This article has been written to educate readers on how to draft a corporate social responsibility (CSR) Report in compliance with Rule 8 of the Companies (Corporate Social Responsibility Policy) Rules, 2014. This will be helpful for in-house counsels, lawyers, and anyone looking to understand CSR.

Table of Contents

Introduction

It was my first day as the in-house counsel at Greenleaf Innovations, a mid-sized renewable energy solutions provider based in India with approximately 500 employees and an annual revenue of Rs. 150 crores.

The first task I got was to draft a Corporate Social Responsibility Report. I will have to admit that I did not know much about it and thought CSR was some fluff, not some serious legal work.

Well, let me tell you that I was wrong.

Mr. Rajesh, my manager, gave me a stern nod while handing me some files as said, “Listen carefully, Rohit, when I first started drafting CSR reports, the Companies Act of 1956 was still in effect. Back then, CSR was entirely voluntary—a matter of corporate philosophy rather than legal obligation. Today, with section 135 of the Companies Act 2013, we’re operating in a different landscape entirely.”

He told me that the 2013 Act was revolutionary. It made India the first country to mandate CSR spending for qualifying companies. If a company has a net worth of ₹500 crore, a turnover of ₹1,000 crore, or a net profit of ₹5 crore, it must allocate 2% of its average net profits from the preceding three years toward CSR initiatives.

It was not discretionary; it was a mandate.

I nodded attentively, taking notes as Mr. Rajesh spoke.

Then, he pulled out a copy of last year’s CSR report along with Annexure II and placed it on the desk for me to read.

“I will ask questions, so be prepared”, he said.

But what exactly is CSR?

We will switch back to that story in a bit.

But before that, let me tell you what CSR really is and why it has become a mandate for companies.

CSR is the legal obligation of companies to contribute to the social, economic, and environmental well-being of society.

The shift from voluntary to mandatory CSR, under the 2013 Act, was driven by the need to address glaring socio-economic inequalities and leverage corporate resources to support national development goals.

But it is not an unreasonable mandate imposed on all companies. As I have already told you, only companies meeting specific thresholds of profitability, turnover, or net worth are required to spend 2% of their average net profits on approved CSR activities.

This is to ensure that thriving businesses play a proactive role in addressing challenges such as poverty, education, healthcare, and environmental sustainability.

Just so you know, Schedule VII of the Companies Act lays down the activities that can be considered as CSR activities. They are: –

- Eradicating hunger, poverty, and malnutrition

- Promoting education and gender equality

- Environmental sustainability

- Employment-enhancing vocational skills

- Contributions to government relief funds

- Social business projects

- Other welfare initiatives

On the other hand, rule 2 (d) of the CSR Rules lists out the activities that are not considered CSR activities. In short, these activities are: –

- Activities undertaken in the normal course of business

- Any activity undertaken outside India

- Contribution of any amount directly or indirectly to any political party under section 182 of the Companies Act

- Activities benefiting employees of the company as defined in the Code on Wages, 2019

- Activities supported by companies on a sponsorship basis for deriving marketing benefits for products or services

- Activities carried out for the fulfillment of any other statutory obligations under any law in force in India

Coming back to Mr. Rajesh, the only question he asked me was– “what happens if a company fails to fulfil their CSR obligations?”

I had not prepared that part. Anyway, this is what I found out.

If a company fails to meet its CSR spending obligations, it faces significant financial penalties and accountability measures under section 135 (7). Here are the penalties: –

- For the company: Twice the unspent amount or one crore rupees, whichever is less

- Defaulting officers: One-tenth of the unspent amount or two lakh rupees, whichever is less

Take a look at this: –

So, as an in-house counsel or a consultant, you need to make sure that you do not get this wrong.

Now that the basics are done, you know that you need to ensure CSR compliance is met. Here are some additional things you need to know if you are working on CSR.

- You need to create a CSR policy that outlines a company’s approach, strategies, and commitment to fulfilling its Corporate Social Responsibility (CSR) obligations. It serves as a roadmap for how the company will contribute to social, economic, and environmental development in compliance with legal requirements. Here’s a freely available policy for your understanding.

- Create CSR reports

In this article, we will focus on the second part. Policy drafting is easy. I will write a separate piece for you to learn that, anyway.

How to draft a CSR report according to Annexure II format

The Companies Act, 2013, specifically section 135, mandates CSR reporting in the prescribed Annexure II format for qualifying companies.

Preparing a CSR report is easy if you know and understand the format as per Annexure II. Here’s a figure below for you to understand:

Comprehensive guide to completing the CSR annual report template

Section 1: CSR policy

Begin by providing a brief outline of your company’s CSR policy.

In my case, I summarized the company’s commitment to sustainable development, community empowerment, and environmental conservation.

Keep this concise but include your core focus areas and implementation approach.

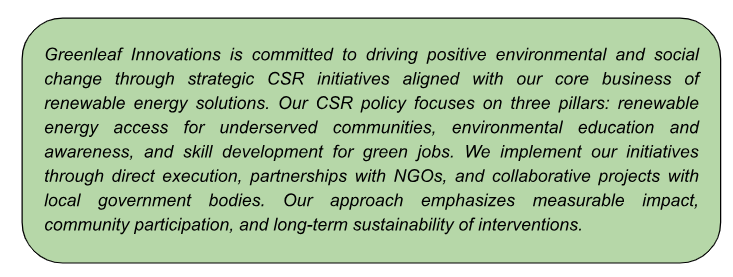

Greenleaf Innovations example: For Greenleaf Innovations, this is what I drafted:

Section 2: CSR committee composition

If you have read section 135 carefully, you will note that the CSR committee needs at least three directors, including one independent director.

But what if you’re advising a private company that doesn’t need an independent director? In that case, a CSR Committee can be formed with just two or more directors.

As far as section 2 of the Annexure II is concerned, you are required to fill in the table with the following details:

- Full names of all directors on the CSR Committee

- Their designation (Executive/Non-Executive/Independent)

- Number of CSR Committee meetings held during the financial year

- Number of meetings each director attended

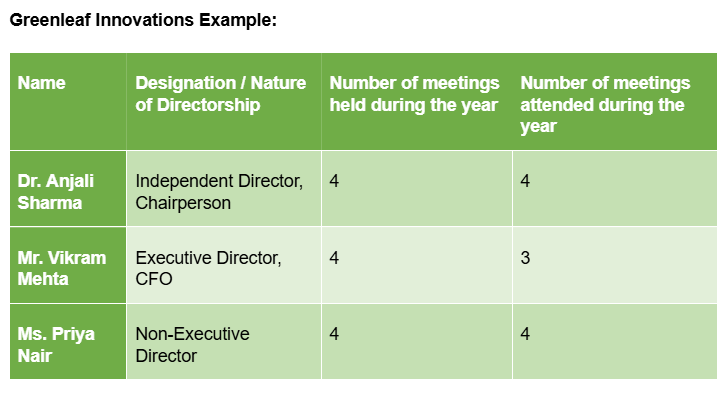

For us, this included our Independent Director, who chaired the committee, our Executive Director, who provided financial oversight, and our Non-Executive Director, who had extensive experience in social impact initiatives.

There is no legally mandated minimum number of meetings that the CSR Committee must conduct. The only requirement is to disclose in the CSR report the number of meetings that actually took place during the year.

Greenleaf Innovations Example:

Section 3: Web links

Provide the exact URL of your company website where the CSR Committee composition, CSR Policy, and approved CSR projects are disclosed.

You have to make sure that these links are active and the information is up-to-date before including them in the report.

Greenleaf Innovations example: I included the following web links in the report. These are just examples of some fictitious links for your understanding:

- Composition of CSR Committee: https://www.greenleafinnovations.in/about-us/governance/csr-committee

- CSR Policy: https://www.greenleafinnovations.in/sustainability/csr-policy

- CSR Projects: https://www.greenleafinnovations.in/sustainability/csr-initiatives

Our IT team ensured these pages were updated quarterly with the latest information so that the stakeholders have the right information all the time. Just so you know, there is not legal mandate to update these pages quarterly, if you wish you may do it monthly or weekly or bi-montly.

Each project page included photographs, testimonials from beneficiaries, and progress metrics to provide stakeholders with transparent information about our CSR activities.

Section 4: Impact assessment

If your company conducted any impact assessments for CSR projects as required under sub-rule (3) of rule 8 of CSR Rules, provide an executive summary and the relevant web links.

If you are wondering what an impact assessment is, as per rule 8(3), impact assessment means an independent evaluation of a company’s CSR projects to determine their effectiveness.

This assessment is required for projects with outlays of one crore rupees or more (for companies with an average CSR obligation of ten crore rupees or more) that have been completed at least one year before the study, and its report must be presented to the Board and annexed to the annual CSR report.

It is important to note that this is only mandatory for companies with a CSR obligation of Rs. 10 crores or more. As a mid-sized company, we weren’t required to conduct formal impact assessments, but we still included brief outcome reports for our major initiatives.

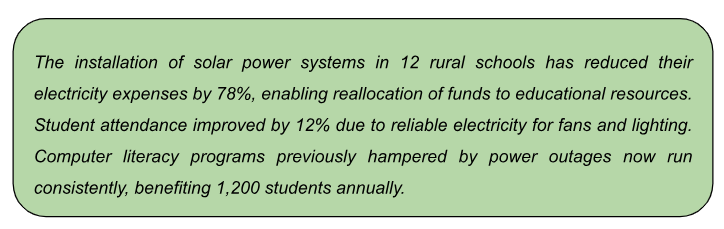

Greenleaf Innovations example: Although Greenleaf wasn’t required to conduct formal impact assessments with our CSR obligation of Rs. 1.56 crores, we voluntarily commissioned a basic assessment of our flagship “Solar for Schools” program.

This is what I wrote in the executive summary:

I also included this information with a link to the full report.

Section 5: CSR spending calculation

This section requires financial data. For this purpose, take assistance from the finance team.

- The average net profit of the company for the last three financial years

- Two percent of the average net profit (this is your CSR obligation)

- Surplus from previous year’s CSR activities

- Amount required to be set off for the financial year

- Total CSR obligation

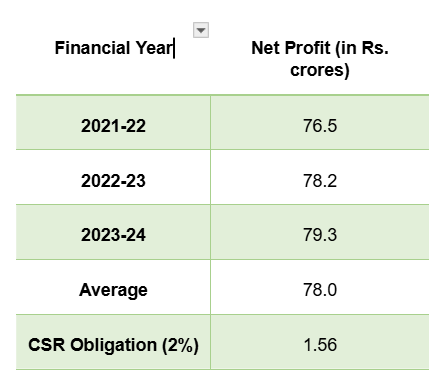

In my case, Greenleaf’s finance team provided us a three-year average net profit of Rs. 78 crores, making our CSR obligation Rs. 1.56 crores (2% of average net profit).

Greenleaf Innovations Example: Working with our finance department, I compiled the following data:

We had a small surplus of Rs. 0.05 crores from the previous year when one of our planned training programs cost less than budgeted.

We decided not to set off any amount, bringing our total CSR obligation to Rs. 1.61 crores (1.56 + 0.05).

Section 6: CSR spending details

Break down your CSR expenditure:

- Amount spent on CSR projects (both ongoing and other projects)

- Amount spent on administrative overheads

- Amount spent on impact assessment (if applicable)

- Total amount spent (6a+6b+6c)

We spent Rs. 1.25 crores on our three main projects, Rs. 0.31 crores on administrative overheads, and nothing on impact assessment, totaling Rs. 1.56 crores.

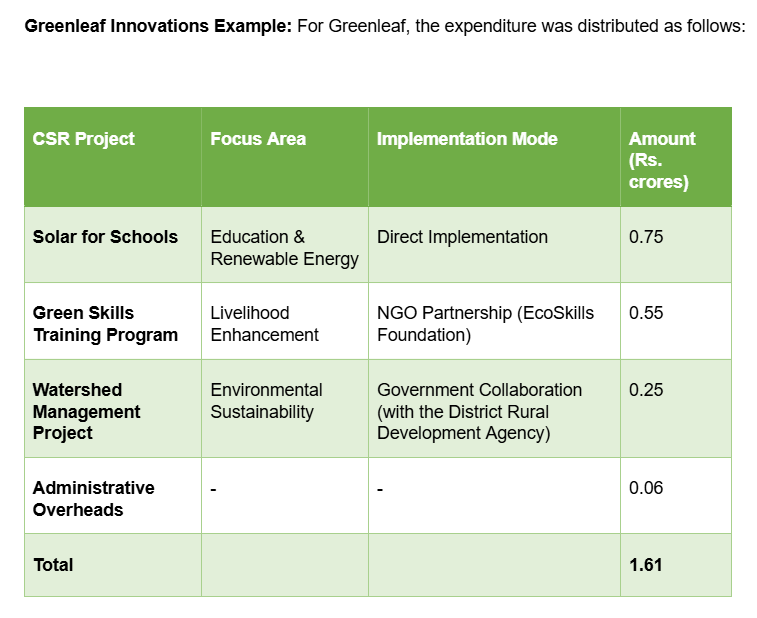

Greenleaf Innovations Example: For Greenleaf, the expenditure was distributed as follows:

Our administrative overhead was kept to 3.7% of total spending, well below the permitted 5% as per rule 7 of the CSR Rules, allowing us to maximize funds for direct project implementation.

The ‘Solar for Schools’ program was our flagship initiative, bringing renewable energy to educational institutions in energy-deficient areas of Rajasthan and Bihar.

Section 7: CSR unspent/excess amount

If your company has unspent CSR funds, complete the table detailing:

- Total amount spent

- Amount transferred to Unspent CSR Account

- Amount transferred to specified funds under Schedule VII

- Excess amount for set-off, if any

In our case, we fully utilized our CSR obligation, so we had no unspent amount to report.

Greenleaf Innovations Example: Greenleaf fully utilized our CSR obligation of Rs. 1.61 crores. We maintained a detailed tracking system to ensure complete fund utilization by the end of the financial year, with quarterly reviews by the CSR Committee to reallocate funds if any project was facing implementation delays.

This proactive management meant we didn’t need to transfer any funds to the Unspent CSR Account or specified funds under Schedule VII of the Companies Act.

Section 8: Capital assets

Indicate whether any capital assets were created or acquired through CSR spending. Meaning that you need to mention if any long-term assets—like buildings, equipment, or infrastructure—were built or bought using the CSR funds.

If yes, provide details including:

- Number of assets created

- Asset details (property particulars, location, pincode)

- Date of creation

- Amount spent

- Details of the beneficiary/entity/owner

We created a community solar power installation in a rural village, so I included full details of this asset.

Greenleaf Innovations example: For Greenleaf, we created several capital assets:

- Solar power systems at 12 schools

- Property details: Roof-mounted 5kW solar power systems with battery backup

- Locations: 8 schools in Alwar district, Rajasthan (Pincodes: 301001, 301028, 301027, 301031) and 4 schools in Gaya district, Bihar (Pincodes: 823001, 823003)

- Date of creation: Installations completed between April 2023 and December 2023

- Amount spent: Rs. 0.72 crores (Rs. 6 lakhs per installation)

- Beneficiary details: Ownership transferred to respective School Management Committees registered under the Right to Education Act

- Green skills training center

- Property details: Retrofitted community building with solar-powered computer lab, workshop area, and training equipment

- Location: Village Ramgarh, Alwar, Rajasthan (Pincode: 301026)

- Date of creation: February 2024

- Amount spent: Rs. 0.18 crores

- Beneficiary: Owned and operated by EcoSkills Foundation (NGO partner) with a 10-year commitment to provide free training to local youth

Each asset was documented with photographs, GPS coordinates, and formal handover certificates to ensure proper accountability and tracking.

Section 9: Explanation for shortfall

If your company failed to spend the required 2% of the average net profit, provide specific reasons. This section is crucial for regulatory compliance if you haven’t met your CSR obligation.

Greenleaf Innovations example: This section was not applicable for Greenleaf, as we fully spent our CSR obligation. However, we prepared a contingency plan for potential underspending that involved:

- Quarterly progress reviews to identify any projects falling behind schedule

- A pipeline of pre-approved smaller initiatives that could be quickly implemented if larger projects faced delays

- Clear criteria for when to consider transferring funds to the Unspent CSR Account for multi-year projects

Signatures

The report must be signed by:

- Chief Executive Officer or Managing Director

- Chairman of the CSR Committee

- Person specified under clause (d) of sub-section (1) of section 380 of the Act (if applicable)

Greenleaf Innovations example: Our final report was signed by:

- Mr. Sandeep Agarwal, Managing Director of Greenleaf Innovations

- Dr. Anjali Sharma, Chairperson of the CSR Committee

We ensured both signatures were obtained well before the filing deadline to avoid any last-minute compliance issues.

Our company secretary maintained digital and physical copies of the signed document in accordance with record-keeping requirements.

Click here to see the final report of Greenleaf Innovation.

Final tips from my experience

- Start collecting data early in the financial year rather than scrambling at the end.

- Maintain detailed records of all CSR activities, including photographs, beneficiary data, and spending receipts.

- Hold regular meetings with your CSR Committee and document discussions and decisions thoroughly.

- Work closely with your finance team to ensure accurate calculation of CSR obligation and tracking of expenditures.

- Keep your company website updated with all required CSR disclosures.

- Use a spreadsheet to track your CSR spending against the allocated budget throughout the year.

- If you’re likely to have unspent funds, plan early for the transfer to the Unspent CSR Account or specified funds.

- For capital assets created through CSR, maintain comprehensive documentation including ownership details and beneficiary information.

Additional tips based on my experience:

- Create a dedicated CSR email address where project partners and beneficiaries can send updates and documentation, making it easier to compile information throughout the year.

- Develop standardized templates for project progress reports that implementing partners can fill out monthly, ensuring consistency in data collection.

- Conduct mid-year internal reviews of CSR documentation to identify any gaps before the reporting rush at year-end.

- Maintain a photo and video repository of all CSR activities, properly labeled and dated, which proves invaluable for both reporting and communications.

- Cross-check CSR expense entries with the finance department quarterly to catch and resolve any discrepancies in categorization early.

- Create a CSR calendar that flags key dates for committee meetings, report submissions, and project milestones to ensure nothing is overlooked.

- Develop relationships with CSR teams at similar companies to share best practices and interpretation of regulatory requirements.

This structured approach helped me transform a daunting regulatory requirement into a valuable exercise that showcased our company’s positive impact on society. By following these steps, you can ensure your CSR annual report not only meets compliance requirements but also effectively communicates your organization’s commitment to corporate social responsibility.

Practical tips for effective completion

- Maintain ongoing documentation: Track CSR expenditures and activities throughout the year to simplify year-end reporting.

- Use specific numbers: Wherever possible, provide exact figures rather than approximations.

- Cross-check reference numbers: Ensure all section numbers and legal references are accurate.

- Include project details: Though not explicitly mentioned in every section, maintain comprehensive project data including:

- Project name and description

- Implementation timeline

- Geographic focus areas

- Target beneficiaries

- Implementing partners (if any)

- Specific objectives and outcomes

- Support with evidence: Have supporting documentation for all financial figures, particularly for impact assessments.

- Address previous shortfalls: If your company had unspent amounts in previous years, clearly explain how these are being addressed.

- Ensure consistent narrative: The qualitative descriptions in Sections 1 and 4 should align with the quantitative data in the financial sections.

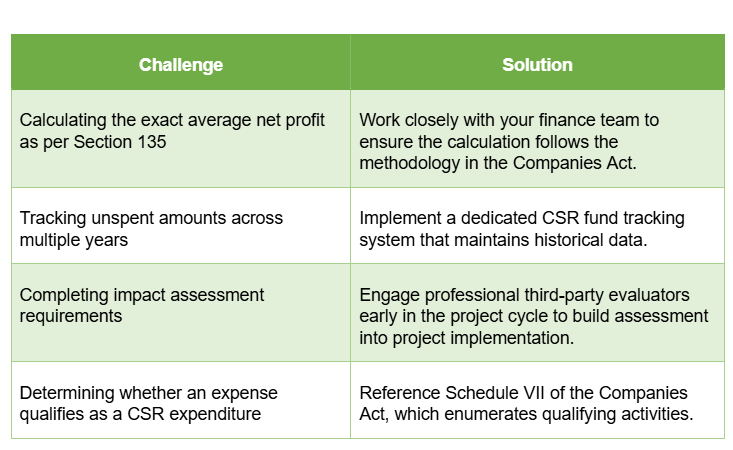

Common challenges and solutions

Final thoughts

As I wrapped up my first CSR report at Greenleaf Innovations, I realized that mastering this skill offers more than just regulatory compliance—it opens doors to rewarding career opportunities in India’s growing CSR sector.

The mandatory nature of CSR reporting under section 135 has created a robust job market for professionals skilled in this area. Job listings on platforms like Glassdoor and Indeed show over 3000 open CSR positions in India as of March 2025, with roles often including responsibilities like preparing and presenting reports on CSR activities.

From my conversations with colleagues in the field, I’ve learned that entry-level CSR professionals can expect salaries starting around ₹4.2 lakhs annually. Mid-level CSR Managers command between ₹7.7-10.2 lakhs, while experienced professionals leading CSR departments at large organizations can earn an impressive ₹50-90 lakhs per year.

For those preferring flexibility, the consulting route offers another lucrative path. Numerous firms like PwC, SoulAce, and Thinkcap Advisors provide specialized CSR reporting services to companies that lack in-house expertise.otential.

By mastering this skill, you not only ensure regulatory compliance but also help shape how companies define and communicate their social impact—while building a rewarding career with promising financial prospects.

As Mr. Rajesh told me on my first day, ‘It’s about telling the story of our company’s commitment to social and environmental impact.’ And that story, I’ve discovered, is increasingly valuable in today’s business landscape.

Allow notifications

Allow notifications