This article covers the core aspects of a Will, including the types of Wills, who can draft a Will, essential components of a Will, and, most importantly, a step-by-step guide on how to draft a comprehensive Will. So if you are a budding lawyer who wants to get their hands on drafting a Will or intend to practice in succession matters, this article is for you.

Table of Contents

Introduction

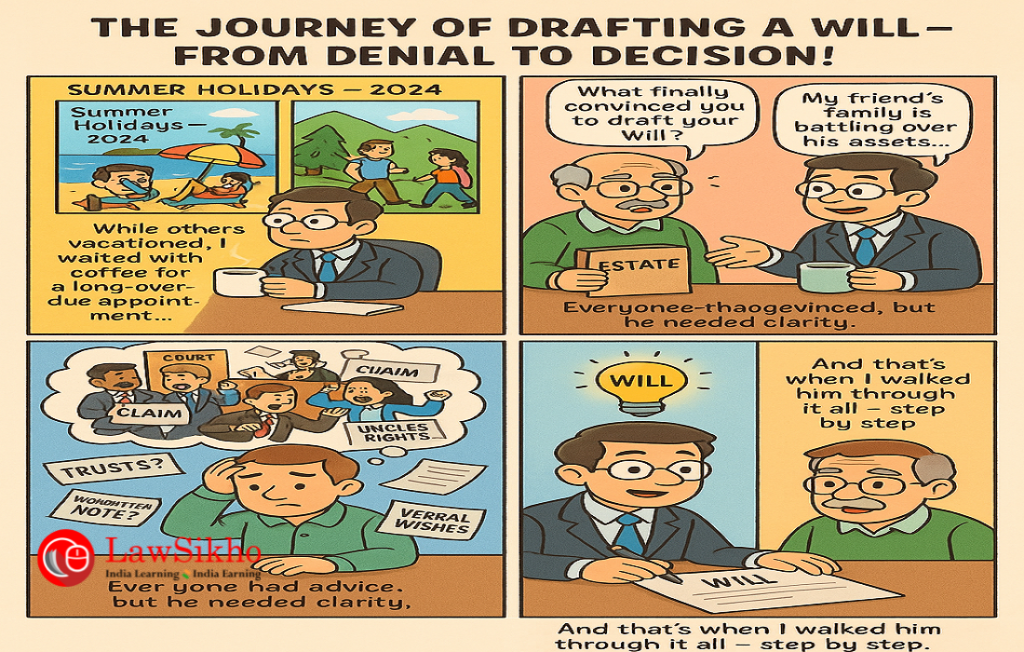

During the 2024 summer holidays, while most of my colleagues were off to hill stations or on some international trip, I was meeting with a client who had been avoiding drafting his Will for years.

I was midway through my coffee when Mr. Sharma arrived for his appointment about the Will.

I offered him tea and asked him what finally convinced him to draft a Will.

I was eager to know because I had been asking him to draft a Will, and he used to always say that my family would never fight over my estate.

That is when he told me that his friend had recently passed away unexpectedly, and the family was now fighting over assets, with distant relatives emerging from nowhere with claims.

This incident left him worried about how to ensure his own family would not face the same fate

Some people had suggested complicated trusts, others told him a simple handwritten note would suffice. He seemed utterly clueless. That is when he recollected my advice of making a Will, and he decided to meet me.

I patiently explained to him how a Will can take care of all his concerns. I walked him through the pros and cons of the Will. He was convinced and asked me to proceed with drafting a comprehensive Will.

So, today, I will guide you through the process of drafting a Will that will protect the estate of your clients from future family disputes as well as take care of the last wishes of your client.

Are you ready? Let us start.

What is a Will?

A Will is a legal document where a person (called the testator) writes down how they want their property and belongings to be distributed after they pass away.

It is like a set of instructions that tells everyone what should happen to their house, money, jewellery, or other assets when they are no longer here.

The Will only takes effect after the person’s death, and outlines their wishes for the distribution of assets, subject to legal validation.

In India, testamentary succession (the process of distributing a person’s property and assets after their death, as outlined in their Will) is governed by the Indian Succession Act, 1925, except in the case of Muslims, who follow Muslim Personal Law.

But you might wonder why it is necessary to make a Will. Let us find out.

Why is it necessary to make a Will?

Well, there are two major reasons to make a Will.

- The first reason is that without a Will, the client’s assets may be divided according to the laws of intestate succession in India, as per their religion, which may not align with the client’s intentions.

- The second and most important reason is that without a Will, there are higher chances of potential disputes between the family members and that will delay the distribution of the assets between the heirs of the deceased person.

Are you following?

Let us now understand who can make a Will.

Who can make a Will?

As per section 59 of the Indian Succession Act,1925, a person can make a Will if they have met the following conditions:

- The person must be an adult, meaning that the person must have attained the age of majority, which is 18 years as per the Indian Majority Act, 1875, or 21 if they are under court guardianship. This is because minors are not legally considered capable of making decisions about their property.

- The person must be of “sound mind” when making the Will. This means they understand:

- That they are creating a Will.

- What property they own.

- Who they are giving it to and why.

A person can have occasional health issues or be elderly, but as long as they are mentally capable of understanding the contents of the Will when signing it, it remains valid. If someone has a mental illness, a doctor’s certificate confirming their mental capacity at the time of signing can help prove the Will’s validity.

Example: Mr. Sharma, an 80-year-old retiree, has mild memory issues but is fully aware when he writes his Will to give his house to his daughter. His Will is valid. However, if he was confused or did not understand what he was doing, the Will could be challenged.

There is another condition that one must bear in mind, although it is not provided in section 59 of the Indian Succession Act,1925.

Can you take a guess?

Well, the person must make the Will out of their free will.

This means that the person making the Will must not be coerced, or deceived or act under someone’s undue influence.

Moving on, let us see the different types of Wills in India.

What are the different types of Wills?

1. Unprivileged Will

An unprivileged Will is a standard form of a Will executed by persons not covered under section 65 of the Indian Succession Act,1925.

This is the most common type of Will, used by ordinary civilians (not soldiers or sailors).

It must be written and signed by the person making it (the testator), and witnessed by at least two people who are not beneficiaries.

2. Privileged Will

A privileged Will is a testamentary instrument made under special circumstances by certain categories of persons, as recognised under section 65 of the Indian Succession Act, 1925. This category includes:

- Any soldier employed in an expedition or engaged in actual warfare,

- Any airman or mariner so engaged.

This is a special type of Will for soldiers, mariners, or airmen engaged in active military service or wartime.

It has fewer formalities, which means that

- It may be in writing or oral,

- It must be signed by the testator or someone under their direction or be in the testator’s handwriting.

- It need not be attested by witnesses,

- It may be dictated to another person and later written down.

- Oral Wills must be substantiated by credible evidence

A privileged Will remains valid unless revoked by the testator, regardless of whether they die during or after active service

For example, Captain Vikram, a soldier deployed in a war zone, verbally tells his commanding officer that he wants his savings to go to his sister, Neha, if he dies. This oral privileged Will is valid under the Indian Succession Act, 1925, because of his active service status.

3. Conditional Will

A conditional Will is a Will that takes effect only if a specific condition or event occurs. If the condition is not met, the Will is invalid or does not take effect, and the estate may be distributed according to the law of intestate succession that the testator will be governed by or a prior valid will.

For example, Sanjay writes a Will stating that his property goes to his nephew, Arjun, but only if Arjun graduates from college by age 25. If Arjun does not graduate by then, the Will is void, and Sanjay’s assets may pass under succession laws or a prior Will.

4. Joint Will

A joint Will is a single document executed by two or more people (typically spouses or partners) intending to dispose of their respective properties through a common instrument.

However, a joint Will takes effect separately upon the death of each testator, and is not irrevocable unless specifically agreed upon.

It is ideal for couples with shared assets and similar intentions.

For example, Mr. and Mrs. Gupta write a joint Will stating that if one dies, their house and savings go to the surviving spouse. After both pass away, everything goes to their son, Rahul. This ensures their shared plan is followed.

5. Mutual Will

A Mutual Will refers to two separate Wills, made by two individuals (often spouses), with a reciprocal disposition of property, and a binding agreement not to revoke the Will without mutual consent.

So, after the death of one testator, the surviving testator may be barred from altering their Will if they had accepted the benefit under the mutual arrangement.

For example, A husband and wife make Wills leaving their property to each other, and after the surviving spouse’s death, to their daughter. If the wife dies and the husband accepts the benefit, he cannot later change his Will to exclude the daughter.

6. Living Will

A document that specifies your medical treatment preferences if you become incapacitated and cannot make decisions (e.g., in a coma).

It is not about property but about healthcare choices, recognised in India by the Supreme Court in the case of Common Cause (A Regd. Society) vs. Union of India and Anr. [AIR 2018 SC 1665], which now stands modified in 2023 in the case of Common Cause (A Regd. Society) v. Union of India and Another, [2023] 1 S.C.R. 1137.

It is suitable for individuals who want to have control over medical decisions, such as refusing life support, in critical health situations.

For example, Rina, a 50-year-old doctor, writes a living Will stating that if she’s in a permanent vegetative state, she does want to be kept on life support. This ensures her wishes are respected if she is unable to communicate.

Now you are aware of the different kinds of Wills. Let us now understand the essential components of a Will.

What are the essential components of a Will?

The following are the essential components of a Will:

1. Personal details of the testator

The testator’s full name, age, address, and identity proof, such as PAN or Aadhaar numbers, must be mentioned to confirm their identity.

2. Declaration

This statement, made at the beginning of the Will, identifies the Will as the testator’s last Will and Testament and revokes any previous Wills or codicils(A codicil is a supplementary document that amends or modifies an existing Will without replacing it).

This establishes the document’s purpose and ensures it supersedes earlier documents. It is also advisable to review your Will regularly or after significant life changes in order to ensure that the directions mentioned in the Will are as per the present wishes of the testator.

3. Appointment of an executor

This is an important clause wherein you name a trusted person who will be responsible for carrying out the instructions mentioned in the Will, such as distributing assets, paying debts, and handling legal processes like probate.

For those unfamiliar with the process, probate is the legal procedure for validating and executing a deceased person’s Will under the supervision of the court.

For Hindus, Buddhists, Sikhs, or Jains, probate is mandatory if the Will is executed in Kolkata, Mumbai, or Chennai, or pertains to immovable property in these cities.

For other communities or locations, probate is optional unless the Will’s validity is contested.

If there is no executor, the court may appoint an administrator to execute the Will of the deceased person.

4. Details of the heirs of the testator

In this part, you clearly mention the names and relation of the heirs to the testator. In case any of the heirs has passed away, then you need to mention the same.

5. Description of assets

The next part is to provide a detailed description of the assets (immovable and movable) of the testator. This prevents any confusion or disputes over the identification of the assets.

6. Distribution plan (Bequests)

This is the main part of any Will, which entails the instructions on how assets should be divided among beneficiaries.

In case any heir or family member is not considered for the purpose of distribution of the assets of the testator, it is always advisable to write reasons to support it. This helps in avoiding any challenge to the Will by that heir or family member.

You must always remember to add contingent clauses in case of the death of any of the beneficiaries prior to the death of the testator. This will avoid the asset from being governed by the laws of intestate succession.

7. Voluntary and sound state of mind

The testator ought to state in clear terms that the Will is made voluntarily and in a sound state of mind and after completely understanding the contents thereof, to disregard any challenges made in future regarding the mental capacity and voluntary action in making the Will.

Although it is not mandatory in any law to have a doctor’s certificate to certify the mental capacity of the testator, it is advisable to obtain a certificate on the same day as that of the Will to further disregard any challenges thereof.

8. Signature and witnesses

The signature of the testator (or mark, if unable to sign) must be done in the presence of at least two witnesses, who must ensure that the testator signs the Will in their presence and that the witnesses also attest the Will in the presence of each other. This is to verify that the testator has himself signed the Will voluntarily.

One more important point to note is that if a beneficiary or spouse of the testator is a witness, the Will will be valid, but the beneficiary or the spouse may lose their inheritance, as per section 67 of the Indian Succession Act, 1925, to avoid bias. However, the beneficiary may still inherit under intestate succession in case there is any asset left to be included in the Will.

One more point to be noted here is that the beneficiary under a Will does not lose their legacy by attesting a codicil which confirms the Will.

Now that you are familiar with the essential components of a Will, I will teach you how to draft a Will.

How to draft a Will?

We will take the following facts into consideration and draft a Will.

Maniben Pradeep Shah, an 82-year-old Mumbai resident, intends to make a Will appointing her son Kunal Pradeep Jain as an executor and bequeathing her estate, comprising three immovable properties (in Bhiwandi, Vashi, Mumbai), three bank accounts (PNB, HDFC, Canara banks), and residuary assets equally to her grandsons Manoj and Darshan Jain with absolute rights. If one grandson predeceases her, the survivor inherits the entire estate, but if both predecease the testator, then the estate passes to her daughter-in-law, Kanchan Kunal Jain. The Will excludes her daughter, Shilpa and daughter-in-law Vijaya, who received 20 tolas of gold each during her lifetime. The Will was signed in the presence of witnesses Karan Dinesh Jain and Manish Kantilal Jain, affirming her sound mind.

Are you ready? Let us start.

WILL

Explanation: This opening clause establishes the nature of the document as a Will and identifies the testator, providing personal details (name, age, address, PAN, and Aadhaar) to confirm the identity of the person making the Will.

I, Maniben Pradeep Shah, aged 82 years holding PAN No. _______and Aadhar No. _______of Mumbai Indian Inhabitant having her residential address at Flat No. 105, 2nd floor Pooja Apartment, Mulund West, Mumbai – 400080 do hereby declare and state as under:

Explanation: This part declares that no prior Wills or codicils exist, and also includes a precautionary revocation clause to nullify any earlier testamentary documents that might surface in future.

1. That I have not heretofore made any Will and/or Wills and/or Codicils and/or any testamentary papers in respect of my assets and properties. However if such Will and/or Wills and/or Codicils and/or testamentary papers if any made by me, are found out, I hereby revoke and cancel all such Will and/or Wills and/or Codicils and/or testamentary papers and I hereby declare this to be my last Will and Testament.

Explanation: This clause designates the testator’s elder son as the executor who will be responsible for administering the estate of the testator in accordance with the instructions mentioned in the Will after the testator’s death.

2. I hereby appoint my son Kunal Pradeep Jain to be the Executor of this my Will.

Explanation: This clause outlines the members of the testator’s family and their relationship with the testator.

3. My family consists of :

(i)my elder son Kunal Pradeep Jain (ii) his wife Kanchan Kunal Jain (iii) his two children Manoj Jain and Darshan Jain (iv) my daughter Shilpa Pradeep Jain (v) my younger son’s wife Vijaya Ashwin Jain and her minor daughter Priyanka Ashwin Jain.

Explanation: This clause confirms the deaths of the testator’s husband and younger son, ensuring they are excluded as beneficiaries of the estate of the testator.

4. My husband Pradeep Jain died on 7th March 2003 and my younger son Ashwin Chandulal Jain expired on 4th June 2012.

Explanation: This clause directs the executor to allocate up to Rs. 10,000/- from the estate for funeral and related ceremonies. By setting a cap and exempting the executor from accounting for these expenses, the process is simplified, and the executor is protected from scrutiny regarding reasonable expenditures.

5. I hereby authorize and direct my executor to spend a sum of not more than Rs.10,000/- (Rupees Ten thousand only) out of my estate for my funeral and obsequial ceremonies and my executor shall not be liable to render any account to anyone for the moneys so spent by him for the said ceremonies.

Explanation: This clause enlists the estate of the testator which the testator intends to bequeath amongst her heirs. The residuary estate is important as it includes any future or unlisted assets, ensuring no part of her estate is governed by the laws of intestate succession, by which she is governed. It is important to provide proper description of the estate for proper identification to avoid confusion in the future.

6. My estate consists of:

(i) Three immovable properties described herein below:

(a) 50% undivided right, title and interest in Gala No.52 admeasuring 2570.35 sq.ft.built up area on ground floor of building no.62 at Bhiwandi, Thane.

(b) 50% undivided right, title and interest in Shop No.11 admeasuring 200 sq.ft. built up area (250 sq.ft. super built up area) in Karim Co-operative Housing Society Ltd. at Sector 17, Vashi, Navi Mumbai along with 50% undivided right, title and interest in shares bearing distinctive Nos. 211-215(both inclusive) of Rs. 50/- each issued by the society.

(c) 100% right, title and interest in Room No.105 admeasuring 146 sq.ft. super built up area in Sanjay Villa Co-operative Housing Society ltd. at Cavel Cross Lane No.3, Mumbai-400002 with 100% undivided right, title and interest in shares bearing distinctive Nos. 91-95(both inclusive) of Rs. 50/- each issued by the society.

(ii) Three Bank Accounts in following banks viz.

- Savings Bank Account No.123456789 in PNB bank held in my name

- Savings Bank Account No.23456789 in HDFC bank held in my name along with my son Kunal Jain

- Savings Bank Account No.34567891 in Canara Bank jointly held with my son Kunal Jain

(iii) Any other residuary estate including all other properties, assets, estates and effects of whatsoever description and whatsoever nature and wheresoever situate whether movable, immovable, tangible or intangible which I may acquire own and possess hereafter and after my death.

Explanation: This operative clause is the primary bequest, directing the entire estate listed above to be bequeathed to her grandsons equally. The phrase “absolute right” grants them full ownership without restrictions, allowing them to manage or dispose of the assets as they choose. This reflects the testator’s intention to secure her grandsons’ financial future, bypassing other family members.

7. I hereby give, bequeath and devise unto my both grandsons the said Manoj Jain and Darshan Jain in equal proportion exclusively in their own absolute right all my right, title and interest in my estate mentioned in Clauses 6(i), 6(ii) and 6(iii) and the same shall belong to my both the said grandsons absolutely as their own properties and my both the said grandsons shall be fully entitled to deal with the same in the manner as they deem fit and proper and at their own discretion.

Explanation: This contingency clause addresses the scenario where one grandson predeceases the testator. It ensures the surviving grandson inherits the entire estate, maintaining her preference for her grandsons as primary beneficiaries.

8. In the unfortunate event of one of my grandson predeceasing me, then in that event the entire legacy given by me to my both the grandsons under clause 7 above shall belong to and shall endure for the benefit of my other grandson living at that time and in that case the said living grandson shall be absolutely and exclusively entitled to the entire legacy under clause 6 and he shall be fully entitled to deal with the same in the manner as he deem fit and proper and at his own discretion.

Explanation: This secondary contingency clause covers the unlikely event that both grandsons predecease the testator It directs the entire estate to her elder daughter-in-law, ensuring it stays within the same family branch.

9. In the unfortunate of my both the grandsons predeceasing me, then in that event the entire legacy given by me to my both the grandsons under clause 7 above shall belong to and shall endure for the benefit of my elder daughter in law the said Kanchan Kunal Jain and in that case the said Kanchan Kunal Jain shall be absolutely and exclusively entitled to the entire legacy under clause 6 and she shall be fully entitled to deal with the same in the manner as she deems fit and proper and at her own discretion.

Explanation: This part clarifies that the testator has already provided significant gifts (20 tolas of gold each) to her daughter and younger daughter-in-law during her lifetime. This justifies their exclusion from the Will’s bequests, reducing the risk of legal challenges claiming they were unfairly overlooked.

10. I hereby say that during my lifetime I have given twenty tolas of gold to my daughter Shilpa Pradeep Jain and my younger son’s wife Vijaya Ashwin Jain each.

Explanation: This clause affirms that the testator has made the Will voluntarily, in a sound mental state, and after understanding the contents. This clause is vital in protecting against challenges alleging coercion or mental incapacity, thereby ensuring the Will’s legal validity.

11. I have made this Will out of my free will and volition and in my good and sound state of mind and after fully understanding the same in all aspects.

Explanation: This execution clause confirms that the testator has signed the Will in the presence of two witnesses, who also signed in her presence and in the presence of each other.

IN WITNESS WHEREOF I, the said Maniben Pradeep Shah, have hereunto set my hand at Mumbai this _____ day of July 2024.

SIGNED AND DECLARED

BY THE WITHIN NAMED

Maniben Pradeep Shah

as and for his last Will and

Testament in the presence

Of Us, i.e. 1) Karan

Dinesh Jain and

2) Manish Kantilal Jain

present at the same time

who at his request in his

presence and in the presence of

each other have hereunto

set and subscribed our

respective names as

attesting Witnesses:

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

Witnesses

Name

Address

Signature

1.Karan Dinesh Jain

Flat No. B/4,103

Manoj Bldg.,

Sarvodaya Nagar

Mulund West

Mumbai-400080

2.Manish Kantilal Jain

Flat no. B/4,103

Manoj Bldg.,

Sarvodaya Nagar

Mulund West

Mumbai-400080

With this, you are now equipped to draft a comprehensive Will for your clients.

With this new skill, you can build a niche practice area for yourself and make a name in the legal field.

Conclusion

By incorporating key elements discussed in the article and adhering to legal requirements, you can prepare a comprehensive Will that will take care of the concerns of your client.

With just a little practice, you can lay the foundation to become the go-to person for estate planning and become an expert in succession law.

I have also prepared a list of FAQ of the common questions that the clients often ask.

Frequently asked questions (FAQs)

1. Is registering a Will mandatory?

No, registering a Will is not mandatory in India. According to section 18(e) of the Registration Act, 1908, it is optional to register a Will. While registration is optional, it provides evidence of the Will’s authenticity, reduces the risk of challenges, and ensures safekeeping with the registrar.

2. Can I change or revoke my Will?

Yes, you can change or revoke your Will at any time during your lifetime as long as you are mentally sound and acting voluntarily. A Will is not final until the testator (the person making the Will) passes away, thereby giving full flexibility to modify or cancel it to align with the new circumstances or wishes of the testator.

3. What happens if I die without a Will?

Your assets are distributed according to succession laws based on your religion. In case of Hindus, the Hindu Succession Act, 1956, applies.

4. Can a Will be challenged?

Yes, a Will can be challenged on grounds such as fraud, coercion, lack of mental capacity, improper execution, or revocation, etc.

5. Can I include foreign assets in my Will?

Yes, but foreign assets may be subject to the laws of the country where they are situated.

Allow notifications

Allow notifications