Learn everything you need to deal with a labour raid: clear protocols and checklists. From maintaining documents to handling officials, this guide helps you navigate every step without fear and panic. Whether you are an HR professional, a business owner, a legal consultant or a compliance officer, this article aims to equip you with the information to ensure that you are always “labour raid ready”.

Table of Contents

Introduction

While most compliance takes place quietly behind the scenes, there is one scenario that can shake up even the most organised HR teams—a surprise labour inspection (commonly referred to as “labour raids”).

Labour inspections are entirely legal and often sudden. It is usually triggered by anonymous complaints, routine inspection, or red flags in your organisation’s filings. And if you are not prepared, it can lead to hefty penalties, disruption of operations, or, in case of grave cases, reputational damage.

With the help of the snapshots below, you can see that in recent years, several organisations including corporate powerhouses across India have found themselves in choppy waters due to non-compliance with core labour laws—ranging from improper work conditions to non-maintenance of registers to violations under the Factories Act, Payment of Wages Act, or EPF Act.

When a raid hits, even a minor oversight can appear damning.

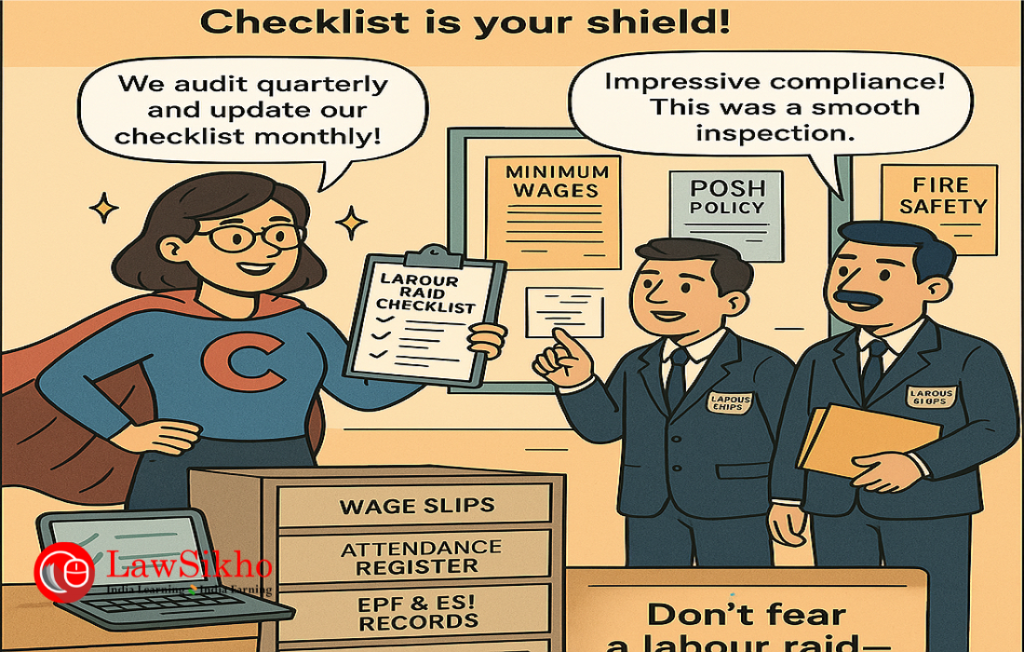

As an HR Manager or in-house counsel, one of your primary responsibilities is to ensure that your workplace operates within the framework of labour laws. This is why every HR head and compliance officer should have a ready-to-go Labour Raid Checklist, a practical tool that ensures your company is always inspection-ready.

In this article, I will show you how to build that checklist from scratch in under an hour. It is easier than you think, and it could be the difference between a smooth inspection and a legal nightmare.

Once you have mastered this, you can go on to design broader labour compliance programs, support startups, or even freelance as a labour compliance advisor—there’s high demand for professionals who can navigate Indian labour law.

Let’s begin by understanding what inspectors typically look for and how to structure your checklist.

What is a labour raid?

Let us understand this by taking an example of Acme India Pvt. Ltd. It employs 50 persons (including permanent, temporary and contractual). One day, labour officers show up for a routine inspection.

They start inspecting:

- Attendance registers

- Wage slips

- Employee Provident Fund (“EPF” ) & Employee State Insurance (“ESI”) contribution records

- To keep a watch against child labour, they also checked Identity proofs and age records of workers

- Working conditions and safety measures on site.

During the raid, they discover that:

- The register of workers was not updated

- Delays

- Overtime is being paid in cash without any statutory documentation.

Even though Acme India Pvt. Ltd. was not intentionally violating the law, the paperwork was incomplete, and that resulted in a penalty.

This is what happens in a labour raid.

What triggers a labour raid?

Labour inspections or labour raids are often triggered by:

- Anonymous complaints from employees or trade unions

- When the authority suspects discrepancies in statutory filings

- Accidents or workplace safety violations

- Routine inspections by labour commissioners or ESIC/EPFO authorities

Now, give a statutory framework to conduct a labour raid

Who can show up for a labour raid?

As you read in the section relating to the statutory framework, you will acknowledge that when it comes to labour law compliance, multiple government bodies have jurisdiction depending on the nature of your business, the number of employees, and the applicable legislation.

Below is a quick reference guide to help you understand which officer is responsible under which Act and by which authority he/she is appointed. Knowing this will help your HR manager or compliance team stay prepared and identify the legitimacy of any inspection.

How to prepare a labour inspection/raid checklist?

Miraa, the HR manager at Acme India Pvt. Ltd. was quite shaken up by the experience. She realised that probably her methods of keeping track were not working out. Determined to prevent future lapses, Miraa adopted a step-by-step approach to draft a comprehensive labour law checklist, which I am sharing with you below:

- At first, identify which labour laws apply to your organisation

Start by listing all the central and state-specific labour laws applicable to your organisation, such as the Payment of Wages Act 1936, Minimum Wages Act 1948, Payment of Bonus Act 1965, Provident Fund & Miscellaneous Provisions Act 1952, Employees’ State Insurance Act 1948, Contract Labour (Regulation & Abolition) Act 1970, Payment of Gratuity Act 1972, Maternity Benefit Act 1961, POSH Act, 2013, etc.

- List compliance requirements

Break down each law into specific compliance tasks, such as:

- Registration or license requirements

- Maintenance of registers and records

- Filing of an update with the authorities

- Display of notices

- Remittance of contributions (e.g., PF, ESI)

- Documentation such as wage slips, appointment letters, etc.

- Set frequency and deadlines

Bifurcate each task based on its frequency, that is, daily, monthly, quarterly or annually.

You can mention specific dates or periods (e.g., “PF to be deposited by the 15th of the following month”).

- Delegate responsibility

Mention which department or person is responsible for each task (e.g., HR manager or compliance office).

- Include supporting documents

Mention the relevant formats and documents that must be maintained/submitted:

- Forms as per the Acts

- Registers of wages, attendance, fines, etc.

- Copies of challans and returns

- Incorporate internal review

Add periodic internal audit checkpoints to:

- Verify compliance

- Identify gaps

- Update the checklist with changes in the law

- Format the checklist

You can use a simple tabular format as stated below:

| Act | Compliance Requirement | Frequency | Due Date | Responsible Person | Remarks |

|---|---|---|---|---|---|

| ESI Act | Deposit ESI contributions | Monthly | 15th of the following month | Accounts Dept. | Online portal filing |

- Update regularly

I cannot emphasise how important it is to be updated with the recent amendments in law, as it keeps evolving. Keep your checklist updated with amendments, notifications and new legislation.

What documents should you keep handy?

- Company registrations & licenses

- Shops & establishments registration certificate: Proof of registration under the applicable state act.

- PF and ESI registration certificates: For PF and ESI, if applicable.

- Labour department registration: Required for certain industries or states.

- Contract labour license: Mandatory if engaging contract labour under the Contract Labour (Regulation and Abolition) Act.

- Employee records

- Attendance register/biometric logs: Daily attendance records and working hours.

- Wage register/salary slips: Evidence of wages paid, compliant with minimum wage laws.

- Appointment letters: Issued to all employees, outlining the terms of employment.

- Leave records: Track earned, casual, and sick leave as per applicable laws.

- Employee ID proofs: Copies of Aadhaar, PAN, or other government-issued IDs.

- Statutory compliance documents

- EPF challans and ECR filing copies: Monthly proof of PF contributions and filings.

- ESI challans and return filing proofs: Evidence of ESI contributions and compliance.

- Bonus and gratuity payment records: Documentation of annual bonus and gratuity payments, if applicable.

- Labour welfare fund payment proofs: For states where Labour Welfare Fund contributions are mandatory.

- Minimum wage compliance records: Proof that wages meet or exceed state-mandated minimum wages.

- Statutory registers

- Leave register: Record of employee leave balances.

- Wages register: Detailed record of wages paid.

- Overtime register: Log of overtime hours and payments.

- Fines register: Details of any fines imposed, if applicable.

- Register of contractors: For organisations engaging contract labour.

- Notices and display requirements

- Abstracts of labour laws: Display abstracts of PF, ESI, Minimum Wages Act, etc., as required.

- Weekly holidays notice: Clearly displayed schedule of weekly off days.

- Name board in local language: Company name board as per state regulations.

- Emergency contacts and fire safety instructions: Displayed prominently for safety compliance.

- POSH compliance

- POSH policy: Displayed and accessible to all employees.

- Constitution of Internal Complaint Committee: Details of committee members, including contact information.

- Annual report: Certain states (e.g. Maharashtra) require proof of submission to the District Officer as per the POSH Act, 2013.

For easier accessibility, ensure that you have both hard as well as soft copies of all the aforementioned documents.

Inspection Protocols

After the “raid” incident, Miraa realised that the difference between chaos and control lies in preparation and awareness. She now cannot afford to lose her credibility and face penalties. Learning from that experience, she transformed her approach and developed a structured protocol for compliance.

This is how it looks.

A. Pre-raid protocols (call it a prep phase)

- Maintain updated records

Keep all statutory registers, challans, licenses, and employee documents up to date and readily accessible.

- Internal compliance audits

Conduct regular audits (quarterly or biannually) to ensure legal and procedural compliance. - Display requirements

Ensure all required notices (labour law abstracts, holidays, safety instructions) are displayed as per law. - POSH and grievance committees

Ensure Internal Committee for POSH is formed and active, with records of training and reports. - Train key staff

Designate and train a compliance point-person to handle interactions with inspectors professionally. - Digital and physical backups

Maintain secure backups of documents in both digital and physical formats.

B. During the aid (inspection phase)

- Stay calm and courteous

Welcome the inspector respectfully; do not panic or argue. - Verify the inspector’s credentials

Politely request the official ID, authorisation letter, and note down details. - Escort and coordinate

Assign a designated staff member (HR/compliance officer) to assist and accompany the inspector. - Provide documents only on request

Share documents requested, do not volunteer excess information or unrelated files. - Record the proceedings

Maintain your own notes of what documents were asked for and questions raised. - No signatures without understanding

Avoid signing any documents unless reviewed by authorised personnel or legal counsel.

C. Post-raid protocols (follow-up phase)

- Brief the team

Share what occurred during the inspection and clarify any action points. - Respond promptly to notices

If the inspector issues a notice or report, prepare a factual, timely response. - Consult legal counsel

Review findings with a legal advisor, especially if violations or penalties are cited. - Corrective action

Immediately address any compliance gaps identified during the inspection. - Document the inspection

Keep a detailed record of the raid, communications, and post-inspection actions for future reference. - Strengthen internal processes

Update internal standard operating procedures or checklists based on the experience to prevent recurrence.

What are the powers of the inspectors?

- Enter and inspect any premises during working hours.

- Demand production of registers, records and other relevant documents

- Examine such documents

- Interrogate employers, HR and workers

- Take copies or extracts of documents.

- Issue show-cause notices for violations.

- Initiate prosecution for non-compliance or false records.

What are the rights of the employer during a labour raid?

Know your rights well! Because this will help you in facing inspections with preparedness and clarity, and not panic or fear.

- Respectfully ask for identification and authorization of the officer.

- Request to state the purpose and scope of the inspection.

- Maintain professional decorum and provide only requested documents.

- Keep a record of the visit: time, date, officer’s name, documents examined.

- Consult a legal counsel before signing any statements or acknowledgements.

The aftermath of a labour raid…

So if you think that paying a penalty is the end of it, then you are very likely to go wrong. Depending on the veracity of your non-compliance, the concerned officer can initiate legal actions against the company in default, depending on their findings.

Here are the possible actions which can be taken against the company in default.

1. Issue of a compliance notice

- A formal notice pointing out missing documents, non-displayed information, or minor irregularities.

- The company in default must submit an explanation or rectify the issues within a stipulated time (usually 7 to 15 days).

2. Show cause notice

- A more serious notice asking the employer to explain why legal action should not be initiated for specific violations.

- A detailed written reply, supported with proof of compliance or explanation, must be submitted.

3. Filing of prosecution/complaint

- For serious or willful violations (e.g., non-payment of minimum wages, no PF/ESI, hazardous working conditions), the officer may file a criminal complaint in the labour court or magistrate’s court.

- Fines, imprisonment (for repeated or grave violations), or orders to pay dues.

4. Seizure or sealing (in case of grave offences)

- If the workplace is hazardous, employs a child/children, or is operating illegally, the officer may recommend sealing of the premises or seizure of records.

- This usually happens after repeated non-compliance or under special provisions of labour or industrial safety laws.

5. Recommendation for re-inspection

- The officer may schedule a follow-up visit to ensure that earlier lapses have been corrected.

- For this, stay fully prepared, correct lapses, and maintain updated documentation.

6. Report to higher authorities

- If a matter is grave, labour officers may escalate it to the labour commissioner, EPF/ESI Authorities, Women’s Commission (in POSH violations), Factory Inspectorate (if applicable)

7. Revocation of business license

Companies that repeatedly act in contravention of critical aspects of labour laws are at risk of losing their operating licenses.

Final thoughts

You need to understand that labour raids are not always a sign of wrongdoing, but unpreparedness can make them seem like one. So, as HR managers, it is your duty to build a transparent, compliant and well-documented workplace. A well-prepared labour raid checklist is not just a tool, it is your shield and your audit companion.

Labour raids can disrupt operations, damage reputation (if the offence is serious), and lead to financial penalties or even legal action. That’s why businesses, especially in manufacturing, construction, hospitality, and logistics sectors, must always be inspection-ready, not just reactive.

Allow notifications

Allow notifications