One Person Company under Section 2(62) of Companies Act 2013 allows single entrepreneurs to incorporate with limited liability. Complete guide covering OPC registration through SPICe+, 2021 amendments, eligibility criteria, compliance requirements, and conversion procedures.

Table of Contents

One Person Company under Section 2(62) of Companies Act 2013 allows single entrepreneurs to incorporate with limited liability. Complete guide covering OPC registration through SPICe+, 2021 amendments, eligibility criteria, compliance requirements, and conversion procedures.

You’re a talented software developer who’s built a revolutionary app, or a creative consultant landing corporate clients, or a skilled manufacturer ready to scale. You have the vision, the expertise, and the drive to build something extraordinary.

But here’s the catch: you don’t have a co-founder, you don’t want investors breathing down your neck, and you certainly don’t want to drag your spouse or a friend into becoming a “dummy partner” just to tick a regulatory box.

For decades, solo entrepreneurs in India faced this impossible choice until the One Person Company arrived in 2013, fundamentally reimagining entrepreneurship in the country.

The concept of a One Person Company represents one of the most significant innovations in Indian corporate law, enabling solo entrepreneurs to enjoy the benefits of a corporate structure while retaining complete control over their business.

Recommended by the JJ Irani Expert Committee in 2005, this business form was introduced through the Companies Act, 2013 to bridge the gap between the informality of sole proprietorship and the compliance intensity of a private limited company.

For legal professionals, company secretaries, and compliance officers, understanding the nuances of OPC has become essential as more clients seek to formalize their businesses with limited liability protection.

This comprehensive guide covers every aspect of One Person Company, from the statutory framework and eligibility criteria to registration procedures, compliance requirements, and conversion mechanisms.

Whether you are advising a client on choosing the right business structure, handling an OPC incorporation, or managing ongoing compliance, this resource provides the legal precision and practical insights you need to navigate the OPC framework effectively.

Legal Framework of One Person Company

The statutory foundation of a One Person Company rests primarily on Section 2(62) of the Companies Act, 2013, which provides the definitional framework, and the Companies (Incorporation) Rules, 2014, which prescribe the procedural requirements.

Understanding these provisions is fundamental for any legal professional advising clients on OPC formation. The Act treats OPC as a variant of a private company, thereby extending most private company provisions to OPC while carving out specific exemptions to reduce the compliance burden on single member entities.

The regulatory framework recognizes that a solo entrepreneur should not be subjected to the same level of compliance as a company with multiple stakeholders. This philosophy underpins the various exemptions granted to OPC under the Act and Rules.

However, OPC remains subject to core corporate governance requirements, including statutory audit, maintenance of books of account, and filing of annual returns with the Registrar of Companies.

Definition of One Person Company Under Section 2(62) of the Companies Act, 2013

Section 2(62) of the Companies Act, 2013 provides a concise yet comprehensive definition that forms the foundation of the entire OPC framework.

The definition establishes the fundamental characteristic that distinguishes OPC from all other company forms: the presence of only one member. This seemingly simple definition carries significant legal implications that affect everything from incorporation to compliance and eventual conversion.

The Single Member Concept and Its Legal Implications

The phrase “one person as a member” in Section 2(62) of the Companies Act, 2013 establishes that an OPC can have only a single shareholder at any given point in time. This member holds 100% of the company’s share capital and exercises complete control over the company’s affairs.

Unlike a sole proprietorship, however, this single member is distinct from the company itself, as the OPC enjoys separate legal entity status.

The single member structure creates a unique governance dynamic where the traditional checks and balances between shareholders and directors become irrelevant. The sole member can also be the sole director, consolidating ownership and management in one individual.

This consolidation, while offering operational efficiency, also means that all decisions, including those typically requiring shareholder approval, can be made by one person through entries in the minutes book.

The legal implications extend to areas such as related party transactions, where the sole member dealing with the company would technically be transacting with a related party.

However, the Act provides practical accommodations, recognizing that imposing full private company compliance on a single member entity would defeat the purpose of the OPC structure.

Classification as a Private Company Under Section 3(1)(c) of the Companies Act, 2013

Section 3(1)(c) of the Companies Act, 2013 explicitly provides that a One Person Company shall be formed as a private company.

This classification means that OPC inherits the fundamental characteristics of a private company, including restrictions on transferability of shares and prohibition on inviting public deposits, while enjoying additional exemptions designed for single member entities.

Naming Requirements: The Mandatory “(OPC) Private Limited” Suffix

Every One Person Company must include the words “(OPC) Private Limited” at the end of its name, as mandated by Section 4(1) of the Companies Act, 2013 read with Rule 8 of the Companies (Incorporation) Rules, 2014.

This mandatory suffix serves to identify the company’s unique structure to all stakeholders, including creditors, customers, and regulatory authorities, ensuring transparency in commercial dealings.

Key Provisions Governing One Person Company Under the Companies Act, 2013

The Companies Act, 2013 contains numerous provisions that either specifically apply to OPC or from which OPC is exempted. Understanding this regulatory map is essential for compliance planning and advising clients on the practical implications of choosing the OPC structure.

Sections Applicable to OPC Operations

Several provisions of the Companies Act apply to OPC with full force. section 12 requires every OPC to have a registered office capable of receiving communications. section 128 mandates the maintenance of proper books of account, and section 139 requires the appointment of an auditor.

Section 173 governs board meetings, though OPC enjoys relaxations in terms of frequency. The provisions relating to director disqualification under section 164, duties of directors under section 166, and restrictions on loans to directors under section 185 apply to OPC directors as they would to directors of any private company.

The filing requirements under section 92 (annual return) and section 137 (financial statements) apply to OPC, though the forms used are simplified. The penalty provisions apply to OPC, albeit at reduced rates under section 446B.

The provisions relating to investigation, inspection, and winding up apply to OPC without significant modification.

Exemptions Available to OPC Under the Companies Act, 2013

The Act grants several exemptions to OPC, recognizing the impracticality of imposing certain requirements on a single member entity.

Under section 96(1), OPC is exempt from holding an Annual General Meeting, as the concept of a meeting with oneself would be redundant. Section 2(40) of the Companies Act, 2013 exempts OPC from including a cash flow statement in its financial statements, reducing the preparation burden on small entities.

The proviso to section 92(1) allows the annual return of an OPC to be signed by the company secretary or, where there is no company secretary, by the director alone. This exemption acknowledges that most OPCs will not have a full time company secretary.

Section 173(5) provides that OPC with a single director need hold only one board meeting per half of the calendar year, with a minimum gap of 90 days between meetings, instead of the four meetings required for other companies.

Eligibility Criteria and Restrictions for Incorporating a One Person Company

The eligibility framework for OPC is designed to ensure that this structure remains available to genuine solo entrepreneurs while preventing misuse.

The Companies (Incorporation) Rules, 2014 prescribe detailed eligibility criteria for the sole member, the nominee, and the directors. The 2021 amendments significantly liberalized these requirements, particularly regarding residency and NRI eligibility, reflecting the government’s intent to promote entrepreneurship.

Understanding who can and cannot form an OPC is crucial for legal professionals advising clients. A mismatch between client profile and eligibility criteria can lead to application rejection, wasted effort, and potential compliance issues down the line. The restrictions also extend to certain business activities, most notably non banking financial activities.

Eligibility Requirements for the Sole Member

Rule 3 of the Companies (Incorporation) Rules, 2014 lays down the eligibility criteria for the sole member of an OPC. These requirements ensure that the person incorporating an OPC has sufficient connection to India and the legal capacity to enter into contracts. The 2021 amendments introduced significant changes to these requirements, particularly regarding residency.

Indian Citizenship Requirement

Only a natural person who is an Indian citizen can be the sole member of an OPC. This requirement excludes foreign nationals from forming OPCs in India, regardless of their residency status.

The citizenship requirement applies to both the member and the nominee, ensuring that control of the OPC remains with Indian citizens.

Residency Requirement: The 120 Day Rule (Post 2021 Amendment)

Prior to April 1, 2021, the sole member of an OPC was required to have stayed in India for at least 182 days during the immediately preceding financial year. The Companies (Incorporation) Second Amendment Rules, 2021 reduced this requirement to 120 days, making it significantly easier for Indian citizens with international commitments to form OPCs.

This reduction acknowledges the reality of modern business, where entrepreneurs frequently travel internationally or may be based abroad for portions of the year.

The 120 day requirement still ensures a meaningful connection to India while providing flexibility for global Indian entrepreneurs. The days of stay can be cumulative and need not be consecutive, providing additional flexibility.

For compliance purposes, the residency is calculated based on the immediately preceding financial year. An applicant incorporating an OPC in October 2025 would need to demonstrate 120 days of stay in India during FY 2024-25 (April 1, 2024 to March 31, 2025).

Documentary evidence such as passport stamps, travel records, or Aadhaar authentication records may be required to establish residency.

Restriction Under Rule 3(2) of Companies (Incorporation) Rules, 2014 on OPC

Rule 3(2) of the Companies (Incorporation) Rules, 2014 restricts a natural person from being a member in more than one OPC or being a nominee in more than one OPC at any point in time.

This “one person, one OPC” rule prevents the proliferation of shell companies and ensures that the OPC structure is used for genuine business purposes by solo entrepreneurs.

NRI Eligibility for OPC Incorporation: 2021 Amendment

One of the most significant changes brought by the 2021 amendments was opening OPC formation to Non Resident Indians. Prior to this amendment, only Indian citizens resident in India could form OPCs, which excluded a large segment of the Indian diaspora interested in starting businesses in India.

Understanding the February 2021 Amendment

The Companies (Incorporation) Second Amendment Rules, 2021, notified on February 1, 2021 and effective from April 1, 2021, amended Rule 3(1) to allow “a natural person who is an Indian citizen whether resident in India or otherwise” to incorporate an OPC.

This change opened the door for millions of NRIs to establish formal corporate entities in India with limited liability protection.

The amendment aligns with the government’s broader objective of attracting investment and expertise from the Indian diaspora.

Many NRIs had previously been unable to formalize their business interests in India through corporate structures without finding partners or nominees to meet the two member requirement of private companies. The OPC structure, now available to NRIs, provides a simpler path.

However, even for NRI promoted OPCs, the residency requirement of 120 days applies. This means that while an NRI can be the member of an OPC, they must have spent at least 120 days in India during the preceding financial year. This requirement ensures that OPC members maintain a meaningful connection to India and are not entirely absent from the jurisdiction.

Documentation and Compliance for NRI Incorporation

NRIs incorporating OPCs must provide additional documentation to establish their citizenship and identity. A valid Indian passport serves as proof of citizenship.

The passport must be notarized and apostilled or consularized if the NRI is applying from abroad. Address proof from the country of residence, such as a utility bill or bank statement, is required along with overseas address verification.

The Permanent Account Number (PAN) is mandatory for all OPC incorporations, and NRIs must obtain PAN before applying for Director Identification Number.

The RBI regulations regarding repatriation and investment may apply depending on how the NRI funds the OPC’s capital, and legal advice should be sought regarding FEMA compliance for NRI promoted OPCs.

Persons Prohibited from Forming an OPC

The Companies Act and Rules specify certain categories of persons who cannot form or be members of an OPC. These restrictions ensure that OPCs are formed by persons with legal capacity and prevent the structure from being used for prohibited activities.

Minors and Persons Incapacitated by Contract

Rule 3(4) of the Companies (Incorporation) Rules, 2014 explicitly prohibits minors from becoming members or nominees of an OPC or from holding shares with beneficial interest in an OPC.

This restriction applies regardless of whether the minor is represented by a guardian. Persons who are otherwise incapacitated from entering into contracts, such as those of unsound mind, are also prohibited.

Foreign Citizens and Non Natural Persons

Only natural persons who are Indian citizens can be members or nominees of an OPC. This excludes foreign nationals, regardless of their residency status in India. It also excludes artificial persons, meaning that companies, LLPs, trusts, or other entities cannot be members of an OPC.

This requirement ensures that the beneficial ownership of OPCs remains with identifiable Indian individuals.

The exclusion of non natural persons is fundamental to the OPC concept. Unlike a private company where another company can be a shareholder, an OPC must have a human being as its sole member. This requirement facilitates the nominee succession mechanism and ensures clear accountability.

Restriction on NBFC Activities Under 3(6) of Companies (Incorporation) Rules, 2014

Rule 3(6) of the Companies (Incorporation) Rules, 2014 prohibits an OPC from carrying on the business of a Non Banking Financial Institution, including investment in securities of any body corporate.

This restriction prevents OPCs from being used as investment vehicles or shadow banking entities. An OPC cannot be registered with the Reserve Bank of India as an NBFC and cannot engage in activities that would require such registration.

This restriction is significant for clients seeking to establish investment holding structures or provide financial services. Such clients must be advised to incorporate a regular private limited company instead of an OPC.

The restriction applies to the nature of the business, not to incidental investments that an OPC might make as part of its treasury operations.

The Nominee Mechanism: Appointment, Rights, and Succession

The nominee mechanism is perhaps the most distinctive feature of a One Person Company, designed to address the fundamental challenge of business continuity in a single member entity.

Unlike a sole proprietorship, which terminates upon the death of the proprietor, an OPC can continue perpetually through the nominee succession mechanism.

This feature provides stakeholders, including creditors, employees, and customers, with the assurance that the business will not abruptly cease to exist.

The nominee stands ready to step into the shoes of the sole member if certain triggering events occur. The appointment of a nominee is mandatory at the time of incorporation, and the nominee’s details form part of the Memorandum of Association.

Understanding the rights, obligations, and procedures relating to nominees is essential for advising OPC clients on succession planning.

Mandatory Nominee Requirement in One Person Company

The requirement to appoint a nominee is not optional for an OPC. Rule 4 of the Companies (Incorporation) Rules, 2014 mandates that the memorandum of every OPC shall indicate the name of a person who shall become the member in the event of the original member’s death or incapacity. This requirement is integral to the OPC concept and cannot be waived.

Ensuring Perpetual Succession in a Single Member Structure

The nominee mechanism ensures that the OPC continues to exist even when its sole member cannot continue. In a regular private company, the death of a shareholder results in transmission of shares to legal heirs through the probate process, but the company continues with other members. An OPC, having only one member, would face dissolution without a succession mechanism.

Statutory Basis Under Rule 4 of the Companies (Incorporation) Rules, 2014

Rule 4(1) of the Companies (Incorporation) Rules, 2014 requires the memorandum of an OPC to indicate the name of a person who shall become the member in case of the subscriber’s death or incapacity to contract. The nominee must give prior written consent in Form INC-3, which must be filed with the Registrar at the time of incorporation. This consent establishes the nominee’s awareness and acceptance of the potential responsibility.

Rule 4(2) of the Companies (Incorporation) Rules, 2014 provides that the member may change the nominee at any time by giving notice to the company and the nominee, followed by intimation to the Registrar. This flexibility allows the member to revise succession plans as circumstances change, whether due to relationship changes, the nominee’s relocation, or other factors.

Difference between Member and Nominee

The distinction between member and nominee is crucial for understanding OPC governance.

The member is the actual shareholder who owns 100% of the company and exercises all shareholder rights, including voting, receiving dividends, and participating in the company’s profits.

The nominee, in contrast, has no current rights in the company but stands ready to become the member upon the occurrence of a triggering event.

Appointment and Change of Nominee

The appointment of a nominee occurs at the time of incorporation and must follow prescribed procedures. The nominee must meet specific eligibility criteria and must provide informed consent to the appointment.

The procedures for changing nominees during the company’s existence are designed to ensure that the Registrar’s records remain current.

Form INC 3: Obtaining Nominee Consent

Form INC-3 is the prescribed format for obtaining the nominee’s consent. This form must be signed by the proposed nominee and attached to the SPICe+ incorporation application.

The form contains declarations by the nominee acknowledging their understanding of the responsibilities that may arise.

The form requires the nominee’s name, address, PAN, and other identification details. The nominee must declare that they consent to being nominated and that they are not already a nominee in another OPC.

The form must be digitally signed using the nominee’s Digital Signature Certificate or signed physically and uploaded as an attachment.

Eligibility Criteria for Nominee

The nominee must meet the same eligibility criteria as the member: they must be a natural person who is an Indian citizen, whether resident in India or otherwise. Minors cannot be nominees, nor can persons incapacitated from contracting.

A person who is already a nominee in another OPC cannot be nominated as a nominee in a second OPC.

Procedure for Changing Nominee During the Company’s Existence

The member of an OPC may change the nominee at any time during the company’s existence. The procedure involves obtaining consent from the new nominee in Form INC-3, giving notice to the existing nominee, and filing Form INC-4 with the Registrar to intimate the change. The change becomes effective upon filing with the Registrar.

The reasons for changing a nominee may include the original nominee’s death, the nominee becoming a member of another OPC, relationship changes, or simply the member’s preference to have a different person as successor.

The flexibility to change nominees ensures that succession planning remains current and effective.

Intimation Requirements to the Registrar

Upon any change in nominee, the member must file Form INC-4 with the Registrar within 30 days of the change, along with the new nominee’s consent in Form INC-3.

Failure to file within the prescribed time attracts additional fees and may result in penalties. The Registrar updates the company’s master data to reflect the new nominee.

Succession Mechanism Upon Death or Incapacity of Sole Member

The succession mechanism is triggered by specific events that render the sole member unable to continue in that role. Understanding these triggering events and the procedures that follow is essential for nominees and for legal professionals advising OPC clients on succession planning.

Triggering Events: Death, Incapacity, and Inability to Contract

The succession mechanism is triggered upon the death of the sole member or upon the member becoming incapacitated or unable to contract.

Death is a clear triggering event, evidenced by a death certificate. Incapacity may include mental incapacity, severe illness, or any condition that renders the member unable to manage their affairs.

The Act does not provide a detailed definition of “incapacity to contract,” leaving room for interpretation.

Generally, any condition that would vitiate a person’s capacity to enter into valid contracts under the Indian Contract Act,1872, would constitute incapacity for OPC succession purposes. Legal professionals should advise clients to include clear provisions in the Articles of Association regarding the determination of incapacity.

Transmission of Membership to the Nominee

Upon the occurrence of a triggering event, the nominee becomes entitled to all the shares of the deceased or incapacitated member. The transmission occurs by operation of law, without the need for a transfer instrument.

However, procedural formalities must be completed to update the company’s records and the Registrar’s records.

The nominee must file Form INC-4 with the Registrar, along with proof of the triggering event (such as a death certificate) and their own KYC documents.

The company must update its register of members to reflect the nominee as the new member. Upon completion of these formalities, the nominee steps into all the rights and obligations of the original member.

Nominee’s Obligation to Appoint New Nominee Within 15 Days

Upon becoming the member of an OPC, the former nominee (now member) must nominate another person as nominee within 15 days.

This requirement ensures that the succession mechanism remains in place for future contingencies. The new member files Form INC-3 containing the new nominee’s consent along with Form INC-4.

Can the Nominee Refuse Membership?

Yes, the nominee has the right to refuse to become the member upon the occurrence of a triggering event. If the nominee refuses, the legal representatives of the deceased member (or the incapacitated member’s guardians) must either find a new member or initiate proceedings for winding up the company.

The nominee’s refusal does not automatically result in dissolution, but the company cannot continue indefinitely without a member.

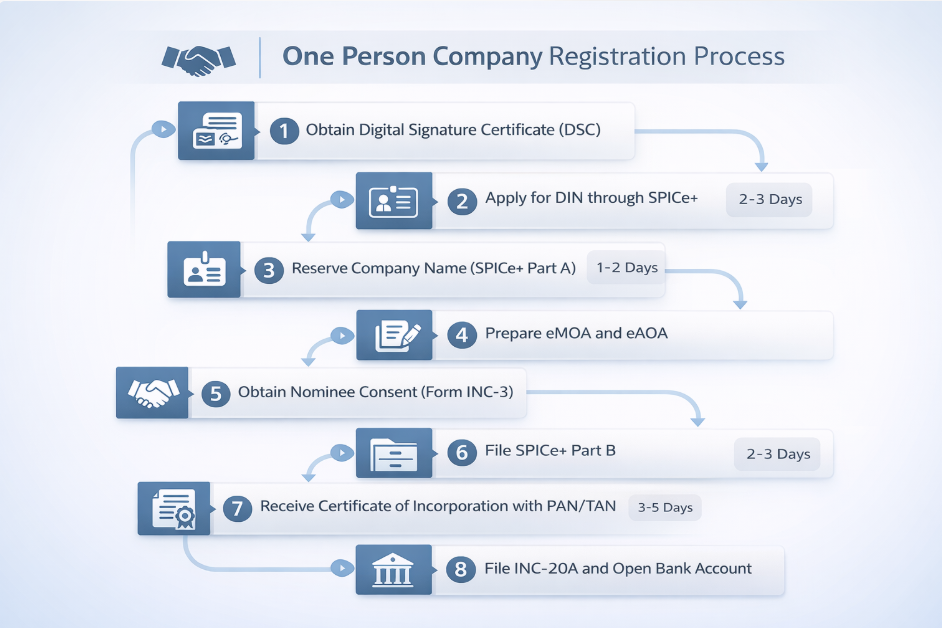

Step by Step One Person Company Registration Through SPICe+ Form

The registration of a One Person Company is conducted entirely online through the Ministry of Corporate Affairs’ SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form. This integrated form allows applicants to reserve a name, incorporate the company, obtain PAN and TAN, and register for EPFO and ESIC in a single application.

The process has been streamlined to reduce incorporation time and eliminate the need for multiple applications.

The Central Registration Centre (CRC) at Manesar processes all OPC incorporation applications, ensuring consistency in processing and faster turnaround times.

Understanding the step by step process, document requirements, and potential pitfalls is essential for professionals handling OPC incorporations.

Pre Incorporation Requirements and Document Checklist

Before filing the SPICe+ form, several prerequisites must be completed and documents assembled. The quality and completeness of documentation directly impacts the processing time and likelihood of first time approval.

Digital Signature Certificate (DSC): Application and Recent Cost Changes

A Class 3 Digital Signature Certificate is mandatory for the proposed director to sign the incorporation forms electronically. The DSC must be obtained from a licensed Certifying Authority authorized by the Controller of Certifying Authorities.

The application requires identity proof (PAN and Aadhaar), address proof, and a photograph.

Effective July 15, 2024, DSC charges increased by approximately Rs.1,000 per certificate due to stricter identity verification standards mandated by the CCA. Current DSC costs range from Rs.2,000 to Rs.3,000 depending on the Certifying Authority and validity period. The DSC is valid for one to three years and must be renewed before expiry to continue signing e-forms.

Director Identification Number (DIN) Through SPICe+

The Director Identification Number is a unique identification number assigned to every director. For new directors, DIN is obtained through the SPICe+ form itself, eliminating the need for a separate Form DIR-3 application. Up to three directors can apply for DIN through a single SPICe+ application.

The DIN application requires the proposed director’s PAN, Aadhaar, mobile number, and email address.

The system verifies PAN details with the Income Tax database and Aadhaar details with UIDAI. Any mismatch between PAN and Aadhaar details (such as name spelling variations) can cause rejection.

Identity, Address, and Registered Office Documentation

The following documents are required for the proposed director and nominee: PAN card (mandatory), Aadhaar card (for identity and address verification), passport size photograph, and latest utility bill or bank statement as address proof (not older than 60 days).

For the registered office, a recent utility bill, rent agreement (if rented), and No Objection Certificate from the property owner are required.

All documents must be self attested and submitted as clear, legible scans. Document quality issues are a common cause of resubmission requests. The registered office must be capable of receiving official communications and must have a verifiable physical address.

Filing SPICe+ Part A: Name Reservation

The name reservation process is the first step in OPC incorporation. The proposed name must be unique, not resemble any existing company or trademark, and comply with the naming guidelines prescribed under Rule 8 of the Companies (Incorporation) Rules, 2014.

Naming Guidelines Under Rule 8 of the Companies (Incorporation) Rules, 2014

The company name must not be identical or too similar to an existing company’s name or a registered trademark. It must not contain words that require government approval (such as “National,” “Central,” or “Bharat”) unless such approval is obtained. The name must not be offensive, vulgar, or contrary to public policy.

For an OPC, the name must end with “(OPC) Private Limited.” The name can include the member’s surname or a descriptive word indicating the nature of business. Imaginative or coined names are also permissible, provided they are not misleading.

RUN (Reserve Unique Name) Process

Applicants can use the RUN (Reserve Unique Name) web service for standalone name reservation before filing SPICe+, or they can reserve the name through SPICe+ Part A. The RUN service allows two name choices, while SPICe+ Part A allows only one proposed name.

The name reservation fee is Rs.1,000 through RUN, which is deducted if the same name is used in a subsequent incorporation application. The reserved name remains valid for 20 days from approval, within which the incorporation application must be filed.

Central Registration Centre (CRC) Processing Timeline

All name reservation and incorporation applications are processed by the Central Registration Centre at Manesar. The CRC typically processes name reservations within 1 to 2 business days.

Incorporation applications are processed within 2 to 3 business days if all documents are in order. Complex cases or applications requiring clarification may take longer.

Filing SPICe+ Part B: Incorporation Application

SPICe+ Part B is the comprehensive incorporation form that captures all details required to incorporate the company and obtain various registrations.

This integrated approach significantly reduces the time and effort required compared to the earlier process of filing multiple applications.

Preparing eMemorandum of Association (eMOA) for OPC

The eMemorandum of Association is filed as part of SPICe+ using the linked Form INC-33.

The eMOA contains the company’s name, registered office state, objects for which the company is proposed to be incorporated, the subscriber’s details, the nominee’s details, and the authorized capital. The objects clause should be carefully drafted to cover all intended business activities.

Preparing eArticles of Association (eAOA) for OPC

The eArticles of Association are filed using the linked Form INC-34. The eAOA contains the internal governance rules for the company.

For OPCs, standard Table F of Schedule I to the Companies Act applies, with modifications to accommodate the single member structure. Custom provisions regarding nominee succession, decision making procedures, and director powers may be incorporated.

Integrated Services: PAN, TAN, EPFO, ESIC Registration

SPICe+ integrates applications for Permanent Account Number (PAN), Tax Deduction Account Number (TAN), EPFO registration, and ESIC registration.

The PAN and TAN are automatically applied for through SPICe+ and are issued along with the Certificate of Incorporation. EPFO and ESIC registrations are optional and should be selected if the company intends to have employees.

Form INC-9 and DIR-2: Declarations and Consents

Form INC-9 is a declaration by the subscriber and first director(s) confirming compliance with the incorporation requirements and declaring that they are not disqualified from acting as directors.

Form DIR-2 is the consent of the proposed director(s) to act in that capacity. Both forms are linked to SPICe+ and must be digitally signed.

Post Approval: Certificate of Incorporation and Next Steps

Upon approval of the SPICe+ application by the CRC, the Registrar issues the Certificate of Incorporation containing the company’s Corporate Identity Number (CIN), PAN, and TAN.

This certificate is conclusive evidence of the company’s incorporation and the date from which the company comes into existence.

Understanding the Certificate of Incorporation

The Certificate of Incorporation is a digital certificate issued via email to the registered email address. It contains the company name, CIN, date of incorporation, PAN, TAN, and other details.

The CIN is a 21 digit alphanumeric code that uniquely identifies the company across all government databases.

Commencement of Business Declaration (Form INC-20A)

Within 180 days of incorporation, the company must file Form INC-20A declaring that every subscriber to the memorandum has paid the value of shares agreed to be taken by them.

This declaration must be filed before the company commences any business operations. Failure to file INC-20A within 180 days can result in the company being struck off and the directors being penalized.

Opening a Current Bank Account for the OPC

After obtaining the Certificate of Incorporation, the company must open a current bank account in its name.

The documents required include the Certificate of Incorporation, PAN card, MOA and AOA, board resolution for opening the account, and KYC documents of the authorized signatories. Most banks require the INC-20A to be filed before or shortly after opening the account.

OPC Registration Timeline and Costs

Understanding the costs and timelines involved in OPC registration helps clients budget appropriately and plan their business launch. The costs include government fees, professional charges, and incidental expenses.

Government Fees Structure

The government fees for OPC registration depend on the authorized capital. For authorized capital up to Rs.15 lakhs, the fee is Rs.2,000 for incorporation plus Rs.500 for name reservation.

Stamp duty varies by state and can range from Rs.1,000 to Rs.5,000 depending on the authorized capital and state of incorporation. The total government fees typically range from Rs.3,000 to Rs.8,000.

Professional Charges and Service Fees

Professional charges for handling OPC incorporation vary based on the service provider and complexity. Costs typically include DSC charges (Rs.2,000-3,000), professional fees for preparation and filing (Rs.5,000 to 15,000), and miscellaneous expenses.

The total cost of OPC registration, including all fees, typically ranges from Rs.10,000 to Rs. 25,000.

Expected Processing Time

The entire OPC incorporation process, from DSC application to receiving the Certificate of Incorporation, typically takes 7 to 15 days. DSC and DIN can be obtained in 1to 2 days, name reservation takes 1 to 2 days, and the incorporation application is processed within 2 to 5 days, subject to document quality and CRC workload.

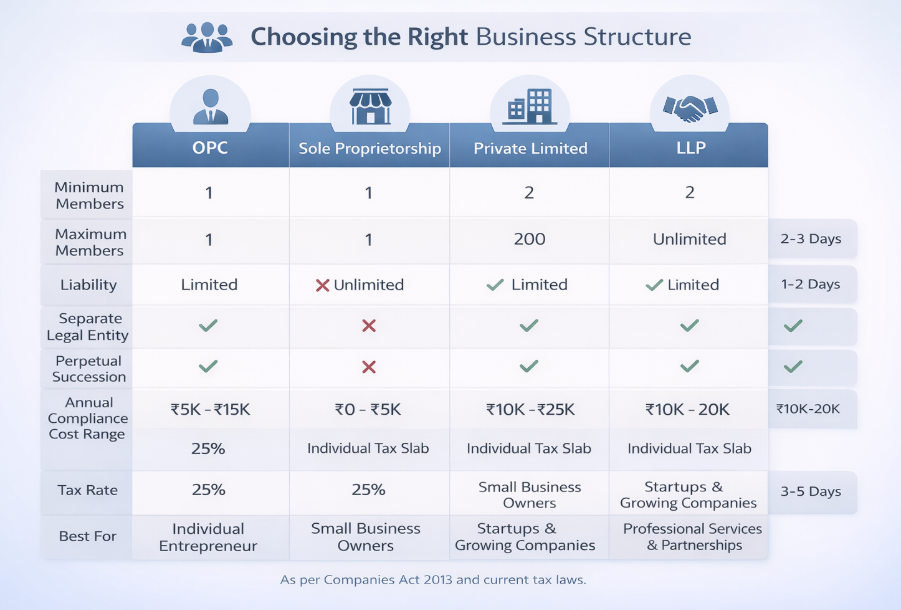

OPC vs Other Business Structures: Making the Right Choice

Choosing the right business structure is one of the most important decisions an entrepreneur makes. The choice affects liability exposure, compliance burden, tax treatment, fundraising ability, and exit options.

Legal professionals must be able to guide clients through this decision by comparing OPC with alternative structures.

This section provides a detailed comparison of OPC with sole proprietorship, private limited company, and Limited Liability Partnership, highlighting the key considerations for each scenario.

OPC vs Sole Proprietorship: Key Distinctions

Sole proprietorship has traditionally been the default choice for individual entrepreneurs due to its simplicity.

However, OPC offers several advantages that make it worth considering despite the additional compliance requirements.

Limited Liability vs Unlimited Liability

In a sole proprietorship, the proprietor bears unlimited personal liability for all business debts and obligations. Creditors can pursue the proprietor’s personal assets, including home, savings, and other property, to satisfy business debts. This exposure can be devastating in case of business failure or liability claims.

An OPC provides limited liability protection, meaning the member’s liability is limited to the unpaid amount on shares held. Personal assets remain protected from business creditors, subject to exceptions for fraud or wrongful trading. This protection is particularly valuable for businesses with significant operational risks or credit exposure.

Separate Legal Entity vs Personal Identity

A sole proprietorship has no separate legal identity from its proprietor. Contracts are signed by the proprietor personally, assets are owned in the proprietor’s name, and litigation is in the proprietor’s name. This creates practical challenges in establishing business identity and credibility.

An OPC is a separate legal entity capable of owning assets, entering contracts, and suing or being sued in its own name. This separation enhances business credibility, facilitates dealings with vendors and customers, and provides a clear distinction between personal and business affairs.

Perpetual Succession vs Dissolution on Death

A sole proprietorship terminates upon the death of the proprietor. While the business assets may pass to heirs, the business relationships, contracts, and goodwill may be disrupted. Customers, suppliers, and employees face uncertainty.

An OPC enjoys perpetual succession through the nominee mechanism. Upon the member’s death, the nominee steps in to continue the business without interruption. This continuity protects stakeholder interests and preserves the going concern value of the business.

Compliance Burden and Cost Comparison

Sole proprietorship has minimal compliance requirements: no registration with ROC, no mandatory audit below certain thresholds, and simplified tax filing. The annual compliance cost is minimal, primarily consisting of income tax return filing.

An OPC has moderate compliance requirements: annual filing of financial statements and returns with ROC, mandatory statutory audit, maintenance of registers and minutes, and compliance with Companies Act provisions.

The annual compliance cost ranges from Rs.15,000 to Rs. 30,000, depending on auditor fees and professional charges. This additional cost is the price of limited liability and corporate structure.

OPC vs Private Limited Company: Comparative Analysis

For entrepreneurs who want a corporate structure, the choice between OPC and private limited company depends on factors such as the number of promoters, growth plans, and compliance capacity.

Member and Director Requirements

A private limited company requires at least two members and two directors, while an OPC requires only one member and one director (who can be the same person).

For solo entrepreneurs, the OPC structure eliminates the need to find a co-founder or sleeping partner purely to meet incorporation requirements.

The maximum number of directors in both structures is 15, so an OPC can appoint additional directors as the business grows without converting to a private company. However, the membership must remain single in an OPC.

Compliance Exemptions Unique to OPC

OPC enjoys several compliance exemptions not available to private limited companies. These include exemption from AGM, requirement of only two board meetings per year (instead of four), exemption from cash flow statement in financial statements, and reduced penalties under section 446B of the Companies Act. These exemptions translate to lower compliance costs and reduced administrative burden.

Private limited companies must comply with full private company requirements, including four board meetings per year, AGM within six months of financial year end, and detailed financial statements including cash flow. The compliance cost for a private company is typically higher than for an OPC.

Fundraising and Investor Considerations

OPC faces limitations in fundraising because it can have only one member. Equity investment from external investors would require conversion to a private limited company. Angel investors and venture capital funds typically prefer investing in private limited companies with standard governance structures.

Private limited companies can have up to 200 members, making equity fundraising feasible. Multiple share classes, investor rights agreements, and standard corporate governance structures are easily accommodated. For businesses with significant growth potential requiring external funding, a private limited company may be more appropriate from inception.

OPC vs Limited Liability Partnership (LLP): A Comparative Analysis

Limited Liability Partnership is another popular structure for small businesses, offering limited liability with partnership style flexibility. Comparing OPC with LLP helps clients understand which structure better suits their needs.

Ownership Structure and Control

An OPC is owned by a single member who holds 100% equity. Decision making is concentrated in one person, providing complete autonomy but also placing the entire responsibility on the sole member.

An LLP requires at least two partners, making it unsuitable for truly solo entrepreneurs. However, for businesses with two or more promoters, LLP offers flexibility in profit sharing, management rights, and internal governance that may not be available in a company structure.

Taxation Differences

Both OPC and LLP are subject to flat rate taxation. OPCs are taxed at 22% under section 115BAA of the Income Tax Act (plus surcharge and cess, effective rate approximately 25.17%) or at 30% under the regular regime. LLPs are taxed at 30% flat rate with no section 115BAA of the Income Tax Act benefit, plus surcharge and cess.

A significant difference is that LLP profits distributed to partners are not subject to additional tax (no dividend distribution tax equivalent), while dividends from OPC are taxed in the hands of shareholders. However, with the abolition of dividend distribution tax and the shift to taxing dividends in shareholders’ hands, this difference has narrowed.

Conversion Flexibility

An OPC can be converted to a private limited company easily by increasing the number of members and directors and filing the appropriate forms. The reverse conversion (private limited to OPC) is also permitted since the 2021 amendments.

An OPC cannot be directly converted to an LLP. The company would need to first convert to a private limited company under section 366 of the Companies Act, which then may convert to LLP under the LLP Act. This multi step process makes direct comparison of conversion flexibility difficult.

Annual Compliance Requirements and Exemptions for One Person Company

Compliance is an ongoing responsibility for every OPC, and failure to comply can result in penalties, prosecution, and even striking off.

While OPC enjoys several exemptions compared to regular private companies, certain core compliances cannot be avoided. Legal professionals advising OPC clients must ensure that a robust compliance calendar is maintained.

This section covers the complete compliance framework for OPC, including the 2024-2025 filing calendar, available exemptions, mandatory compliances, and consequences of non-compliance.

Annual Compliance Calendar for FY 2024-2025

The annual compliance cycle for OPC follows the financial year (April 1 to March 31). The key filings and their due dates for FY 2024-2025 are outlined below.

Form AOC-4: Financial Statements Filing

Every OPC must file its financial statements with the Registrar in Form AOC-4 within 180 days from the close of the financial year. For FY 2024-2025 (year ending March 31, 2025), the due date for Form AOC-4 is September 27, 2025.

However, the MCA has extended this deadline to December 31, 2025 through General Circular for companies.

Form AOC-4 contains the audited balance sheet, profit and loss statement (cash flow statement is exempt for OPC), and directors’ report. The form must be certified by a Chartered Accountant and digitally signed by the director.

The financial statements must be prepared in accordance with Schedule III of the Companies Act and applicable Accounting Standards under section 133 of the Companies Act.

Form MGT-7A: Simplified Annual Return for OPC

OPCs file the simplified annual return in Form MGT-7A instead of the detailed Form MGT-7 required for other companies. MGT-7A must be filed within 60 days from the close of the financial year or the date of AGM, whichever is later.

Since OPCs are exempt from AGM, the due date is calculated as 60 days from 180 days after the financial year end, effectively making it November 26, 2025 for FY 2024-2025 (extended to December 31, 2025).

Form MGT-7A contains summarized information about shareholding, directors, and compliance status. It is simpler than MGT-7 and designed for small companies and OPCs.

DIR-3 KYC: Director’s Annual Verification

Every director of an OPC must complete DIR-3 KYC by September 30 each year. For FY 2024-2025, the due date is September 30, 2025.

Directors who have already filed DIR-3 KYC in the previous year and have no changes to their details can use the web-based KYC service (DIR-3 KYC WEB) instead of filing the full e-form.

Form ADT-1: Auditor Appointment (If Applicable)

If the OPC appoints a new auditor or the existing auditor’s term ends, Form ADT-1 must be filed within 15 days of the appointment.

The first auditor is typically appointed by the board within 30 days of incorporation and need not file ADT-1. Subsequent auditor appointments require ADT-1 filing.

Form DPT-3: Return of Deposits

If the OPC has received any deposits or loans that fall within the deposit definition under the Companies (Acceptance of Deposits) Rules, 2014, it must file Form DPT-3 by June 30 each year.

Most OPCs receiving loans from the sole member or their relatives are exempt from deposit regulations, but the exemption must be properly structured.

Compliance Exemptions Available to OPC

The Companies Act provides several exemptions to OPC, recognizing that imposing full private company compliance on a single member entity would be disproportionate.

Exemption from Annual General Meeting (Section 96)

Section 96(1) of the Companies Act exempts OPC from holding an Annual General Meeting. The concept of a meeting with a single member would be redundant, and the Act recognizes this reality.

However, the sole member must still approve the financial statements and may do so through written resolution entered in the minutes book.

Relaxed Board Meeting Requirements

Under section 173(5) of the Companies Act, an OPC with a single director need hold only one board meeting in each half of the calendar year, with a minimum gap of 90 days between meetings. This means only two board meetings per year are required, compared to four for other companies. If the OPC has multiple directors, the same relaxation applies.

The board meeting must be properly minuted, with decisions recorded in the minutes book maintained under section 118 of the Companies Act. Even informal decisions should be formalized through board minutes for corporate governance purposes.

Simplified Financial Statement Requirements

OPCs enjoy simplified financial statement requirements. The financial statements need only be signed by the director, without requiring company secretary attestation. The level of detail in disclosures may be reduced compared to larger companies, though the core requirements of Schedule III apply.

Exemption from Cash Flow Statement Under Section 2(40) of Companies Act, 2013

Section 2(40) of the Companies Act defines “financial statement” and specifically excludes cash flow statement from the financial statements of an OPC. This exemption reduces the preparation burden on OPCs and their auditors. The balance sheet and profit and loss statement are sufficient.

Reduced Penalty Provisions Under Section 446B of Companies Act, 2013

Section 446B of the Companies Act provides that for OPCs, small companies, and one person companies, the penalties for violations shall be half of the penalty specified for such violations. This recognition of the limited capacity of small entities translates to meaningful cost savings in case of inadvertent non compliance.

Mandatory Compliance That OPC Cannot Avoid

Despite the exemptions, certain core compliances apply to OPC with full force. Non compliance with these requirements can result in penalties and legal consequences.

Statutory Audit Requirement

Every OPC must have its financial statements audited by a Chartered Accountant, regardless of turnover or capital. There is no threshold based exemption for OPCs as exists for sole proprietorships.

The auditor must be appointed within 30 days of incorporation and must audit the accounts for each financial year.

The auditor’s report must be attached to Form AOC-4 when filing financial statements. The auditor must be independent and must comply with the auditing standards prescribed by ICAI. The audit ensures credibility of financial statements and protects stakeholders.

Maintenance of Books of Account Under Section 128 of the Companies Act, 2013

Section 128 of the Companies Act requires every company, including OPC, to maintain proper books of account on an accrual basis. The books must give a true and fair view of the company’s affairs and must be kept at the registered office or such other place as the board may decide (with intimation to the Registrar).

The books must be maintained for eight years from the end of the relevant financial year. Failure to maintain proper books can result in penalties and adverse audit qualifications. For OPCs, maintaining organized accounting records from inception is essential.

Statutory Registers and Minutes Book Under Section 118 of the Companies Act, 2013

An OPC must maintain various statutory registers including the register of members, register of directors, and minutes book. Section 118 of the Companies Act requires minutes of all board meetings and resolutions passed by the member to be maintained in a bound minutes book.

Even though an OPC may have limited activity, proper minute keeping is essential for corporate governance.

Decisions regarding contracts, bank accounts, compliance matters, and other business affairs should be recorded through board resolutions or member resolutions as appropriate.

Income Tax Return Filing

Every OPC must file its income tax return by September 30 of the assessment year (for the preceding financial year). For FY 2024-2025, the income tax return due date is September 30, 2025.

OPCs must file Form ITR-6 and must get their accounts audited under section 44AB of the Income Tax Act (since statutory audit under Companies Act satisfies this requirement).

GST Registration and Return Filing (If Applicable)

If the OPC’s turnover exceeds the GST threshold (currently Rs. 40 lakhs for goods and Rs. 20 lakhs for services in most states) or if it engages in interstate supply, GST registration is mandatory.

The threshold for special category states is Rs. 20 lakhs for goods and Rs. 10 lakhs for services.

Once registered, the OPC must file GST returns as applicable (GSTR-1, GSTR-3B, and annual return GSTR-9). The compliance burden includes maintaining GST compliant invoices, reconciling input tax credit, and filing returns by prescribed due dates.

Many OPCs prefer to remain below the threshold initially to avoid GST compliance.

Penalties for Non-Compliance: What OPC Owners Must Know

Non-compliance with statutory requirements attracts penalties, and persistent default can lead to prosecution and striking off. OPC owners must understand the consequences to appreciate the importance of timely compliance.

Additional Fees for Late Filing

Late filing of forms with the ROC attracts additional fees calculated on a daily basis. For Form AOC-4 and MGT-7A, the additional fee is Rs. 100 per day of delay. Over months of delay, this can accumulate to significant amounts. The MCA portal automatically calculates and collects additional fees at the time of filing.

Prosecution Provisions

In addition to additional fees, the Companies Act provides for prosecution of the company and its officers in default for various non-compliances. Section 137 of the Companies Act (failure to file financial statements) and section 92 of the Companies Act (failure to file annual return) provide for penalties extending to several lakhs of rupees. Directors can also be personally liable.

Striking Off for Persistent Default

If an OPC fails to file annual returns for two or more consecutive years, the Registrar may initiate action to strike off the company under section 248 of the Companies Act. A struck off company ceases to exist, and its assets vest in the government. The directors become disqualified from being appointed as directors in other companies for five years.

Revival of a struck off company is possible through an appeal to the NCLT, but the process is expensive and time consuming. Preventing strike off through timely compliance is far preferable to revival proceedings.

Conversion of One Person Company: To and From Other Company Types

The ability to convert between company types provides flexibility as business circumstances evolve. The 2021 amendments significantly liberalized the conversion provisions for OPC, removing the mandatory conversion thresholds and the two-year waiting period. This section covers the conversion procedures in both directions.

Converting OPC to Private Limited Company

An OPC may voluntarily convert to a private limited company when it wishes to admit additional members, raise external equity, or simply upgrade its corporate structure. The conversion involves increasing the number of members and directors and filing appropriate forms with the ROC.

When Should an OPC Consider Conversion?

Conversion should be considered when the sole member wishes to bring in partners or co-founders, when external investors express interest in investing equity, when the business scale requires a more robust governance structure, or when the member simply prefers the private limited structure for credibility or legacy reasons.

Since the 2021 amendments removed the mandatory conversion thresholds, conversion is now entirely voluntary. An OPC can grow to any size (in terms of capital or turnover) without being forced to convert. This provides significant flexibility for business planning.

Step by Step Conversion Procedure

The conversion procedure involves: (1) obtaining consent from the proposed new members, (2) holding a board meeting to consider and approve the conversion, (3) passing a special resolution for alteration of MOA and AOA, (4) issuing new shares to additional members, (5) altering the MOA to remove nominee provisions and change the name to remove “(OPC)”, (6) altering the AOA to accommodate multiple members, and (7) filing the required forms with the ROC.

Form INC-6 and Required Attachments

Form INC-6 is the application for conversion of OPC to private limited company. The form must be filed within 60 days of the special resolution approving the conversion. Attachments include the altered MOA and AOA, board resolution, special resolution (in Form MGT-14), NOC from creditors if any debts are outstanding, and a list of the new members and directors.

Increasing Membership and Appointing Additional Directors

The conversion requires increasing the number of members from one to at least two. This is done by issuing new shares to additional persons who subscribe to the shares and pay the consideration. The allotment is recorded in the register of members, and Form PAS-3 (Return of Allotment) is filed.

Additional directors (at least one more to meet the minimum of two) must be appointed through board resolution. Their consent in Form DIR-2 and DIN applications (if new directors) must be filed.

Alteration of MOA and AOA

The MOA must be altered to remove the nominee clause (which becomes irrelevant in a multi-member company), change the company name to remove “(OPC)”, and update the subscriber sheet to reflect new members. The AOA must be altered to accommodate governance by multiple members and directors.

Form MGT-14: Filing Special Resolution

Form MGT-14 must be filed within 30 days of passing the special resolution for conversion. The form contains details of the resolution and must be accompanied by the certified copy of the resolution. This filing ensures the resolution is part of the public record.

Converting Private Limited Company to OPC

The 2021 amendments enabled private limited companies to convert to OPC regardless of their paid up capital or turnover. This reverse conversion may be attractive for companies where all but one member have exited or where simplified governance is desired.

Eligibility and Prerequisites

To convert to OPC, the private limited company must ensure that only one member will remain after conversion, the remaining member meets OPC eligibility criteria (Indian citizen, natural person), and a nominee is appointed. The company must not be engaged in NBFC activities and must not be a section 8 company.

Share Transfer and Member Reduction Process

The conversion requires reducing the number of members to one. This is achieved by transferring shares from other members to the remaining member or by buying back shares (subject to buyback restrictions). The share transfers must be properly documented with share transfer forms and board resolutions.

Obtaining NOC from Members and Creditors

No objection certificates must be obtained from all members whose membership is being terminated and from secured creditors if any. These NOCs are attached to the conversion application and demonstrate that affected parties consent to the conversion.

Filing Requirements with ROC

The conversion requires filing Form INC-6 with the ROC, along with altered MOA and AOA (including nominee provisions), list of members and directors post-conversion, NOCs from members and creditors, and board and member resolutions approving the conversion.

Form INC-6 for Private Limited to OPC Conversion

Form INC-6 serves for both OPC to private limited and private limited to OPC conversions. The form captures the nature of conversion, details of the applicant company, and attachments as prescribed. The filing fee is calculated based on the company’s authorized capital.

Restrictions on OPC Conversion

Certain conversions are prohibited for OPC under the Companies Act and Rules.

Prohibition on Conversion to Section 8 Company

An OPC cannot be converted into a company registered under section 8 of the Companies Act (company with charitable objects and licensed to omit “Limited” from its name).

This restriction is prescribed under Rule 3(5) of the Companies (Incorporation) Rules, 2014. A section 8 company cannot be incorporated or converted to OPC either.

This restriction ensures that the OPC structure, designed for commercial enterprises, is not used for non profit activities that require different governance standards.

Practical Considerations for Legal Professionals Advising on One Person Company

Legal professionals advising clients on OPC matters must go beyond textbook knowledge to provide practical, actionable guidance. This section covers drafting considerations, common pitfalls, and tax planning aspects that are relevant in real world practice.

Drafting the MOA and AOA for OPC

The constitutional documents of an OPC require careful drafting to accommodate the unique governance structure and nominee mechanism.

Object Clause Considerations

The object clause in the MOA should be drafted broadly enough to cover all contemplated business activities but precisely enough to provide clarity.

The MCA’s standard industrial classification codes must be correctly selected. Including related and ancillary objects provides flexibility for business evolution without requiring object clause amendments.

For OPCs, the object clause is particularly important because the sole member cannot convene meetings to amend objects as easily as a multi member company. Anticipating future business lines and including them in the initial object clause prevents amendment requirements later.

Nominee Provisions in the MOA

The MOA of an OPC must include provisions regarding the nominee, including the nominee’s name, address, and consent.

These provisions must be drafted clearly to avoid ambiguity regarding succession. The MOA should reference the nominee consent form (INC-3) and the procedure for changing nominees.

Capital Clause: Authorized and Paid Up Capital

The capital clause specifies the authorized share capital and the division into shares of fixed amounts. For OPCs, a minimum authorized capital of Rs. 1 lakh is recommended for operational credibility, though there is no statutory minimum.

The paid up capital can be as low as one share of any value, but banks and other stakeholders may require higher paid up capital for account opening and credit facilities.

Customizing the AOA for Single Member Governance

The AOA should be customized to reflect the single member structure. Provisions regarding shareholder meetings can be simplified since there is only one shareholder. Decision making procedures should clarify how the sole member’s decisions are recorded.

The director appointment and removal provisions should reflect that the sole member controls all appointments.

Common Pitfalls in OPC Incorporation and How to Avoid Them

Experience reveals several common errors in OPC incorporation that cause delays and rejections. Awareness of these pitfalls helps professionals avoid them.

Name Mismatch Across Documents

One of the most common rejection reasons is inconsistency in the director’s name across PAN, Aadhaar, DSC, and SPICe+ forms. Variations in spellings, initials, or order of names cause verification failures. All documents must reflect the identical name exactly as it appears on the PAN card.

Invalid or Expired DSC Issues

Filing with an expired or revoked DSC results in immediate rejection. Before filing, professionals should verify that the DSC is valid, correctly registered on the MCA portal, and compatible with the MCA’s signing utility. DSC validity should be checked well before the intended filing date.

Incorrect Registered Office Documentation

The registered office proof must be current (utility bills not older than 60 days), must clearly show the address, and must be consistent with other documents.

If the property is rented, a notarized rent agreement and NOC from the landlord are required. Mismatches between the address in documents and the address entered in forms cause rejections.

Tax Planning Considerations for OPC

Tax planning is an important aspect of advising OPC clients. The choice of structure affects the overall tax burden, and various optimization strategies are available.

Applicable Tax Rates and Section 115BAA Option

OPCs can opt for the concessional tax rate of 22% under section 115BAA of the Income Tax Act, resulting in an effective tax rate of approximately 25.17% including surcharge and cess.

However, opting for section 115BAA of the Income Tax Act requires forgoing certain deductions and exemptions. The regular tax rate is 30%, with an effective rate of approximately 34.94% with surcharge and cess for income exceeding Rs. 10 crores.

For most OPCs with income below Rs. 1 crore, the effective regular tax rate is approximately 26%.

The choice between section 115BAA of the Income Tax Act and the regular regime depends on whether the company can claim significant deductions (such as depreciation, research expenses, or investment allowances) that exceed the benefit of the lower rate.

MAT Applicability

Minimum Alternate Tax applies to OPCs that do not opt for section 115BAA of the Income Tax Act. Under MAT, the company pays tax at 15% of book profits if the tax calculated under regular provisions is lower.

However, companies opting for section 115BAA of the Income Tax Act are exempt from MAT. MAT credit can be carried forward and set off against future tax liability for companies under the regular regime.

Salary vs Dividend: Optimizing Owner Compensation

The sole member who is also a director can receive remuneration as salary from the OPC. Salary is deductible for the company, reducing its taxable income, and is taxed in the hands of the director at slab rates.

Dividends, on the other hand, are distributed from post tax profits and are taxed in the shareholder’s hands at slab rates (with a deduction of Rs. 5,000 under section 57 of the Income Tax Act).

The optimal mix of salary and dividend depends on the tax brackets of the sole member, the company’s profit level, and compliance considerations (such as TDS on salary).

Generally, paying salary up to the amount that keeps the member in lower tax brackets, and distributing remaining profits as dividend, may be tax efficient.

Available Deductions and Exemptions

OPCs can claim all deductions available to companies, including depreciation under section 32 of the Income Tax Act, deduction for research and development under section 35 of the Income Tax Act, and various business expenses under section 37 of the Income Tax Act.

Investment in specified assets under section 35AD of the Income Tax Act, employment generation under section 80JJAA of the Income Tax Act, and startup benefits under section 80-IAC of the Income Tax Act (if eligible) are also available.

Companies opting for section 115BAA of the Income Tax Act cannot claim most incentive deductions, but can still claim depreciation and normal business expenses. The decision to opt for 115BAA of the Income Tax Act should consider the company’s specific deduction profile.

Conclusion

The One Person Company structure represents a significant advancement in Indian corporate law, providing solo entrepreneurs with the benefits of corporate status while minimizing the compliance burden.

The statutory framework under section 2(62) of the Companies Act, 2013, combined with the procedural rules and exemptions, creates a balanced regime that encourages formalization of businesses.

The 2021 Budget amendments transformed the OPC landscape by removing mandatory conversion thresholds, reducing residency requirements, and enabling NRIs to form OPCs.

These changes have made OPC an even more attractive option for entrepreneurs seeking limited liability, separate legal entity status, and perpetual succession without the complexity of multi-member governance.

For legal professionals, understanding these provisions in depth is essential for advising clients effectively on structure selection, incorporation, compliance, and conversion.

Frequently Asked Questions

What is the minimum capital required to register a One Person Company in India?

There is no statutory minimum capital requirement for registering an OPC in India. The Companies Act, 2013 does not prescribe a minimum paid up capital for OPCs.

Can a person be a member of more than one One Person Company?

No, Rule 3(2) of the Companies (Incorporation) Rules, 2014 restricts a natural person from being a member in more than one OPC at any point in time. Similarly, a person cannot be a nominee in more than one OPC. This “one person, one OPC” restriction prevents proliferation of shell companies.

Is a One Person Company required to hold an Annual General Meeting?

No, section 96(1) of the Companies Act, 2013 specifically exempts OPC from the requirement of holding an Annual General Meeting. Since an OPC has only one member, the concept of a meeting is redundant.

Can an NRI incorporate a One Person Company in India after the 2021 amendment?

Yes, the Companies (Incorporation) Second Amendment Rules, 2021 (effective from April 1, 2021) allows Non Resident Indians who are Indian citizens to incorporate OPCs in India. However, the NRI must have stayed in India for at least 120 days during the immediately preceding financial year to meet the residency requirement.

What happens to the One Person Company if the sole member dies?

Upon the death of the sole member, the nominee appointed in the Memorandum of Association becomes entitled to all the shares of the deceased member. The nominee must file Form INC-4 with the Registrar, along with the death certificate and KYC documents, to become the member. Within 15 days of becoming a member, the former nominee must appoint a new nominee.

Is a statutory audit mandatory for all OPCs regardless of turnover?

Yes, every OPC must have its financial statements audited by a Chartered Accountant, regardless of its turnover or capital. There is no threshold based exemption for OPCs as exists for sole proprietorships. The auditor must be appointed within 30 days of incorporation and must audit the accounts for each financial year.

Can a One Person Company be converted into an LLP?

An OPC cannot be directly converted into an LLP. The company would first need to convert to a private limited company under section 366 of the Companies Act, 2013. The private limited company can then apply for conversion to LLP under section 56 of the Limited Liability Partnership Act, 2008, subject to meeting eligibility criteria.

What are the penalties for late filing of annual returns by a One Person Company?

Late filing of Form AOC-4 and Form MGT-7A attracts additional fees of Rs. 100 per day of delay. Section 446B provides that penalties for OPCs are half of those specified for regular companies. Additionally, persistent default for two or more years can trigger striking off proceedings under section 248.

Can a One Person Company carry out NBFC activities?

No, Rule 3(6) of the Companies (Incorporation) Rules, 2014 prohibits an OPC from carrying on the business of a Non Banking Financial Institution, including investment in securities of any body corporate.

How many directors can a One Person Company have?

An OPC must have at least one director and can have a maximum of 15 directors. The sole member can be the sole director. If additional directors are desired for professional expertise or governance reasons, they can be appointed by the sole member through board resolution. At least one director must be resident in India (stayed for 182 days in the preceding year).

Can a foreign national be a nominee in a One Person Company?

No, only a natural person who is an Indian citizen can be a nominee in an OPC. Rule 3(1) of the Companies (Incorporation) Rules, 2014 requires both the member and the nominee to be Indian citizens. The nominee need not be resident in India but must be a citizen.

Is GST registration mandatory for a One Person Company?

GST registration is not automatically mandatory for an OPC. It becomes mandatory only if the OPC’s turnover exceeds the applicable threshold (Rs. 40 lakhs for goods or Rs. 20 lakhs for services in most states), if it makes interstate supplies, or if it engages in activities requiring compulsory registration under GST law.

What is the difference between Form MGT-7 and MGT-7A?

Form MGT-7 is the detailed annual return required for regular companies, containing comprehensive information about shareholding, indebtedness, members, and directors. Form MGT-7A is a simplified annual return prescribed for OPCs and small companies, containing summarized information.

Can a One Person Company accept deposits from the public?

No, an OPC cannot invite, accept, or renew deposits from the public. As a private company under section 3(1)(c) of the of the Companies Act, 2013, an OPC is subject to section 73(2) which prohibits private companies from accepting deposits from persons other than members, directors, and their relatives. Deposits from related parties are subject to compliance with the Companies (Acceptance of Deposits) Rules, 2014.

Allow notifications

Allow notifications