Posted inUGC NET

Data Interpretation UGC NET

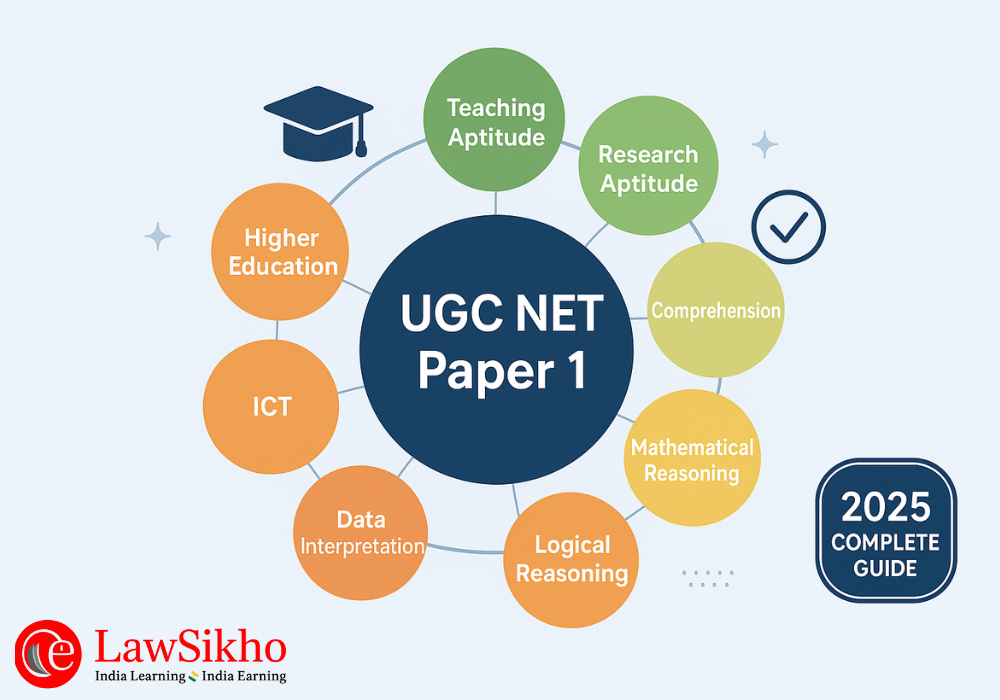

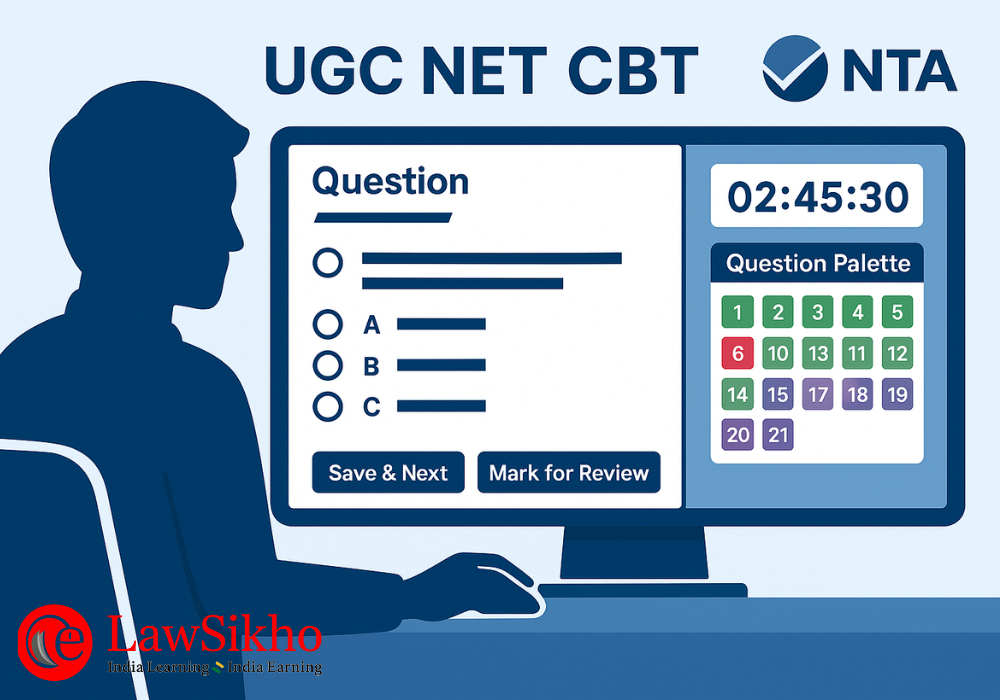

Master UGC NET Paper 1 Data Interpretation with this complete guide covering essential formulas, calculation shortcuts, graph-type strategies, and a 15-day preparation plan for guaranteed marks.

Allow notifications

Allow notifications