Documents required for company registration in India include PAN, identity proof, address proof, DSC, registered office documents, MoA, AoA, and Form INC-9 declarations. Complete guide with checklist.

Table of Contents

Registering a company in India involves far more than just filling out forms on the MCA portal. Whether you are advising a client on their first incorporation, handling compliance for a corporate house, or preparing your own startup for registration, the success of your application depends entirely on submitting the right documents in the correct format. One missing signature, an outdated utility bill, or an improperly apostilled passport can delay your incorporation by weeks or even result in outright rejection. Section 7 of the Companies Act, 2013 establishes the statutory foundation for incorporation, mandating specific documents and declarations that the Registrar of Companies must receive before issuing the Certificate of Incorporation.

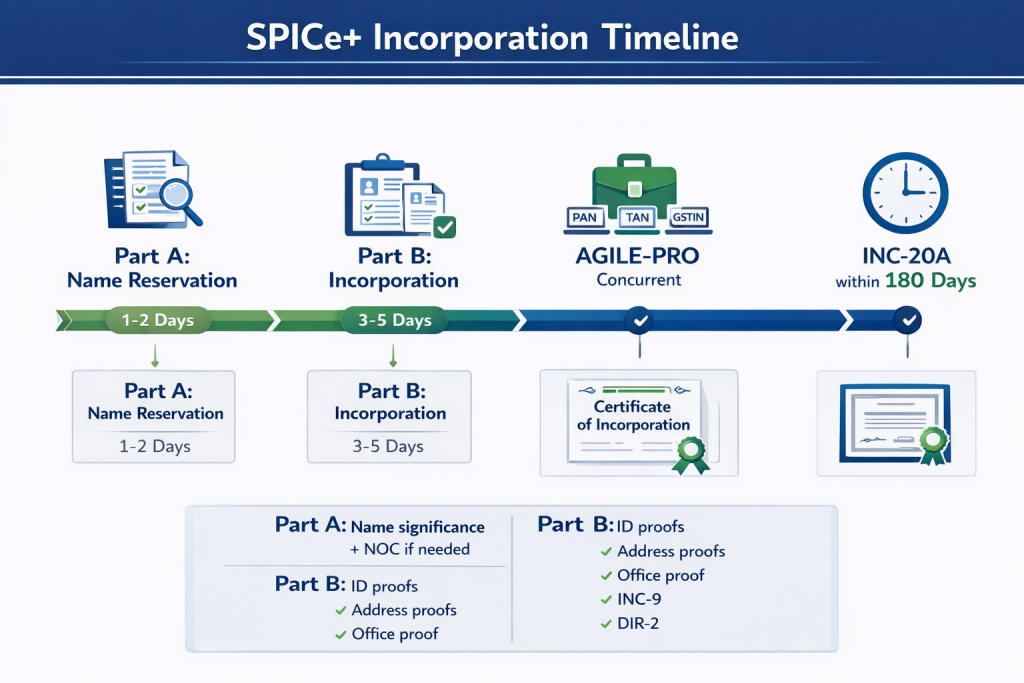

The introduction of SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) in February 2020 transformed the incorporation landscape in India. What once required multiple applications to different government departments now happens through a single integrated web form. SPICe+ bundles together name reservation, incorporation, DIN allotment, PAN and TAN applications, GSTIN registration, EPFO and ESIC registration, and even bank account opening through AGILE-PRO. This consolidation has made the process faster but has also raised the stakes for document preparation. Every attachment you upload must be precisely formatted, properly signed, and compliant with the latest MCA specifications.

This guide provides a systematic breakdown of every document required for company registration in India. You will find detailed coverage of identity and address proofs for directors and shareholders, registered office documentation, constitutional documents like the Memorandum and Articles of Association, statutory declarations and forms, and the specific requirements for different company types. We also address the documentation needs of NRIs and foreign nationals, common rejection scenarios and how to avoid them, and the critical post-incorporation filings that must follow the issuance of your Certificate of Incorporation. By the end of this guide, you will have a comprehensive checklist that serves as your reference for every incorporation you handle.

Legal Framework for Documents Required for Company Registration

Understanding the statutory framework behind documentation requirements helps practitioners advise clients with confidence. The documents you submit are not arbitrary bureaucratic requirements; they serve specific legal purposes mandated by the Companies Act, 2013 and the rules framed thereunder.

Section 7 of the Companies Act, 2013

Section 7 is the cornerstone provision governing company incorporation in India. It specifies the documents and information that must be filed with the Registrar of Companies for a company to be registered. The provision operates through several sub-clauses, each addressing a distinct category of documentation.

Section 7(1)(a) requires the filing of the Memorandum of Association and Articles of Association, duly signed by all subscribers to the memorandum in the prescribed manner. This establishes the constitutional foundation of your company.

Section 7(1)(b) mandates a declaration from a practicing professional, specifically an advocate, chartered accountant, cost accountant, or company secretary in practice, confirming that all requirements of the Act and rules have been complied with. A person named in the articles as a director, manager, or secretary must also provide this declaration.

Section 7(1)(c) is particularly important as it requires a declaration from each subscriber to the memorandum and from persons named as first directors. This declaration must confirm that the individual has not been convicted of any offence related to the promotion, formation, or management of any company, has not been found guilty of fraud, misfeasance, or breach of duty to any company during the preceding five years, and that all documents filed contain correct, complete, and true information.

Section 7(1)(d) through 7(1)(g) cover additional requirements including the company’s correspondence address, particulars of subscribers with proof of identity, details of first directors’ interests in other firms or bodies corporate, and their consent to act as directors. These provisions collectively create the complete documentation framework that every incorporation application must satisfy.

Procedural Requirements under Companies (Incorporation) Rules, 2014

The Companies (Incorporation) Rules, 2014 translates the statutory requirements of Section 7 into practical procedures. These rules prescribe the specific forms, formats, and filing procedures that practitioners must follow.

Rule 12 addresses the application for incorporation, specifying that Form SPICe+ (INC-32) must be used for all company incorporations. Rule 13 prescribes the manner in which the Memorandum and Articles of Association must be signed by subscribers, including requirements for witness signatures and the format of the subscribers’ sheet. Rule 14 states that the declaration by an advocate, company secretary or any other professional shall be as per Form INC-8. Rule 15 specifically deals with the declaration required under Section 7(1)(c), prescribing Form INC-9 as the format for declarations by subscribers and first directors.

Rule 16 is crucial for practitioners as it specifies the particulars of every subscriber that must be filed with the Registrar. These include the subscriber’s name, father’s or mother’s name, nationality, date of birth, place of birth, educational qualification, occupation, income tax PAN, permanent and current address, email ID, and phone number. The rule also requires a recent photograph of each subscriber to be affixed and scanned with the MoA and AoA.

Rule 17 prescribes that particulars of each person mentioned in the articles as first director of the company and his interest in other firms or bodies corporate along with his consent to act as director of the company shall be filed in Form No.DIR.12.

Rule 25 deals with verification of the registered office address. The rule requires companies to furnish verification of their registered office within 30 days of incorporation using Form INC-22, along with documentary proof of the registered office address. This includes either the registered document of title of the premises, a notarized copy of the rent or lease agreement, or authorization from the owner to use the premises as registered office along with proof of ownership.

Recent Amendments and MCA Notifications

The Ministry of Corporate Affairs continues to refine incorporation procedures through amendments and notifications. Several changes in 2024 and 2025 directly affect document preparation.

Effective July 15, 2024, the Controller of Certifying Authorities updated the Identity Verification Guidelines (CCA-IVG 2024), introducing mandatory video verification for all DSC applicants. This change has increased the time required to obtain Digital Signature Certificates, so practitioners should factor this into their project timelines. Additionally, DSC charges increased by approximately Rs. 1,000 per certificate following this update.

In 2025, the Ministry of Corporate Affairs (MCA) completed the migration to the MCA21 Version 3 (V3) portal, with the rollout of the final 38 company e-forms: including those related to incorporation via SPICe+ and AGILE-PRO-S, going live from July 14, 2025. This fully web-based platform introduces real-time validations, enhanced auto-prefill features, expanded bank integrations for seamless account opening, and procedural optimizations, while maintaining existing core document requirements. The platform now supports mandatory Profession Tax registration for companies incorporated in Maharashtra, Karnataka, and West Bengal, reducing the need for separate state-level filings. Practitioners should verify the latest form versions and attachment requirements on the MCA portal before each filing, as the ministry frequently updates technical specifications.

Complete List of Documents Required for Company Registration in India

This section provides the comprehensive checklist of documents required from directors and shareholders. Understanding both the document types and their format specifications is essential for first-time approval.

Documents Required from Promoters and Directors

Every proposed director and shareholder must submit personal documents establishing their identity, address, and eligibility to participate in the company.

Identity Proof Documents for Indian Nationals

For Indian nationals, the Permanent Account Number (PAN) card is mandatory and serves as the primary identity proof. The PAN also enables the automatic allotment of DIN through SPICe+ without requiring a separate DIR-3 application. Ensure that the name on the PAN card exactly matches the name being used in all incorporation documents; even minor variations can trigger rejection.

Beyond PAN, applicants must submit one additional government-issued identity proof. Acceptable documents include Aadhaar card, Voter ID (Election Commission of India), valid Passport, or Driving License. The identity proof must clearly show the applicant’s photograph, name, and date of birth. For the subscriber and director declarations to be valid, the name on identity proof must match the name as it appears in the PAN database.

Address Proof: Documents Accepted and Validity Period

Address proof requirements are stringent, and this is one of the most common areas where applications face queries. The MCA accepts the following as valid address proof: bank statement, electricity bill, telephone bill (landline), mobile postpaid bill, or gas bill. The critical requirement is that the document must not be older than two months from the date of filing the incorporation application.

For residential address proof, the document must show the applicant’s name and current residential address. If you are using a bank statement, ensure it is the most recent statement showing transactions. Utility bills should be recent bills (not just payment receipts) that clearly display the name and service address. Many practitioners overlook this two-month validity requirement, leading to unnecessary rejections and resubmission delays.

Passport-Sized Photographs: Specifications and Format

At the time of incorporation, recent passport-sized photographs in PDF form of each subscriber and director are required. The photographs should be recent (taken within the last six months) with a clear frontal view of the face against a light background. When scanning the documents, ensure the photographs are clearly visible and not distorted.

Additional Documents Required from NRIs and Foreign Directors

Non-resident Indians and foreign nationals face additional documentation requirements that reflect the need for identity verification across jurisdictions.

Passport and Visa Documentation

For foreign nationals, the passport is mandatory as the primary identity document. The passport copy must show personal details, photograph, and validity period. For foreign nationals visiting India, if they intend to be involved in the incorporation process, a valid Business Visa is required unless they hold Person of Indian Origin (PIO) or Overseas Citizen of India (OCI) status.

NRIs who hold Indian passports but reside abroad must provide their Indian passport as identity proof. The residential status (NRI vs. resident) affects the attestation and apostille requirements for their documents.

Apostille and Notarization

The attestation requirements for foreign nationals depend on their country of residence and whether that country is a member of the Hague Apostille Convention of 1961.

For residents of Hague Convention member countries (which includes approximately 105 countries such as the USA, UK, Australia, Germany, France, and Singapore), all documents signed outside India must be notarized by a Public Notary and then apostilled by the competent government authority in their country of residence. The apostille certifies the authenticity of the notary’s signature and seal.

For residents of non-member countries, documents must be notarized by a Public Notary and then consularised (attested) by the Indian Embassy or Consulate in that country. This process takes longer than apostillation, so factor additional time into your project schedule.

Important exception: If an NRI holding an Indian passport is physically present in India at the time of incorporation, their documents can be attested by a practicing professional in India (CA, CS, or CMA) or by an Indian Notary Public, eliminating the need for apostillation.

Translation Requirements for Non-English Documents

All documents submitted to the MCA must be in English. If any identity proof, address proof, or other document is in a language other than English, it must be translated by a certified translator or notary public of the home country. The translation must be notarized along with the original document before apostillation or consularisation.

Digital Signature Certificate

The Digital Signature Certificate is the gateway to all electronic filings with the MCA. Without a valid DSC, no incorporation application can be submitted.

Class 3 DSC

In India, Class 1 and Class 2 DSCs have been discontinued. Only Class 3 DSC is now issued and accepted for all government filings, including MCA, Income Tax, GST, and e-tendering portals. Class 3 DSC provides the highest level of security with rigorous identity verification.

For company incorporation, every proposed director who will sign the SPICe+ application must have a valid Class 3 DSC. The DSC is issued in the individual’s name and can be used to sign documents for multiple companies where that individual serves as a director.

Obtaining DSC from Authorized Certifying Authorities

DSCs are issued by Certifying Authorities (CAs) licensed by the Controller of Certifying Authorities (CCA) under the Information Technology Act, 2000. Major licensed CAs include eMudhra, Sify Technologies, (n)Code Solutions, Capricorn Identity Services, and IDRBT. The complete list is available at cca.gov.in.

The application process is entirely online. Applicants must submit identity proof (PAN card for Indians, passport for foreign nationals), address proof (not older than two months), and a recent photograph. Following the CCA-IVG 2024 guidelines, live video verification is now mandatory for all DSC applicants. This enhances identity assurance and complies with data protection norms, typically adding 1-2 days to processing time as applicants schedule and complete a short recorded video call confirming their details and documents.

DSCs are typically issued within 2 to 3 business days for straightforward applications. The certificate is delivered on a USB token that stores the private key securely. DSCs can be issued with validity periods of 1, 2, or 3 years.

Common DSC Issues and Their Solutions

Practitioners frequently encounter DSC-related issues during incorporation. The most common is DSC expiry, where applicants attempt to use expired certificates. Always verify the validity of all directors’ DSCs before beginning the filing process. DSC mismatch is another frequent issue, where the name on the DSC does not exactly match the name in other incorporation documents. Even minor variations (such as middle name inclusion or abbreviation differences) can cause problems. Technical issues like incompatible browser versions, missing DSC drivers, or corrupted USB tokens can also delay filings. Maintaining updated browser certificates and DSC utility software helps avoid these issues.

Director Identification Number

Every individual who wishes to be appointed as a director of an Indian company must have a Director Identification Number (DIN). This unique identification number tracks directorship across all companies in India.

Previously, DIN was obtained through a standalone DIR-3 application before incorporation. SPICe+ has simplified this process by integrating DIN allotment into the incorporation form itself. The SPICe+ Part B allows DIN applications for up to three directors simultaneously with the incorporation application. For directors who already have a valid DIN, their existing number is used in the incorporation.

To apply for DIN through SPICe+, applicants must provide their PAN details, personal information, and attach identity and address proofs. For Indian residents, PAN is mandatory. For foreign nationals, passport details serve as the primary identifier.

Directors who need to obtain DIN outside the incorporation process (for example, directors being added after incorporation) must apply through Form DIR-3. The form requires certification by a practicing professional and submission of identity and address proofs as prescribed.

Documents Required for Registered Office Address Proof

The registered office is the company’s official address for receiving all communications, notices, and legal documents. Documentation proving the legitimacy of this address is critical for incorporation approval.

Valid Registered Office Under Section 12

Section 12 of the Companies Act, 2013 requires every company to have a registered office within 30 days of incorporation. The registered office must be capable of receiving and acknowledging all communications and notices addressed to the company.

The Act also mandates that the company must display its name and registered office address on the outside of every office or place where business is carried on, in legible letters and in the language or script of the locality if different from English. The company’s name, registered office address, Corporate Identity Number (CIN), telephone number, fax number (if any), email, and website must also appear on all business letters, billheads, letter papers, and other official publications.

Non-compliance with Section 12 attracts a penalty of Rs. 1,000 per day of default, up to a maximum of Rs. 1 lakh, for both the company and every officer in default.

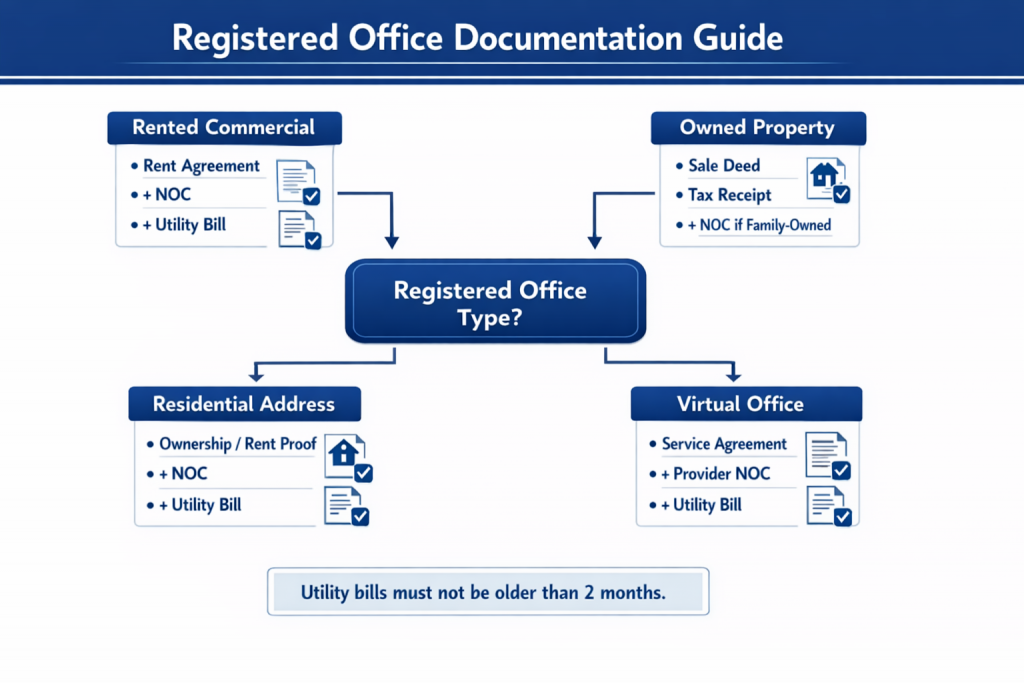

Documentation for Rented Commercial Premises

Most new companies establish their registered office in rented commercial premises. The documentation requirements for rented premises are more extensive than for owned property.

Rent or Lease Agreement: Essential Clauses

The rent or lease agreement must be a valid, subsisting agreement that clearly identifies the premises being rented. Essential clauses that the agreement should contain include: clear identification of the landlord and tenant, complete address of the premises, term of the lease or rent period, rent amount and payment terms, and permitted use of the premises (which should include or not exclude use as a company’s registered office).

For SPICe+ filing, a notarized copy of the rent or lease agreement is required. The agreement need not specifically mention the company name (since the company does not exist yet at the time of signing), but it should be in the name of one of the proposed directors or subscribers who is authorizing the use of the premises.

No Objection Certificate from Property Owner

A No Objection Certificate (NOC) from the property owner is mandatory when using rented premises as the registered office. The NOC should be on the owner’s letterhead (if applicable) and must clearly state that the owner has no objection to the premises being used as the registered office of the proposed company.

The NOC should include: the owner’s name and address, complete address of the premises, name of the proposed company (or at least identification of the proposed directors), clear statement of no objection, date and signature of the owner. If the property owner is a company or LLP, the NOC should be signed by an authorized signatory with appropriate authorization.

Utility Bill: Electricity, Water, or Telephone

A utility bill serves as proof that the premises exist and are operational. Acceptable utility bills include electricity bills, water bills, telephone bills (landline), or gas connection bills. The utility bill must show the address of the premises and must not be older than two months from the date of incorporation application.

This two-month validity requirement is strictly enforced by the ROC. Many practitioners face rejections because they use utility bills that were valid when document collection began but expired by the time the application was actually filed. Always verify utility bill validity immediately before final submission.

Documents Required When Using Owned Property

When a director or shareholder owns the property being used as the registered office, the documentation requirements differ.

Property Ownership Documents: Sale Deed or Property Title Documentation

The primary document required is proof of ownership, which can be the registered sale deed, property title document, or conveyance deed. This document establishes that the person providing authorization actually owns the property.

Latest Property Tax Receipts

Recent property tax payment receipts serve as supplementary proof of ownership and confirm that the property is in active use. The receipt should show the property address and owner’s name matching the authorization provider.

NOC Requirements for Family-Owned Property

If the property is owned by a family member of one of the directors (rather than the director themselves), an NOC from the actual owner is still required. The NOC should clearly state the relationship and the owner’s consent for the property to be used as the company’s registered office.

Using Residential Address as Registered Office

The MCA permits the use of residential addresses as registered offices for companies, particularly useful for startups and small businesses that do not require separate commercial premises. When using a residential address, the documentation requirements are similar to rented commercial premises: proof of ownership or rent agreement, NOC from the owner (if rented), and a recent utility bill not older than two months. The applicant using the residential address should typically be one of the proposed directors of the company.

There are no restrictions under company law on operating from a residential address, though practitioners should advise clients to verify local zoning regulations and housing society rules that may restrict commercial activities in residential premises.

Documents Required for Virtual Office as Registered Office

Virtual office arrangements have become increasingly popular, particularly for companies with remote operations. Virtual office providers can be used as registered office addresses only if the premises constitute a real, functioning place capable of receiving official communications and passing ROC physical verification under Section 12.

In practice, ROC generally insists on a lease/rent or service agreement with the provider, an NOC from the actual property owner, and a recent utility bill for the premises as address proof. The agreement should explicitly permit use of the address as “registered office” and provide for mail handling and notice receipt, and the company must still ensure display of its name and address at the site in accordance with Section 12 of the Act.

Memorandum and Articles of Association

The Memorandum of Association (MoA) and Articles of Association (AoA) are the constitutional documents of your company. Together, they define who the company is, what it can do, and how it will operate.

Memorandum of Association: Contents and Format

The MoA is the charter document that establishes the company’s relationship with the outside world. Section 4 of the Companies Act, 2013 prescribes the contents of the MoA, which must include six mandatory clauses.

Name Clause

The Name Clause states the official name of the company. For a private limited company, the name must end with “Private Limited.” For a public company, it must end with “Limited.” Section 8 companies (non-profit) may use terms like “Foundation,” “Forum,” “Association,” “Federation,” “Chambers,” “Confederation,” “Council,” or “Electoral Trust” instead.

The name must be unique and not identical or too similar to an existing company or registered trademark. The MCA’s name search facility and trademark database should be checked before finalizing the name.

Registered Office Clause

This clause specifies the state in which the company’s registered office will be situated. Note that you specify only the state (for example, Maharashtra or Karnataka), not the complete address. The exact address is provided in SPICe+ Part B and verified through Form INC-22.

Object Clause: Main Objects and Ancillary Objects

The Object Clause defines the business activities the company is authorized to undertake. Under the Companies Act, 2013, the object clause is streamlined compared to the 1956 Act. The clause should clearly state the main objects of the company and any objects incidental or ancillary to the main objects.

When drafting object clauses, practitioners should ensure they are broad enough to cover all intended business activities and potential future expansions, while being specific enough to comply with any sector-specific regulations. For companies requiring regulatory approval (such as those in banking, insurance, or telecommunications), the object clause must align with the sector regulator’s requirements.

Liability Clause: Limited vs Unlimited

The Liability Clause states the nature of members’ liability. For a company limited by shares (the most common type), this clause states that the liability of members is limited to the amount unpaid on their shares. For a company limited by guarantee, it specifies the amount each member undertakes to contribute in the event of winding up. Unlimited companies have no limit on member liability.

Capital Clause: Authorized and Subscribed Capital

The Capital Clause specifies the authorized share capital of the company and its division into shares of fixed amounts. For example: “The Authorized Share Capital of the Company is Rs. 10,00,000 (Rupees Ten Lakhs Only) divided into 1,00,000 (One Lakh) Equity Shares of Rs. 10 (Rupees Ten Only) each.”

The authorized capital determines the maximum amount of share capital the company can issue without amending its MoA. The subscribed capital (what subscribers actually take) can be less than the authorized capital.

Subscriber Clause and Witness

The Association Clause (also called the Subscription Clause) contains the declaration by subscribers that they wish to form a company and agree to take the shares set against their names. Each subscriber must sign the MoA, stating their name, address, description/occupation, and the number of shares taken.

Rule 16 of the Companies (Incorporation) Rules, 2014 specifies that the subscriber’s signature must be witnessed by at least one witness who shall attest the signature and add their name, address, description, and occupation. For electronic filings through SPICe+, the e-MoA is a linked form that captures subscriber details digitally.

Articles of Association

The Articles of Association govern the internal management and operations of the company. While the MoA defines what the company can do, the AoA defines how it will function.

Adopting Table F vs Customized AoA

The Companies Act, 2013 provides model articles in Schedule I. Table F contains the model articles for a company limited by shares. Companies can either adopt Table F in its entirety or file their own customized articles.

For most private limited companies with straightforward shareholding structures, adopting Table F (with or without modifications) is sufficient. However, companies with complex arrangements such as multiple classes of shares, investor rights, drag-along and tag-along provisions, or detailed transfer restrictions will need customized articles.

Special Provisions for Private Limited Companies

Private limited companies must include certain mandatory restrictions in their articles as per Section 2(68) of the Act. These include: restriction on the right to transfer shares, limitation on the number of members to 200 (excluding employee-shareholders), and prohibition on inviting public subscription for shares or debentures.

AoA Requirements for Different Company Types

The format of AoA varies based on company type. Table F applies to companies limited by shares. Table G applies to companies limited by guarantee having share capital. Table H applies to companies limited by guarantee without share capital. Table I applies to unlimited companies having share capital. Table J applies to unlimited companies without share capital.

For Section 8 companies (non-profit), the articles must include provisions regarding application of profits and income solely toward promoting the company’s objectives and prohibition on dividend payments to members.

Statutory Forms and Declarations Required for Company Registration

Beyond the constitutional documents, several statutory forms and declarations must accompany every incorporation application.

Form INC-9: Declaration by Subscribers and First Directors

Form INC-9 is the declaration required under Section 7(1)(c) of the Companies Act, 2013 and Rule 15 of the Companies (Incorporation) Rules, 2014. This declaration is mandatory for every incorporation and must be signed by all subscribers and proposed first directors.

Content of Form INC-9 Declarations

Through Form INC-9, each subscriber and first director declares that:

They have not been convicted of any offence in connection with the promotion, formation, or management of any company during the preceding five years. They have not been found guilty of any fraud or misfeasance or of any breach of duty to any company under the Companies Act, 2013 or any previous company law during the preceding five years. All documents filed with the Registrar for registration of the company contain information that is correct, complete, and true to the best of their knowledge and belief.

For foreign nationals who require government approval under FEMA regulations before subscribing to shares, the declaration also includes confirmation that such approval has been obtained or that approval is not required.

Auto-Generation Through SPICe+ vs Manual Preparation

For most incorporations, Form INC-9 is auto-generated in PDF format through the SPICe+ system. This auto-generation occurs when the total number of subscribers and directors is 20 or fewer and all such persons have valid DIN or PAN.

In cases where the total number exceeds 20, or where any subscriber or director lacks both DIN and PAN, Form INC-9 must be prepared manually outside the system and uploaded as an attachment. The manual form must follow the prescribed format and be properly signed by all relevant parties.

Special Requirements for Foreign Nationals in Form INC-9

For NRI and foreign national subscribers and first directors, the INC-9 declaration must be notarized and apostilled (or consularised) as discussed earlier. The declaration should be prepared in the country of residence, notarized by a Public Notary, and apostilled by the competent government authority before being submitted with the incorporation application.

Form DIR-2: Consent to Act as Director

Form DIR-2 captures the consent of each proposed director to act as a director of the company. This consent must be obtained before the person can be named as a director in the incorporation application.

The form requires the proposed director to provide personal details, confirm their eligibility (no disqualification under Section 164 of the Act), and declare their consent to act. The form must be signed with the director’s DSC and is filed as an attachment to SPICe+ Part B.

Form INC-14: Professional Declaration for Section 8 Companies

Section 8 companies (companies formed for charitable or non-profit purposes) require an additional professional declaration in Form INC-14. This declaration must be provided by a practicing Chartered Accountant, Company Secretary, or Cost Accountant.

Through Form INC-14, the professional certifies that the MoA and AoA have been drawn up in conformity with Section 8 requirements, the company’s objects fall within the permitted categories, and all statutory requirements for Section 8 incorporation have been complied with.

Form INC-3: Nominee Consent for One Person Companies

One Person Companies (OPCs) have a unique requirement: the sole member must nominate a person who will become the member of the OPC in the event of the original member’s death or incapacity. This nominee must provide consent in Form INC-3.

The nominee declaration confirms that the person consents to act as nominee, understands that they will become the sole member upon the original member’s death or incapacity, and provides their personal details and identity proof.

Documents Required for Different Types of Company Registration

Different company structures have varying documentation requirements. Understanding these variations helps practitioners advise clients on the most appropriate structure for their needs.

Private Limited Company: Standard Documents Checklist

A private limited company requires a minimum of 2 directors and 2 shareholders (who can be the same individuals). At least one director must be a resident of India (stayed in India for at least 182 days in the previous calendar year).

The standard document checklist includes: identity proof and address proof for all directors and shareholders (PAN mandatory for Indians), DSC for signing directors, registered office proof (rent agreement/ownership proof, NOC, utility bill), MoA and AoA (or e-MoA and e-AoA through SPICe+), Form INC-9 declarations from all subscribers and first directors, and Form DIR-2 consent from all proposed directors.

Public Limited Company: Additional Requirements

Public limited companies have enhanced requirements reflecting their larger scale and public accountability. The minimum requirement is 3 directors and 7 shareholders.

In addition to the standard documents, public limited companies must ensure their articles do not contain restrictions on share transfer (unlike private companies), and they have no cap on the number of members. If the public company intends to list its securities, additional regulatory requirements under SEBI guidelines will apply.

One Person Company: Sole Director and Nominee Documentation

OPCs allow a single individual to incorporate a company with limited liability. Only a natural person who is an Indian citizen and resident in India can form an OPC.

Unique documentation includes Form INC-3 (Nominee consent), along with identity and address proof of the nominee. The member and nominee cannot be the member or nominee in more than one OPC at the same time.

Section 8 Company Registration

Section 8 companies (non-profit companies) have additional requirements reflecting their special status.

Required documents include: Form INC-12 (application for license to incorporate under Section 8), Form INC-13 (Memorandum of Association for Section 8 company in the prescribed format), Form INC-14 (declaration by practicing professional), estimated annual income and expenditure for the next three years, and draft MoA and AoA specifically formatted for Section 8 companies.

The objects of a Section 8 company must fall within the permitted categories: promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment, or any other similar object. The company must intend to apply its profits and income solely toward promoting these objects and prohibit dividend payments to members.

Filing Documents Through SPICe+ Portal: Step-by-Step Guide

Understanding the SPICe+ filing process helps practitioners prepare documents in the correct format and sequence for smooth approval.

SPICe+ Part A: Documents for Name Reservation

SPICe+ Part A is used for name reservation. This can be filed separately or together with Part B.

At the Part A stage, minimal documents are required: the application form with proposed names (up to 2 names in order of preference), significance of the proposed name, and any NOC or approval letters if the proposed name requires clearance from a sectoral regulator or is based on a trademark belonging to another entity.

Common reasons for name rejection include: name identical or too similar to an existing company, name containing prohibited words without appropriate approval, name suggesting government connection without approval, or name that is undesirable in the opinion of the Central Government.

The approved name is reserved for 20 days, within which Part B must be filed. This period can be extended by paying additional fees, but practitioners should aim to complete Part B within the original 20-day window.

SPICe+ Part B: Complete Incorporation Package

Part B is the comprehensive incorporation form that captures all company details, director and shareholder information, and accepts all document attachments.

Document Upload Specifications: Format and Size Requirements

All documents must be uploaded in PDF format. The maximum file size for each attachment is typically 6 MB. Documents should be scanned clearly at a resolution that makes all text legible. Color scans are preferred for documents with stamps, seals, or photographs.

Common attachments include: proof of identity and address for all directors and subscribers, registered office proof (agreement, NOC, utility bill), affidavit/declaration by first subscribers and directors (INC-9), consent of directors (DIR-2), and any regulatory approvals or NOCs if required.

Sequence of Document Attachment

While the MCA portal does not mandate a specific attachment sequence, organizing documents logically helps during ROC review. A recommended sequence: identity proofs of directors, identity proofs of subscribers (if different from directors), address proofs, registered office documents (agreement, then NOC, then utility bill), INC-9 declaration, DIR-2 consents, and any additional documents.

DSC Affixation

SPICe+ Part B requires digital signatures from multiple parties: the applicant (typically a director or professional), all first directors whose DIN is being applied for through the form, and the practicing professional certifying the form.

Ensure all DSCs are valid and properly registered with the MCA portal before attempting to sign. The form cannot be submitted without all required signatures.

AGILE-PRO Integration: Documents for Linked Services

AGILE-PRO-S (Application for Goods and Services Tax Identification Number, Employees’ State Insurance Corporation Registration, Employees’ Provident Fund Organisation Registration, and Opening Bank Account for the company) is a linked form that enables multiple registrations alongside incorporation.

For bank account opening through AGILE-PRO, select the bank and branch where you wish to open the account. The bank will contact the company after incorporation for KYC formalities. For GSTIN, provide the principal place of business details. For EPFO and ESIC, provide establishment details if you intend to hire employees.

Common Rejection Reasons and Ways to Avoid Them

Understanding why applications get rejected helps practitioners prepare bulletproof submissions.

Name and Address Mismatches

The most common rejection reason is inconsistency between documents. The name on PAN, identity proof, and SPICe+ form must match exactly. Even variations like “Kumar” vs “K.” can trigger queries. Similarly, the registered office address must be consistent across the rent agreement, NOC, utility bill, and SPICe+ form.

Prevention: Create a standardization sheet before starting document collection, specifying the exact name format and address format to be used consistently across all documents.

Utility Bill Validity Issues

Utility bills older than two months from the filing date are rejected. This is particularly problematic when there are delays between document collection and actual filing.

Prevention: Collect utility bills as close to the filing date as possible. If delays occur, obtain fresh utility bills before submission.

Incomplete or Improperly Signed Declarations

Form INC-9 rejections occur when declarations are incomplete, signatures are missing, or for NRI/foreign national subscribers, when apostillation is absent or improper.

Prevention: Use checklists to verify all signatures are in place. For foreign nationals, work with reliable apostillation service providers in their country of residence.

DSC and DIN Related Rejections

Expired DSCs, DSCs with name mismatches, or technical issues with DSC affixation cause rejections. DIN-related issues include using deactivated DINs or DINs where annual KYC compliance is pending.

Prevention: Verify all DSCs are valid and names match exactly. Confirm all directors have completed DIR-3 KYC. Test DSC functionality before final submission.

Documents Required After Company Registration is Complete

Receiving the Certificate of Incorporation is not the end of the documentation journey. Several critical filings must follow incorporation.

Form INC-20A: Declaration for Commencement of Business

Section 10A of the Companies Act, 2013 mandates that companies incorporated on or after November 2, 2018 with share capital must file a declaration for commencement of business within 180 days of incorporation.

Form INC-20A requires directors to declare that every subscriber to the MoA has paid the value of shares agreed to be taken by them, and that the company has filed verification of its registered office. The form must be filed before the company can commence any business activities or exercise borrowing powers.

Non-compliance attracts a penalty of Rs. 50,000 on the company and Rs. 1,000 per day on officers in default (up to Rs. 1 lakh). Additionally, if such a declaration is not filed within 180 days, the Registrar may initiate action to strike off the company from the register.

Documents required for INC-20A include: proof of payment of subscribed capital (bank statements showing deposits from subscribers), verification of registered office (if not already filed), and board resolution authorizing the director to sign the form.

Documents pertaining to the First Board Meeting

The first board meeting must be held within 30 days of incorporation. This meeting transacts several important matters including adoption of common seal (optional), appointment of first auditor, opening of bank account, issue of share certificates, and authorization for registered office.

The minutes of this meeting must be properly documented and preserved. Required documentation includes: notice of board meeting, attendance register, minutes book with properly drafted minutes signed by the chairman, and any resolutions passed.

Documents Required for Opening Company Bank Account

While AGILE-PRO facilitates bank account opening, banks still require KYC documentation from the company. Typically required documents include: Certificate of Incorporation, MoA and AoA, PAN card of the company (allotted through incorporation), board resolution for opening the account and authorizing signatories, identity and address proof of authorized signatories, and proof of registered office address.

Banks may have additional requirements specific to their policies. Coordinate with the chosen bank to obtain their exact documentation checklist before the first board meeting so that all necessary resolutions can be passed.

Conclusion

Proper documentation is the foundation of successful company incorporation in India. From the statutory requirements under Section 7 of the Companies Act, 2013 to the procedural specifications in the Companies (Incorporation) Rules, 2014, every document serves a specific legal purpose. Understanding these requirements helps practitioners avoid rejection, minimize delays, and ensure their clients’ companies start operations on solid legal footing.

The key principles to remember are consistency, validity, and completeness. Names must match exactly across all documents. Address proofs and utility bills must be current within the prescribed validity periods. All required signatures, attestations, and apostillations must be properly obtained before submission.

For NRI and foreign national clients, the additional requirements of notarization and apostillation add complexity but are manageable with proper planning. Building relationships with reliable service providers in key jurisdictions can streamline this process.

Post-incorporation filings, particularly Form INC-20A, are equally critical. The 180-day window for filing the declaration of commencement of business should be calendared immediately upon receiving the Certificate of Incorporation. Missing this deadline can result in penalties and even strike-off proceedings.

Use this guide as your checklist for every incorporation. The few hours spent in careful document preparation and verification will save weeks of potential delay from rejections and resubmissions. Your clients deserve companies that are incorporated correctly from day one, and this comprehensive approach to documentation is how you deliver that outcome.

Frequently Asked Questions

What is the complete list of documents required for private limited company registration in India?

For a private limited company, you need: PAN cards of all directors and shareholders, identity proof (Aadhaar, Passport, Voter ID, or Driving License), address proof not older than two months (bank statement, utility bill), passport-sized photographs, DSC for signing directors, registered office proof (rent agreement or ownership document, NOC from owner, utility bill not older than two months), Form INC-9 declarations from all subscribers and first directors, and Form DIR-2 consent from all proposed directors.

Can a company be registered at a residential address in India?

Yes, the MCA permits residential addresses as registered offices for companies. The documentation requirements remain the same: proof of ownership or rent agreement, NOC from the property owner (if not the director themselves), and a utility bill not older than two months. However, practitioners should advise clients to verify local zoning regulations and housing society rules that may restrict commercial activities in residential areas.

What documents are required for company registration from foreign nationals?

Foreign nationals must provide: valid passport (notarized and apostilled), address proof from their country of residence not older than two months (notarized and apostilled), passport-sized photographs, and Form INC-9 declaration (notarized and apostilled). If documents are not in English, certified translations are required. The apostillation requirement applies to residents of Hague Convention member countries; others require consularization by the Indian Embassy.

How long is the validity of address proof documents for company registration?

Address proof documents must not be older than two months from the date of filing the incorporation application. This applies to both personal address proofs of directors and shareholders and the utility bill for registered office verification. This is one of the most common reasons for application rejection, so verify document dates immediately before submission.

Is notarization mandatory for documents required for company registration?

For Indian residents, notarization is generally not mandatory for incorporation documents. However, the rent agreement for registered office premises is typically submitted as a notarized copy. For NRIs and foreign nationals, all documents signed outside India must be notarized by a Public Notary in their country of residence and subsequently apostilled or consularized before submission.

What is the difference between MoA and AoA in company registration?

The Memorandum of Association (MoA) defines the company’s relationship with the external world, including its name, registered office state, objects, liability, and capital structure. The Articles of Association (AoA) govern the internal management and operations, including share transfer procedures, board meeting requirements, director appointment processes, and dividend policies. Both are constitutional documents required for incorporation.

Can I register a company without a physical office address?

Yes, virtual office addresses are accepted by the MCA as registered offices. You need proper documentation from the virtual office provider including service agreement, authorization to use the address as registered office, NOC, and utility bill. The address must be capable of receiving and acknowledging all communications and notices addressed to the company as required under Section 12.

What happens if documents are rejected during SPICe+ filing?

If documents are rejected, the MCA issues a query or resubmission notice specifying the deficiencies. You have the opportunity to rectify the issues and resubmit. Common rejections relate to name mismatches, expired utility bills, incomplete signatures, or improper attestation. The SPICe+ system allows two resubmissions; after that, a fresh application may be required.

What is Form INC-9 and who needs to sign it?

Form INC-9 is the declaration by subscribers and first directors required under Section 7(1)(c) of the Companies Act, 2013. Every subscriber to the Memorandum of Association and every person named as first director must sign this declaration, confirming they have no convictions related to company management, no fraud findings against them in the past five years, and that all information provided is true and complete.

Is DSC mandatory for all directors during company registration?

DSC is mandatory for all directors who will sign the SPICe+ application, typically at least one director designated as the applicant. For DIN allotment through SPICe+, all directors applying for DIN must have valid DSC to sign the application. After incorporation, all directors will eventually need DSC for signing various statutory forms and filings.

What documents are required for the registered office if the property is rented?

For rented premises, you need three documents: a notarized copy of the rent or lease agreement, a No Objection Certificate (NOC) from the property owner permitting use as registered office, and a utility bill (electricity, water, telephone, or gas) not older than two months showing the premises address.

Can the same person be a director in multiple companies?

Yes, Section 165 permits a person to hold directorships in multiple companies, subject to a maximum of 20 companies. Within this limit, the person cannot be a director in more than 10 public companies. Each directorship must be properly disclosed, and the director must comply with annual DIR-3 KYC requirements for their DIN.

What is the timeline for company registration once documents are submitted?

With complete and accurate documents, the typical timeline is: Part A name reservation takes 1 to 2 working days for approval, and Part B incorporation takes 3 to 5 working days after Part A approval. The entire process can be completed within 7 to 10 working days. Delays occur primarily due to incomplete documents, queries from ROC, or technical issues requiring resubmission.

What post-incorporation documents need to be filed after receiving the Certificate of Incorporation?

The most critical post-incorporation filing is Form INC-20A (Declaration for Commencement of Business) within 180 days, confirming all subscribers have paid for their shares. Additionally, Form INC-22 may be required if registered office verification was not completed through SPICe+. The first board meeting must be held within 30 days, with proper minutes maintained. Annual compliances including MGT-7 (Annual Return) and AOC-4 (Financial Statements) begin from the first financial year.

Allow notifications

Allow notifications