To answer the question in the subject line: The biggest benefits are, of course, money, prestige, and fame. I’ll tell you more about each of these.

But let us start with the earnings.

The first thing you need to understand is that being an independent director is a part-time gig. You don’t get a salary; you get a sitting fee for attending meetings.

So how much can this be, and how much do you earn this way?

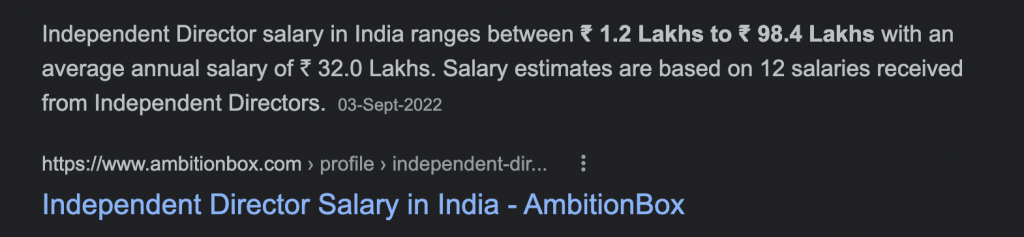

Here is the broad range of fees earned by independent directors.

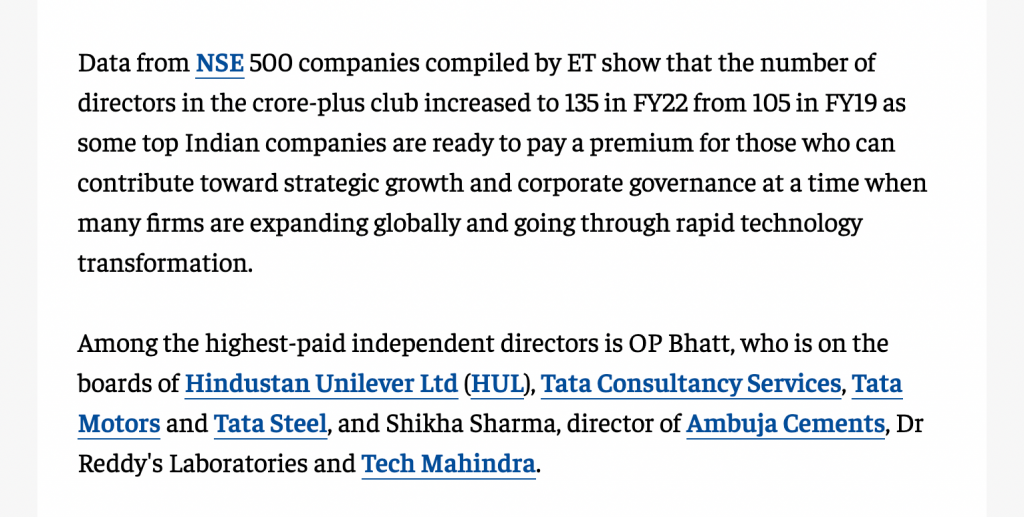

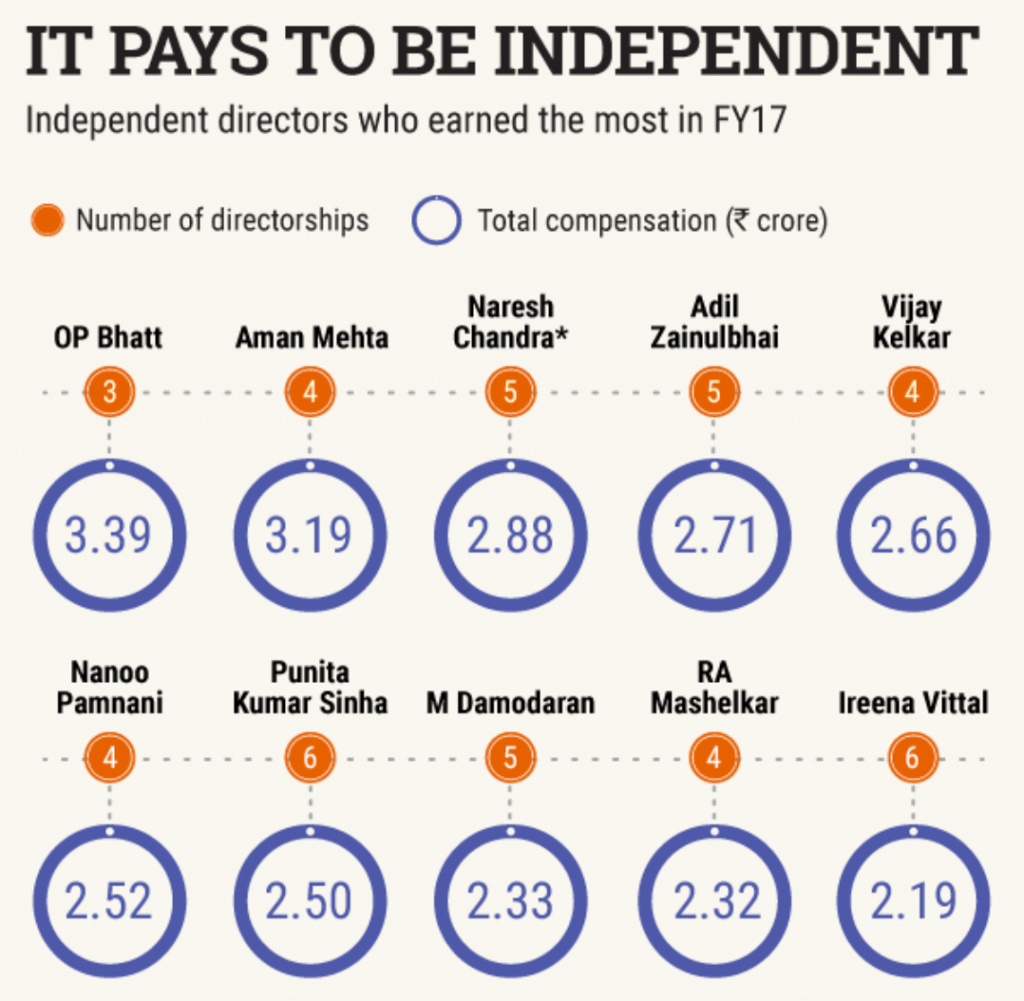

At the top end of the spectrum, the pay is extremely high.

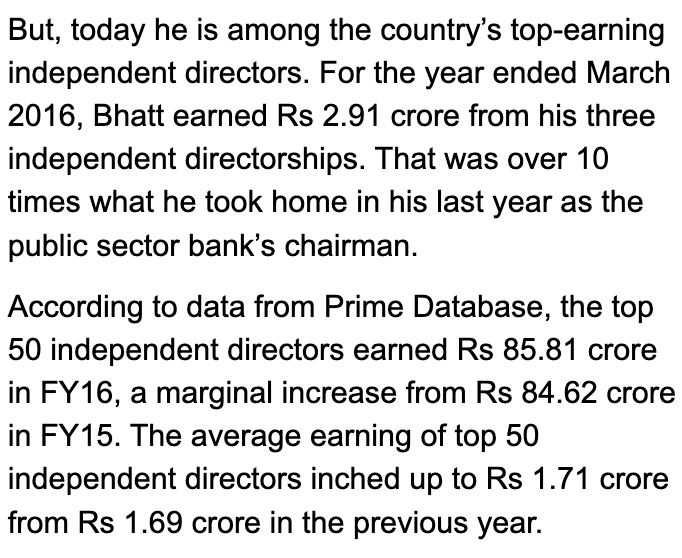

Here is some information that I found on their earnings from 2015 article. The ‘he’ (below) refers to OP Bhatt, who sits on the boards of many leading and high-profile companies in India.

Earnings as an ID

Let me give you a very basic calculation for independent directors at an entry level. It is reasonable for independent directors to charge up to INR 50,000-1 lakh per meeting. The board of a company must meet at least once in every 3 months, and can meet more frequently.

Independent directors must also be present on the committees of the board, especially the audit committee, nomination committee, remuneration committee, and attend meetings of such committees as well.

The board meets at least 4 times a year, and the committees meet at least twice in a year. In addition, there is an exclusive independent directors’ only meeting to be held every year.

Assuming that you charge INR 50,000 per meeting and there are 9 meetings per year for a company on an average, which is reasonable.

If you are an independent director for 5 companies, you can earn INR 22.5 lakh, or almost INR 2 lakh per month! That too for part-time work, where you are primarily attending a few meetings.

This is only the starting point. As you build your track record, you can charge more. Maybe after 3-5 years, you could charge INR 1 or 2 lakh per meeting as well, and companies will pay because of the value that you bring to the board.

You can go on increasing your fee with more and more experience, as you seek out appointments on the boards of the largest and most valuable companies of India, who need your expertise.

Other benefits

The other benefits are recognition, prestige, fame and power. It is a big achievement to be associated with India’s largest and most prestigious companies. Major moves by such companies, even your appointment as independent director itself, are covered in the press.

You won’t have to worry about media coverage any more. Your actions at the meetings and their impact on corporate strategy at the board level will likely be reported by the media.

This not only brings you recognition, but if your conduct is principled and sound, this media coverage will amplify your goodwill and track record very rapidly

There are other benefits too. Being an independent director is at the top of the pyramid for multiplying your networking as well. You will be in the same boardroom as the top business leaders of the country, who trust you for your wisdom and the value that you add.

For example, Cyril Shroff and Zia Mody, managing partners of two of India’s biggest corporate law firms, are appointed as independent directors of many companies. Why do they choose to do it despite running law firms that rake in over INR 500 crore every year?

It is because there is no better networking opportunity than being an ID on a board. This way, they ensure revenue flow to their law firms. These are very valuable relationships and ensure a significant flow of work in the long term.

Of course, for the period of your appointment, you or your firm cannot work in a professional capacity with companies on whose boards you have been appointed. But you can get introductions through such networks to other reputed companies. The investors of one company are on the boards of other companies, too. And they have a huge say in which law firms get their work.

Being an ID puts you in a very exclusive club with many intangible benefits. Like investment opportunities that are not open or known to the general public. Perhaps you can tag along in certain strategic investments or angel investment funds that never open up to general investors.

Ashneer Grover, entrepreneur and former MD of BharatPe, was trying to access pre-IPO shares from Nykaa through Kotak Mahindra. Why was he angry and shouting at the banker in the video clip that went viral? It is because he did not want to miss the investment opportunity that he knew would make him a lot of money (he did miss it, which is why he was angry).

Your professional network as an ID can open up better job opportunities, too. If you are already working somewhere, you can get access to much more prestigious career opportunities as these business leaders can refer you to their friends and their network.

The position of being an independent director also lends very high credibility for any professional engagements in future. There is no other comparable position or achievement in the corporate world that requires you to have demonstrated a greater level of integrity and character, as an independent director.

Having such powerful connections and such a high credibility are very important for escaping the middle management trap. This has a force multiplier effect on your career. Suddenly, you are very much in demand.

You get to see the inner workings of a board and contribute to it. You help your board navigate the ups and downs. What a learning opportunity! You will be more respected for being a corporate insider.

Also, there is an opportunity for service and contribution. You are safeguarding the interests of the public who have invested in India’s largest and most reputed companies. You have the responsibility to ensure that management operates ethically and with integrity.

The impact is tremendous.

So do you see yourself becoming an Independent Director? Are you interested in this opportunity?

We can help you get there. Connect with us to know more. You can do so by joining our Telegram channel.

Allow notifications

Allow notifications