Private limited company registration in India requires minimum 2 directors, 2 shareholders, and filing through SPICe+ form. Complete guide covering Companies Act 2013 provisions, documents, registration process and fees, and post-incorporation compliance.

Table of Contents

India’s corporate landscape is overwhelmingly dominated by private limited companies, which account for approximately 96% of all registered entities in the country. In FY 2023-24 alone, more than 185,000 new companies were incorporated, with a collective paid-up capital exceeding ₹30,927 crore; a clear testament to their continued preference among businesses. These compelling figures highlight a fundamental reality: whether you are advising clients on business formation, preparing for company secretary examinations, or planning to launch your own venture, a thorough understanding of private limited company registration is indispensable.

This guide is designed for legal professionals, company secretaries, compliance officers, and entrepreneurs who need more than just a procedural overview. You will find detailed analysis of the relevant provisions under the Companies Act, 2013, practical insights on the SPICe+ registration process, comprehensive post-incorporation compliance requirements, and the exemptions available to private companies under various MCA notifications. Whether you are filing your first incorporation application or advising a client on structuring their business, this guide will serve as your authoritative reference.

The registration process has evolved significantly since the introduction of SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) in February 2020. What once required multiple forms, separate applications for PAN, TAN, GSTIN, and visits to various government departments is now consolidated into a single integrated web form. However, the legal requirements remain stringent, and non-compliance during or after incorporation can result in penalties, rejection of applications, or even striking off the company from the register. Let us begin with the foundational legal framework that defines what a private company actually is under Indian law.

Definition of Private Company under Section 2(68) of the Companies Act 2013

Understanding Section 2(68) is essential for anyone advising on or establishing a private limited company because these statutory restrictions have far-reaching operational and legal implications. The restriction on share transferability affects exit strategies and ownership succession planning, the 200-member ceiling influences capital structure decisions and employee stock option schemes, while the prohibition on public invitations determines permissible fundraising avenues, restricting companies to private placements under Section 42 of the Companies Act 2013 (“the Act”), rights issues, or preferential allotments.

Section 2(68) of the Act provides the statutory definition of a private company. According to this provision, a private company is one which, by its articles of association, restricts the right to transfer its shares, limits the number of its members to two hundred (excluding present and former employees who are members), and prohibits any invitation to the public to subscribe for any securities of the company. These three characteristics are mandatory and must be reflected in the company’s Articles of Association at the time of incorporation.

Essential Characteristics That Define a Private Company

For legal practitioners, drafting compliant Articles of Association requires careful incorporation of the three mandatory restrictions (stated below) while balancing promoters’ control objectives with minority shareholders’ legitimate expectations. Failure to incorporate these restrictions means the company cannot be registered as a private limited company, and for company secretaries and compliance officers, these definitional requirements shape ongoing compliance obligations and determine eligibility for various regulatory exemptions available exclusively to private companies throughout their corporate existence.

Restriction on Transfer of Shares

Every private company must restrict the right of its members to transfer shares. This restriction is typically implemented through pre-emption rights, where existing shareholders have the first right to purchase shares before they can be transferred to outsiders. The Articles of Association usually require that any member wishing to transfer shares must first offer them to existing members at a price determined by the board or through a prescribed valuation mechanism.

This restriction serves a critical purpose: it maintains the “private” character of the company by preventing unwanted outsiders from acquiring ownership. Unlike public companies whose shares can be freely traded on stock exchanges, private companies retain control over their shareholder composition. For legal practitioners, this means carefully drafting the share transfer provisions in the Articles to balance the promoters’ desire for control with the legitimate expectations of minority shareholders.

Limitation on Number of Members to 200

A private company cannot have more than 200 members at any given time. However, the calculation of this limit has specific exclusions under Section 2(68). Present employees of the company who are also members are not counted towards this limit. Similarly, former employees who became members during their employment and continued as members after their employment ceased are also excluded.

Additionally, if two or more persons hold shares jointly, they are treated as a single member for the purpose of calculating the 200-member limit. This provision is particularly relevant for family-owned businesses where shares are often held jointly by spouses or family members. For practitioners advising on employee stock option plans (ESOPs), understanding this exclusion is crucial because employees exercising their options and becoming shareholders will not count towards the membership limit.

Prohibition on Public Invitation for Securities

A private company is prohibited from inviting the public to subscribe for any of its securities, whether shares or debentures. This means a private company cannot issue a prospectus, cannot list its shares on any stock exchange, and cannot make any public offering of securities. All fundraising must be through private placement under Section 42 of the Act, rights issues to existing shareholders, or preferential allotment.

This restriction has significant implications for fundraising. While private companies can raise capital from angel investors, venture capital funds, and private equity investors through private placement, they cannot access public markets. Companies seeking to raise funds from the general public must convert to public limited companies, which involves a different set of compliance requirements and the loss of many exemptions available to private companies.

Advantages, Exemptions, and Regulatory Benefits of Private Limited Companies

The private limited company structure represents the optimal choice for businesses seeking growth, credibility, and investor appeal while maintaining operational control. This structure offers limited liability protection to shareholders, ensuring personal assets remain insulated from business liabilities, combined with separate legal entity status that enables the company to own property, enter contracts, and sue or be sued in its own name. For entrepreneurs planning to scale operations, raise venture capital, or build investor-ready businesses, the private limited company structure delivers unmatched advantages in credibility, compliance flexibility, and regulatory benefits unavailable to other business forms.

Key Advantages That Make Private Companies the Preferred Choice

Private limited companies offer compelling operational advantages that make them the preferred choice for serious entrepreneurs and growth-oriented businesses.

- Limited liability protection ensures that shareholders’ personal assets cannot be attached to satisfy corporate debts, with liability restricted to the extent of unpaid share capital.

- The corporate structure enhances brand credibility with customers, suppliers, and financial institutions, as it signals permanence, professionalism, and regulatory compliance.

- Perpetual succession guarantees business continuity independent of shareholder mortality or ownership changes, while the transferability of shares (subject to pre-emption rights in Articles) facilitates smooth succession planning and exit strategies for investors.

- From a fundraising perspective, private limited companies possess distinct advantages over alternative structures. The ability to issue equity shares attracts venture capital, private equity, and angel investors who require shareholding mechanisms, anti-dilution protections, and clear exit routes through share transfers or acquisitions.

- Foreign Direct Investment (FDI) flows into private limited companies through the automatic route in most sectors without requiring prior government approval, unlike LLPs which face regulatory restrictions.

- Professional management structure with clearly defined roles; shareholders providing capital, directors managing operations, and potential separation between ownership and control; enables scalability and attracts experienced talent through employee stock option plans (ESOPs) that convert key employees into stakeholders.

Regulatory Exemptions Under MCA Notification Dated June 30, 2015

The Central Government, exercising powers under Section 462 of the Companies Act, 2013, has granted significant exemptions to private companies through notifications, most notably the notification dated June 5, 2015 (subsequently amended). These exemptions recognize that private companies, with restricted membership and no public interest in their securities, warrant lighter regulatory oversight compared to public companies. Understanding and leveraging these exemptions is crucial for legal practitioners advising clients on compliance strategies and for company secretaries managing corporate governance frameworks.

Exemptions from Board Resolution Filing Requirements (Section 117)

Section 117 of the Act mandates companies to file certain board resolutions and agreements with the Registrar of Companies, but private companies enjoy exemptions from filing resolutions related to borrowing money beyond limits prescribed under Section 180(1)(c) and creating charges on assets under Section 180(1)(a), provided the borrowing is from banks, financial institutions, or involves securities issuance in the ordinary course of business.

This exemption significantly reduces filing burden for private companies that frequently raise working capital through bank loans or create security interests on assets for business financing. However, the underlying board resolution must still be passed and recorded in board minutes; only the ROC filing requirement is exempted, ensuring internal corporate governance remains intact while reducing external regulatory compliance.

Relaxations in Related Party Transaction Approvals (Section 188)

Section 188 of the Act governs related party transactions and ordinarily requires special resolution for transactions exceeding prescribed thresholds, but private companies benefit from relaxed approval requirements when the related party with whom the transaction is entered is also a member of the company and such member abstains from voting on the resolution.

This exemption provides crucial flexibility to family-owned businesses and closely-held companies where transactions between the company and promoter families or related entities are common and necessary for operational efficiency. The transaction must still comply with arm’s length pricing requirements and be in the ordinary course of business where applicable, but the special resolution requirement is replaced with ordinary resolution (with interested party abstention), streamlining the approval process while maintaining governance safeguards.

Exemptions from Managerial Remuneration Limits

Private companies are completely exempt from the managerial remuneration caps prescribed under Section 197 of the Act, which limits remuneration to managerial personnel (managing directors, whole-time directors, managers) as a percentage of net profits for public companies. This exemption allows private companies unrestricted freedom to structure competitive compensation packages necessary to attract and retain top talent without being constrained by profit-linked percentage limitations.

While there is no statutory ceiling on remuneration, private companies must still exercise prudence as excessive remuneration may attract income tax scrutiny under the reasonableness test, and for companies with cross-border arrangements, transfer pricing regulations require arm’s length remuneration to prevent profit shifting.

Additional Benefits for Small Company Classification Under Section 2(85)

Private companies qualifying as “Small Companies” under Section 2(85) of the Companies Act, 2013 enjoy additional layers of exemptions beyond those available to all private companies, creating a cumulative benefit structure that substantially reduces compliance burden for startups and small and medium enterprises (SMEs).

These exemptions span board meeting frequencies, annual return requirements, auditor rotation mandates, and financial statement preparation, making the small company classification particularly attractive for early-stage businesses focused on growth rather than compliance administration.

Qualifying Criteria for Small Company Status

Under Section 2(85) as amended, a private company qualifies as a Small Company only when both conditions are simultaneously satisfied: paid-up share capital does not exceed ₹10 crore AND turnover as per the last audited financial statements does not exceed ₹100 crore. Both thresholds must be met concurrently; breaching either limit disqualifies the company from small company status and associated exemptions. Importantly, holding companies, subsidiary companies (whether Indian or foreign), and Section 8 companies (not-for-profit) are statutorily excluded from small company classification regardless of their capital or turnover, ensuring complex corporate structures remain subject to full compliance requirements.

Reduced Compliance Requirements for Small Companies

Small companies benefit from significantly relaxed compliance obligations across multiple regulatory dimensions. Board meeting requirements are reduced from four meetings per year to just two meetings annually (one in each half of the calendar year with a minimum 90-day gap), substantially reducing directors’ time commitment and costs.

Small companies are exempt from mandatory auditor rotation under Section 139(2), allowing them to retain the same audit firm indefinitely, and the annual return in Form MGT-7 can be signed by a Company Secretary alone or by a single director if no CS is appointed. Additionally, the auditor’s report need not include statements on adequacy of internal financial controls under Section 143(3)(i), recognizing that small enterprises may lack sophisticated control systems.

Exemption from Cash Flow Statement Preparation

Small companies, along with one person companies and dormant companies, are statutorily exempt from preparing a Cash Flow Statement as part of their annual financial statements under the Companies Act, 2013. This exemption reduces technical complexity and professional costs associated with financial statement preparation, as cash flow statements require detailed analysis of operating, investing, and financing activities that may be disproportionately burdensome for small entities. However, small companies must still prepare a Balance Sheet and Statement of Profit and Loss in accordance with Schedule III to the Act, ensuring fundamental financial reporting obligations remain intact.

Brief Comparison: Private Company vs LLP, OPC, and Public Company

When evaluating business structure options, three key distinctions separate private limited companies from alternatives.

Fundraising capability: private companies can issue equity shares to venture capitalists and angel investors with FDI permitted under the automatic route, whereas LLPs cannot issue shares and face FDI restrictions, OPCs are limited to a single shareholder with mandatory conversion thresholds (₹50 lakh capital or ₹2 crore turnover), and public companies can raise unlimited capital but face significantly higher compliance costs.

Ownership transferability: private companies allow share transfers subject to pre-emption rights facilitating investor exits, while LLPs require partner consent for ownership changes, OPCs cannot transfer ownership without structure conversion, and public companies offer free transferability with potential stock exchange listing.

Compliance burden: private companies balance structured governance with substantial MCA exemptions (board resolution filing relief, related party transaction relaxations, no managerial remuneration caps), LLPs have lighter compliance but lack investor appeal, OPCs face similar compliance with membership restrictions, and public companies endure the heaviest regulatory burden including mandatory board committees and SEBI regulations; making private limited companies the optimal choice for scalable, investor-ready businesses.

Minimum Requirements for Private Limited Company Registration

Before initiating the registration process, you must ensure that all requisites under the Companies Act, 2013 and the Companies (Incorporation) Rules, 2014 are satisfied. These requirements relate to directors, shareholders, capital, and registered offices. Understanding these requirements helps avoid application rejections and ensures smooth incorporation.

Director Mandate Under Section 149

Directors are the individuals responsible for managing the company’s affairs. The Companies Act, 2013 prescribes specific requirements regarding the number of directors, their qualifications, and residency status. Non-compliance with these requirements can result in rejection of the incorporation application or subsequent penalties.

Minimum Number and Maximum Limit of Directors

Under Section 149(1) of the Companies Act, 2013, every private company must have a minimum of two directors. There is no requirement for independent directors in private companies (unless the company falls within certain thresholds under the SEBI LODR Regulations for listed entities, which is not applicable to private companies). The maximum number of directors is fifteen, though this can be increased by passing a special resolution.

Both directors can also be shareholders, meaning a private limited company can be incorporated with just two individuals who serve as both directors and shareholders. This is a common structure for startups and family businesses where the founders want to maintain complete control.

Resident Director Requirement Under Section 149(3)

Section 149(3) mandates that every company must have at least one director who has stayed in India for a total period of not less than 182 days in the previous calendar year. This “resident director” requirement ensures that at least one person responsible for the company’s management is physically present in India and accessible to regulatory authorities.

For companies with foreign promoters, this requirement often necessitates appointing an Indian resident as a director. The residency is calculated based on physical presence in India during the calendar year preceding the year of incorporation. For example, if incorporated in 2025, at least one proposed director must have been resident in India for 182 days or more during 2024 (previous calendar year).

Director Disqualification Grounds Under Section 164

Before appointing any individual as a director, you must verify that they are not disqualified under Section 164. The disqualification grounds include being of unsound mind, being an undischarged insolvent, having been convicted of an offence involving moral turpitude with imprisonment of six months or more (within the last five years), and having been disqualified by a court or tribunal order.

Importantly, Section 164(2) disqualifies any person who is or was a director of a company that failed to file financial statements or annual returns for a continuous period of three years, or failed to repay deposits, debentures, or interest thereon. This provision has resulted in the disqualification of lakhs of directors and underscores the importance of compliance even in dormant companies. Before accepting a directorship or appointing a director, always verify their DIN status on the MCA portal.

Shareholder Structure and Capital Requirements

One of the most persistent misconceptions about private limited company registration relates to minimum capital requirements. The legal position has changed significantly since the original enactment of the Companies Act, 2013, and practitioners must advise clients based on the current law.

Minimum and Maximum Number of Shareholders

A private limited company must have a minimum of two shareholders (subscribers to the Memorandum of Association). The maximum is 200, excluding employees and former employees as discussed earlier. The shareholders can be individuals or body corporates (including other companies, LLPs, or foreign entities). Unlike directors, there is no residency requirement for shareholders.

The same two individuals can serve as both directors and shareholders, enabling the incorporation of a company with just two people. For foreign companies looking to establish subsidiaries in India, the holding company can be one shareholder, with either another group entity or an individual (such as a nominee) as the second shareholder.

Minimum Paid-Up Capital Requirement

This is where significant confusion exists due to outdated information. The original Section 2(68) required private companies to have a minimum paid-up share capital of ₹1 lakh. However, this requirement was repealed by the Companies (Amendment) Act 2015, with effect from May 29, 2015. As of 2025, there is no statutory minimum paid-up capital requirement for private limited companies.

A company can be incorporated with a paid-up capital as low as ₹10,000 or even ₹1,000. The authorized capital (the maximum capital the company is authorized to issue) can also be kept minimal to reduce stamp duty costs during incorporation. However, the authorized capital should be fixed keeping in mind future capital requirements, as increasing it later requires filing Form SH-7 and paying additional fees and stamp duty.

Authorized vs Paid-Up Capital

Authorized capital is the maximum amount of share capital that the company is authorized to issue to shareholders as specified in the Memorandum of Association. Paid-up capital is the portion of authorized capital that has actually been subscribed and paid for by shareholders. For example, a company may have an authorized capital of ₹10 lakh but a paid-up capital of only ₹1 lakh if that is all that has been subscribed.

Starting with lower authorized capital reduces initial costs but may require increasing it (with associated fees) when raising further capital. Practitioners should advise clients to balance immediate cost savings against likely future capital requirements.

Registered Office Requirements Under Section 12

Every company must have a registered office from the date of incorporation. The registered office is the official address for all communications and legal notices. Section 12 of the Act requires that the company must verify its registered office with the Registrar within 30 days of incorporation by filing Form INC-22.

The registered office can be a commercial property, an office in a co-working space, or even a residential address. There is no legal prohibition on using a residential address as the registered office, though some landlords or housing societies may have restrictions on commercial use. The address must be a valid physical address within India where the company’s statutory registers and records are kept or can be made available.

Step-by-Step Private Limited Company Registration Process Through SPICe+ Form

The Ministry of Corporate Affairs introduced SPICe+ in February 2020 as part of the Ease of Doing Business initiative. This integrated web form replaced the earlier SPICe (INC-32) form and consolidated multiple services that previously required separate applications. Understanding the SPICe+ process is essential for anyone involved in company formation.

SPICe+ offers 10 services through 3 Central Government Ministries and Departments: the Ministry of Corporate Affairs, the Ministry of Labour, and the Department of Revenue under the Ministry of Finance. It also integrates with one State Government (Maharashtra for Professional Tax registration). The services include name reservation, incorporation, DIN allotment, PAN application, TAN application, GSTIN application (optional), EPFO registration, ESIC registration, Professional Tax registration (Maharashtra), and opening of a bank account.

Company Name Approval Through SPICe+ Part A

The name of your company is its identity in the marketplace and legal realm. The name reservation process ensures that the proposed name is unique, not prohibited under the naming guidelines, and does not infringe on existing trademarks or company names. Name reservation is handled through SPICe+ Part A.

Name Availability Guidelines Under Rule 8

Rule 8 of the Companies (Incorporation) Rules, 2014 prescribes detailed naming guidelines. A proposed name will be rejected if it is identical or similar to the name of an existing company or LLP registered in India. The name also cannot be similar to a registered trademark unless the trademark owner provides a No Objection Certificate.

Certain words are restricted and require prior approval or specific conditions. Words like “Bank,” “Insurance,” “Stock Exchange,” “Venture Capital,” and “Asset Management” require approval from the relevant regulator (RBI, IRDA, SEBI). Words suggesting government patronage like “National,” “Bharat,” “India,” “Republic,” or “Union” require Central Government approval. Generic names like “India Private Limited” without a distinctive first word are not permitted.

The name should ideally have three parts: a distinctive word (unique identifier), a descriptive word (indicating the nature of business), and the suffix “Private Limited.” For example, “Zenith Technologies Private Limited” has “Zenith” as the distinctive word, “Technologies” as descriptive, and “Private Limited” as the mandatory suffix.

Filing SPICe+ Part A for Name Reservation

SPICe+ Part A is a web-based form specifically for name reservation. You can apply for up to two proposed names in order of preference. The form requires basic company details including type of company (private/public/OPC), main division of industrial activity (NIC code), and a brief significance or meaning of each proposed name explaining how it relates to the proposed business.

The fee for SPICe+ Part A is ₹1,000 (for new companies). Upon submission, the Central Registration Centre (CRC) reviews the application and either approves the name or rejects it with reasons. If the first preference is rejected, the second preference is considered. If both are rejected, you must file a fresh application with new names and pay the fee again.

One resubmission (RSUB) is permitted without additional fees if the application is marked for resubmission due to minor issues. However, if names are rejected outright, a fresh filing with fresh fees is required.

Validity of Reserved Name and Extension Options

Once approved, the reserved name is valid for 20 days from the date of approval. Within this period, you must file SPICe+ Part B for incorporation. If you fail to file Part B within 20 days, the reserved name lapses and becomes available for others to apply.

The validity can be extended by filing SPICe+ Part A again with the same approved name before expiry. This is useful if there are delays in arranging documents or obtaining DSCs. However, the extension requires payment of the fee again.

Applying for Director Identification Number (DIN)

Every individual intending to be appointed as a director must have a Director Identification Number. DIN is a unique identification number assigned by the MCA under Section 153 of the Companies Act, 2013. Once allotted, DIN remains valid for life unless surrendered or deactivated due to disqualification.

Applying for DIN Through SPICe+ Form

For new company incorporations, DIN can be applied through the SPICe+ form itself for up to three directors. This is the most convenient method as it eliminates the need for a separate DIN application. The SPICe+ form captures the personal details, identity proof, address proof, and photograph of the proposed directors, and DIN is allotted upon approval of the incorporation application.

If the company has more than three directors who do not have DIN, the company must be incorporated with three directors first, and additional directors can be appointed later after obtaining DIN.

Applying for DIN Through Separate Form DIR-3

For individuals seeking appointment as directors in existing companies, or for proposed directors of a new company beyond the first three, DIN must be obtained by filing Form DIR-3. This form requires details of the company in which the individual intends to be appointed (for existing company appointments), personal information, identity and address proof, and DSC of the applicant and a practicing professional (CA, CS, or Cost Accountant) who certifies the form.

The fee for DIR-3 is ₹500. Processing time is typically 3-5 working days, though it may be longer if queries are raised. The DIN approval letter is sent to the email ID mentioned in the application.

Obtaining a Digital Signature Certificate (DSC)

All documents filed with the MCA must be digitally signed. A Digital Signature Certificate is an electronic credential that establishes the identity of the signatory and ensures the integrity of the signed document. DSCs are mandatory for all proposed directors and subscribers to the Memorandum of Association.

DSC Requirements for Proposed Directors

Every individual who will sign the incorporation documents must have a valid DSC. This includes all proposed directors (for signing Form DIR-2 consent and the SPICe+ form) and all subscribers to the Memorandum of Association (for signing the e-MOA and e-AOA). If an individual is both a director and subscriber, one DSC serves both purposes.

For foreign nationals, the DSC must be obtained from an Indian certifying authority, which may require additional documentation including apostilled identity proof. The DSC is linked to the PAN or passport number of the individual, so these details must be accurate and consistent across all documents.

Classes of DSC and Certifying Authorities

For MCA filings, a Class 3 DSC is required. Class 3 certificates provide the highest level of assurance and are issued only after verification of the applicant’s identity through physical presence or equivalent verification. The DSC can be issued on a USB token (hardware) or as a paperless/cloud-based certificate.

DSCs are issued by Certifying Authorities (CAs) licensed by the Controller of Certifying Authorities under the Information Technology Act, 2000. The list of licensed CAs is available on the MCA website. Popular certifying authorities include eMudhra, Sify, and (n)Code Solutions.

Documents Required of DSC

To obtain a DSC, individuals must submit identity proof (PAN card for Indian nationals, passport for foreign nationals), address proof (Aadhaar, passport, driving license, or utility bill), a passport-size photograph, and a mobile number and email ID for OTP verification.

Completing Incorporation Through SPICe+ Part B

SPICe+ Part B is the main incorporation form that captures all details about the company, its directors, shareholders, capital structure, and registered office. Upon successful processing, the Registrar issues the Certificate of Incorporation along with PAN and TAN.

Linked Forms: AGILE-PRO, e-MOA, e-AOA, and INC-9

SPICe+ Part B is not a standalone form but works with several linked forms that are automatically generated and must be completed as part of the filing:

AGILE-PRO (INC-35): This form is for applying for GST registration, EPFO registration, ESIC registration, Profession Tax registration (Maharashtra), and opening a bank account. All fields are auto-populated from SPICe+ Part B, and you must select which registrations you want to apply for.

e-MOA (INC-33): The electronic Memorandum of Association captures the company’s name, registered office state, objects (main, ancillary, and other), liability clause, and capital clause. For private companies using standard formats, the e-MOA uses a simplified template. The e-MOA must be digitally signed by all subscribers.

e-AOA (INC-34): The electronic Articles of Association contains the rules for internal management of the company. Private companies can adopt Table F of Schedule I to the Companies Act (with or without modifications) or create custom articles. The e-AOA must also be digitally signed by all subscribers.

INC-9: This is the declaration by first subscribers and directors that they are not convicted of any offence in connection with the formation of the company, they have not been found guilty of fraud, and all information provided is true and correct. It must be signed by each subscriber and director.

Integrated Services: PAN, TAN, GSTIN, and Statutory Registrations

One of the most significant advantages of SPICe+ is the integration of multiple services:

PAN and TAN: Applications for the company’s Permanent Account Number (PAN) and Tax Deduction Account Number (TAN) are mandatory and automatically generated. No separate application to the Income Tax Department is required.

GSTIN: If the company will be making taxable supplies, you can apply for GST registration through AGILE-PRO. This is optional at the incorporation stage but saves time if GST registration will be required immediately.

EPFO and ESIC: Registration with the Employees’ Provident Fund Organisation and Employees’ State Insurance Corporation is mandatory through AGILE-PRO. Even if the company has no employees at incorporation, these registrations are obtained.

Bank Account: AGILE-PRO includes an option to initiate opening of a current account with designated banks. The company’s basic details are shared with the selected bank, which contacts the company to complete account opening formalities.

Filing Process and Timeline for Certificate of Incorporation

Once all forms are completed and digitally signed, they are uploaded to the MCA portal along with supporting documents. The system generates a Service Request Number (SRN) upon payment of fees. The fees depend on the authorized capital and state of registration (for stamp duty).

The Central Registration Centre reviews the application. If everything is in order, the Certificate of Incorporation (COI) is issued electronically, typically within 3-7 working days. The COI contains the Corporate Identity Number (CIN), which is the unique identifier for the company, along with PAN and TAN. If there are deficiencies, the application is marked for resubmission with specific queries that must be addressed.

The total timeline from DSC procurement to COI issuance is typically 10-15 working days, assuming all documents are in order and no major queries arise.

Essential Documentation for Private Limited Company Registration

Proper documentation is the foundation of a successful incorporation application. Incomplete or incorrect documents are the primary reason for application rejections and delays. This section provides a comprehensive checklist of all documents required, with specific guidance for different categories of directors and shareholders.

Documents Requirements from Indian Directors and Shareholders

The documentation requirements for directors and shareholders have been streamlined under SPICe+, but accuracy and consistency across documents remain critical. Any discrepancy in name spelling, address, or other details between documents can lead to queries and delays.

Identity and Address Proof Documents

For Indian nationals, the following documents are required:

Identity Proof: PAN card is mandatory for all Indian directors and shareholders. The PAN details are verified with the Income Tax database, so the name must match exactly.

Address Proof: Any one of the following: Aadhaar card, Voter ID, Passport, or Driving License. The address proof should not be more than two months old if it is a utility bill.

Photograph: Recent passport-size photograph with white background.

For each director, the personal details including father’s name, date of birth, residential address, occupation, and educational qualifications must be provided in the SPICe+ form.

Director’s Consent in Form DIR-2

Every person proposed to be appointed as a director must give consent in Form DIR-2. This consent confirms that the individual agrees to act as a director, is not disqualified under Section 164, and has not been debarred by SEBI or any court from being a director. The DIR-2 must be digitally signed by the proposed director.

The consent includes an undertaking that the individual will comply with the requirements of the Companies Act and that they will inform the company of any changes in their status that may affect their eligibility to continue as a director.

Declaration and Affidavit in Form INC-9

Form INC-9 is a declaration by each subscriber and director stating that the company is not being incorporated with any illegal or fraudulent purpose, the documents submitted are genuine, and the information provided is true and correct to the best of their knowledge. This form must be digitally signed by each subscriber and director individually.

The INC-9 requires verification of identity and address details and serves as a legal undertaking. False declarations can result in prosecution under Section 448 (punishment for false statement) and Section 449 (punishment for false evidence) of the Act.

Document Requirements for Foreign Nationals and NRIs

Foreign nationals and Non-Resident Indians can be directors and shareholders in Indian private limited companies, but additional documentation and compliance requirements apply. Understanding these requirements is essential for cross-border incorporations and foreign investments.

Apostille and Notarization Requirements

All documents of foreign nationals must be notarized in the country of their residence and apostilled (for countries that are party to the Hague Apostille Convention) or consularised/authenticated by the Indian Embassy (for non-Hague countries).

Documents requiring apostille/notarization include:

- Passport (entire passport copy including all pages)

- Address proof (utility bill, bank statement, or driving license)

- Photograph

The apostille must be recent (typically within 3-6 months) and the documents must be in English or accompanied by a certified English translation if in another language.

Valid Business Visa Requirements

Foreign nationals who will be involved in managing the company from India typically require a valid Business Visa or Employment Visa. While there is no express requirement under the Companies Act for directors to hold a visa, immigration regulations require appropriate visa status for conducting business activities in India.

For directors who will not be physically present in India and will only participate in board meetings remotely, the visa requirement may not apply. However, the resident director requirement (182 days presence in India in the previous calendar year) cannot be fulfilled by a foreign national on a tourist visa.

Foreign Inward Remittance Certificate (FIRC) for Investment

When foreign nationals or NRIs invest in the share capital of the company, the investment must be made through proper banking channels, and a Foreign Inward Remittance Certificate (FIRC) must be obtained. The FIRC serves as proof that the investment has been received from overseas through an authorized dealer bank.

The investment must comply with the Foreign Exchange Management Act (FEMA) regulations and the relevant sector-specific FDI policy. For most sectors, FDI is permitted under the automatic route, meaning no prior approval is required. However, certain sectors require government approval, and some sectors have FDI caps.

Registered Office Address Documentation

The registered office address documentation must establish that the company has a legitimate place of business where statutory records will be maintained and official communications can be received.

For owned premises, required documents include a copy of the sale deed, conveyance deed, or property tax receipt evidencing ownership, along with a utility bill (electricity, water, or gas) in the owner’s name not older than two months. For rented premises, documentation comprises a copy of the registered rent agreement or lease deed, a utility bill in the landlord’s name not exceeding two months old, and a mandatory No Objection Certificate from the property owner. The NOC should be on the letterhead of the owner (if a company) or on plain paper (if an individual), must include the complete address of the property, and should be signed by the owner or, for company-owned properties, by an authorized signatory with the company seal affixed.

Registration Fees and State-Wise Stamp Duty

MCA Registration Fees

The MCA fee structure is prescribed in the Companies (Registration Offices and Fees) Rules, 2014, as amended from time to time. Fees depend primarily on the authorized capital of the company.

SPICe+ Part A and Part B Filing Fees

SPICe+ Part A (Name Reservation): The fee is ₹1,000 regardless of the authorized capital.

SPICe+ Part B (Incorporation): The fee structure for incorporation is as follows:

| Authorized Capital | Filing Fee |

| Up to ₹1,00,000 | Nil |

| ₹1,00,001 to ₹5,00,000 | ₹2,000 |

| ₹5,00,001 to ₹10,00,000 | ₹2,000 + ₹200 for every ₹1,00,000 above ₹5,00,000 |

| Above ₹10,00,000 | Calculated as per slab |

Fee Exemption for Companies with Authorized Capital Up to ₹15 Lakh

For companies with authorized capital up to ₹15 lakh, the SPICe+ Part B filing fee is minimal or nil. This is a significant incentive for startups and small businesses. The zero-fee structure for small companies is part of the government’s Ease of Doing Business initiative.

However, remember that stamp duty is separate and payable based on state-specific rates. So while MCA fees may be nil, stamp duty will still apply.

Additional Fees for DIN, PAN, and TAN Application

DIN: When applied through SPICe+, DIN allotment is included in the incorporation fee at no additional cost. If applied separately through DIR-3, the fee is ₹500 per DIN.

PAN and TAN: These are automatically processed through the SPICe+ system. The combined fee for PAN and TAN application is approximately ₹150-200, which is included in the overall SPICe+ processing.

State-Wise Stamp Duty Variation

Stamp duty is a state subject under the Indian Constitution, meaning each state has its own Stamp Act and fee structure. Stamp duty is payable on the Memorandum of Association, Articles of Association, and certain other incorporation documents. The duty is calculated based on the authorized capital and the state-specific rates. Higher authorized capital means higher stamp duty.

Some states have a flat rate system while others use an ad valorem (percentage-based) system. For example, in the State of Maharashtra, the stamp duty payable by a Company (whether it has no share capital or nominal share capital or increased share capital) towards Articles of Association is 0.3 per cent on share capital or increased share capital (ad-valorem), subject to a maximum of Rs, 1,00,00,000; and towards Memorandum of Association (if accompanied with AoA) it is Rs. 1000 (flat rate).

Stamp duty increases with higher authorized capital. Always verify current rates on the respective state’s stamp duty portal or through the MCA SPICe+ system, which auto-calculates stamp duty.

E-Stamp Duty Payment Through SPICe+

The SPICe+ system has integrated e-stamp duty payment, making the process seamless. When filing SPICe+ Part B, the system automatically calculates the applicable stamp duty based on the selected state and authorized capital. The duty is paid online along with the MCA filing fees.

This integration has eliminated the earlier requirement of purchasing physical stamp papers, getting documents franked, and uploading stamped documents. The e-stamping is reflected in the final incorporation documents.

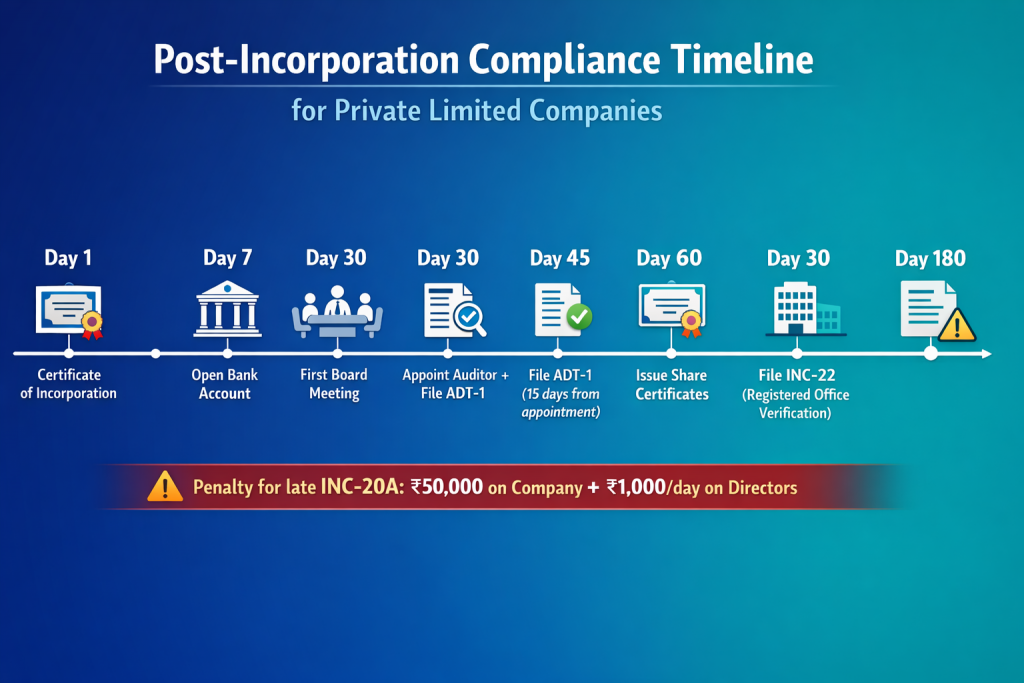

Post-Incorporation Compliances

Receiving the Certificate of Incorporation is a milestone, but it marks the beginning, not the end, of compliance obligations. Several mandatory compliances must be completed within specific timelines after incorporation. Failure to comply can result in penalties, disqualification of directors, and in extreme cases, striking off of the company.

As legal professionals and compliance officers, understanding these post-incorporation requirements is essential for advising clients and ensuring they start their business journey on a compliant footing.

Mandatory Compliance Steps Within 30 Days of Incorporation

The first 30 days after incorporation are critical. Several important actions must be taken during this period, and delays can result in penalties and complications.

First Board Meeting Under Section 173(1)

Under Section 173(1) of the Companies Act, 2013, the first meeting of the Board of Directors must be held within 30 days of incorporation. This meeting is crucial as several important matters must be addressed:

- Appointment of the first statutory auditor

- Approval of the registered office address and adoption of common seal (if any)

- Adoption of preliminary contracts entered into by promoters on behalf of the company

- Opening of bank account and authorization of signatories

- Allotment of shares to subscribers

- Appointment of Key Managerial Personnel (if applicable)

- Authorization for making necessary applications (GST, MSME, etc.)

Minutes of this meeting must be prepared and entered in the Minutes Book within 30 days of the meeting as per Section 118 of the Companies Act, 2013. The minutes must be signed by the chairperson of the meeting.

Appointment of First Statutory Auditor Under Section 139

Section 139(6) of the Act requires the Board of Directors to appoint the first auditor within 30 days of incorporation. If the Board fails to appoint the auditor within 30 days, the members must appoint the auditor in an Extraordinary General Meeting within 90 days of incorporation.

The first auditor holds office until the conclusion of the first Annual General Meeting (AGM). Before appointment, the proposed auditor must give written consent in Form ADT-1 and confirm that their appointment is within the limits prescribed under Section 141 (which restricts the number of audits a firm can undertake).

Form ADT-1 (Notice of appointment of auditor) must be filed with the ROC within 15 days of the appointment. The fee for filing ADT-1 is ₹200.

Opening Company Bank Account and Depositing Share Capital

A current account in the company’s name must be opened with a bank. The subscribers to the Memorandum must deposit their subscription money (the amount they agreed to pay for their shares) into this account. This is essential for filing Form INC-20A.

With the AGILE-PRO integration in SPICe+, the process of opening a bank account has been simplified. The company’s details are shared with the selected bank, and the bank contacts the company to complete KYC and account opening formalities. However, physical verification and KYC procedures as per banking regulations still apply.

Issuance of Share Certificates to Subscribers

Share certificates must be issued to all subscribers within 60 days of incorporation as per Section 56 of the Companies Act, 2013. The share certificates must be signed by two directors (or one director and the Company Secretary, if appointed) and must bear the company’s common seal if adopted.

Stamp duty on share certificates varies by state. In some states, share certificates are exempt from stamp duty while in others, a nominal duty applies. Physical share certificates are still issued in private companies, though there are provisions for dematerialization which have now become mandatory for certain classes of private companies.

Declaration for Commencement of Business (Form INC-20A)

Form INC-20A is the Declaration for Commencement of Business. It is one of the most important post-incorporation filings and has significant consequences if not filed on time.

Timeline and Consequences of Non-Filing

Under Section 10A of the Companies Act, 2013 (inserted by the Companies (Amendment) Act, 2018), a company with share capital must file a declaration within 180 days of incorporation confirming that every subscriber to the Memorandum has paid the value of shares agreed to be taken by them. This filing is done through Form INC-20A.

The consequences of not filing INC-20A within 180 days are severe:

- The company cannot commence business or exercise any borrowing powers

- If the company has not filed INC-20A within 180 days and is found to have commenced business, the company is liable to a penalty of ₹50,000 and every officer in default (usually directors) is liable to a penalty of ₹1,000 per day for each day of default

- The Registrar may initiate action for removal of the company’s name from the register if the declaration is not filed and the company has not commenced business

Documents Required for INC-20A Filing

Form INC-20A requires:

- Declaration that every subscriber has paid the value of shares agreed to be taken

- Bank statement or evidence of receipt of subscription money

- Verification of registered office (if not already filed through INC-22)

- DSC of a director and certification by a practicing professional (CA, CS, or Cost Accountant)

The fee for filing INC-20A is ₹200. Given its importance and the severe penalties for non-filing, this form should be filed as soon as the subscription money is received, without waiting until near the 180-day deadline.

Obtaining Additional Registrations After Incorporation

While not all registrations are mandatory, several registrations enhance the company’s ability to conduct business, access benefits, and comply with sector-specific requirements.

GST Registration

Goods and Services Tax (GST) registration is mandatory if:

- The company’s aggregate turnover exceeds ₹40 lakh (₹20 lakh for special category states) for goods suppliers

- The company’s aggregate turnover exceeds ₹20 lakh (₹10 lakh for special category states) for service providers

- The company makes inter-state taxable supplies

- The company is required to deduct TDS under GST

- The company supplies goods or services through e-commerce platforms

Even if not immediately mandatory, voluntary GST registration is advisable for B2B businesses as it allows claiming Input Tax Credit and enhances credibility with customers and suppliers. GST registration can be applied through AGILE-PRO during incorporation or separately through the GST portal.

Professional Tax Registration (State-Specific)

Professional Tax is a state-level tax applicable in several states including Maharashtra, Karnataka, West Bengal, Gujarat, and others. If the company is registered in Maharashtra, Professional Tax registration is integrated with SPICe+ through AGILE-PRO.

For other states, separate registration is required. The company must register as an employer and deduct Professional Tax from employees’ salaries above the threshold limit. Directors receiving remuneration are also subject to Professional Tax.

Shops and Establishment Registration

Companies operating from physical premises must register under the Shops and Establishment Act of the respective state. This registration governs working hours, holidays, leave entitlements, and other employment conditions for employees.

The registration is typically done with the local municipal corporation or labour department. Requirements vary by state, but common documents include proof of premises, identity proof of the proprietor/director, and business address proof.

MSME Registration and Startup India Recognition

MSME Registration: If the company qualifies as a Micro, Small, or Medium Enterprise based on its investment in plant and machinery or equipment and turnover, it should register under the MSME Development Act. MSME registration provides access to various benefits including priority sector lending, subsidies, and protection under the MSME Act against delayed payments.

MSME registration is now done through the Udyam Registration portal (udyamregistration.gov.in) and is linked to the company’s PAN and GST numbers. Registration is free of cost and entirely online.

Always check the latest classification thresholds and eligibility details on the official portals, as criteria (such as MSME investment and turnover limits) were revised effective April 1, 2025.

Startup India Recognition: Companies that meet the definition of a “startup” under DPIIT guidelines (incorporated for not more than 10 years, turnover not exceeding ₹100 crore in any financial year, working towards innovation/improvement of products/processes/services, not formed by splitting or reconstruction of existing business) can apply for recognition under the Startup India scheme.

Recognized startups get benefits including self-certification for labor and environmental compliance, faster IP examination and reduced fees, tax exemption under Section 80-IAC for three consecutive years, and exemption from angel tax under Section 56(2)(viib) of the Income Tax Act, 1961.

Conclusion

Private limited company registration in India has been significantly streamlined through the SPICe+ system, integrating multiple services into a single web-based platform. However, the legal framework under the Companies Act, 2013 remains comprehensive, and compliance obligations begin from the day of incorporation and continue throughout the company’s existence.

For legal professionals, company secretaries, and compliance officers, mastering the nuances of private limited company registration opens doors to advising startups, MSMEs, and corporate clients on one of the most fundamental business decisions they will make. The knowledge extends beyond mere procedure to understanding the strategic implications of capital structure, the importance of proper documentation, and the penalties that await non-compliance.

The exemptions available to private companies and small companies make this structure particularly attractive for most businesses. By leveraging these exemptions while maintaining compliance practices, companies can focus on growth while minimizing regulatory burden. As the business environment evolves and the government continues to simplify procedures, staying updated with the latest amendments and notifications becomes essential.

Whether you are advising a first-time entrepreneur on choosing between an LLP and private limited company, helping a foreign investor set up an Indian subsidiary, or ensuring your own company meets all post-incorporation requirements, the principles remain the same: understand the law, prepare thorough documentation, meet deadlines, and maintain continuous compliance. The rewards of getting it right are significant; the consequences of getting it wrong can be severe.

Frequently Asked Questions on Private Limited Company Registration

What is the minimum capital required to register a private limited company in India?

There is no minimum paid-up capital requirement for registering a private limited company in India. The earlier requirement of ₹1 lakh minimum capital was repealed by the Companies (Amendment) Act, 2015. You can incorporate a company with any amount of share capital, even as low as ₹10,000 or ₹1,000. However, the authorized capital affects stamp duty, so strategic planning on capital structure is advisable.

Can a single person register a private limited company?

No, a private limited company requires a minimum of two shareholders and two directors under the Companies Act, 2013. If you want a company structure with single ownership, consider registering a One Person Company (OPC), which can be incorporated with just one member and one director (plus a nominee director). An OPC provides similar benefits of limited liability and separate legal entities.

How long does it take to register a private limited company through SPICe+?

The typical timeline is 10-15 working days from DSC procurement to receipt of Certificate of Incorporation. This includes 1-3 days for DSC, 2-3 days for name reservation approval (SPICe+ Part A), and 3-7 days for incorporation processing (SPICe+ Part B). Delays may occur if there are queries on documents or if the name requires additional clearances.

Can foreign nationals be directors or shareholders in an Indian private limited company?

Yes, foreign nationals can be both directors and shareholders in Indian private limited companies. However, all documents must be apostilled/notarized, and the investment must comply with FEMA regulations and FDI policy. At least one director must be a resident of India (having stayed in India for 182 days or more in the previous calendar year). The foreign national director need not be a resident.

What is the difference between authorized capital and paid-up capital?

Authorized capital is the maximum share capital that the company is authorized to issue as stated in its Memorandum of Association. Paid-up capital is the portion of authorized capital that has actually been issued to and paid for by shareholders. For example, a company may have authorized capital of ₹10 lakh but paid-up capital of only ₹1 lakh if that is all that has been subscribed. Stamp duty and fees are based on authorized capital.

Is GST registration mandatory immediately after private company limited company registration?

GST registration is not automatically mandatory. It becomes mandatory if the company’s aggregate turnover exceeds the threshold limits (₹40 lakh for goods, ₹20 lakh for services in regular states), if the company makes inter-state supplies, or if it falls under other mandatory registration categories. However, voluntary registration can be obtained even below the threshold to claim Input Tax Credit and enhance business credibility.

What happens if Form INC-20A is not filed within 180 days?

If INC-20A is not filed within 180 days, the company cannot legally commence business or exercise borrowing powers. The company faces a penalty of ₹50,000, and every officer in default (typically directors) faces a penalty of ₹1,000 per day of continuing default. Additionally, the Registrar may initiate action to remove the company’s name from the register if the declaration is not filed and the company has not commenced business.

Can the registered office of a private limited company be a residential address?

Yes, there is no legal prohibition on using a residential address as the registered office of a private limited company. The requirement is that there must be a valid physical address in India where the company’s statutory registers can be maintained and official communications received. However, check local municipal regulations and housing society rules, as some may restrict commercial use of residential premises.

What is the penalty for not holding the first board meeting within 30 days?

Failure to hold the first board meeting within 30 days of incorporation attracts penalties under Section 450 of the Companies Act, 2013. The company and officer in default is liable to a penalty of ₹10,000, and in case of continuing default (including directors) is liable to a penalty of ₹1,000 for each day after the first during which the contravention continues. However, the penalty cannot exceed Rs. 2 lakhs in case of a company and Rs. 50,000 in case of an officer in default.

Additionally, consistent non-compliance with board meeting requirements can lead to disqualification of directors under Section 164(2).

Can a private limited company be converted to an LLP or vice versa?

Yes, conversion is possible both ways. A private limited company can convert to an LLP by following the procedure under the LLP Act, 2008, and obtaining approval from the Registrar of Companies. An LLP can convert to a private limited company under Section 366 of the Companies Act, 2013. Both conversions require compliance with specific conditions regarding liabilities, assets, and creditor protection.

Is audit mandatory for all private limited companies?

Yes, all private limited companies, regardless of their size or turnover, must get their accounts audited by a practicing Chartered Accountant. There is no exemption from audit for private companies (unlike LLPs where audit is required only above certain thresholds). However, small companies and OPCs have simplified audit reporting requirements and need not include statements on internal financial controls.

What are the annual compliance requirements for a private limited company?

Annual compliance requirements include: holding Annual General Meeting within six months of the end of financial year (first AGM within nine months), filing financial statements in Form AOC-4 within 30 days of AGM, filing annual return in Form MGT-7/MGT-7A within 60 days of AGM, holding minimum board meetings (four per year for regular companies, two for small companies), filing DIR-3 KYC annually for directors, and compliance with income tax and GST filing requirements.

Can a private limited company accept deposits from the public?

No, a private company is strictly prohibited from accepting deposits from the general public. This is one of the defining characteristics under Section 2(68). However, private companies can accept deposits from their members, directors, and relatives of directors, subject to conditions prescribed under the Companies (Acceptance of Deposits) Rules, 2014. Such deposits must be disclosed in the annual return.

What is the maximum number of directors allowed in a private limited company?

A private limited company can have a maximum of 15 directors under Section 149(1) of the Companies Act, 2013. If the company wishes to appoint more than 15 directors, it can do so by passing a special resolution in a general meeting. There is no regulatory approval required for increasing the number of directors beyond 15, only a special resolution is needed.

How can a company change its name after registration?

A company can change its name by following the procedure under Section 13 of the Companies Act, 2013. This requires: passing a special resolution in a general meeting, applying for name availability through RUN (Reserve Unique Name) service on the MCA portal, filing Form INC-24 (application for name change) with the ROC, and paying the prescribed fee and stamp duty. The ROC issues a fresh Certificate of Incorporation reflecting the new name.

Allow notifications

Allow notifications