchases

- Individual valuations

- Mobility of the assets

- Can you purchase intangible assets with an asset purchase agreement?

- Tax implications

- How to draft an asset purchase agreement?

- Negotiating terms of business transfers

- How to determine a lump sum consideration

- Transfer of ‘block of assets’ - taxation implications of slump sale

- Accounting concerns

- Employment concerns when entire undertakings are transferred

- How to draft a business transfer agreement

- Acquiring listed companies: regulatory requirements

- Approach target’s management

- Agreements / Negotiations

- Stock exchange announcements

- Notifying regulators

- Notifying shareholders about any changes

- Competing offers

- Drafting offer letters and competing offer letters

- Completing the transfer of shares and vested stock options, if any

- Integration and management changes

- Hostile takeovers and defences

- Introduction to merger control

- Combinations and types of combinations

- Horizontal Combinations

- Vertical Combinations

- Conglomerate Combinations

- Composite Transactions

- Reverse Triangular Combinations

- International Competition Network and bilateral and multilateral agreements

- Unique features of Competition law in major economies

- US Antitrust law

- EU Competition law

- Japanese anti-monopoly law

- German competition law

Subject 9: IPOs and Public Listing on Exchanges Across the World: NYSE, NASDAQ, LSE, AIM, Luxembourg, SGX (4 credits)

- When is the right time to go public?

- Eligibility criteria based on the law

- Visibility and investor interest

- Growth forecast

- Deploying the issue proceeds

- Managing investor expectations

- Readiness to manage higher compliance levels

- The IPO Process in different countries

- IPO registration documents

- Appointing an IPO team - intermediaries

- Due diligence

- Drafting and filing offer documents

- Opening and closing the issue

- Allocation of IPO shares - where is this regulated?

- Credit of electronic shares

- Are dematerialised shares offered in all countries through an IPO?

- IPO Vs. SPAC and De-SPAC process for US and Non-US entities

- Different methods to list on the New York Stock Exchange (NYSE)

- Initial Public Offering

- Direct Floor Listing

- Special Purpose Acquisition Company (SPAC)

- Transfer from other stock exchanges

- Quotation listing

- Reg. S Issuances

- 144A issuances

- Upgrade for an OTC trading company

- Regulation of intermediaries

- Banking Secrecy Act and managing AML filings

- Broker regulation and filings with FINRA

- How to list on the NYSE

- Choose the market

- NYSE

- NYSE American

- NYSE Arca

- NYSE Bonds

- Eligibility criteria for listing on that specific market (quantitative and qualitative listing standards)

- Reserve ticker symbol

- CUSIP number

- Draft and handle director and officer questionnaires

- Submit original listing application

- Select Designated market maker

- Important filings for listed company work

- Continued listing requirements for NYSE

- Continued listing criteria

- No. of Stockholders

- Trading Volume

- No. of publicly traded shares

- Disclosures and reporting material information

- Completing filings on EDGAR

- Preparation and filing of DocuSign’s 10-K, 10-Q, 8-K, proxy statement - DEF 14A and other public company and regulatory filings,

- working in collaboration with attorneys, accounting and finance and other professionals

- Prepare and file Forms 3, 4 and 5; manage Section 16 compliance tracker; assist in administering 10b5-1 trading plan compliance

- Corporate Governance Standards

- Agencies, depositories, trustees

- Suspension and delisting

- How to list on the NASDAQ

- Choosing a market tier

- NASDAQ Global Select

- NASDAQ Global

- NASDAQ Capital

- Eligibility criteria for listing

- Corporate Governance requirements

- Using NASDAQ’s corporate services

- How to list on London Stock Exchange (NSE)

- How to list on the Alternative Investment Market (AIM)

- How to list on Luxembourg Stock Exchange

- How to list on Singapore Stock Exchange (SGX)

Specialisation II: International Trade and International Taxation

Subject 1: Introduction to International Trade - Sale of Goods / Services (including export of content, services, intellectual property over the internet) and customs work (6 credits)

- Components of international trade

- Imports,

- Exports

- Re-exports

- How is international trade regulated

- GATT

- Sanctions

- Licensing and prohibited products for import and export

- Taxes and duties

- Documentation norms

- Imports - registration and licensing

- Requirement to register as an importer

- Obtaining import licenses

- Import licensing requirements

- US - Licensing for specific items

- UK - Licenses for specific items from ILB

- EU - Countries having significant international trade: Germany, France, Netherlands

- India - IEC No., OGL, licensing for specific items

- UAE: Registering with Dubai customs department to get IEC

- Singapore:

- Import Duties

- Exports - registration and licensing

- Export duties / taxes

- Incentives for International Trade in various countries

- Concept of re-exports and uses or benefits of re-export

- How are re-exports regulated in different countries

- US: Export Administration Regulations regulating products which are imported but which have US technology

- Europe: Chapter III of Title VIII of the Union Customs Code of Europe

- India: Customs Act, 1962

- UAE: GCC Common Customs Law, Dubai Customs Procedures

- Singapore: Regulation of Imports and Exports Regulations

- Regulation of exports of legal Cannabis and Marijuana

- Export of content or intellectual property directly through the internet

- Information services

- Selling content / books

- Software subscriptions

- Educational courses

- Typical issues for exporting content through the internet

- Jurisdiction issues - which courts have jurisdiction?

- Taxation issues - which country’s tax laws shall apply?

Subject 2: International Trade Financing, Documentation, Contracts and Regulation of Intermediaries (4 Credits)

- Letters of Credit and Standby Letters of Credit

- Bonds and Guarantees

- Pre-shipment credit

- Purchase order finance or Suppliers’ credit

- Buyer’s credit

- Bill / Invoice discounting

- Inventory / Stock / Commodity financing

- Financing programmes offered by Governments across the world

- Cross border contracts for sale of goods

- Model Contracts

- Incoterms

- Specific terms

- Service contracts and service level agreements

- Distribution Agreements

- Manufacturing and technology transfer agreements

- Online content / software subscription agreements

- How is governing law and dispute resolution determined in contracts for international trade?

- Customs Documentation in international trade

- UCP 600

- Transport of goods through land

- Shipping

- Air transport

- Logistics intermediaries

- Warehousing companies

- Export Management Companies

- Export Packers

- Customs House Brokers

- Freight Forwarders

- Carriers

- Non-vessel operating common carriers (NVOCCs)

- Channel intermediaries

- Manufacturer / supplier

- Distributor / Agent

- Wholesaler

- Retailer

- Other intermediaries

- Insurers

- Electronic intermediaries (e-intermediaries)

Subject 3: How to perform legal work for companies situated in free trade zones under international law and domestic laws of important countries (SEZs / FTZs / EPZs, etc.) - e.g. UAE, China, India (2 Credits)

- What are Special Economic Zones and some important SEZs across the world

- NAFTA

- EU Single Market

- ACFTA

- AFTA

- China Special Economic Zones

- Laws regulating the setting up and the operation of Special Economic Zones

- How do Free Trade Zones work?

- Free Trade Zones in the UAE

- How do Export Processing Zones work?

- EPZs around the world

- How do International Financial Services Centres work?

- Dubai

- Dublin

- GIFT City, India

- Taxation incentives for SEZs

Subject 4: International trade disputes, WTO, International Commercial Arbitration and disputes before local customs authorities (2 Credits)

- Introduction to WTO dispute settlement mechanism

- When can the WTO dispute settlement process be availed?

- WTO bodies which are involved in the dispute settlement process

- Dispute Settlement Process

- Consultation

- Process before the Panel

- Report of the panel

- Appellate Review

- Adoption of Reports by DSB

- Implementation by the losing member country

- Countermeasures

- Investment treaty arbitration

- What are bilateral investment treaties

- Extent of protection offered by bilateral investment treaties

- Disputes between investors and governments

- International Arbitration bodies

- ICSID

- UNCITRAL

- What is the work that international law firms do with respect to investment treaty arbitration?

- Enforcement of international awards at a local level

- The New York Convention

- Enforcement of foreign arbitral awards in 10 major economies

- Customs Appellate Bodies / tribunals in different countries

- US Customs and border protection disputes

- Reporting trade through the Automated Control Environment (ACE)

- e-Allegations

- CBP Investigations under the Enforce and Protect Act of 2015

- Advanced Rulings by CBP

- Customs Rulings Online Search System (CROSS)

- Priority trade issues

- Import Quotas

- Import Safety and Bioterrorism Act

- Anti-dumping duty and countervailing duty

- Trade Agreements

Subject 5: Advanced International Tax and Indirect tax on international transactions (4 Credits)

- Direct and indirect taxation forms across the world

- Income and wealth taxes

- Taxes on supply or value added taxes

- Duties

- Cesses

- Surcharge

- Applicability of taxation on payments for purchases / sales / provision of services

- For goods and services

- For technology transfers

- For licensing of IP

- Applicability of taxation for return on investment

- Taxes on interest

- Taxes on dividends

- Applicability of taxation on Capital Gains across the world

- Applicability of taxation on payments for intellectual property

- Royalty

- Technical fees

- Applicability of taxation on income from leasing / renting assets

- International tax issues in secondment agreements

Subject 6: How to read financial statements and interpret accounting standards for tax lawyers (4 credits)

- Why should tax lawyers know about financial statements?

- What do financial statements contain?

- Accounting systems, journal entries, ledger and trial balance

- Profit and Loss Account or Income Statement and its relevance to taxation

- Goodwill and Depreciation Accounting and its relevance to taxation

- What should you review in the Balance Sheet of a company as a tax lawyer?

- How are financial statements of companies prepared and approval process

- How can you find financial statements of different companies?

- Popular accounting software used across the globe

- What are accounting standards and how are they relevant in preparing financial statements?

- A peak into International Financial Reporting Standards (IFRS) and their relevance to tax lawyers

- What are generally accepted accounting principles (GAAP)?

Subject 7: US taxation system and how to perform US tax filing, compliance and litigation support work for trade and tax disputes for US lawyers, law firms and legal departments of corporations (8 credits)

- Tax laws in the US

- Internal Revenue Code

- Treasury (Tax) Regulations