Learn how to create an effective ESOP policy in this comprehensive guide. Part 1 covers foundational clauses, including purpose statements, definitions, eligibility criteria, and determining the ideal pool size, with practical examples and expert drafting tips.

Table of Contents

Introduction

I remember the time when I was randomly browsing through Google News on my phone when I saw this headline “A Success Story: How 35 Indian Start-ups Entered 100 Cr ESOP Pool.”

I clicked the headline only to find out that they were not even company founders or CEOs. They were regular employees who became millionaires simply because their companies had set up good Employee Stock Option Plans (ESOPs). I remember thinking, “Why didn’t anyone teach me this in law school?“

My curiosity peaked, and I did some Googling to find out that when Zomato went public, eighteen employees (people who probably started as regular team members) woke up as millionaires the day the company went public.

And Flipkart?

Their massive Rs 17,000 crore ESOP pool and Rs 600 crore buyback changed the lives of their employees overnight. One of my former students called me after getting his Flipkart payout. He paid off his parents’ home loan with a single bank transfer, which made me feel good for him.

Then the other day, I was at a conference where one of the speakers mentioned that nearly half of Indian companies, 47% to be exact, had already implemented or were planning ESOPs. He was referring to a KPMG India report, not his personal opinion. And I think that the trend is only growing stronger.

Just in the past years, I have watched companies like PhonePe, Razorpay, and Swiggy conduct ESOP buybacks worth Rs 3,200 crore.

Think about it for a second.

That is money going straight into employees’ bank accounts, turning paper promises into actual cash.

What I find really interesting is how this idea is spreading beyond traditional companies. I was chatting with a friend who works at Unacademy, and he told me they are now offering ESOPs to the teachers on their platform.

Not employees, but educators! And BharatPe has created something similar for their merchant partners.

Ten years ago, I would have told you this was impossible.

But here is the problem that no one is talking about that is poorly written ESOP documents.

I remember a startup founder calling me late at night because her key developer quit after realizing his stock options were not what he thought they were. The paperwork was so confusing that he misunderstood the whole deal. The difference between creating millionaire employees and angry ex-employees often comes down to clear paperwork.

That is why I wrote this article.

It is for three groups:

- lawyers who need practical guidance (not the theoretical stuff from textbooks),

- founders who want to really understand ESOPs, and

- HR/legal teams who have to manage these plans day-to-day.

I am breaking this article into two parts. In Part 1, I will walk you through the basic building blocks of any ESOP scheme. For each part, I will explain what it does, give you sample wording you can use, and share real-world drafting tips from situations I have seen in my practice.

I am not giving you a template to copy blindly.

I want you to understand why each section matters so you can adapt it to what your company or client may actually need.

So let us get started with what really makes a good ESOP plan work. Trust me, this will be more helpful than any generic template you will find online.

What is an ESOP

I want to start with the basics first.

If I have to explain ESOP in simple words, I would say that ESOP is simply a formal document that lets a company give its employees the right to purchase shares in the company at a predetermined price, usually after they have worked there for a certain period. It is a powerful tool that aligns the interests of employees with the long-term success of a company.

What are the benefits of ESOPS?

When I was a young associate, a client asked me, “Why are you spending so much time on their ESOP document?”. “Just copy what the big firms do,” he said.

I explained that his high-growth tech company needed something different than a multinational corporation. He did not get it until three years later, when half his engineering team left because their options were underwater after a down round. (‘Down Round’ is a term used when a company raises new funds at a lower valuation than before)

“Now I understand what you meant,” he told me over drinks. That lesson has stayed with me for decades.

Why ESOPs matter: benefits for everyone involved

Let me break down why ESOPs are worth the effort to draft properly. I have seen firsthand how they transform companies and careers when structured correctly.

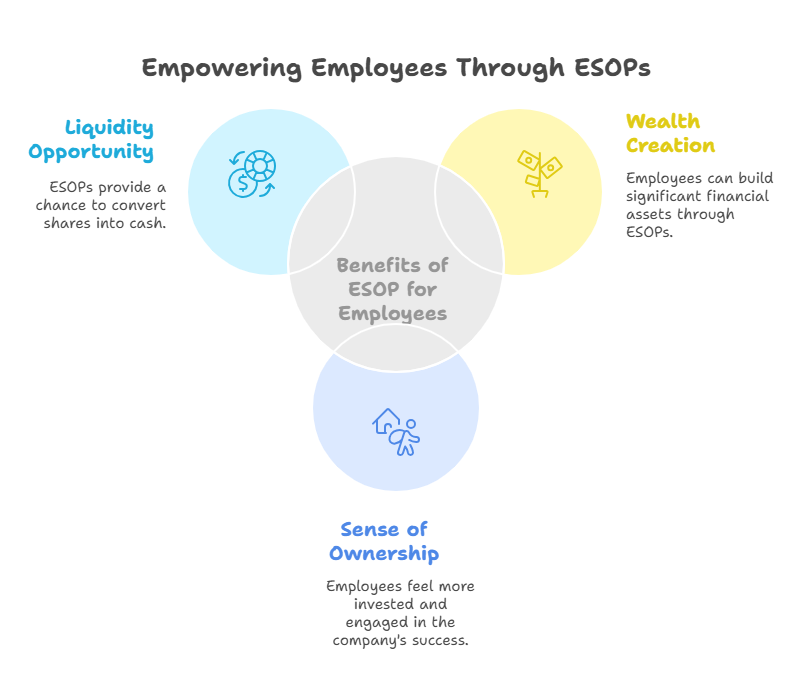

For employees:

- Wealth creation: ESOPs can completely change employees’ lives. Remember those 35 non-founder managers I mentioned who joined the ₹100-crore club in 2021? That wasn’t just a news headline—it was real people with real bank accounts. That’s the kind of wealth creation I am talking about, not just a better salary, but life-changing money.

- Sense of ownership: There is a psychological shift that happens when someone becomes an owner. I have observed this countless times in my career. Employees with stock options tend to think differently they scrutinize costs, challenge inefficient processes, and make decisions with long-term value in mind. With ESOPs, they are not just working for a paycheck, but they are building something they partly own.

- Liquidity opportunity: Three of my younger brother’s friends participated in recent ESOP buybacks, and the stories are incredible. One of them was an early employee at Razorpay. When they did their buyback, she cashed out enough to put a down payment on her first apartment in Bangalore. Another friend from Flipkart’s 2021 buyback used his payout to fund his entire education abroad, something he never thought possible on a regular salary.

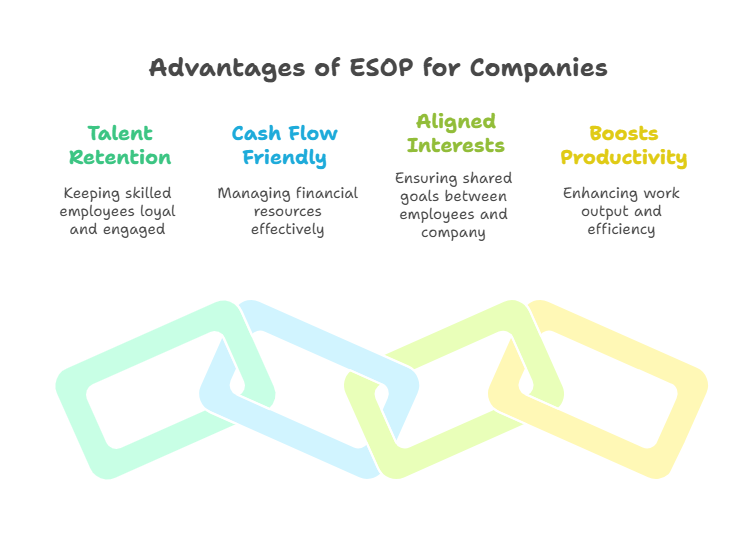

For companies:

- Talent retention: I saw this play out in real time a few years ago with two fintech startups in Mumbai. They were direct competitors, started around the same time, and even had offices in the same building complex. One set up a four-year vesting schedule for their tech team. The other thought ESOPs were “too complicated” and skipped them entirely. Guess what happened? The first company kept nearly all its key engineers through its critical growth phase. The second one? They lost more than half their developers in just a year and a half. Some even jumped to the first company! That four-year vesting timeline creates what we call “golden handcuffs”—a powerful reason for talented people to stick around. This is especially important for Indian startups that were losing their best people to companies in Singapore and the US before ESOPs became common here.

- Cash flow friendly: Early-stage companies often operate on tight budgets. I have helped numerous founders structure compensation packages where ESOPs make up for below-market salaries. A recent client, a fintech startup in Bangalore, saved nearly Rs 2 crore annually in cash compensation by offering a robust ESOP package to their senior team. This can be particularly effective with experienced hires who understand the potential upside and are willing to bet on your company’s future.

- Aligned interests: There is something powerful that happens when employees become partial owners. I noticed this with my own law firm when we changed our partner structure. Suddenly, the same people who used to leave at 6 PM were staying late to help with important cases, not because anyone told them to, but because they now had skin in the game. This same principle explains why the KPMG survey found that nearly half, 47% of 460 Indian companies, had either already implemented ESOPs or were planning to. When your success is my success, everything changes.

- Boosts productivity: The productivity difference in teams with and without equity can be stark. I have consulted for companies before and after implementing ESOPs, and the change is often remarkable. It is generally seen that when people have a direct stake in outcomes, their commitment and creativity tend to flourish.

It is important to understand that these benefits only materialize when the ESOP scheme is thoughtfully designed and clearly drafted. So this takes me to discuss.

Why does a well-drafted ESOP matter?

You will see startups losing key talent because their ESOP terms were ambiguous. What i mean by ambiguous is that employees had no clue as to:

- when their options would vest,

- how they could exercise them, or

- what would happen if they left the company.

In some cases I saw, founders ended up giving away more equity than intended because they failed to cap or structure their ESOP pool correctly.

If that was not bad, I have seen some companies unintentionally triggering unexpected tax liabilities for employees by misaligning grant and exercise conditions with the law.

These mistakes do not just create confusion, they erode trust, damage morale, and can even scare off potential investors. And yet, all of this is entirely avoidable with careful drafting and a clear understanding of how ESOPs work.

Now that you know what ESOPs are, their benefits to companies and employees, and why it is important to draft a clear ESOP policy. I can start teaching you how to create an ESOP policy for a startup.

In order to do so, I am going to take a business scenario and use it to create an ESOP policy that complements such business scenario.

Setting the stage: A hypothetical startup scenario

Let me introduce you to TechSolve, a fictional company I will use throughout this article to demonstrate how to draft an effective ESOP scheme. I have created this example based on dozens of similar startups I’ve worked with over my career, and I believe it represents the typical challenges and opportunities you’re likely to encounter.

TechSolve is a B2B SaaS company based in Koramangala, Bengaluru, that is been operating for just over two years. They have developed a cloud-based inventory management platform that helps small and medium retailers automate their stock control and supply chain operations. The company began with three co-founders: Vikram Mehta, a technical genius who built the initial platform; Priya Sharma, a business development specialist with retail connections; and Arjun Reddy, an operations expert who understands the pain points of their target customers.

The startup currently employs 15 team members, including:

- 6 engineers (2 senior, 4 junior)

- 3 sales representatives

- 2 customer success managers

- 2 product managers

- 1 marketing specialist

- 1 office administrator

Their initial angel round brought in Rs 1.5 crore about 18 months ago, and they have since grown to achieve an ARR (Annual Recurring Revenue) of Rs 3.2 crore. Not bad for a young company! Now, they are preparing for a pre-Series A funding round, hoping to raise Rs 12 crore at a pre-money valuation of approximately Rs 40 crore.

With this funding, TechSolve plans to expand its team by adding 5 key positions:

- A Chief Technology Officer (CTO)

- Two senior engineers with specialized skills in AI and machine learning

- A seasoned VP of Sales

- A Finance Head

Here is where the ESOP scheme becomes crucial. All these hires are experienced professionals who will demand competitive compensation packages. Based on market rates, TechSolve would need to pay approximately Rs 1.8 crore annually to attract this talent—a financial burden that would significantly strain their runway.

The founders are smart enough to know they need these individuals to scale, but they can not afford to pay market-rate salaries yet. Their solution? Offer a compelling ESOP package to complement more modest cash compensation.

I was in a similar situation back in 2008 with a fintech startup in Mumbai. We managed to hire a brilliant CTO from a multinational bank by offering him a below-market salary but a generous equity package with carefully structured vesting terms. Three years later, when the company was acquired, that CTO’s patience and faith paid off handsomely—his options were worth nearly ten times his annual salary.

But here is the thing: that happy ending was only possible because we crafted a clear, comprehensive ESOP document that protected both the company and the employee. That’s exactly what we are going to do for TechSolve.

Throughout the rest of this article, I will walk you through drafting each key clause of TechSolve’s ESOP scheme. I will explain not just what to write, but why each provision matters in practical terms. By the end, you will have a framework you can adapt for your own startup or client’s needs.

Let us start by laying down the foundational clauses that will shape this entire scheme.

Core framework clauses

A. Purpose of the ESOP scheme

Now that I have established TechSolve’s situation, I am all set to build their ESOP scheme piece by piece. The first thing I always do when working with startups like TechSolve is to draft a solid purpose clause. Too many lawyers jump straight into technical provisions without establishing this foundation. I suggest you do not do that.

I never draft purpose clauses for the sake of formality. Rather, I draft so that it could lay down the objective that guides the interpretation of every other provision of the scheme. It is the same as the preamble to a constitution. In case a dispute arises, it will help courts and arbitrators to determine the intent behind ambiguous provisions.

Why this clause matters:

You need to understand here what TechSolve is trying to accomplish.

They need to attract that CTO, those senior engineers, and the VP of Sales without breaking the bank. They also want to make sure their existing 15 team members stay motivated as the company grows. A clear purpose clause addresses these goals explicitly.

When I articulated that TechSolve’s ESOP exists primarily to “attract, retain, and motivate exceptional talent,” I am doing more than stating the obvious. I am creating a lens through which every other provision will be interpreted when questions inevitably arise.

Here is the sample draft I created:

1. PURPOSE OF THE PLAN

1.1 TechSolve Private Limited (“Company”) has established this Employee Stock Option Plan (“ESOP” or “Plan”) to attract, retain, and motivate exceptional talent by providing eligible employees with an opportunity to acquire ownership in the Company.

1.2 The Plan aims to:

- Align the interests of employees with the long-term growth and profitability of the Company;

- Recognize and reward employees’ contributions to the Company’s success;

- Create a sense of ownership among employees that fosters innovation and dedication; and

- Provide employees with an opportunity to share in the value they help create.

1.3 This Plan shall be interpreted and administered in a manner consistent with these purposes.

Drafting tips:

- Keep it concise but comprehensive: Your purpose clause should not be longer than a page, but it should capture all key objectives. I have seen lawyers draft purpose clauses that ramble on for three pages—nobody reads those, and they often create conflicting objectives.

- Be specific about your priorities: Notice how TechSolve’s clause emphasizes “attract, retain, and motivate” in that order. This reflects their primary concern of bringing in key new hires.

- Include an interpretation guide: That last line (1.3) is crucial. It explicitly tells anyone interpreting the document—whether it’s a judge, arbitrator, or board member—that when in doubt, go back to these stated purposes.

- Avoid overpromising: I once had a client who wanted to include “guarantee financial rewards to employees” in their purpose clause. I strongly advised against it, as no ESOP can guarantee financial outcomes.

B. Definitions clause

Now let me tell you about the definitions.

This I find to be the dullest part of drafting an ESOP scheme, but I cannot leave this part since a lot of disputes can be avoided with a properly crafted definitions clause.

I remember a case where a Pune-based startup was acquired, and the acquirer disputed whether vested options of departed employees should convert. The entire case hinged on the definition of “Exercise Period,” which was poorly defined. What should have been a straightforward matter dragged on for 11 months and cost the company nearly ₹30 lakhs in legal fees. All because someone thought defining terms precisely was too tedious.

The definitions clause is where you build a shared vocabulary that everyone, from founders, employees, investors, and eventually judges or arbitrators, will use to understand the scheme. For TechSolve, I felt that this was important as they were planning to bring in senior hires who would scrutinize these terms carefully.

Key terms to define:

For TechSolve’s ESOP scheme, here are the essential terms that I defined clearly:

Sample definitions clause for TechSolve:

2. DEFINITIONS

2.1 In this Plan, unless the context otherwise requires:

“Board” means the Board of Directors of the Company.

“Cause” means:

(a) the Participant’s willful misconduct or gross negligence in performance of their duties;

(b) the Participant’s conviction of, or plea of guilty or nolo contendere to, a crime that constitutes a felony;

(c) the Participant’s material breach of their employment agreement or confidentiality obligations to the Company;

(d) the Participant’s fraud or dishonesty in connection with the Company’s business; or

(e) the Participant’s engagement in conduct that brings or is reasonably likely to bring the Company into public disrepute or disgrace.

“Committee” means the committee of the Board constituted to administer the Plan.

“Company” means TechSolve Private Limited, having its registered office at Koramangala, Bengaluru.

“Date of Grant” means the date on which Options are granted to an Eligible Employee by the Committee.

“Eligible Employee” means an Employee who qualifies for issue of Options under this Plan based on the eligibility criteria as may be determined by the Committee.

“Employee” means:

(a) a permanent employee of the Company working in India or outside India; or

(b) a director of the Company, whether whole-time or not; or

(c) an employee or director as defined in sub-clauses (a) or (b) above, of a Subsidiary, in India or outside India.

“Exercise” means the act of paying the Exercise Price to convert vested Options into Shares.

“Exercise Period” means the time period after vesting within which the Participant should exercise their vested Options. Unless otherwise specified in the Grant Letter, the Exercise Period shall be 5 (five) years from the date of vesting.

“Exercise Price” means the price payable by a Participant to exercise their vested Options, as determined by the Committee.

“Grant Letter” means the letter issued by the Company to an Eligible Employee, containing the terms and conditions of the Options granted to them.

“Good Leaver” means a Participant whose employment with the Company terminates due to:

(a) retirement or early retirement as per Company policy;

(b) disability resulting in inability to perform duties;

(c) death; or

(d) any other circumstance as may be determined by the Committee.

“Option” means a right but not an obligation granted to a Participant to apply for Shares of the Company pursuant to this Plan at the Exercise Price.

“Participant” means an Eligible Employee who has been granted Options under this Plan.

“Plan” or “ESOP” means this TechSolve Employee Stock Option Plan 2023.

“Shares” means equity shares of the Company.

“Subsidiary” means a company in which the Company holds, directly or indirectly, more than 50% of the equity share capital.

“Vesting” means the process by which the Participant becomes entitled to receive the benefit of the Options granted.

“Vesting Period” means the period during which the vesting of Options granted to a Participant takes place.

Drafting tips:

- Be precise with termination categories: Did you notice how “Cause” and “Good Leaver” are defined in detail? These definitions become critical when employees leave—a common occurrence in startups. This will help Vikram and Priya at TechSolve to understand when they can claw back unvested options and when they should allow accelerated vesting.

- Tailor definitions to your company’s needs: For TechSolve, I have included comprehensive definitions for “Employee” that cover their team structure across different roles. Vikram told me that they would most likely expand internationally. Accordingly, I widened the definition of “Employee,” which will accommodate growth without needing amendment.

- Consider future scenarios: I have defined “Exercise Period” as 5 years from vesting. This gives TechSolve’s employees reasonable time to exercise options, even after leaving.

- Include operational flexibility: The definition of “Committee” allows TechSolve to delegate ESOP administration to a smaller group rather than requiring full Board decisions for every matter. As they grow from 15 to 20+ employees, this administrative flexibility will become increasingly valuable.

One important advice: There is a tendency among new lawyers to copy-paste definitions from templates without thinking through the implications. I strongly advise you to resist this urge because every defined term creates rights, obligations, and consequences.

C. Eligibility criteria

After establishing the purpose and defining the terms clearly, it is time to address a question that inevitably comes up in board meetings. “Who exactly gets options?” This question is addressed in the eligibility criteria clause.

There are two common mistakes startups make with eligibility criteria that you should avoid. Some make it too restrictive. What I mean by that is, the ESOP policy is drafted in a way that limits the ability of the company to use ESOPs as a flexible compensation tool.

On the other hand, some make the scheme so broad that practically anyone who walks through the door qualifies. This does nothing except dilute the incentive value and create headaches for the administration.

For TechSolve, finding the right balance is crucial for me. They need the flexibility to attract those key hires while ensuring their ESOP pool remains a meaningful incentive for top performers.

After long deliberation with the founders, this is what I created:

3. ELIGIBILITY CRITERIA

3.1 The Committee shall, in its sole discretion, determine which Employees are eligible to receive Options under the Plan. However, the following guidelines shall generally apply:

3.2 Categories of Eligible Employees:

(a) Full-time employees who have completed at least 6 (six) months of continuous service with the Company;

(b) Directors of the Company, whether whole-time or not, excluding Promoter Directors;

(c) Key senior management personnel identified by the Committee;

(d) Employees of any Subsidiary of the Company; and

(e) Any special category of persons as the Committee may approve from time to time.

3.3 Factors for Determining Eligibility:

The Committee may consider the following factors when determining an Employee’s eligibility and the number of Options to be granted:

(a) Performance record and potential for future contribution;

(b) Criticality of role and skill set to the Company’s business;

(c) Length of service with the Company;

(d) Level within the organizational hierarchy;

(e) Market compensation benchmarks for similar positions; and

(f) Any other factors the Committee deems relevant.

3.4 Exclusions:

Notwithstanding the above, the following persons shall not be eligible to participate in the Plan:

(a) Promoters of the Company;

(b) Independent directors of the Company;

(c) Consultants and advisors engaged on a contract basis; and

(d) Any Employee who is a relative of any director or promoter of the Company, except with the approval of the shareholders by a special resolution.

(e) Any director who holds, directly or indirectly, more than 10% of the outstanding equity shares of the Company.

3.5 The decision of the Committee regarding an Employee’s eligibility shall be final and binding.

Drafting tips:

- Balance specificity with flexibility: Watch and learn how I drafted the clause that starts with a broad discretionary power for the Committee, but then provides guidelines. I did this so that the ESOP Scheme gives TechSolve clear parameters while maintaining flexibility for unique situations.

- Include a minimum service requirement: I strategically included a 6-month waiting period for regular employees. Why? Because this will help TechSolve avoid granting options to employees who might leave during the early probation period. However, this does not apply to key hires (covered under 3.2(c)), giving them the flexibility to offer ESOPs as part of recruitment packages for those critical roles, like the CTO they are looking to hire.

- Explicitly state exclusions: The exclusions in Section 3.4 are important. Excluding promoters ensures compliance with regulatory requirements and prevents conflicts of interest. The clause about relatives of directors (3.4(d)) is particularly important for family-run businesses, though this might not apply directly to TechSolve’s current situation.

- List the factors for determining allocation: Section 3.3 provides a framework for how TechSolve will decide not just who gets options, but how many. This transparency helps employees understand the basis for different allocation sizes.

It is important that you remember that the eligibility criteria in the ESOP scheme should reflect your company’s philosophy about equity ownership. For TechSolve, with their need to attract senior talent while maintaining a lean financial structure, broad eligibility with clear prioritization made sense to me and the board. The startups you might advise in the future might need more restrictive criteria if their ESOP pool is smaller or their compensation strategy is different. Take note of it and draft it thoughtfully, with your company’s specific needs in mind.

D. ESOP pool size

With our purpose established, terms defined, and eligibility criteria set, we now come to a clause that directly impacts the company’s cap table: the ESOP pool size. This is often where the interests of founders and investors start to diverge, making it one of the more politically charged elements of your ESOP scheme.

For TechSolve, getting this right is particularly important as they prepare for their pre-Series A round. Too small a pool won’t provide enough equity to attract those key hires they need. Too large a pool will unnecessarily dilute the founders and existing investors.

I have had countless conversations with founders who did not properly cap their ESOP pools, only to discover during fundraising that investors expected them to create a 10-15% pool, causing unexpected founder dilution at precisely the wrong moment.

How to decide the pool size:

For a company at TechSolve’s stage, two years old, pre-Series A, with plans to hire several senior roles. I typically recommend an ESOP pool of 8-12% of the fully diluted equity. Let me walk you through how I approached this calculation for them:

- Assess planned hires: TechSolve needs to hire 5 key positions, including a CTO and VP of Sales. Based on market standards, these roles might require:

- CTO: 1.5-2.5% equity

- VP of Sales: 1-1.5% equity

- Senior engineers (2): 0.5-1% each

- Finance Head: 0.5-1% that is roughly 4-6.5% for just these immediate hires.

- Account for existing team: TechSolve already has 15 team members who may deserve options as retention incentives. Setting aside 2-3% for them is reasonable.

- Consider future hires: As they scale post-funding, they will need to hire more people. Reserving an additional 2-3% for future hires provides flexibility.

Adding these up, 8-12% seems appropriate for TechSolve’s situation. But this is not just about math—it is about strategy and negotiation. Investors will have their own views on pool size, and this will be part of the funding discussions.

Here is the sample clause that I created:

4. ESOP POOL SIZE

4.1 The maximum number of Shares that may be issued pursuant to this Plan shall not exceed 9,000 (nine thousand) Equity Shares, representing 9% (nine percent) of the fully diluted paid-up share capital of the Company as on the date of adoption of this Plan.

4.2 The ESOP pool may be increased or decreased by a special resolution of the shareholders, subject to compliance with applicable laws.

4.3 In case of a corporate action such as a bonus issue, rights issue, stock split, consolidation of shares, or other reorganization of the capital structure of the Company, the Committee shall make appropriate adjustments to the ESOP pool and outstanding Options to ensure that the value of Options already granted is not diminished.

4.4 Any Shares that remain unallocated due to lapse, cancellation, forfeiture, or surrender of Options may be added back to the ESOP pool and shall be available for future grants, subject to compliance with applicable laws.

4.5 The Board shall monitor the ESOP pool utilization on a quarterly basis to ensure alignment with the Company’s hiring plans and compensation strategy.

Drafting Tips:

- Specify both numerical and percentage values: Notice I have included both the absolute number of shares (9,000) and the percentage (9%). This dual approach prevents confusion if the company’s share count changes due to other capital raises or restructuring.

- Include adjustment provisions: Section 4.3 addresses how corporate actions like stock splits will affect the pool. I once advised a gaming startup that neglected this clause, creating a mess when they did a 5:1 stock split without clear provisions for adjusting outstanding options.

- Add a recycling provision: Section 4.4 allows unused shares from lapsed options to return to the pool. This essentially gives TechSolve some breathing room if early employees leave before vesting fully.

- Create a monitoring mechanism: Regular review of pool utilization (Section 4.5) helps prevent surprises when the pool is suddenly depleted. I have seen companies run out of available options mid-year, leaving them unable to honor equity promises to new hires.

Let me share a real-life example from my experience to help you understand the importance of deciding the right pool size.

About five years ago, I was working with a B2B SaaS company similar to TechSolve. Their initial ESOP pool was 5%, which I personally thought was too small for their growth plans. So when a dream CTO candidate asked for 2% equity, the company could not accommodate it. So they had to create a larger pool, which delayed hiring by months. Had they set a more appropriate initial pool size, they could have done the hiring process much faster.

On the flip side, I have also seen founders creating unnecessarily larger pools that caused them significant dilution when they could have negotiated for investors to share in the dilution of future pool increases.

So my final piece of advice to you is, while this clause establishes the maximum size of your ESOP pool, it does not obligate you to grant all of those options immediately. I specifically advised the founders of TechSolve that they should consider creating a specific grants budget, perhaps 40-50% of the pool for immediate use, with the remainder reserved for future needs.

By setting a thoughtful pool size with clear governance mechanisms, you create a balance that serves both your recruiting needs and your capitalization requirements.

Wrap-up

I have now covered the foundational elements of TechSolve’s ESOP scheme: purpose, definitions, eligibility, and pool size. These might not be the most exciting clauses, but they are the ones that prevent headaches down the road.

Think of what we have covered as the operating system for your ESOP.

In Part 2 of this series, I will build on this foundation to cover what I call the “operational clauses”. The provisions that control how options are granted, vest, exercise, and eventually convert to shares or cash. I will explore vesting schedules, exercise periods, termination provisions, and buyback rights, all the mechanisms that make your ESOP function effectively day-to-day.

But before we move on, I encourage you to test what we have built so far.

Take TechSolve’s framework and apply it to a fictional startup and see how the purpose clause might need adjustment for different business models. Consider whether your eligibility criteria should be more or less restrictive depending on your specific situation. Take the time to build your ESOP on solid ground.

Stay tuned for Part 2, where I will complete the entire ESOP scheme together.

I will walk you through the remaining clauses step by step, share more war stories from my practice, and give you the practical tools you need to create an ESOP that actually works.

Trust me, the operational clauses are where things get really interesting, and where most costly mistakes happen. You would not want to miss it!

Allow notifications

Allow notifications