Posted inCorporate Finance US

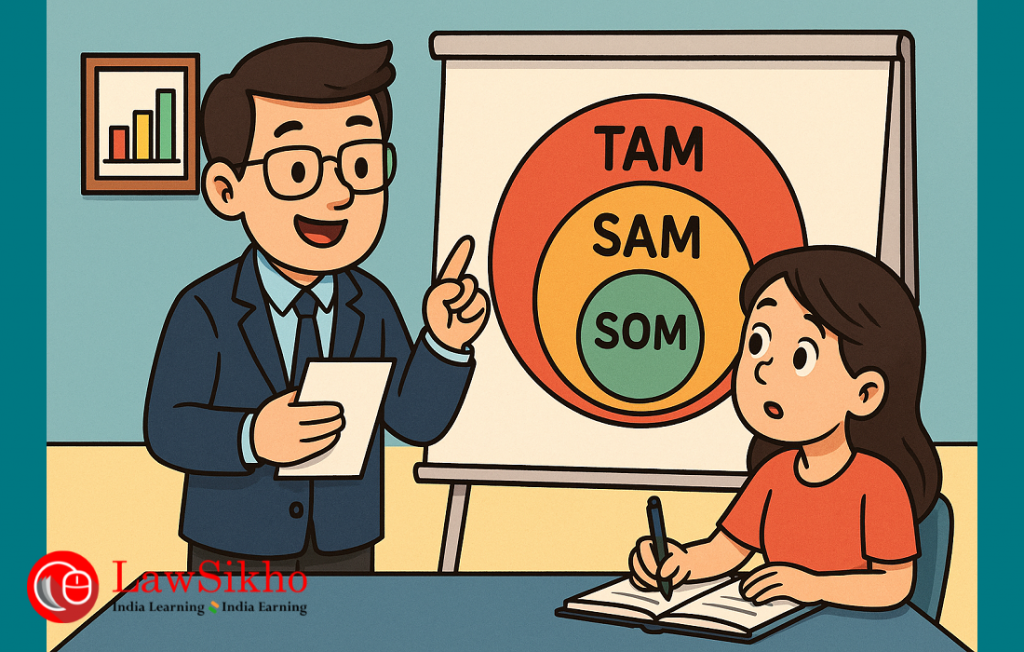

From market potential to market reality: How finance professionals can calculate TAM, SAM & SOM

A practical guide for young finance professionals to learn market sizing with real calculations. Build credible market models...

Allow notifications

Allow notifications