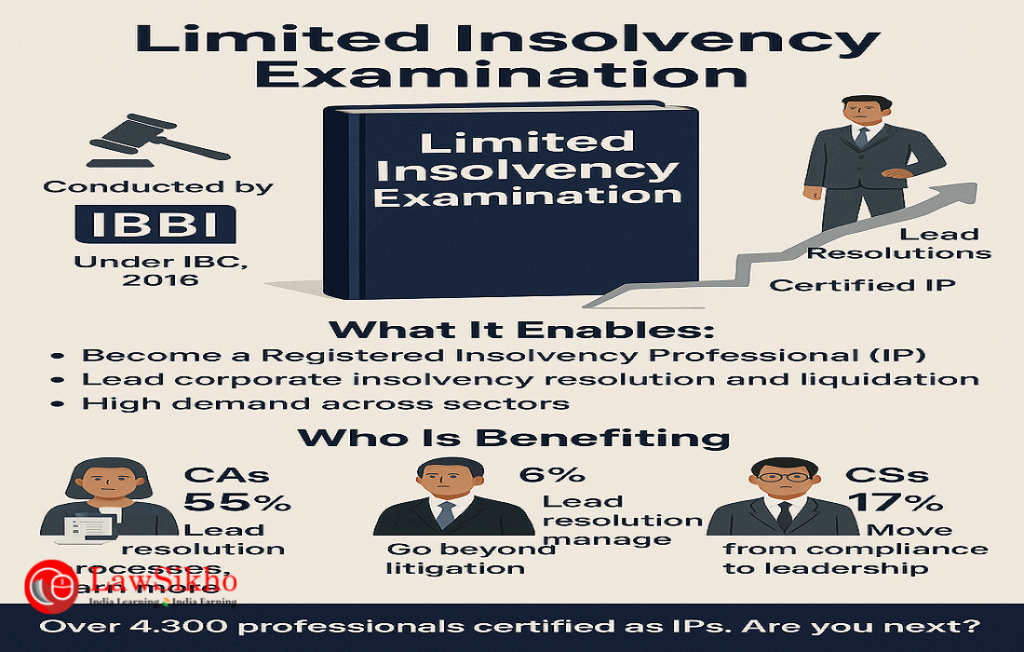

India’s Insolvency and Bankruptcy Code (IBC) has opened a new professional frontier for mid-career experts through the IRP certification. With over 4,300 registered Insolvency Professionals (IPs) by 2024, the domain is dominated by Chartered Accountants but is seeing growing interest from lawyers and company secretaries. In this article, you will witness how IRP certification is transforming careers across law, finance, and corporate governance.

Table of Contents

Introduction

India’s Insolvency and Bankruptcy Code (IBC) opened a new professional avenue for mid-career experts to become licensed Insolvency Resolution Professionals (IRPs). The qualifying exam conducted by the Insolvency and Bankruptcy Board of India (IBBI) – often called the Limited Insolvency Examination – enables seasoned professionals from various fields to register as Insolvency Professionals (IPs).

There is robust demand for IPs in the market; in fact, the demand has grown so much that in 2022 the IBBI even allowed Insolvency Professional Entities (IPEs) to act as IPs to bolster capacity (previously only individuals could be IPs).

As of 2024, over 4,300 individuals have become registered IPs. Notably, about 55% of these are Chartered Accountants, 17% are Company Secretaries, 6% are lawyers, 5% are Cost Accountants, and the remaining ~17% come from other managerial backgrounds. This indicates a diverse mix of professionals taking the IRP exam, though some cohorts are far more represented than others.

Below, we identify and describe the key professional personas – each with 5–10+ years of experience – who are either actively pursuing or stand to benefit from the IRP exam, along with their motivations, career alignment, and awareness levels. We also highlight emerging or underrepresented segments who could leverage this certification.

Lawyers (Advocates in Corporate Law and Litigation)

Experienced lawyers – especially those specialising in corporate, banking, or insolvency law – form a distinct cohort interested in the IRP exam. Many have spent years representing creditors or debtors in courts and tribunals and are familiar with the Insolvency and Bankruptcy Code’s legal intricacies. Their professional background in law equips them to handle the procedural and compliance aspects of insolvency resolution. However, lawyers currently make up a relatively small share of registered IPs (only about 6% as of 2024), suggesting this cohort is underrepresented compared to others.

- Motivations: Mid-career lawyers are motivated to take the IRP exam to expand their role in the insolvency process. Obtaining the IRP certification allows a lawyer not just to argue cases at the National Company Law Tribunal (NCLT) but to be appointed as an Insolvency Professional managing a resolution or liquidation process. This can elevate their practice – they can directly act as Interim Resolution Professionals (IRPs) or Resolution Professionals (RPs) in corporate insolvency cases, rather than only advising or representing clients. The credential also signals expertise in insolvency law, which can attract banks and corporations as clients for advisory roles.

In fact, even some top law firm partners pursued the IP qualification for the prestige and signal it provides – for example, Ajay Bahl (of AZB & Partners) and Cyril Shroff (of Cyril Amarchand Mangaldas) qualified as IPs, though they don’t actively practice as RPs due to their firm commitments. This illustrates the value lawyers see in the certification as a mark of distinction in the field. - Career Alignment and Opportunities: For a lawyer, the IRP certification aligns naturally with their legal expertise while opening new career avenues. It enables a shift from purely advocacy roles to quasi-judicial management roles in insolvency proceedings. A lawyer-turned-IP can leverage their knowledge of the law to ensure IBC procedures are followed meticulously during a Corporate Insolvency Resolution Process (CIRP).

It also broadens opportunities: they can join panels of insolvency professionals maintained by banks or the government, get court-appointed to high-profile cases, or even start an independent insolvency practice. This diversification can be especially appealing in a maturing insolvency ecosystem where legal skills are crucial. Additionally, being both an advocate and an IP allows one to handle end-to-end resolution for distressed companies (legal strategy plus management of the resolution process), enhancing their professional versatility. - Awareness and Challenges: Despite these advantages, many eligible lawyers may be unaware of the full benefits. Some mid-career advocates might assume that insolvency matters can be handled through litigation alone, not realising that becoming an IP lets them take charge of insolvency cases directly. Others may be deterred by the exam’s emphasis on finance and accounting concepts which are outside a typical lawyer’s comfort zone.

Moreover, the initial enthusiasm among big-firm lawyers waned when they found limited time to actually act as RPs, which might signal to smaller-firm lawyers that the field is niche. Increasing awareness that the IRP certification is not only for accountants, and highlighting success stories of lawyers who have built a practice as RPs, could encourage more in this cohort. With IBC cases growing, lawyers with 5–10 years of practice – especially those already dealing with NCLT cases – stand to gain by adding the insolvency professional credential to expand their career horizon.

Chartered Accountants (CAs and Audit/Finance Professionals)

Chartered Accountants are the largest cohort among insolvency professionals in India, comprising roughly 55% of registered IPs. These are seasoned CAs with significant experience in auditing, accounting, corporate finance, or consulting. Their strong financial and accounting background makes them well-suited to handle the debt, valuation, and business restructuring issues that arise in insolvency cases. Many CAs taking the IRP exam have 10+ years of practice in auditing firms or as finance controllers, or have been advising companies on corporate finance and compliance.

- Motivations: Experienced CAs are drawn to the IRP exam as a natural extension of their skill set. It allows them to diversify beyond traditional audit and tax practice into the booming field of insolvency resolution. The motivations for a CA include the opportunity to lead Corporate Insolvency Resolution Processes, where their expertise in analysing financial statements, managing cash flows, and understanding creditors’ claims is invaluable. For many, it is a chance to participate in high-stakes turnaround cases and enhance their professional standing. The prospect of higher professional fees and “success fees” from successful resolutions is also a practical incentive.

Additionally, CAs often work closely with banks and corporate clients; by becoming licensed IPs, they can deepen these relationships – for instance, being nominated by lenders to serve as the Resolution Professional in cases of default. The role of IP can thus be a recession-proof and prestigious addition to a CA’s career, given the critical need for financial expertise in insolvency matters. - Career Alignment and Opportunities: The insolvency profession aligns strongly with a CA’s career trajectory. After a decade in finance roles, many CAs have developed the analytical, managerial, and ethical skills needed to run distressed companies as RPs. The IRP certification formalises their ability to do so. It opens opportunities such as partnering in or founding an Insolvency Professional Entity (IPE) along with other professionals, taking on administrator or liquidator roles in bankruptcy cases, and serving as independent experts on committees of creditors. CAs turned IPs often handle marquee cases – for example, many of the large IBC cases (steel, infrastructure, etc.) have had Chartered Accountants as resolution professionals, given their financial acumen.

The qualification also complements existing practice areas: a CA-IP can offer a one-stop solution to clients for insolvency advisory, from filing the case to managing the resolution process. In the long term, being an IP can elevate a CA’s profile, potentially leading to board positions (as companies seek directors knowledgeable in insolvency) or consultancy roles in restructuring firms. - Awareness and Observations: Among all cohorts, CAs arguably have the highest awareness of the IRP exam’s benefits, thanks in part to the Institute of Chartered Accountants of India (ICAI) actively promoting the Insolvency profession. The pathway for CAs (10 years post-qualification experience) is well-known, and many see it as a logical step after attaining seniority in their field. One observation is that mid-career CAs often realise their existing practice can plateau, and insolvency is a growing domain where their skills remain in demand even during economic downturns. This “early adopter” attitude of CAs has led to them dominating the IP space so far.

The challenge, however, is that not all CAs may have the managerial experience to run a company in crisis, so the certification’s requirement of significant experience helps ensure only those capable step in. Going forward, continued outreach and success stories of CA-turned-RP (for example, how a chartered accountant successfully led the turnaround of a manufacturing firm under IBC) will sustain this cohort’s interest. Given their current majority in the field, CAs also set the benchmark for professional standards and multidisciplinary knowledge that other cohorts need to match.

Company Secretaries (Corporate Compliance Professionals)

Company Secretaries (CS) are another key cohort pursuing the IRP exam. Often having 5–15 years of experience in corporate compliance, governance, and secretarial practices, these professionals understand the inner workings of companies and regulatory requirements. Company Secretaries make up about 17% of registered insolvency professionals, reflecting a strong interest from this group. Many senior CS professionals have been at the forefront of corporate law compliance and have interacted with boards and shareholders – experience which translates well into the role of an insolvency professional managing diverse stakeholder interests.

- Motivations: For an experienced CS, the IRP exam is an opportunity to broaden their professional horizon beyond compliance and board advisory roles. Their motivations include leveraging their deep knowledge of corporate law (Companies Act, SEBI regulations, etc.) in the insolvency arena. They are often skilled in documentation, legal filings, and corporate governance – all crucial in conducting a transparent and legally sound resolution process.

By becoming an IP, a Company Secretary can break out of the “compliance only” mold and take on a more strategic, leadership role in business turnarounds. Many are driven by the examples of fellow CS who have excelled as IPs – notably, Mamta Binani, who was a practicing CS for over two decades and became the first registered insolvency professional in India.

Such trailblazers demonstrated that CS professionals could not only qualify but lead major insolvency cases (Binani, for instance, played key roles in prominent resolutions). The prospect of working closely with insolvency tribunals and committees of creditors also appeals to CS professionals looking to apply their governance expertise in a new way. - Career Alignment and Opportunities: The role of an IP aligns neatly with the skill set of company secretaries, while also expanding their career trajectory. CS professionals are trained to coordinate between various stakeholders (boards, regulators, investors), which is directly applicable when balancing interests of creditors, debtors, and courts during insolvency.

With the IRP certification, a CS can serve as an IRP/RP or liquidator, often focusing on ensuring that legal procedures and disclosures are meticulously handled in a case. This can lead to opportunities such as being empaneled by the ICSI Insolvency Professional Agency for appointments, or collaborating with CAs and lawyers in multi-disciplinary insolvency teams. It also enhances their credibility for roles like compliance officers or legal heads in companies undergoing restructuring, since they bring specialised insolvency know-how.

Importantly, a CS-turned-IP can pivot to independent practice, offering services in insolvency resolution, advisory for distressed acquisitions, or even interim management for companies in crisis. This is a significant expansion from the traditional corporate secretarial career path, potentially leading to higher remuneration and more influential roles. - Awareness and Niche Areas: Company Secretaries, through the Institute of Company Secretaries of India (ICSI), have been made quite aware of the insolvency profession – the ICSI set up its own Insolvency Professional Agency and many CS were quick to enroll. Awareness is reasonably high in this group that the IBC presents a new career avenue. One niche aspect is that CS professionals often bring a compliance lens to insolvency which can help avoid legal pitfalls in the process.

However, some mid-career CS might still be unaware that their experience (if beyond 10 years) makes them eligible, or they might underestimate their ability to handle the business aspects of the RP role. There is also an emerging trend of younger CS (with the minimum experience) looking to specialise in insolvency early, although the majority are those who have already reached senior positions. Overall, the CS cohort is increasingly visible among IPs, and continued success in this arena (such as exemplary conduct as RPs and smooth resolutions) will reinforce the alignment of the CS career with the insolvency profession.

Bankers and Finance Professionals in Banking (Credit and Recovery Experts)

Bankers – particularly those with substantial experience in corporate lending, credit analysis, or recovery of non-performing assets – form a highly relevant cohort for the IRP exam. This includes mid-career professionals from public and private sector banks (often with 10+ years in roles like corporate loan officers, risk managers, or legal departments of banks) and retired bank officers. Many such bankers come under the “managerial experience” category of eligibility, which constitutes roughly 17% of the registered IP pool. They possess firsthand knowledge of debt resolution from the creditor’s perspective, which is immensely valuable in an insolvency resolution scenario.

- Motivations: Bankers are motivated to become insolvency professionals for several reasons. For serving bankers nearing retirement or taking early retirement, the IRP exam offers a path to a second career where they can monetise their deep understanding of banking and NPAs (non-performing assets). They have often been on committees that decide on loan restructuring or have dealt with defaulters; by becoming IPs, they can flip roles and lead the restructuring of distressed borrowers under the IBC framework. Many see it as a way to continue their professional engagement post-retirement, staying connected with the banking industry as independent experts.

Even mid-career bankers (with the requisite experience) might pursue the certification to transition into consulting roles with asset reconstruction companies or insolvency firms.

A great example is the case of Essar Steel’s insolvency, where State Bank of India recommended Satish Kumar Gupta – a veteran banker (formerly with SBI) who had joined a restructuring consultancy – to be appointed as the Resolution Professional. His banking background gave creditors confidence in his ability to manage the resolution of such a large default. Such instances motivate other bankers to see the IRP role as a natural extension of their careers in handling big-ticket stressed loans. - Career Alignment and Opportunities: For bankers, the insolvency professional role aligns with their expertise in finance, risk, and recovery. It allows them to apply their institutional knowledge in a broader context. A former bank executive acting as an RP can effectively liaise with committees of creditors (since they may personally know many of the banking officials involved) and can devise pragmatic solutions for recovery, given their insight into what lenders expect.

This alignment means opportunities like: appointment as IRP/RP in cases admitted to NCLT (banks often nominate retired senior bankers from their panels), advisory roles in insolvency cases (guiding other IPs on dealing with lenders), or joining IPEs focused on banking sector insolvencies.

Many retired bankers have in fact joined hands to create or work for professional insolvency firms, contributing their experience. The certification also empowers currently employed bankers to be insolvency experts within their organisations – for instance, to lead internal stressed asset management teams or represent the bank in creditor committees with added authority.

Additionally, bankers-turned-IPs can handle Liquidation processes which involve asset sales – something their collateral recovery experience is aligned with. - Awareness and Considerations: Within the banking community, awareness of the IBBI’s insolvency exam and the new profession is growing, especially after high-profile IBC cases hit headlines. Banks and the Indian Banks’ Association have circulated guidelines about engaging external insolvency professionals, and many banks maintain a panel of eligible professionals (often including ex-bankers). Thus, senior bank staff are generally aware that passing the exam can put them on a path to such opportunities.

One consideration is the “fit and proper” criteria – bankers drawing a pension from a bank that is a creditor in a case have been legally affirmed as eligible to serve as RPs, which removed a concern about conflict of interest for retired bankers. Some mid-level bankers may still be unaware that they personally can register (often thinking only CAs/lawyers are eligible) – increasing targeted awareness that any person with 15 years managerial experience (e.g. as a bank manager) qualifies could bring more of them in.

By and large, bankers (particularly ex-PSU bank officers) have started to embrace the insolvency professional path, and they are highly valued in complex cases due to their domain knowledge of finance. This cohort’s participation also underpins the credibility of the insolvency process with creditors.

Ex-PSU and Government Officers (Retired Public Sector Executives and Regulators)

A less-heralded but important cohort comprises former public sector unit (PSU) executives and ex-government officials who have significant management experience. These individuals may come from a variety of backgrounds – for instance, retired IAS officers, ex-executives of public sector enterprises (oil, steel, power, etc.), former regulators or officials from agencies like SEBI/RBI, or even defense PSU managers. Many of them have 20-30 years of leadership experience in large organisations (often qualifying under the 15-year management experience criterion). While not as large a group as CAs or bankers in the IP space, they represent an emerging segment that can bring operational and administrative expertise to insolvency resolution.

- Motivations: Ex-PSU officers are often motivated by the opportunity to leverage their vast experience in a new professional domain after retirement. Having managed large teams, handled government negotiations, or run industrial units, they see the IRP exam as a gateway to stay professionally active and relevant. One strong motivator is the chance to contribute to the economy by turning around failing companies – something that resonates with career bureaucrats or PSU leaders who have a service mindset.

For example, a retired IAS officer who dealt with industrial policy might take up the IP role to help distressed companies restructure rather than shut down. Indeed, there have been retired IAS officers who qualified as IPs – Dr. G. K. Saraswat, a retired IAS, became an Insolvency Professional in 2017, signaling to others in government service that this path is viable.

Similarly, an ex-managing director of a PSU engineering company might pursue this to utilise their domain knowledge in handling insolvency of manufacturing companies. Another motivation is that these professionals usually have strong networks in industry and government, which can be advantageous in resolving complex cases (e.g., coordinating with ministries, or understanding compliance issues in regulated sectors during a resolution). The prestige of being an court-appointed resolution professional also appeals to those who have held high responsibility and wish to maintain a role in nation-building activities. - Career Alignment and Opportunities: The alignment for ex-PSU or government officers comes from their management and administrative skill set. As insolvency professionals, they can excel in cases that require hands-on operational leadership. For instance, a retired executive from a steel PSU would be well-suited to oversee the insolvency process of a steel manufacturer – they understand the technology, workforce issues, and government linkages of the sector, thus can manage the company as a going concern during CIRP.

Opportunities for this cohort include serving as resolution professionals for cases in the sectors they hail from (where technical know-how is as important as financial know-how), being appointed as government-nominated liquidators or bankruptcy trustees in certain public interest cases, or joining professional insolvency firms to provide mentorship and credibility.

Some may also take up roles as independent directors on boards of companies emerging from insolvency, given their governance experience. The IRP certification essentially formalises their transition from a public service role to a consulting and problem-solving role in the private sector. They often collaborate with CAs and lawyers to form a team – the ex-PSU officer might act as the face of management while the others handle compliance and finance, a combination that can be very effective. - Awareness and Underrepresentation: Currently, this cohort is underrepresented among exam takers – the data suggests that a majority of IPs come from finance professions, with relatively few from pure management backgrounds. Part of this is awareness: many senior PSU officials may not be fully aware that their experience makes them eligible to be an IP (since the typical messaging around the exam focuses on CAs, CS, etc.). There may also be a tendency to think that insolvency resolution is the domain of financial experts, not realising that their operational expertise is equally needed. Efforts by the IBBI and professional bodies to reach out to institutions like the Institute of Directors, or associations of retired public servants, could improve awareness.

It’s worth noting that when such individuals do join the ranks, they are often welcomed for the diversity of perspective they bring. The insolvency ecosystem benefits from having people who have run companies or government departments, as they can navigate regulatory hurdles and organisational challenges in ways others might not. As more success stories emerge – for example, if a retired PSU oil company director successfully leads the resolution of a distressed oil & gas firm – it could inspire peers and increase representation of this cohort.

Finance Professionals and Corporate Managers (CFOs, MBAs, and Business Executives)

Beyond the traditional professions, a broad cohort of finance professionals and corporate managers has started to eye the IRP exam. These include Chief Financial Officers (CFOs), finance vice-presidents, investment bankers, private equity professionals, and even general managers or directors of companies who have substantial exposure to corporate finance and strategy. Typically, they might not hold a CA/CS qualification but often have an MBA or similar background, and have 15+ years of experience managing businesses or investments. This group overlaps with the “managerial experience” category and is part of the 15–17% of IPs from a non-practicing-professional background. They bring a mix of financial savvy and strategic management skills to the table.

- Motivations: Seasoned corporate finance professionals are motivated to become IPs as a means of career transformation or enhancement. For a CFO or finance controller, the insolvency professional license can be a way to transition into consulting or independent practice after years in industry. They are driven by the challenge of turning around distressed companies – a natural extension of having managed finances of healthy (and sometimes not-so-healthy) companies. Private equity and investment executives might pursue the IRP exam to gain an edge in the distressed assets investment space; by becoming IPs, they can directly participate in resolutions or liquidations, giving them insider perspective on acquiring stressed businesses.

There’s also a prestige factor: being an IP is seen as joining an elite cadre of problem-solvers for the corporate sector. As one 2017 report put it, after the new bankruptcy law, finance executives stumbled upon a career-growth opportunity based on insolvency – it has ironically become a hot career in an area (insolvency) that was previously viewed negatively. These professionals are motivated by both intellectual challenge and potential financial rewards, as complex resolutions can be lucrative and position them as leaders in the field of restructuring. - Career Alignment and Opportunities: For corporate managers and finance-focused executives, the IRP certification aligns with their broad understanding of business operations and finance. It effectively broadens their role from managing one company’s finances to potentially managing the rehabilitation of many companies. A CFO who becomes an IP, for example, can capitalise on their understanding of cash flow management, investor relations, and cost control to keep an insolvent company running during CIRP. The certification opens up opportunities such as joining a boutique turnaround consultancy, becoming a partner in an established IPE, or taking on high-profile cases as an independent RP where their corporate credibility reassures stakeholders.

Furthermore, these professionals can use the credential to augment their current roles – e.g., an MBA who is a director in a firm might not immediately quit to practice as an IP, but the additional knowledge helps them oversee insolvency matters for their company or group (and they always have the option to practice independently later). Some may take on advisory positions on creditor committees or act as domain experts working alongside an IP.

The career expansion can also be international; with India’s IBC aligning with global practices, an IP with strong corporate management background could collaborate with foreign investors or insolvency practitioners on cross-border cases. In essence, it adds a layer of professional independence to those who may have been employees all their life – a finance executive can, post-certification, market themselves as an independent board advisor or crisis manager for any number of companies. - Awareness and Growing Interest: Initially, this segment was not as aware that they too could become insolvency professionals. The narrative was dominated by “professionals (CA, CS, etc.)” – an MBA who rose through corporate ranks might not have realised that 15 years in management makes them eligible.

However, awareness is growing through word of mouth and targeted programs (for instance, training sessions and bootcamps aimed at professionals with 10+ years experience in industry). We are seeing a growing interest among executives in industries like manufacturing, IT, and real estate who have faced insolvency situations from the inside and now want to be on the resolution side. They remain an underserved cohort in the sense that relatively few have taken the plunge compared to their numbers in the economy. The complexity of the exam and the need to study law may deter some. But those who do obtain the certification often find that their diverse experience is highly valued.

A noteworthy emerging trend is the collaboration between such managers and traditional IPs: for example, in the Essar Steel case, while the formal RP was a banker, the day-to-day operations during insolvency were overseen by a steel industry veteran with 25 years at Tata Steel – highlighting that industry experts play a crucial role. If more industry veterans become both the operational expert and the licensed IP, it could streamline processes. In summary, corporate finance and management professionals are increasingly recognising the IRP qualification as a powerful complement to their careers, and their entry is broadening the talent pool of India’s insolvency regime.

Cost Accountants (CMA) and Other Niche Professionals

Cost and Management Accountants (formerly known as Cost Accountants), though smaller in number compared to CAs, are another professional cohort that engages with the IRP exam. They represent about 5% of registered IPs. With at least 5–10 years of experience, CMAs often work in roles focusing on cost auditing, internal audit, and management accounting in industries. Their analytical skills in cost control and efficiency can be quite useful during corporate turnarounds. Alongside CMAs, there are other niche segments like registered valuers, forensic auditors, or compliance specialists who have eligible experience and interest in the insolvency field. We group them here as they often overlap or complement the main professions.

- Motivations: Cost Accountants are motivated to take the insolvency exam to expand beyond their traditional costing and pricing advisory roles. The insolvency process requires rigorous analysis of business viability, asset valuation, and efficient running of operations to preserve value – areas where CMAs excel. By becoming IPs, they can take on roles that influence not just the cost structure of a company, but its very survival and revival. It’s a step up in terms of impact and scope. They are also driven by professional growth; the Institute of Cost Accountants of India has its own Insolvency Professional Agency and encourages members to consider this path.

For other niche professionals like certified valuers or forensic accountants, the motivation lies in diversifying their practice. A valuer who is also an IP could both manage an insolvency process and handle the valuation of assets in-house, offering a more integrated service. These professionals often see the IRP certification as a way to distinguish themselves in a crowded market – a cost accountant with an IRP license might have an edge in getting appointed on insolvency cases that have significant cost management or fraud analysis issues. - Career Alignment and Opportunities: For CMAs, the alignment is natural in the sense that they bring a micro-economic perspective to insolvency cases. During CIRP, an IP has to quickly make decisions on which operations to continue and how to cut losses; a CMA’s training in cost-benefit analysis and budgeting is directly applicable. The IRP certification opens opportunities such as being appointed as an RP in mid-sized manufacturing or services companies where cost optimisation is key to turnaround. They might also join teams led by CAs or lawyers to provide specialised input on cost management during insolvency. Some cost accountants have taken lead roles in liquidations, where they oversee the efficient sell-off of assets – again leveraging their cost efficiency mindset. For valuers and similar experts, having the IP credential means they can lead cases rather than only advise; this can elevate them to team leader positions in multi-disciplinary insolvency assignments.

Moreover, these professionals often take up teaching or training roles in insolvency courses (leveraging their niche expertise), which can be another avenue opened by the credibility of the IP certification. - Awareness and Underserved Niches: While the primary professional institutes (ICAI, ICSI) have been active, the cost accountants’ institute and other bodies are catching up in spreading awareness. The representation of cost accountants among IPs (5%) is lower than their representation in corporate finance roles, indicating room for growth. Some in this field may feel overshadowed by CAs, and might be unsure if the market will favor them as IPs – but the Code does not differentiate, and performance in assignments speaks louder than one’s prefix. Increasing success stories of CMAs who have handled resolutions could boost confidence.

Similarly, many valuers or analysts may not realise they qualify via the 15-year management route if they’ve been running their own consultancy. As the insolvency profession matures, these niche players are likely to find their footing, especially in cases requiring specialised analysis (e.g. resolution of a cost-intensive infrastructure project could benefit from a CMA-IP, or a fraud-hit company’s resolution might be led by an IP with a forensic accounting background). They remain a somewhat underserved cohort in terms of sheer numbers, but their potential contribution is significant in making the insolvency resolution process more robust and multidimensional.

Emerging and Underserved Cohorts to Watch

In addition to the established groups above, there are some emerging or currently underrepresented cohorts who could benefit greatly from pursuing the IRP exam, even if their uptake so far has been limited:

- Senior Industry Specialists and Entrepreneurs: Seasoned professionals who have spent a decade or more running businesses or heading operations (for example, an auto industry expert, a tech startup founder, or a manufacturing plant head) often have exactly the kind of practical problem-solving skills needed in insolvency cases. Many of these individuals qualify through the 15-year management criterion but may not realise it. An entrepreneur who has navigated business cycles could become an IP and help steer other companies out of trouble. Their hands-on experience with everything from HR issues to supply chain management can be invaluable during a resolution.

Currently, pure entrepreneurs are rarely seen among IPs, likely due to lack of awareness and the focus on traditional professions. With targeted outreach, this cohort could become more involved. Their motivation would be both altruistic (helping other businesses survive) and personal (a new career path, especially if they have exited their own business).

We saw a glimpse of the value of industry specialisation in the Essar Steel case, where a steel industry veteran (though not a formal IP in that instance) was crucial in managing operations – if more industry experts become IPs, such synergy can be formalised. - Women Professionals: Across all the above categories, women remain an underserved segment. Only about 10% of India’s registered IPs are women, even though there are many experienced female lawyers, CAs, CS, and bankers. The low representation is partly due to fewer women in the senior echelons of these professions (and the eligibility requiring 10+ years experience), but also due to perceptions about the insolvency role. As more women professionals break into senior roles, encouraging them to pursue the IRP exam could improve diversity in the field. Women IPs like Mamta Binani (mentioned above) have already demonstrated excellence. This cohort could benefit from the exam as it opens doors to independent practice and direct appointments, potentially overcoming glass-ceiling issues in traditional corporate hierarchies. Efforts by professional bodies to mentor and support women candidates can help bridge the gap.

- Young Professionals via GIP: While not in the 5–10 year experience bracket, it’s worth noting the Graduate Insolvency Program (GIP) as an emerging route. GIP graduates (often in their 20s) can become IPs without the decade of experience. They represent a new cohort of full-time insolvency-dedicated professionals. As they gain experience over the next few years, they will join the ranks of mid-career IPs. Established professionals might soon find themselves working alongside these GIP graduates. The synergy of youth and experience will be interesting to watch.

- Academics and Researchers: A small yet notable underserved group are academics in law, finance, or business who have the requisite experience (some professors are also lawyers or CAs with practice experience). They might pursue the IRP exam to lend their expertise to high-level cases or policy formulation. While not many have done so yet, a few subject-matter experts have qualified as IPs to act as consultants or court-appointed experts in complex resolutions. This shows the exam isn’t just for those seeking commercial gain, but also for those who want to contribute their analytical skills to the public good of insolvency resolution.

Conclusion

The IBBI’s Insolvency Resolution Professional exam is attracting a wide range of mid- to senior-career professionals in India. Each cohort – be it lawyers expanding their legal practice, chartered accountants and cost accountants branching into resolution roles, company secretaries stepping beyond compliance, bankers and ex-PSU officers leveraging their institutional knowledge, or corporate managers seeking a dynamic second career – finds unique value in the certification.

The insolvency profession by its nature sits at the intersection of law, finance, and management, so it naturally appeals to diverse expertise. Many professionals are discovering that qualifying as an IP not only enhances their credibility but also unlocks new career pathways, from leading headline-making corporate turnarounds to founding specialised firms.

At the same time, raising awareness among underrepresented groups (like women, certain industries, and non-traditional professionals) can further broaden the talent pool. The IBBI IRP exam thus serves as a catalyst for mid-career transformation, aligning experienced talent with the national need to resolve distressed assets efficiently. Each persona that enters this field enriches it – bringing their background to bear on complex problems – and stands to reap significant career rewards in return, as India’s insolvency ecosystem continues to mature.

Allow notifications

Allow notifications