Complete Independent Director Exam 2025 guide: eligibility, IICA databank registration, exam syllabus, preparation strategies by background, post-exam process. Pass on first attempt!

Table of Contents

Companies today face increasing pressure to maintain transparency, protect shareholder interests, and uphold ethical governance standards.

Independent Directors serve as the conscience of corporate boards—professionals who bring:

- unbiased judgment,

- strategic oversight, and

- accountability to company decision-making without being influenced by management or promoter interests.

The Independent Director examination has been introduced under the Companies Act, 2013 to professionalise this critical governance role.

The Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2019 effective from 1st December, 2019 require the existing Independent Directors as well as the professionals aspiring to become independent directors, to apply online to IICA for inclusion of their name with the Independent Directors Databank.

Before this examination, anyone could be appointed as an independent director without demonstrating competence in company law, financial literacy, or governance principles.

The exam ensures only qualified individuals with proven knowledge serve on boards, protecting investors and strengthening corporate India’s credibility.

This comprehensive guide walks you through everything you need to know to become a certified Independent Director in India—from understanding eligibility requirements and registering with the IICA databank to mastering the exam syllabus and securing your first board appointment.

Whether you are :

- a legal professional,

- commerce graduate, or

- technical expert exploring governance careers, you will find actionable strategies tailored to your background.

Understanding Independent Director Exam

The Independent Director examination is not just another professional certification—it is a statutory requirement under Rule 6(4) of the The Companies (Appointment and Qualification of Directors) 2014 that determines who can serve on corporate boards in India’s most important companies.

Understanding the pattern of Online Proficiency Self-Assessment Test/Exam, who conducts this exam, why it’s mandatory, and what makes it unique helps you appreciate the professional recognition that comes with qualification.

Let me break down the examination framework that governs independent director appointments across India’s corporate landscape.

What is the Independent Director Online Proficiency Self-Assessment Test?

The proficiency test consists of 50 multiple-choice questions totaling 100 marks, divided into 25 questions on Board Essentials (direct knowledge questions) and 25 questions on Board Practices (scenario-based questions).

Candidates receive 75 minutes to complete the exam, averaging 1.5 minutes per question.

The exam covers:

- company law (primarily Companies Act 2013),

- securities law (SEBI regulations),

- basic accounting and financial literacy, and

- corporate governance fundamentals including case laws.

There is no negative marking—incorrect answers simply score zero marks while correct answers earn 2 marks each.

Candidates must score at least 50% aggregate (50 marks out of 100) to pass the proficiency test.

The exam can be attempted unlimited times with a minimum one-day gap between attempts, though all attempts must occur within two years of databank registration to maintain eligibility.

Who conducts the Independent Director exam?

The Indian Institute of Corporate Affairs (IICA), notified by the Central Government under Section 150(1) of the Companies Act 2013, conducts the Online Proficiency Self-Assessment Test. IICA is a government institute under the Ministry of Corporate Affairs, giving the examination official regulatory backing.

The exam is administered using a robust, scalable, and secure proctor-based assessment platform that issues e-certificates upon successful completion. The proctored online format allows candidates to attempt the exam from their office or residence without visiting physical test centers.

Why is the Independent Director exam mandatory?

Rule 6(4) of the Companies (Appointment and Qualification of Directors) Rules 2014 makes passing the proficiency test mandatory for independent director eligibility, with limited exemptions for highly experienced professionals.

The requirement stems from recognition that independent directors exercise significant governance responsibilities requiring specialized knowledge.

Without this exam requirement, unqualified individuals could influence critical board decisions affecting shareholders, employees, and stakeholders.

The proficiency test ensures independent directors understand their legal duties under Schedule IV of the Companies Act, financial statement interpretation, SEBI compliance obligations, and ethical governance principles before assuming board positions.

Companies appointing independent directors who have not passed the proficiency test (except exempted categories) face regulatory non-compliance issues. The mandatory nature protects both companies from appointing unqualified directors and investors from governance failures stemming from board incompetence.

Eligibility & Exemption for Independent Director Exam

Before investing time in exam preparation, you need to confirm whether you are eligible to take the proficiency test or qualify for exemption based on your professional experience. Understanding these criteria prevents wasted effort on ineligible applications or unnecessary exam preparation when you are already exempt.

Let me walk you through the complete eligibility framework, including:

- age requirements,

- educational qualifications,

- exemption categories, and

- nationality considerations.

Who can take the Independent Director exam?

Generally speaking, any individual meeting basic eligibility criteria can register for the Independent Director exam. Before booking an exam slot, one must register with the Independent Director Databank managed by IICA. We will discuss about the registration with Independent Director Databank and how to book an exam slot in detail in the later part of the article.

What are the age, qualification, and educational requirements?

There is no minimum or maximum age limit to qualify as independent directors under Section 149 of the Companies Act 2013. However, in terms of Regulation 16 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 a candidate must be 21 years or above to be appointed as independent direction in a listed company.

There’s no mandatory educational qualification specified in the Act—individuals from diverse backgrounds including law, commerce, science, technology, and management can qualify.

However, practical knowledge matters more than formal degrees.

Companies seeking independent directors value expertise in specific areas:

- financial literacy for audit committee roles,

- legal knowledge for compliance oversight,

- industry-specific technical expertise, or

- strategic management experience.

Your background determines which board positions you are best suited for.

While no specific degree is mandatory, certain educational backgrounds provide preparation advantages.

Legal professionals already understand Companies Act provisions and regulatory compliance. Commerce graduates possess accounting knowledge essential for financial statement analysis. Even engineers and professional coming from science background qualify if they develop business acumen and governance understanding through proper courses.

Who is exempt from taking the exam?

Rule 6(4) exempts specific categories from the proficiency test requirement: individuals who have been practicing as chartered accountants, cost accountants, company secretaries, or advocates for at least 10 years. These professionals’ extensive practice experience is deemed sufficient demonstration of requisite knowledge.

Also exempt are individuals with at least 3 years experience (calculated from databank registration date) as key managerial personnel or directors in:

- listed public companies,

- unlisted public companies with paid-up capital of ₹10 crore or more,

- foreign body corporates with paid-up capital exceeding $2 million,

- body corporates listed on any stock exchange, or statutory corporations established in India.

Government officials working in pay scales of Director or equivalent in central/state government ministries with experience in commerce, corporate affairs, finance, industry, or public enterprises are exempt, as are officials in Chief General Manager or above positions at SEBI, RBI, IRDAI, or PFRDA with experience in corporate/securities/economic laws.

Even if you qualify for exemption, you must still register with the Independent Director’s Databank and declare your exemption status with supporting documentation proving your qualifying experience or position.

Can foreign nationals take the exam?

Foreign nationals can be appointed as Independent Directors in Indian companies.

Section 149(6) of the Companies Act, 2013 lays down the independence criteria, but it does not mandate Indian citizenship or residency for Independent Directors.

Further, under Rule 4(2)(a) of the Companies (Creation and Maintenance of Databank of Independent Directors) Rules, 2019, even foreign nationals may be included in the Independent Director databank using their passport number (without the requirement of an Indian PAN).

Thus, foreign nationals who obtain a DIN, register on the databank, and meet the eligibility criteria can serve as Independent Directors. They are also required to take the online proficiency test, unless specifically exempted.

In addition, foreign nationals can of course serve as non-independent directors (executive or non-executive) on Indian company boards, subject to compliance with FEMA and other applicable regulations.

Registration Process with Independent Director Databank

As stated previously, registering with the Independent Director’s Databank is your mandatory first step before attempting the proficiency test/exam or being eligible for board appointments.

This section walks you through the complete registration journey—understanding what the databank is, navigating both MCA and IICA portals, gathering required documents, obtaining your DIN, and paying registration fees.

Let me guide you through each registration component ensuring you complete the process correctly without delays from missing documents or procedural errors. But first, let’s understand what is the Independent Director Databank.

What is the Independent Director Databank?

The Independent Director’s Databank is an online platform created by the Ministry of Corporate Affairs along with IICA containing details of individuals eligible and willing to serve as independent directors. Companies searching for independent directors access this databank to identify qualified candidates.

The databank serves three critical functions:

- First, it maintains a verified registry of individuals who have passed the proficiency test or qualify for exemptions.

- Second, it provides the platform for conducting the online proficiency self-assessment test.

- Third, it offers e-learning courses helping candidates prepare for the exam and develop governance competencies.

When you register, your profile becomes searchable by companies seeking independent directors matching your expertise, industry experience, and qualifications. Think of it as LinkedIn for corporate governance—your professional credentials, skills, and availability are visible to companies looking for appointment of Independent Directors.

How do you register on Databank through the MCA and IICA Portal?

Registering with the Independent Director Databank is a two-part process.

First, you need to create an account on the MCA (Ministry of Corporate Affairs) portal.

Then, you must log in through the MCA system to complete your registration on the IICA Independent Director’s Databank.

Part I: Creating an MCA Account

To begin, you must create your MCA User Account.

Step 1: Go to the MCA Website

- Visit MCA Portal

- Click on Login/Sign up at the top-right corner of the homepage.

Step 2: Register as a User

- On the User Login/Registration page, click Register under User Login.

- In the User Registration section:

- Select Registered User as the User Category.

- Select Individual as the User Role.

- Enter your PAN card details (in CAPITAL letters).

- Select Registered User as the User Category.

- Click Next.

Step 3: Enter Personal Details

Fill in the following:

- First name, middle name (if any), last name

- Date of birth, gender, profession, and industry of operation

- Click Next.

Step 4: Enter Contact Details

- Provide your address, mobile number, and email ID.

Step 5: Set Password & Security Question

- Create a secure password.

- Choose a password recovery question for account recovery.

- Click Create my account.

Step 6: OTP Verification

- Enter the OTP sent to your registered mobile number.

- Registration is now complete.

Please note that Your User ID will be sent to your registered email. This may take a few days (up to a week). Once you receive it, you can proceed to Part II.

Part II: Independent Director Databank Registration

Now that your MCA account is active, follow these steps:

Step 1: Login to MCA Account

- Go to MCA Portal.

- Click Login/Sign Up.

- Enter your email ID and MCA password, along with Captcha.

- Select Login for V3 Filing.

Step 2: Access ID Databank Services

- Once logged in, go to ‘MCA Services’ tab.

- From the dropdown, click ‘ID Databank Services’ → Individual Registration.

Step 3: Provide Identification Details

You will be asked:

- Do you have a valid DIN? (Yes/No)

or - Do you have a valid PAN? (Yes → Enter PAN number)

or - Do you have a Passport? (Yes → Enter Passport number)

Please note, if you have a valid DIN then you do not required PAN/Password for registration. In case you do not have a DIN then only apply using PAN or Passport.

You will receive an otp for verification. Fill in the OTP.

- Click Proceed.

- You will be redirected to the Independent Director’s Databank Portal.

Step 4: Login to Databank Portal

- Click Login with OTP.

- Enter your email ID or mobile number, then request OTP.

- Enter the OTP received and click Login.

Step 5: Complete Your Profile

Fill in details to build your Independent Director profile:

- Personal details (matching PAN, DOB, contact info)

- Educational qualifications (upload degree certificates)

- Professional experience (previous directorships, KMP positions, relevant expertise)

- Areas of specialization (industry sectors, finance, law, operations, etc.)

You can choose what information is visible to companies.

Step 6: Pay Subscription Fees

Choose one of the subscription options:

- ₹5,000 + GST → 1-Year Subscription

- ₹15,000 + GST → 5-Year Subscription

- ₹25,000 + GST → Lifetime Subscription

Make the payment online to activate your account.

Final Step: Empanelment

Once payment is complete, you are now officially empanelled in the Independent Director Databank.

From here, you can also attempt the Independent Director Online Self-Proficiency Test to further strengthen your profile.

What documents are required for registration with the Independent Director databank?

You need several documents ready before starting registration to avoid interruptions. First, your PAN card is mandatory—the system verifies your PAN details with income tax databases, so ensure your PAN is active and details match exactly.

For identity proof, prepare Aadhaar card, or passport, or voter ID card—any government-issued photo identity document works.

For address proof, you can use Aadhaar, passport, driving license, or utility bills with your name and address.

Educational certificates proving your graduation or professional qualifications must be scanned and uploaded.

If claiming exemption from the proficiency test, gather proof documents: CA/CS/CMA/Advocate practice certificates showing 10+ years practice, experience letters from previous companies proving 3+ years as KMP/director in qualifying entities, or government employment certificates with pay scale details.

Have a recent passport-size photograph in digital format (JPG/JPEG, typically under 300 KB). Prepare these documents in PDF format (typically under 2 MB per document) before beginning registration.

Is it mandatory to have a Director Identification Number (DIN)?

Yes, every director in India including independent directors must have a Director Identification Number (DIN) as per Section 153 of the Companies Act 2013. DIN is an eight-digit unique identification number allotted by the Ministry of Corporate Affairs.

You can register on the Independent Director’s Databank without DIN initially, but you will need DIN before companies can formally appoint you as an independent director. Many candidates obtain DIN parallel to databank registration to have complete documentation ready when board opportunities arise.

DIN has lifetime validity—once allotted, it remains yours permanently even if you resign from all directorships.

If you have served as a director in any company previously, you already have DIN and simply need to provide that number during databank registration.

How do you obtain a DIN?

To obtain DIN, file Form DIR-3 on the MCA portal (www.mca.gov.in) with your personal details including PAN, Aadhaar, photograph, proof of identity, and proof of address. Generally, people engaged professional services of Chartered Accountant, Company Secretary, or Cost Accountant to obtain the DIN.

The form is digitally signed and certified by you and a practicing CA/CS/CMA.

The application fee for DIN is ₹500 (subject to revision—check MCA portal for current fee).

After submitting Form DIR-3 with required documents and fee payment, the MCA processes your application typically within 7-10 working days. Upon approval, your DIN is allotted and communicated via email to your registered email address.

If you are unsure whether you already have DIN from previous directorship positions, you can check DIN status on the MCA portal using your PAN number. The system will show existing DIN associated with your PAN if any was allotted previously.

Please note that before applying for DIN, you need to purchase a Digital Siganture Certificate (DSC) as well to digitally sign the DIR-3. You can purchase a DSC from the professional certifying your DIR-3.

How much does databank registration cost?

The Independent Director’s Databank registration fee is approximately ₹5,000 + GST.

This fee covers your databank profile creation, access to IICA e-learning modules (42 online courses covering board essentials and governance topics), and the ability to attempt the proficiency test unlimited times within your two-year validity period.

The registration fee is separate from DIN application fee (₹500 for Form DIR-3). If you’re engaging professionals (CA/CS/CMA) to help with registration and certification, their professional charges are additional and vary based on location and professional rates.

Once you pay the databank registration (empanelment) fee, that grants you inclusion for the chosen duration (1 year / 5 years / lifetime). However, this does not mean there is no renewal fee in all cases.

- If you opted for a lifetime subscription, no renewal is required.

- For 1-year or 5-year subscriptions, you must renew before or within 30 days of expiry; failure to do so may lead to removal of your name from the databank.

- If you delay renewal, a late renewal fee of ₹1,000 + GST is applicable.

- Additionally, if your profile is disabled due to not passing the proficiency test within two years, restoring it also attracts a ₹1,000 + GST fee.

Independent Director Exam Structure

Understanding the exam’s structure, pattern, question distribution, passing criteria, and attempt flexibility helps you prepare strategically and manage expectations realistically. The Independent Director proficiency test isn’t designed to be extremely difficult—it’s a competency assessment ensuring candidates possess baseline knowledge for board service.

Let me break down every structural element so you know exactly what to expect when you sit for the exam.

What is the exam pattern for the Independent Director exam?

As discussed previously, the exam follows a fully objective multiple-choice question format with 50 questions divided into two distinct categories:

- 25 questions on Board Essentials testing direct knowledge of laws, regulations, and governance concepts, and

- 25 questions on Board Practices presenting scenario-based situations requiring application of knowledge.

Board Essentials questions are straightforward:

- “What is the minimum number of independent directors required for a listed company under Section 149?” or

- “Under which Schedule of the Companies Act are independent director duties specified?”

These test your grasp of statutory provisions, SEBI regulations, and governance fundamentals.

Board Practices questions present realistic board scenarios: “The CFO proposes an aggressive revenue recognition policy that technically complies with accounting standards but misleads investors about actual business performance. As an independent director, your most appropriate action is…” followed by multiple choice options requiring you to apply governance principles and ethical judgment.

What is the duration and passing score for the exam?

Candidates receive 75 minutes (1 hour 15 minutes) to complete all 50 questions, averaging 1.5 minutes per question. This timing is generally comfortable for well-prepared candidates—you have sufficient time to read scenarios carefully, evaluate options, and mark answers without extreme time pressure.

The passing score is 50% aggregate—you must score at least 50 marks out of 100 total marks to pass the proficiency test. There’s no sectional passing requirement, meaning you could theoretically score 40% in Board Essentials and 60% in Board Practices and still pass with 50% aggregate.

Importantly, there’s no negative marking in the exam—incorrect answers simply score zero marks without deducting from your total. This no-penalty structure means you should attempt every single question even if unsure, using educated guessing when necessary since wrong answers don’t hurt your score.

How frequently is the Independent Director exam conducted, and how many attempts are allowed?

Unlike fixed-date examinations conducted once or twice annually, the Independent Director proficiency test follows an on-demand scheduling model. The exam is available every day of the week in two time slots:

- afternoon slot (2:00 PM – 3:00 PM), and

- late evening slot (8:00 PM – 9:00 PM).

You can book any available slot that suits your schedule—no waiting for specific exam dates months in advance. This flexibility allows working professionals to schedule around their commitments and attempt the exam when they have completed adequate preparation.

Candidates enjoy unlimited attempts at the proficiency test with one important restriction: you must maintain a minimum one-day gap between consecutive attempts. If you take the exam on Monday and do not pass, you can attempt again Wednesday onwards (not Tuesday). All attempts must occur within two years of your databank registration date.

Is the exam online or offline?

The proficiency test is conducted entirely online in a proctored environment that can be attempted from your office or residence without visiting any physical test center. This home-based online format offers tremendous convenience—no travel to exam centers, no accommodation expenses, and flexibility to take the exam in your comfortable, familiar environment.

However, online doesn’t mean unsupervised. The exam uses proctor-based assessment technology monitoring you via webcam throughout the 75-minute duration. The proctoring system verifies your identity, ensures no unauthorized persons are in the room, monitors for prohibited materials or devices, and flags suspicious activities.

You’ll need a computer or laptop with stable internet connection (minimum 2 Mbps recommended), working webcam and microphone, updated Chrome/Firefox/Edge browser, and a quiet private space where you won’t be disturbed. The system performs pre-exam checks verifying your equipment meets technical requirements before starting the actual exam.

Complete Syllabus for Independent Director Exam

Knowing what to study is as important as how to study.

The Independent Director Online Proficiency Test, conducted by the Indian Institute of Corporate Affairs (IICA), evaluates your understanding of company governance, board responsibilities, and regulatory compliance.

The Independent Director proficiency test syllabus covers four major areas:

- Company Law,

- Securities Law and SEBI Regulations,

- Financial Literacy and Basic Accounting, and

- Corporate Governance Fundamentals including case studies.

Think of the syllabus as concentric circles:

- The core focuses on Companies Act provisions directly dealing with independent directors.

- The middle layer includes board procedures, audit committees, and related-party governance.

- The outer layer expands to SEBI LODR Regulations, financial interpretation, and corporate governance case studies.

Let me break down each syllabus area with specific topics, key provisions, and practical focus areas helping you prioritize preparation efficiently.

Company Law

Company law is the backbone of the proficiency exam, forming approximately 35-40% of the exam syllabus.

Your Companies Act 2013 knowledge must be both broad (understanding key chapters) and deep (knowing specific section numbers and provisions relevant to independent director responsibilities).

Which Sections of the Companies Act 2013 are most important?

The following sections are the key for cracking the proficiency exam

Section 149 – Defines Independent Directors, lays down appointment criteria, tenure (two consecutive five-year terms), and the one-third minimum requirement for listed companies.

Section 150 – Governs the Independent Director’s Databank, explaining its operation and link with board appointments.

Schedule IV – The Code for Independent Directors, detailing duties, professional conduct, and role expectations.

Section 164 – Lists disqualifications for directors (convictions, SEBI/court orders, non-filing of financials, wilful default, etc.).

Section 166 – Specifies general duties of all directors — acting in good faith, avoiding conflicts of interest, maintaining confidentiality, and exercising independent judgment.

What are the key provisions related to Board Meetings, Directors’ Duties, and Compliance Requirements?

Section 173 – Meeting Requirements: – Mandates minimum four board meetings annually with maximum 120-day gaps between consecutive meetings. Independent directors must attend these meetings to fulfill their oversight responsibilities. Know quorum requirements, notice periods, agenda circulation, and minute-keeping procedures.

Chapter XII – Meetings of Board and Powers: –Understanding this chapter is essential for effective board service, covering procedures, powers, and operational aspects of board functioning.

What are the key compliance provisions for Independent Director Exam?

Section 177 – Audit Committee: – Covers audit committee composition and powers, a critical area where independent directors play significant oversight roles.

Section 178 – Vigil Mechanism/Whistle-blower Policy: –Independent directors often chair or serve on committees overseeing these mechanisms.

Section 188 – Related Party Transactions: – Heavily tested because independent directors play gatekeeping roles preventing insider self-dealing. Understand what constitutes related parties, which transactions require board approval vs shareholder approval, and independent directors’ duty to approve only arm’s-length transactions benefiting the company.

Chapter XIII – Appointment and Remuneration of Managerial Personnel: – Independent directors must understand this chapter, particularly regarding their role in the Nomination and Remuneration Committee.

Section 134 – Board Report Disclosures: – Independent directors share collective board responsibility for ensuring the company meets all statutory compliance obligations covered under these and related provisions.

How do rules and regulations relating to mergers & amalgamations, and oppression & mismanagement affect directors?

Sections 230–232 – Mergers, Amalgamations, and Arrangements

Require independent director involvement in fairness opinions, protecting minority shareholder interests, and ensuring proposed transactions serve legitimate business purposes rather than promoter enrichment at shareholder expense.

Sections 241–246 – Oppression and Mismanagement

Provide remedies for minority shareholders against controlling shareholders’ abusive conduct. Independent directors are expected to prevent oppression/mismanagement through vigilant oversight, and failure to act can expose them to shareholder suits alleging breach of fiduciary duty.

Securities Law and SEBI Regulations

The syllabus relating to securities law, particularly SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015, comprises approximately 25% of exam focus. This material matters primarily for independent directors serving on listed company boards.

What SEBI LODR Regulations an Independent Director must understand?

Regulation 17 requires top 1000/2000 listed entities (by market cap) to have minimum 6 directors, with independent director requirements varying based on whether the chairperson is non-executive (1/3 minimum) or if there’s no regular non-executive chairperson/chairperson is promoter-related (50% minimum).

Regulation 17A caps independent directors at maximum seven listed entity directorships, reducing to three if serving as whole-time director elsewhere. These limits prevent over-boarding—individuals holding too many directorships to effectively fulfill each board’s obligations.

Regulation 25 governs independent director obligations including separate meetings (at least once annually without non-independent directors/management), filling vacancies by the immediate next board meeting or three months (whichever is later), and reviewing performance of non-independent directors, the board, and the chairperson.

Regulation 46 mandates website disclosures about independent directors including appointment terms and familiarization program details.

How do Securities Laws affect Independent Director duties?

Securities laws transform independent director duties from internal governance oversight to external stakeholder protection. You are not just ensuring Companies Act compliance internally—you are protecting public investors who’ve trusted their money to the listed company.

SEBI regulations impose strict disclosure obligations on listed companies, and independent directors share responsibility for ensuring disclosure accuracy, timeliness, and completeness. Material information affecting stock prices must be disclosed promptly under Regulation 30. Independent directors must verify management isn’t withholding material information or making misleading disclosures.

What disclosure requirements apply to Independent Directors?

Independent directors must provide initial declarations confirming independence status per Section 149(7), declaring databank inclusion per Rule 6, and disclosing other directorships/committee positions. These declarations must be renewed annually confirming continued independence.

Companies must disclose independent directors’ appointment terms, sitting fees, commission structures, and any material pecuniary relationships on their websites per Regulation 46.

Annual reports must detail independent director attendance at board/committee meetings, their participation in familiarization programs, and board evaluation outcomes.

How does an Independent Director handle Insider Trading Regulations?

SEBI (Prohibition of Insider Trading) Regulations 2015 apply fully to independent directors who possess unpublished price-sensitive information (UPSI) through board participation. You cannot trade company securities during closed trading windows (typically before financial results, mergers, dividends, or other material events).

Independent directors must maintain trading window compliance, pre-clear all trades with the company’s compliance officer, and disclose their trading to stock exchanges within two working days. Violations carry severe penalties including disgorgement of profits, fines, and potential prosecution.

Beyond personal trading restrictions, independent directors must ensure the company maintains robust insider trading prevention mechanisms: designated persons list, trading window closures, pre-clearance procedures, and UPSI need-to-know restrictions preventing information leakage.

Financial Literacy and Basic Accounting

Financial literacy, comprising approximately 20% of exam content, tests your ability to read and interpret financial statements, understand key financial ratios, and assess company financial health—competencies essential for audit committee service and oversight of management’s financial reporting.

What financial statements must Independent Directors understand?

You must interpret three core financial statements:

- Balance Sheet (showing assets, liabilities, and shareholder equity at a point in time),

- Profit & Loss Statement (showing revenues, expenses, and net profit over a period), and

- Cash Flow Statement (showing operating, investing, and financing cash flows).

Understanding goes beyond reading headline numbers.

Can you identify red flags:

- declining cash flows despite reported profits (potential earnings manipulation),

- growing receivables disproportionate to sales growth (revenue recognition issues),

- rising debt-to-equity ratios (increasing financial leverage and risk), or

- unusual related party transactions buried in notes?

Independent directors must question management when financial statements show warning signs. Your role isn’t conducting detailed audits—that’s the external auditor’s job—but asking probing questions ensuring financial reporting reflects business reality rather than management spin.

How do you read and analyze company financial reports?

Start with the auditor’s report—the first page most shareholders should read.

Is it an unqualified/clean opinion, or does it contain qualifications, emphasis of matter, adverse opinions, or going concern warnings? Any deviation from clean opinion requires deep investigation.

Next, read Management Discussion & Analysis (MD&A) explaining business performance, risks, and outlook. Compare MD&A narrative against actual financial numbers—do they align or does management paint rosy pictures contradicted by deteriorating financials?

Analyze notes to financial statements containing critical details:

- accounting policy choices, contingent liabilities, off-balance-sheet obligations, related party transactions, and segment reporting.

The real story often hides in footnotes rather than headline numbers.

What key financial ratios should an Independent Director know?

Following are some of the basic ratios, understanding of which is going to increase the desirability of you as an independent direction in the eyes of potential companies.

Profitability ratios measure financial performance: Return on Equity (net profit / shareholder equity) shows how efficiently the company generates returns on invested capital.

Operating Profit Margin (operating profit / revenue) indicates operational efficiency before interest and taxes.

Liquidity ratios assess short-term financial health: Current Ratio (current assets / current liabilities) above 1.5 generally suggests comfortable liquidity. Quick Ratio (liquid assets / current liabilities) excludes inventory providing stricter liquidity test.

Solvency ratios evaluate long-term stability: Debt-to-Equity Ratio (total debt / shareholder equity) indicates financial leverage—higher ratios mean greater financial risk. Interest Coverage Ratio (EBIT / interest expense) shows ability to service debt from operating profits.

How does an Independent Director assess a company’s financial health?

Financial health assessment combines ratio analysis with trend analysis (are ratios improving or deteriorating?), peer comparison (how do our ratios compare to industry competitors?), and business context understanding (are financial trends explained by strategic initiatives or operational problems?).

Red flags demanding investigation include: declining revenue/margins despite positive management commentary, operating cash flows consistently lower than reported profits, growing receivables and inventory suggesting demand weakening, increasing debt without corresponding asset/revenue growth, and frequent accounting policy changes impacting reported earnings.

Independent directors should request management explanations for concerning trends, seek audit committee investigation of suspicious transactions, and if necessary, demand forensic audits when fraud indicators emerge. Your financial literacy protects shareholders from management malfeasance.

Corporate Governance Fundamentals

Corporate governance principles comprise approximately 15% of exam focus, testing your understanding of board effectiveness, ethical conduct, risk oversight, stakeholder balancing, and the philosophical foundations underlying independent director roles.

What are the principles of good Corporate Governance?

Good governance rests on five pillars:

- Accountability (directors answer to shareholders and stakeholders for their decisions),

- Transparency (full, accurate, timely disclosure of material information),

- Fairness (equitable treatment of all shareholders including minorities),

- Responsibility (compliance with laws, ethical conduct, social responsibility), and

- Independence (unbiased decision-making free from conflicts of interest).

For independent directors specifically, these principles translate into: questioning management assumptions, protecting minority shareholders from majority/promoter oppression, ensuring board decisions serve company and stakeholder interests rather than insider interests, maintaining independence from management influence, and holding management accountable for performance and conduct.

How does an Independent Director handle conflicts of interest?

Independent directors must disclose any material relationships with the company, promoters, or management that could compromise independent judgment per Section 149(6) and Schedule IV guidelines. If conflicts arise (personal business relationship with supplier under board consideration, family member employment, etc.), you must recuse yourself from those specific decisions.

Conflict disclosure must be proactive—don’t wait for conflicts to be discovered. Inform the board immediately when potential conflicts arise, abstain from participating in discussions or voting on conflicted matters, and ensure your recusal is recorded in minutes.

Beyond personal conflicts, guard against cognitive conflicts: relationship biases (friendship with management clouding judgment), sunken cost fallacies (defending past poor decisions rather than correcting course), or groupthink (going along with consensus rather than voicing concerns).

What is the role of Independent Directors in Risk Management?

Independent directors don’t manage day-to-day operational risks—that’s management’s job. Your role focuses on risk oversight: ensuring adequate risk management frameworks exist, major risks are identified and monitored, risk appetites are appropriate for the business, and management isn’t taking excessive risks threatening company survival.

Key risk oversight questions:

- Does the company have documented risk management policies?

- Are risks regularly reported to the board with mitigation strategies?

- Are emerging risks (cybersecurity, regulatory changes, technology disruption) being addressed proactively?

- Is management’s risk appetite aligned with board-approved strategy?

Independent directors particularly focus on risks that could materially impair company value:

- financial risks (liquidity crises, debt defaults),

- regulatory risks (non-compliance penalties, license cancellations),

- reputational risks (product failures, ethical lapses), and

- strategic risks (technology disruption, market shifts).

How does an Independent Director ensure effective Board Evaluation?

SEBI LODR Regulation 25(4) mandates that independent directors, in their separate annual meeting, evaluate the performance of non-independent directors, the board as a whole, and the chairperson, while also assessing information flow between management and the board. Independent directors thus play dual roles: conducting evaluation of board and committee effectiveness, while being individually evaluated on their own performance and independence criteria by the entire board under Regulation 17(10).

Effective evaluation isn’t box-checking exercises.

Use structured criteria:

- attendance and preparation for meetings,

- quality of discussion participation,

- constructive questioning of management,

- committee leadership effectiveness, and

- whether directors bring relevant expertise to board deliberations.

Evaluation outcomes should drive board improvement actions.

How does professional ethics apply in practice?

Schedule IV Code for Independent Directors mandates maintaining confidentiality of sensitive company information (including commercial secrets and unpublished price-sensitive information), avoiding misuse of position for personal advantage, and acting in a bona fide manner with sufficient time and attention devoted to professional obligations. The Code requires independent directors to uphold ethical standards of integrity and probity in their conduct.

Practical ethical dilemmas independent directors face:

- management proposes aggressive but legal accounting that misleads investors—do you approve or object?

- CEO requests non-disclosure of bad news until after their stock option vesting—do you consent or insist on immediate disclosure?

- Controlling shareholders demand related party transactions benefiting them—do you approve or block?

In each situation, ethics demand prioritizing stakeholder interests (especially minorities and creditors) over management convenience or controlling shareholder pressure.

If management resists ethical oversight, independent directors must escalate concerns to audit committees, full board, or ultimately shareholders and regulators.

Case Study

Case studies comprise approximately 5% of exam content but carry disproportionate importance—they test whether you can apply governance principles to real failures. Studying governance disasters helps you recognize red flags before they become catastrophes on boards you serve.

What lessons can be learned from Indian cases such as Amrapali, IL&FS, Satyam, Yes Bank, and Essar Steel?

The Satyam scandal (2009) involved ₹7,000+ crore accounting fraud where promoter-chairman Ramalinga Raju fabricated assets, inflated profits, and created fictitious cash balances for years. Independent directors failed to detect massive fraud occurring under their oversight, raising questions about their financial literacy, audit committee diligence, and willingness to challenge management.

Key lesson: Independent directors must verify material information, not just accept management assertions. Satyam’s board failed to investigate warning signs including unusual related party transactions, cash balances not generating expected interest income, and lack of dividend payments despite reported profits.

IL&FS collapse (2018) exposed ₹91,000 crore liability crisis caused by excessive leverage, maturity mismatches (short-term borrowings funding long-term infrastructure projects), and inadequate risk oversight by the board. Independent directors failed to question unsustainable debt growth or ensure proper asset-liability management.

Key lesson: Risk oversight requires understanding business model sustainability. IL&FS’s independent directors should have questioned how infrastructure projects with 20-30 year payback periods were being funded with short-term debt requiring refinancing every 2-3 years.

Yes Bank crisis (2020) stemmed from questionable loan practices, under-recognition of non-performing assets, and founder-CEO’s excessive control with board failing to provide independent oversight. The company hid loan quality deterioration from regulators, investors, and even some directors.

Key lesson: Independent directors need independent information sources. Yes Bank’s independent directors relied exclusively on management-provided information, failing to commission independent credit quality reviews or engage directly with regulators regarding supervisory concerns.

What global case studies (e.g., Enron, WorldCom, Volkswagen, Olympus) highlight Independent Directors’ roles and failures?

Enron’s 2001 collapse involved systematic accounting fraud hiding debt in off-balance-sheet entities, inflating revenues through mark-to-market accounting manipulation, and financial engineering disguising business failure. The board, including independent directors, approved complex special purpose entities enabling fraud without understanding their purpose or risks.

Key lesson: If you don’t understand a transaction’s business rationale, vote no. Enron’s independent directors approved structures they admittedly didn’t fully understand, deferring to CFO’s “expertise” rather than demanding clear explanations accessible to non-experts.

WorldCom’s 2002 fraud involved $11 billion in accounting manipulations capitalizing ordinary operating expenses as capital expenditures, inflating assets and profits. The audit committee, chaired by an independent director, failed to detect the fraud despite external auditor warnings about company’s aggressive accounting.

Key lesson: Audit committees must investigate when external auditors raise concerns. WorldCom’s independent directors dismissed auditor warnings as conservative accounting preferences rather than fraud red flags, demonstrating inadequate professional skepticism.

Volkswagen’s 2015 emissions scandal involved deliberately installing “defeat device” software to cheat emissions tests, deceiving regulators and customers globally. The supervisory board (including independent members) either knew about or failed to detect systematic fraud affecting millions of vehicles.

Key lesson: Corporate culture flows from board tone-at-the-top. Volkswagen’s board prioritized competitive performance over compliance, creating culture where employees felt pressured to achieve targets by any means, including fraud.

Preparation Strategy for Independent Director Exam

Knowing what’s in the exam is only half the battle—executing effective preparation determines your success. This section provides strategic preparation frameworks tailored to different timelines (30-day vs 60-day), candidate backgrounds (legal, commerce, non-business), and study resources, helping you prepare efficiently without wasting time on low-yield activities.

Let me walk you through proven preparation strategies maximizing your chance of first-attempt success.

Study Planning and Time Management

Effective preparation requires realistic timeline assessment, systematic topic coverage, and disciplined execution. Whether you have 30 days or 60 days, the key is covering all syllabus areas with appropriate depth rather than perfect mastery of some topics while neglecting others.

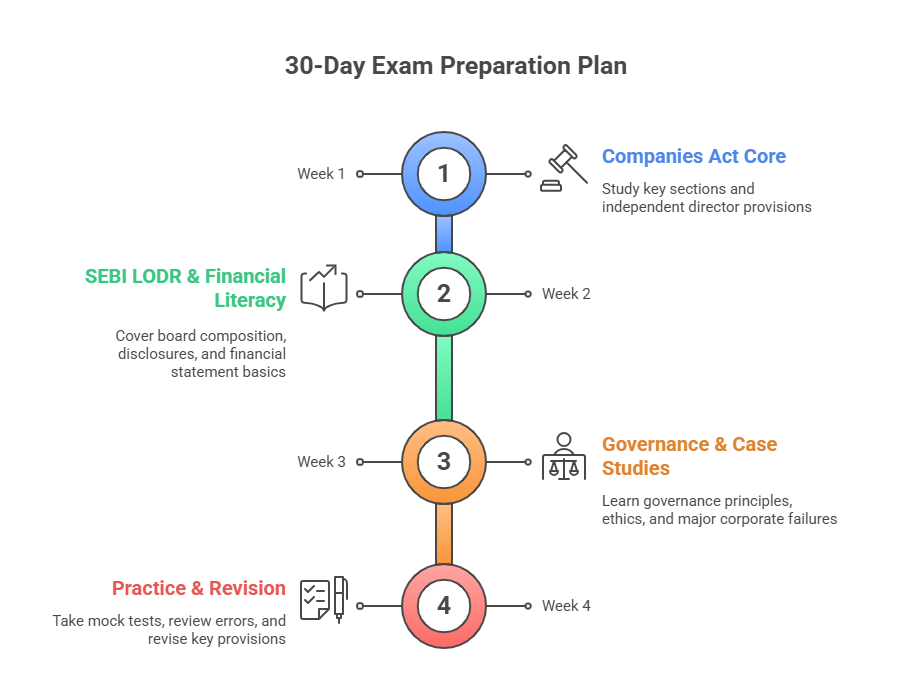

How do you create a 30-Day study plan?

A 30-day plan works for candidates with strong business/legal foundations who need exam-specific preparation rather than learning fundamentals from scratch. Allocate 2-3 hours daily (60-90 hours total) distributed across syllabus areas by weightage.

Week 1 (Focus: Companies Act Core):

Study Sections 149–150, Schedule IV (independent director provisions), Section 164 (disqualifications), Section 166 (director duties), and Section 173 (board meetings). Allocate 12-15 hours. Make notes on section numbers, key provisions, and independent director-specific obligations.

Week 2 (Focus: SEBI LODR & Financial Literacy):

Study SEBI LODR Regulations 17, 25, 46 (board composition, independent director obligations, disclosures). Learn balance sheet, P&L statement, cash flow statement basics, and key financial ratios. Allocate 15 hours covering both areas.

Week 3 (Focus: Governance & Case Studies):

Study corporate governance principles, Schedule IV ethics guidelines, conflict of interest handling, and major case studies (Satyam, IL&FS, Enron). Understand failure patterns and governance lessons. Allocate 10-12 hours.

Week 4 (Focus: Practice & Revision):

Take 3-4 full-length mock tests, review incorrect answers, revise weak areas identified through mocks, and do quick revision of section numbers and key provisions. Allocate 15-18 hours for intensive practice and revision.

What is an effective 60-Day preparation strategy?

A 60-day plan suits candidates from non-business backgrounds or those wanting thorough preparation with deeper understanding rather than just exam clearing. Allocate 1.5-2 hours daily (90-120 hours total) allowing comprehensive topic coverage.

Weeks 1-2 (Foundation Building):

Start with business fundamentals: company structure, board roles, shareholder rights, financial statement basics. If you’re unfamiliar with accounting, spend extra time on balance sheets and P&L interpretation. Access IICA e-learning modules providing structured foundational content.

Weeks 3-4 (Companies Act Deep Dive):

Systematically cover key Companies Act chapters: Chapters III-IV (directors), Chapter VIII (board meetings), Chapters X-XII (audit, compliance), and specific sections heavily tested. Make comprehensive notes on section numbers and provisions.

Weeks 5-6 (SEBI Regulations & Securities Law):

Study SEBI LODR Regulations focusing on independent director-specific provisions. Understand disclosure requirements, corporate governance norms for listed companies, and insider trading regulations. Compare Companies Act vs SEBI requirements noting where SEBI imposes stricter standards.

Weeks 7-8 (Financial Literacy & Governance):

Deepen financial literacy—practice interpreting actual company annual reports, calculate financial ratios, identify red flags. Study corporate governance frameworks, ethical dilemmas, and case studies. Allocate final days to mock tests and intensive revision.

How should working professionals plan their study schedule?

Working professionals face time constraints requiring efficient preparation. Focus on high-yield topics and leverage commute time, lunch breaks, and weekends strategically.

Weekday Strategy:

Dedicate early mornings (6:00-7:30 AM, 1.5 hours before work) or evenings (9:00-11:00 PM, 2 hours after dinner) to focused study. Avoid studying immediately after exhausting workdays when retention suffers—take 30-minute breaks before evening study sessions.

Weekend Strategy:

Block 4-6 hours Saturday and Sunday (not consecutively—break into morning and afternoon sessions) for in-depth topic coverage and mock tests. Use weekends for difficult topics requiring concentration rather than routine revision suitable for weekday snippets.

Commute Utilization:

If you commute 30-60 minutes daily, use time for audio revision (record yourself reading key provisions, listen during commute), reading PDF notes on mobile, or quick revision of section numbers and important provisions.

What topics should you prioritise in your preparation?

Prioritize based on exam weightage:

- Companies Act 2013 (35% weightage) must receive maximum attention,

- followed by SEBI LODR Regulations (25%),

- Financial Literacy (20%),

- Corporate Governance (15%), and Case Studies (5%).

Within Companies Act, prioritize Sections 149–150 (independent director definition, databank), Schedule IV (duties and code), Section 164 (disqualifications), Section 166 (general director duties), Section 173 (board meetings), Section 177 (audit committee), and Section 188 (related party transactions). These sections appear most frequently in exam questions.

Don’t neglect low-weightage areas completely—spend proportional time.

For example, if case studies comprise 5% of exam, allocate 5% of preparation time (4-6 hours in 80-hour plan) studying major failures and governance lessons. Skipping low-weightage areas entirely risks losing easy marks.

What study materials are recommended for the exam?

Primary resources should be official statutory documents: Companies Act 2013 (download from www.mca.gov.in), Companies (Appointment and Qualification of Directors) Rules 2014, SEBI LODR Regulations 2015 (download from www.sebi.gov.in), and Schedule IV Code for Independent Directors.

The Independent Director’s Databank provides 42 e-learning modules covering board essentials and governance topics—these modules are included free with your databank registration fee and are specifically designed for exam preparation. Complete these modules systematically as they align directly with exam syllabus.

Supplement official materials with standard reference books: “Corporate Governance: Principles, Policies and Practices” by A.C. Fernando for governance frameworks, “Independent Director’s Handbook” published by ICSI for practical guidance, and “Companies Act 2013 with Rules” by Taxmann or similar publishers for section-by-section explanations.

Mock Tests and Practice Resources

Mock tests serve multiple purposes: identifying knowledge gaps, building time management skills, familiarizing yourself with question styles, and building confidence through repeated successful practice. Never skip mock tests assuming syllabus study alone suffices.

Where can you find official mock tests?

The Independent Director’s Databank portal provides official mock tests candidates can attempt for practice. These mocks mirror actual exam format, question distribution (25 Board Essentials + 25 Board Practices), and difficulty level.

Access mock tests through your databank login after completing registration. Take the first mock test early (after covering 30-40% syllabus) to understand exam format and identify weak areas, even if your score is low. This early reality check prevents overconfidence or misdirected preparation.

Take subsequent mocks after completing syllabus segments—one mock after Companies Act study, another after SEBI regulations study, and final mocks after completing entire syllabus.

Give a gap of 5-7 between mocks allowing time to address identified weaknesses between attempts.

How important are mock tests for exam success?

Mock tests are critical—they’re the bridge between knowledge acquisition and exam performance. Many candidates study diligently but underperform on exam day due to poor time management, unfamiliarity with scenario questions, or exam anxiety.

Mock tests address these performance barriers.

Specifically, mock tests help you:

- develop question-solving speed (can you comfortably attempt 50 questions in 75 minutes?),

- practice scenario-based thinking (Board Practices questions require applying principles to situations, not just recalling facts),

- identify consistently weak areas (certain Companies Act sections, specific financial ratios), and

- build exam-taking confidence through repeated successful practice reducing anxiety.

Target taking 4-6 full-length mock tests before your actual exam attempt.

Your mock scores should progressively improve—if you are consistently scoring below 50% (passing threshold) on mocks after completing syllabus study, delay your actual exam and address foundational gaps rather than hoping for luck on exam day.

What types of questions can you expect?

- Board Essentials questions test direct knowledge: –

Q. Section 149(6)(d) of the Companies Act disqualifies individuals who have been ______ of the company in the preceding _____ years from appointment as independent director.

(a) Employees; 2 years,

(b) Employees; 3 years,

(c) Key Managerial Personnel; 2 years,

(d) Key Managerial Personnel; 3 years.

- Board Practices scenario questions present situations: –

Q. The CFO informs the audit committee that changing revenue recognition policy (legally permissible) will increase reported profits by 20%, helping meet analyst expectations and potentially increasing stock price.

As independent director on audit committee, you should:

(a) Approve immediately as it’s legal,

(b) Request auditor’s opinion on appropriateness,

(c) Reject to maintain conservative accounting,

(d) Approve but demand full disclosure in financial statements.”

- Financial literacy questions test interpretation:

Q. Company shows debt-equity ratio of 3.5:1. Current ratio is 0.8:1. As independent director, your primary concern should be:

(a) High leverage increasing financial risk,

(b) Liquidity issues threatening short-term obligations,

(c) Both leverage and liquidity pose serious concerns,

(d) Ratios are acceptable for infrastructure companies.

- Case study questions assess learning from failures:

“In the Satyam fraud, independent directors failed to detect ₹7,000 crore accounting manipulation. Which governance practice could have prevented this?

(a) Higher independent director sitting fees,

(b) Independent verification of material financials rather than relying solely on management data,

(c) More frequent board meetings,

(d) Mandatory CA qualification for all independent directors.”

How should you analyze your mock test performance?

Don’t just check your score—deep-dive into performance patterns.

Create error analysis tracking:

- Which syllabus areas have highest error rates (Companies Act sections, SEBI regulations, financial ratios, governance principles)?

- Are errors due to knowledge gaps (didn’t know the answer) or careless mistakes (knew but marked wrong option)?

For Board Essentials errors, review related statutory sections and make focused notes.

For Board Practices errors, analyze your decision-making process—did you apply wrong principles, miss critical facts in the scenario, or rush through reading?

Scenario question errors often indicate thinking process issues, not just knowledge gaps.

Track time management: Did you complete all 50 questions comfortably or run short on time? Which question types consume excessive time (long scenario questions)?

If time is consistently tight, practice strategic question sequencing—attempt easier questions first, mark difficult ones for review, use remaining time on marked questions.

Review incorrect answers understanding why wrong options are wrong, not just why right options are right. This negative elimination skill helps on actual exam when you’re unsure—eliminating obviously wrong options improves guessing accuracy on remaining choices.

Which books are best for the exam?

For Companies Act 2013 understanding, use “Taxmann’s Students’ Guide to Companies Act 2013” providing section-wise explanations in accessible language, or “Bloomsbury’s Corporate Laws” by V.K. Agarwal for comprehensive coverage with case law references.

For corporate governance concepts, “Corporate Governance and Business Ethics” by Abe & Batra, or “Corporate Governance Simplified” by Chander & Kumar provide governance frameworks, case study analyses, and ethical decision-making guidance specifically relevant to independent director roles.

For financial literacy basics, “Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports” by Thomas Ittelson, or “Financial Accounting for Management” by Ambrish Gupta provide non-accountants with practical financial statement interpretation skills.

Avoid overly technical books written for CA/CS professionals—those assume accounting/legal expertise you may not possess.

Choose books explicitly targeting independent director aspirants or corporate governance students explaining concepts clearly without assuming specialized background.

Are there official IICA study resources?

Yes, IICA provides 42 e-learning modules through the Independent Director’s Databank covering board essentials (company law, securities law, accounting basics) and board practices (governance principles, case studies, ethical scenarios). These modules are the most relevant preparation resources being created specifically for the proficiency test by the exam-conducting authority.

Access e-learning content through your databank portal login after registration and payment. Modules include video lectures, reading materials, and embedded quizzes testing understanding. Complete all 42 modules systematically—they’re designed as comprehensive exam preparation requiring no supplementary materials for well-educated candidates.

Additionally, IICA occasionally conducts orientation programs and webinars for aspiring independent directors. While not mandatory, these programs provide networking opportunities with practicing independent directors, companies seeking board members, and governance experts offering practical insights beyond textbook knowledge.

Background-Specific Preparation Tips

Your educational and professional background determines your natural strengths and knowledge gaps. Tailored preparation strategies leveraging strengths while systematically addressing gaps optimize your preparation efficiency.

How do legal professionals leverage their backgrounds?

Legal professionals already understand Companies Act structure, statutory interpretation, and SEBI regulatory frameworks—use this foundation to your advantage. Skip elementary company law tutorials and dive directly into independent director-specific provisions (Section 149, 150, Schedule IV).

Your preparation gap lies in financial literacy and accounting. Allocate disproportionate time (40-50% of total preparation) to understanding financial statements, calculating ratios, and interpreting financial data. Take online financial analysis courses or read “Finance for Non-Financial Managers” to build accounting competency quickly.

When studying case studies, analyze them through your legal lens: What governance failures occurred? What legal frameworks existed that could have prevented the failure? How should independent directors have applied statutory duties in Schedule IV or Section 166 to detect problems earlier?

What advantages do commerce graduates have?

Commerce graduates possess financial literacy advantage—you already understand balance sheets, P&L statements, financial ratios, and basic accounting principles.

Use this strength to excel in financial literacy questions requiring minimal additional preparation.

Your gap typically lies in legal provisions—Companies Act sections and SEBI regulations may feel dense and unfamiliar. Dedicate primary preparation time (50-60% of total) to systematically studying relevant Companies Act chapters, SEBI LODR Regulations, and understanding how statutory frameworks govern board functioning.

Create section number flashcards: Front shows “Section 149(6)“, back shows “Definition of independent director including criteria like no material pecuniary relationship, not promoter-related, not employed in preceding 3 years, etc.” Legal professionals memorize provisions naturally; commerce graduates need conscious memorization effort.

How can non-business professionals prepare effectively?

Engineers, scientists, and other technical professionals face steepest learning curves but can absolutely succeed with systematic preparation. Allocate a 60-day timeline minimum rather than attempting 30-day crash preparation—you need time to build foundational business concepts.

- Start with Business Fundamentals: Before diving into Companies Act, understand: What is a company? What are shares? What’s the difference between shareholders and directors? What are board meetings? How do financial statements work? Use IICA’s introductory e-learning modules providing this foundation.

- Learn Financial Literacy First: Understanding financial statements helps you grasp why independent directors need financial oversight competency. Spend 20-30 hours on accounting basics, financial statement reading, and ratio interpretation before tackling Companies Act.

- Relate to Your Technical Background: When studying governance failures, think of them as system failures requiring debugging (your engineering mindset). Satyam fraud involved system failure in financial verification processes. IL&FS involved risk management system failure. Your technical problem-solving skills apply to governance problem-diagnosis.

- Use Visual Learning: Create flowcharts showing board structures, decision trees for conflict of interest scenarios, and mind maps connecting related statutory provisions. Technical professionals often find visual representations easier to grasp than dense statutory text.

How to book a slot for the Exam

After completing preparation and achieving consistent 60-70% scores on mock tests, you a re ready to schedule your actual proficiency test. The booking process is straightforward but requires attention to technical prerequisites ensuring smooth exam experience.

How do you book the exam slot?

Login to your Independent Director’s Databank account at www.independentdirectorsdatabank.in using the credentials created during registration.

Navigate to the “Self-Assessment Test” or “Proficiency Test” section from your dashboard menu.

The system displays available exam slots across two daily time windows ( 2:00 PM and 8:00 PM) for upcoming dates.

Select your preferred date and time slot—availability shows in real-time.

Weekend evening slots often fill quickly due to working professional demand, so book 5-7 days in advance when possible.

Before confirming booking, the system may perform technical readiness check verifying your computer meets minimum requirements (updated browser, functional webcam/microphone, stable internet connection). Complete any prompted system checks before finalizing booking.

After booking confirmation, you receive email confirmation with: scheduled exam date/time, technical requirements checklist, instructions for exam day, and helpline contact for technical issues. Review these instructions carefully—technical failures on exam day due to equipment issues waste your attempt.

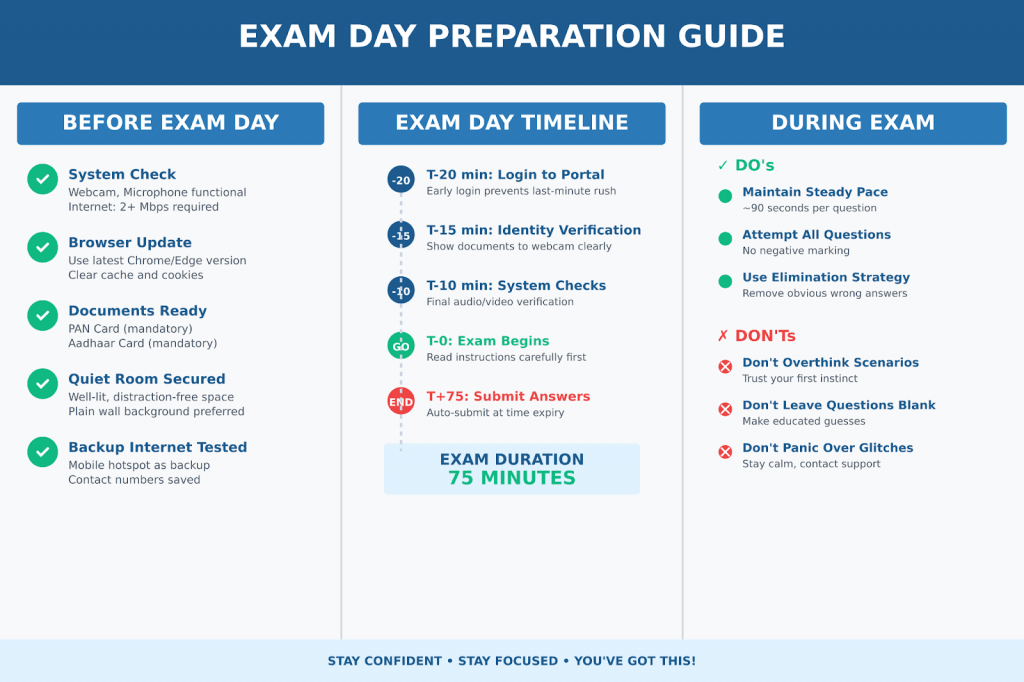

Exam day strategy and tips

Exam day execution matters as much as preparation quality. Many well-prepared candidates underperform due to technical glitches, time management failures, or anxiety-driven mistakes. Following proven exam-day strategies maximizes your performance.

What should you expect on exam day?

Log in to the databank portal 15-20 minutes before your scheduled time—don’t wait until exact start time as pre-exam system checks require several minutes.

The system performs identity verification (showing PAN card and Aadhaar to webcam), equipment testing (webcam, microphone, internet connectivity), and displays exam instructions.

The proctoring system monitors you throughout the 75-minute exam duration via webcam.

You will see your video feed in a corner of the screen. Proctors may observe real-time or review recordings—maintain natural behavior, avoid excessive head turning, and don’t speak aloud as these may trigger suspicious activity alerts.

Once you begin the exam, you cannot pause—the timer runs continuously for 75 minutes. You can review and change answers before final submission but cannot exit and return.

Ensure you have eliminated bathroom needs, secured quiet space, and informed family members not to interrupt during your scheduled slot.

How do you manage time during the exam?

With 50 questions in 75 minutes, you average 1.5 minutes per question—adequate time if you maintain a steady pace without getting stuck on difficult questions. Use strategic question sequencing rather than attempting questions sequentially.

First Pass (40-45 minutes):

Quickly scan all 50 questions, attempting easy ones immediately while marking difficult ones for review. Your goal is securing guaranteed marks from questions you know confidently. This pass should yield 30-35 correct answers.

Second Pass (20-25 minutes):

Tackle marked difficult questions using elimination strategy—cross out obviously wrong options, apply governance principles to scenarios, and make educated guesses. Aim for 10-15 additional correct answers bringing total to 40-50.

Final Review (5-10 minutes):

Verify you’ve attempted every question (remember: no negative marking means blank answers are wasted opportunities). Double-check any flagged questions where you were uncertain, but avoid changing answers impulsively—your first instinct is often correct.

If stuck on a difficult scenario question consuming excessive time, make your best guess and move forward. Don’t sacrifice 3-4 easy questions’ worth of time trying to perfect one difficult question—points are equal regardless of difficulty.

What equipment and setup do you need for the exam?

You need a computer or laptop (not tablet or mobile phone) with webcam and microphone capabilities. Desktop computers require external webcam and microphone. Laptops generally have built-in equipment—test them before exam day ensuring video and audio work.

Internet connection should be stable with minimum 2 Mbps bandwidth. Test your connection speed at speedtest.net—if it’s consistently below 2 Mbps, arrange backup internet (mobile hotspot) in case primary connection fails mid-exam.

Install an updated version of Chrome, Firefox, or Edge browser—outdated browsers may cause compatibility issues. Disable browser extensions and ad-blockers potentially interfering with proctoring software. Clear browser cache before the exam avoiding technical glitches.

Use a clean, well-lit room with white or light-colored wall background minimizing glare and shadows. Ensure adequate lighting on your face from front (desk lamp) avoiding backlit situations where light source behind you creates silhouette effect triggering proctoring alerts.

Keep required documents ready at desk: original PAN card and Aadhaar card for identity verification shown to webcam at exam start. Have technical support helpline number (from booking confirmation email) available in case urgent technical issues arise during the exam.

How do you handle the online proctored environment?

Understand proctoring limitations—the system monitors via webcam but cannot read minds. If you naturally look away while thinking, look up/down rather than side-to-side which appears like you’re reading hidden materials. Minimize head movement focusing on screen.

The proctoring system flags suspicious behaviors: covering/blocking the webcam, looking off-screen repeatedly, multiple persons visible in webcam feed, background noise suggesting someone else is present, leaving your seat, or opening other applications/tabs during the exam.

Avoid behaviors triggering false positives:

- don’t bring phones/tablets into view (leave them in another room),

- don’t have papers on desk (system may flag as cheat sheets),

- don’t talk aloud while thinking (appears like you’re speaking with someone off-camera), and

- don’t leave your chair even briefly.

If technical issues occur mid-exam (internet disconnects, browser crashes, proctoring system malfunctions), note the exact time, take screenshots if possible, and immediately contact the technical helpline number provided in booking confirmation.

What common mistakes should you avoid during the exam?

Overthinking Scenario Questions:

Board Practices scenarios often have multiple defensible answers—choose the MOST appropriate governance response rather than searching for perfect theoretical answer. For instance, when CFO proposes aggressive accounting, the most appropriate first action is requesting auditor opinion, not immediately approving or resigning—independent directors investigate before deciding.

Ignoring the No-Negative-Marking Advantage:

Some candidates leave difficult questions blank preserving time. This wastes potential points—guess strategically even on questions you’re unsure about since wrong answers cost nothing. Eliminate obviously incorrect options, make educated guesses, and capture some points rather than guaranteed zero from blank answers.

Changing Correct Answers During Review:

Unless you distinctly recall making an error, avoid changing answers during final review. Research shows first instincts are often correct—anxiety-driven second-guessing during review frequently changes correct answers to incorrect ones. Only change answers when you’ve identified clear mistakes.

Time Mismanagement on Low-Value Activities:

Don’t spend 5 minutes perfecting one difficult question worth 2 marks while leaving 3 easy questions unattempted also worth 2 marks each. If a question requires excessive time, make best guess and move forward—you can always return during review if time permits.

Panic Over Technical Glitches: Minor webcam freezes, momentary internet lag, or temporary system slowdowns don’t automatically invalidate your exam. Stay calm, wait 10-20 seconds for auto-recovery, and only contact helpline if issues persist beyond 30 seconds. Premature panic wastes exam time and increases anxiety.

Post Exam Process and Certification

After completing the 75-minute proficiency test and clicking final submit, your journey toward independent director eligibility enters its final phase. Understanding what happens next—result declaration, certificate download, validity periods, retake procedures, and ongoing requirements—ensures you complete all necessary steps for active eligibility.

What happens after you pass the Independent Director exam?

Immediately upon completing and submitting the exam, the system auto-grades your responses and displays your result on-screen—you know within seconds whether you passed or need to reattempt. The system shows your total score out of 100 marks and pass/fail status based on the 50% threshold.

If you pass, the system generates your e-certificate instantly accessible for download. Your databank profile status updates from “Registered” to “Qualified,” making you visible to companies searching for independent directors who’ve successfully cleared the proficiency test.

If you score below 50%, the system notifies you of your score and allows booking your next attempt after the mandatory one-day gap. Your result history remains in your databank profile showing all attempt dates and scores—consider reviewing which syllabus areas you scored poorly before reattempting.

How do you download your exam certificate?

After passing the proficiency test, login to your Independent Director’s Databank account and navigate to the “Self-Assessment Test” or “Certificates” section. Your e-certificate displays showing: your name, databank registration number, exam date, score achieved, and certificate issuance date.

Download the certificate as PDF file—save multiple copies on computer, cloud storage, and email to yourself for redundancy. Print physical copies for your records. Companies requesting proof of proficiency test qualification accept this IICA-issued e-certificate as official documentation.

The certificate includes a unique certificate number verifiable by companies on the IICA portal. This verification mechanism prevents certificate forgery—companies can independently confirm your certificate authenticity before finalizing appointments.

How long is your certification valid?

Your proficiency test qualification has lifetime validity—unlike some professional certifications requiring periodic renewal, the Independent Director proficiency test certificate never expires once earned. You remain qualified indefinitely without needing to retake the exam.

However, your databank registration itself requires renewal. While the exact renewal period isn’t perpetual, you must maintain active databank registration to remain eligible for independent director appointments. Check your databank profile for registration expiry date and renewal requirements.

What should you do if you fail the exam?

First, analyze your performance identifying knowledge gaps. Which syllabus areas had most incorrect answers—Companies Act provisions, SEBI regulations, financial literacy, or governance scenarios? Were mistakes due to conceptual misunderstanding or careless reading?

Review incorrect answers understanding why you chose wrong options. For Board Practices scenarios, analyze whether you misapplied governance principles, missed critical facts in scenarios, or made decisions inconsistent with independent director duties under Schedule IV.