One Person Company registration in India allows single entrepreneurs to form companies with limited liability under Section 2(62) of Companies Act, 2013. Complete guide covering eligibility, SPICe+ process, NRI provisions, compliance, taxation, and conversion to private limited company.

Table of Contents

What if you could build a company empire without a single co-founder, enjoy complete control over every business decision, and still protect your personal assets from business liabilities?

Until 2013, Indian entrepreneurs faced a stark choice: operate as a sole proprietor with unlimited personal liability, or bring in unwanted partners just to form a private limited company.

The introduction of the One Person Company (OPC) under Section 2(62) of the Companies Act, 2013 changed everything.

For the first time, a single individual could establish a company with the credibility and legal protections of a corporate entity viz. limited liability, separate legal personality, and perpetual succession, without sacrificing entrepreneurial independence.

This wasn’t just a regulatory update; it was a recognition that the modern entrepreneur doesn’t always need a boardroom of co-founders to build something meaningful.

The entrepreneurial landscape became even more promising with the 2021 amendments, which removed mandatory conversion thresholds and opened OPC registration to Non Resident Indians (NRIs), a game changer for the Indian diaspora looking to establish businesses back home.

Today’s OPC framework, further streamlined through MCA V3 portal updates and extended compliance timelines, represents one of the most entrepreneur friendly corporate structures in India.

Whether you’re a Company Secretary drafting SPICe+ applications, a lawyer advising first time founders on business structuring, or a compliance officer managing annual filings for OPC clients, understanding this framework isn’t optional, it’s essential.

From statutory provisions and eligibility criteria to the complete registration process, ongoing compliance obligations, NRI specific provisions, taxation implications, and conversion to private limited company, this comprehensive guide equips you with everything you need to navigate OPC formation and management with confidence.

Let’s begin with the statutory foundation that makes it all possible.

Legal Framework and Definition of One Person Company in India

The One Person Company represents a significant departure from traditional company law principles that historically required a minimum of two persons to form a company.

The concept was first recommended by the Dr. J.J. Irani Expert Committee Report on Company Law in 2005, which recognized the need to provide limited liability protection to individual entrepreneurs without forcing them into partnership or private company structures.

The Companies Act, 2013 gave statutory recognition to this business form, supported by detailed procedural requirements under the Companies (Incorporation) Rules, 2014.

The legal framework governing OPCs comprises the primary legislation under the Companies Act, 2013, subordinate rules under the Companies (Incorporation) Rules, 2014, and subsequent amendments that have progressively liberalized the eligibility criteria and operational flexibility for OPCs.

Understanding this statutory foundation is crucial for practitioners advising clients on business structuring decisions and ensuring compliance with incorporation requirements.

Definition and Legal Classification Under Section 2(62) of Companies Act, 2013

Section 2(62) of the Companies Act, 2013 defines a One Person Company as a company that has only one person as its member.

This seemingly simple definition carries significant legal implications, as it creates a distinct corporate entity separate from its sole owner while maintaining the single ownership characteristic.

The definition establishes the fundamental principle that distinguishes OPCs from all other company forms, which require multiple members.

The statutory classification places OPCs squarely within the private company category, which determines the regulatory framework applicable to these entities.

This classification affects everything from compliance requirements to restrictions on share transfers and public offerings. The legal architecture ensures that while OPCs enjoy corporate benefits, they operate within boundaries designed to prevent misuse of the limited liability privilege.

Key Provisions of Section 2(62) and Section 3(1)(c) of Companies Act, 2013

Section 2(62) of the Companies Act, 2013 establishes that a One Person Company is simply a company with only one member. This definition works in conjunction with Section 3(1)(c) of the Companies Act, 2013, which explicitly states that a company may be formed for any lawful purpose by one person, where the company to be formed is a One Person Company that is to be a private company.

The combined effect of these provisions creates the legal basis for single-member incorporation in India.

The classification under Section 3(1)(c) of the Companies Act, 2013 as a private company means that OPCs are subject to the provisions applicable to private companies unless specifically exempted.

Private company characteristics automatically apply, including restrictions on share transferability, prohibition on inviting public subscriptions, and limitations on the number of members.

However, the Act and Rules carve out specific exemptions for OPCs, recognizing their unique single-member nature.

OPC as a Private Limited Company: Legal Implications

The classification of OPC as a private company under Section 3(1)(c) of the Companies Act, 2013 has far reaching legal implications for its operations and compliance.

The company must mandatorily use the suffix “(OPC) Private Limited” after its name, distinguishing it from regular private limited companies and indicating its single-member structure to third parties dealing with the company.

This naming requirement under Rule 8 of the Companies (Incorporation) Rules, 2014 ensures transparency in commercial dealings.

Being a private company, an OPC cannot invite public deposits or issue securities to the public, maintaining the closed nature of private company ownership.

The shares of an OPC cannot be freely transferred without following the transfer restrictions applicable to private companies. Additionally, the OPC enjoys the benefit of reduced compliance requirements compared to public companies while maintaining full corporate identity and limited liability protection for its members.

Companies (Incorporation) Rules, 2014: Regulatory Framework

The Companies (Incorporation) Rules, 2014 provide the detailed procedural framework for OPC incorporation and operation.

These rules prescribe eligibility criteria for members and nominees, documentation requirements, and procedural aspects that complement the substantive provisions of the Companies Act, 2013. The Rules have undergone significant amendments, most notably the Companies (Incorporation) Second Amendment Rules, 2021, which substantially liberalized OPC formation requirements.

The regulatory framework balances the need for simplified compliance for single member companies with adequate safeguards against misuse. The Rules establish the nominee mechanism that ensures perpetual succession, prescribe the forms for incorporation and consent, and lay down the conditions under which a person becomes eligible to form or participate in an OPC.

Understanding these rules is essential for proper compliance with OPC requirements.

Rule 3: Member Eligibility Criteria for OPC

Rule 3 of the Companies (Incorporation) Rules, 2014 establishes the fundamental eligibility criteria for persons who can become members of a One Person Company. Only a natural person who is an Indian citizen can incorporate an OPC, which means companies, LLPs, trusts, or other artificial legal entities cannot form an OPC.

The requirement for natural person status ensures that the single member concept is not circumvented through corporate nominees.

The Rule further requires that the person should be resident in India, though this requirement was significantly relaxed by the 2021 Amendment to include NRIs.

As per the current position, a person is considered resident in India if they have stayed in India for a period of not less than one hundred and twenty days during the immediately preceding financial year.

This residency requirement applies to the member, while the resident director has a separate 182 day requirement under Section 149(3).

Rule 4: Mandatory Nominee Appointment Requirements

Rule 4 of the Companies (Incorporation) Rules, 2014 mandates the appointment of a nominee at the time of OPC incorporation, which is a unique requirement designed to ensure perpetual succession. The nominee is a person who shall become the member of the OPC in the event of the original member’s death or incapacity to contract. This mechanism addresses the practical concern of what happens to a single member company if the sole member dies or becomes incapacitated.

The nominee must provide written consent in Form INC-3 at the time of incorporation, and this consent along with the nominee’s identity and address proof must be filed with the Registrar.

The nominee must also be a natural person who is an Indian citizen and cannot be a minor. Importantly, Rule 4 also restricts a person from being a nominee in more than one OPC at any given time, preventing concentration of potential ownership across multiple single member entities.

2021 Amendment Rules: Major Changes for OPC Registration

The Companies (Incorporation) Second Amendment Rules, 2021 brought transformative changes to the OPC framework, making it significantly more attractive for entrepreneurs.

The most significant change was the removal of mandatory conversion thresholds, which previously required OPCs to convert to private limited companies upon crossing paid-up capital of fifty lakh rupees or average annual turnover of two crore rupees during the preceding three consecutive financial years.

The 2021 Amendment also extended OPC eligibility to Non Resident Indians (NRIs), opening this business structure to the Indian diaspora seeking to establish businesses in India. Prior to this amendment, only Indian residents could form OPCs.

Additionally, the amendment removed the two year waiting period that previously prevented OPCs from voluntarily converting to private limited companies, allowing conversion at any time based on business needs. These changes collectively positioned OPCs as a more viable long term business structure rather than merely a stepping stone.

OPC Eligibility Criteria and Registration Requirements

Understanding the eligibility criteria is the first step in advising clients on OPC incorporation or deciding whether this structure suits your business needs. The eligibility framework encompasses requirements for the member who will own the company, the director who will manage its affairs, and the nominee who provides succession continuity.

Each category has distinct requirements that must be carefully verified before proceeding with incorporation.

The eligibility requirements serve dual purposes: ensuring that OPCs are formed by genuine entrepreneurs who can manage corporate responsibilities, and preventing misuse of the limited liability privilege through shell companies or nominee arrangements. The restrictions on multiple OPC memberships and the nominee mechanism work together to maintain the integrity of the single member concept while providing operational flexibility.

Who Can Be a Member of an OPC in India?

The member of an OPC is essentially its sole shareholder and owner, holding the entire share capital of the company. The eligibility criteria for members are prescribed under Rule 3 of the Companies (Incorporation) Rules, 2014, as amended, and establish clear boundaries on who can utilize the OPC structure.

These requirements ensure that the person forming an OPC has genuine ties to India and is capable of bearing the responsibilities of corporate ownership.

The member requirements balance accessibility with accountability. While the 2021 amendments expanded eligibility to include NRIs, the fundamental requirements of natural person status and Indian citizenship remain.

These criteria prevent corporate entities from forming OPCs while ensuring that the benefit of limited liability through single member companies is available to individual Indian entrepreneurs regardless of their current residence.

Natural Person and Age Requirements (18+ years)

Only a natural person can be a member of an OPC, which excludes companies, LLPs, Hindu Undivided Families (HUFs), trusts, and other artificial legal entities from forming One Person Companies.

This requirement is fundamental to the OPC concept, as allowing corporate nominees would effectively permit multi layered single member structures that could circumvent the regulatory framework. The natural person requirement ensures genuine individual entrepreneurship.

The person must be competent to contract, which under the Indian Contract Act, 1872 means they should be of the age of majority (18 years or above), of sound mind, and not disqualified from contracting by any law.

Minors cannot be members of OPCs, which is consistent with general company law principles preventing minor shareholding in private companies. This ensures that the sole owner has legal capacity to enter into contracts and bear corporate obligations.

Indian Citizenship: Residents and Non-Resident Indians (NRIs)

The citizenship requirement restricts OPC membership to Indian citizens only, excluding foreign nationals and Persons of Indian Origin (PIOs) who are not Indian citizens. This restriction applies regardless of residency status.

An Indian citizen holding dual citizenship of another country may still be eligible, subject to Indian law on dual citizenship. The citizenship verification is typically done through passport or Aadhaar documentation during incorporation.

The 2021 Amendment significantly expanded the eligibility by allowing NRIs to form OPCs. Prior to this change, only Indian residents were eligible. For NRIs, the residency requirement of 120 days does not apply to their role as a member, though they must still be Indian citizens.

This change was particularly beneficial for the Indian diaspora seeking to establish businesses in India without relocating. However, NRIs must note that at least one director must still be resident in India, maintaining some domestic operational presence.

One Person One OPC: Single Membership Limitation

Rule 3 of the Companies (Incorporation) Rules, 2014 imposes a crucial restriction: a person cannot incorporate more than one OPC or become a nominee in more than one OPC at any point in time. If a person becomes a member of an OPC through the nominee route (due to the original member’s death or incapacity), they must meet this single OPC requirement.

This restriction prevents entrepreneurs from creating multiple limited liability entities while maintaining nominal single member status.

The restriction serves important policy objectives. First, it prevents the fragmentation of business activities across multiple OPCs to limit liability artificially. Second, it ensures that the OPC remains a genuine single entrepreneur vehicle rather than a tool for corporate structuring.

Violation of this provision can lead to the member being treated as having contravened the provisions, potentially exposing them to penalties and requiring regularization of the excess OPCs.

Director Requirements for One Person Company

While the member is the owner of an OPC, directors are responsible for its management and governance. An OPC must have a minimum of one director and can have up to fifteen directors, similar to private companies.

The sole member may also serve as the sole director, creating a complete unification of ownership and management in one person. However, having multiple directors can bring diverse expertise and shared governance responsibility.

The director requirements for OPCs include both the general eligibility criteria applicable to all company directors under the Companies Act, 2013 and specific requirements regarding resident directors.

Directors must obtain Director Identification Numbers (DIN) before appointment, must not be disqualified under Section 164, and must meet age and other eligibility requirements. The resident director requirement ensures some level of local accountability.

Resident Director Requirement: 182 Days Residency Mandate

Section 149(3) of the Companies Act, 2013 mandates that every company, including OPCs, must have at least one director who has stayed in India for a total period of not less than one hundred and eighty two days during the immediately preceding financial year.

This resident director requirement ensures that at least one person responsible for company management has substantial presence in India and can be held accountable under Indian law.

This requirement is particularly important for NRI promoted OPCs. While an NRI can be the sole member, they cannot be the sole director unless they meet the 182 day residency requirement. In practice, NRI entrepreneurs must either ensure they spend adequate time in India or appoint an Indian resident as an additional director.

The resident director bears significant responsibilities, including signing statutory documents, representing the company before authorities, and ensuring compliance with Indian laws.

Can the Sole Member Be the Director of OPC?

Yes, the sole member of an OPC can simultaneously serve as its sole director, provided they meet the director eligibility requirements including the resident director mandate. This arrangement creates maximum simplicity in governance, with one person serving as shareholder, director, and often the key managerial personnel.

Many OPCs operate with this unified ownership management structure, particularly in their early stages.

Appointing Multiple Directors in an OPC

Although an OPC requires only one director, it can appoint up to fifteen directors, bringing in expertise and shared governance responsibility. Additional directors can be appointed through board resolution and must file Form DIR-12 with the Registrar within thirty days of appointment.

Multiple directors may be beneficial for OPCs engaging professional management, seeking investment preparation, or requiring diverse skill sets on the board.

The presence of multiple directors does not change the fundamental ownership structure, as the sole member retains complete shareholding.

However, it does introduce board governance dynamics, including the need for board meetings (though with relaxed frequency requirements for OPCs), quorum considerations, and collective decision making on certain matters. Directors owe fiduciary duties under Section 166 regardless of OPC status.

Appointment of Nominee: Mandatory Requirement for OPC

The nominee mechanism is a distinctive feature of OPCs, designed to ensure perpetual succession, which is a key advantage of corporate form over sole proprietorship. Unlike a partnership or proprietorship that dissolves upon the owner’s death, an OPC continues its existence through the nominee stepping into the member’s position.

This mechanism addresses the fundamental concern of business continuity in single member entities.

The nominee must be appointed at the time of incorporation itself, and their consent in Form INC-3 is a mandatory attachment to the incorporation application. The nominee arrangement can be changed during the company’s existence through a prescribed procedure, providing flexibility while maintaining succession continuity at all times.

Role and Responsibility of the Nominee

The nominee’s role activates only upon the death or incapacity of the original member to contract. Until such event occurs, the nominee has no ownership rights, management responsibilities, or legal position in the company.

They are essentially a contingent successor whose role remains dormant during the original member’s active involvement with the company. The nominee does not receive any shares or dividends during this period.

Upon the triggering event, the nominee automatically becomes the member of the OPC, acquiring all rights and responsibilities of corporate ownership. This transition happens by operation of law without requiring any transfer of shares or ROC approval.

The nominee then has the option to continue the OPC, convert it to a private limited company by inducting additional members, or wind up the company if they choose not to continue the business.

Eligibility Criteria for Nominees

The eligibility criteria for nominees largely mirror those for members with some variations. A nominee must be a natural person (not a company or LLP), must be an Indian citizen, and cannot be a minor.

The nominee should be competent to contract under the Indian Contract Act. Unlike the member, there is no specific residency requirement for nominees, though they must have a valid address in India for communication purposes.

Critically, a person cannot be a nominee in more than one OPC at any given time, similar to the membership restriction. This prevents a single individual from becoming contingent owner of multiple OPCs simultaneously. The nominee should ideally be someone trusted by the member and capable of handling business affairs, as they may need to manage the company in difficult circumstances following the member’s death or incapacity.

Form INC-3: Nominee Consent and Documentation

Form INC-3 is the prescribed format for obtaining and documenting the nominee’s consent to act as nominee for an OPC. This form must be signed by the nominee and submitted along with the incorporation documents through the SPICe+ system. The form requires details including the nominee’s name, address, nationality, occupation, and a declaration of consent to act as nominee.

Along with Form INC-3, the nominee must provide identity proof (PAN card, passport, or voter ID), address proof (Aadhaar, passport, utility bill, or bank statement), and a passport sized photograph.

All documents must be self attested. If the nominee is different from the director signing the incorporation documents, their documents undergo separate verification by the Central Registration Centre before approval.

How to Change Nominee in OPC: Procedure Under Rule 4 of Companies (Incorporation) Rules, 2014

Rule 4(4) of the Companies (Incorporation) Rules, 2014 permits the member to change the nominee at any time by giving notice to the company in the prescribed manner. The procedure involves obtaining fresh consent from the new nominee in Form INC-3 and filing the change with the Registrar within thirty days of the change.

The company must also update its records and memorandum of association reflecting the new nominee details.

The existing nominee can also withdraw their consent by giving notice to the member and the company. Upon receipt of withdrawal notice, the member must nominate a new nominee within fifteen days of such notice.

The company must then file information about the new nominee with the Registrar within thirty days. Failure to maintain a valid nominee at all times constitutes non compliance with OPC requirements.

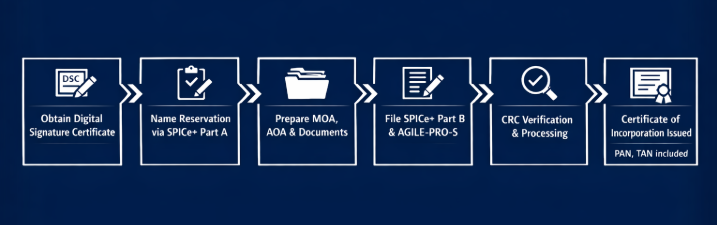

How to Register a One Person Company: Step by Step Process Through SPICe+

The OPC registration process in India has been significantly streamlined through the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) system introduced by the Ministry of Corporate Affairs.

This integrated platform combines multiple registrations into a single application, reducing time and complexity compared to the earlier multi-form process. The entire incorporation can typically be completed within seven to ten working days with proper documentation.

The SPICe+ system offers ten services through three Central Government Ministries and one State Government, including company incorporation, DIN allotment, PAN, TAN, GSTIN application, EPFO registration, ESIC registration, Profession Tax registration (for Maharashtra), and bank account opening.

This single window approach eliminates the need for separate applications to different authorities and represents a significant improvement in ease of doing business.

Step 1: Obtaining Digital Signature Certificate (DSC) for Directors

The Digital Signature Certificate is a mandatory prerequisite for OPC registration, as all incorporation documents must be digitally signed on the MCA portal. A Class 3 DSC with signing capability is required for directors who will sign the incorporation forms.

The DSC serves as the electronic equivalent of a physical signature and ensures document authenticity and non repudiation in electronic filings.

The DSC must be obtained before initiating the incorporation process, as without a valid DSC, the applicant cannot proceed with SPICe+ filing. The certificate is valid for one to two years depending on the issuing authority and must be renewed before expiry to ensure uninterrupted filing capability.

The member director of an OPC needs at least one DSC for signing incorporation documents.

DSC Requirements for Directors and Nominees

Every person who will sign the incorporation documents requires a valid Class 3 Digital Signature Certificate. For OPCs, this typically means the proposed director who will sign SPICe+ Part B, eMOA, eAOA, and other linked forms.

If the OPC has multiple proposed directors, each signing director needs their own DSC. The nominee does not require a DSC, as Form INC-3 can be physically signed and uploaded as an attachment.

The DSC application requires submission of identity proof (PAN card, Aadhaar), address proof (passport, Aadhaar, driving license, or utility bill), a passport sized photograph, email address, and mobile number. Video verification is typically required by Certifying Authorities as part of the issuance process.

The DSC is linked to the applicant’s PAN, and mismatches between PAN details and DSC details can cause filing rejections.

Certifying Authorities and OPC Registration Fee

DSCs are issued by licensed Certifying Authorities (CAs) authorized by the Controller of Certifying Authorities under the Information Technology Act, 2000. Leading Certifying Authorities include eMudhra, Sify, NSDL, and CDAC.

The cost of Class 3 DSC has increased to approximately ₹2,000 to ₹3,000 following the Controller of Certifying Authorities (CCA) Guidelines effective July 15, 2024, which mandated enhanced security features and video verification.

The overall OPC registration fee structure comprises DSC charges, government filing fees, stamp duty, and professional charges if using incorporation services. Government fees for SPICe+ filing are based on authorized capital, with minimal fees applicable for authorized capital up to ₹15 lakh.

Stamp duty varies significantly by state, with states like Maharashtra and Punjab having higher rates than Delhi or Karnataka.

Step 2: Company Name Reservation Through SPICe+ Part A

Selecting an appropriate company name is crucial for brand identity and regulatory approval. The name reservation is done through SPICe+ Part A, which allows applicants to propose up to two names for approval by the Central Registration Centre (CRC).

The name must be unique, not identical or similar to existing companies or trademarks, and must comply with naming guidelines prescribed under the Companies Act and Rules.

The name approval process typically takes one to two working days, though it may extend if the proposed names require clarification or are rejected. Applicants can either apply for name reservation separately through SPICe+ Part A and then proceed with Part B, or file Part A and Part B simultaneously with a single proposed name.

The former approach provides greater flexibility if name approval issues arise.

OPC Naming Restrictions Under Rule 8 of Companies (Incorporation) Rules, 2014

Rule 8 of the Companies (Incorporation) Rules, 2014 prescribes detailed naming guidelines that must be followed for OPC name approval. The company name must mandatorily include the words “One Person Company” or the abbreviation “OPC” and end with “Private Limited.” For example, “ABC Consulting (OPC) Private Limited” or “XYZ Technologies One Person Company Private Limited” are acceptable formats.

The name should not be identical or too similar to existing company names, LLP names, or registered trademarks. Similarity is assessed phonetically and visually, not just literally. Names suggesting government patronage, using words like “President,” “Governor,” “Minister” without approval, or including prohibited words under the Emblems and Names Act, 1950 will be rejected.

The name should also reflect the proposed business activity and not be misleading to the public.

How to File SPICe+ Part A for Name Approval?

To file SPICe+ Part A, log in to the MCA portal using valid credentials. Navigate to MCA Services, select Company Services, and click on “SPICe+ Part A.” Select “New Application” and choose the company type as “One Person Company.” Enter up to two proposed names along with their significance explaining how the name relates to the proposed business activity.

The system performs automatic name checking against existing databases and flags potential conflicts. Once the form is complete, upload supporting documents if required, such as trademark registration certificates or NOC from existing companies with similar names. Pay the filing fee of ₹1,000 (for 20-day reservation) through the payment gateway and submit.

The application is processed by the Central Registration Centre, which typically approves or rejects within one to two working days.

Name Approval Timeline and Resubmission Process

The standard name reservation is valid for twenty days from approval, during which the applicant must proceed with Part B filing. An extension of an additional twenty days can be obtained by paying ₹3,000, providing a total of forty days to complete incorporation.

If Part B is not filed within the validity period, the reserved name lapses and becomes available for others.

If the proposed names are rejected, the CRC provides reasons for rejection, and the applicant can resubmit with modified names. Common rejection reasons include similarity with existing companies, unacceptable words, or lack of distinctiveness.

The resubmission process involves filing a fresh SPICe+ Part A with new name proposals and paying the applicable fee again. Learning from rejection reasons helps avoid repeated rejections.

Step 3: Preparing Required Documents for OPC Registration

Document preparation is a critical phase that determines the smoothness of the incorporation process. All documents must be current, properly formatted, and accurately filled to avoid rejections or resubmission requests.

The required documents fall into categories: constitutional documents (MOA, AOA), identity and address proofs (for directors and nominee), registered office proofs, and consent/declaration forms.

Proper document preparation also involves ensuring consistency across all documents. The director’s name should be spelled identically in PAN, Aadhaar, address proof, and incorporation forms. Address details should match across documents. Any discrepancies can trigger verification queries from the CRC, delaying incorporation.

Memorandum of Association (eMOA Form INC-33)

The Memorandum of Association (MOA) is the constitutional document that defines the company’s relationship with the outside world. For OPCs, the electronic MOA (eMOA) is filed using Form INC-33, which is an integrated form within the SPICe+ system.

The eMOA contains six clauses: Name Clause (company name), Situation Clause (state of registered office), Objects Clause (business activities), Liability Clause (limited liability declaration), Capital Clause (authorized share capital), and Subscription Clause (subscriber details).

The Objects Clause is particularly important as it defines the business activities the OPC can undertake. The main objects should accurately reflect the intended business, using appropriate National Industrial Classification (NIC) codes.

The object clause can include ancillary objects and other objects not included in main objects. The sole subscriber (member) must sign the subscription clause, indicating the number of shares they agree to take.

Articles of Association (eAOA Form INC-34)

The Articles of Association (AOA) contain the internal governance rules of the company, prescribing how the company will be managed, directors’ powers and duties, member rights, dividend policies, and other operational matters.

For OPCs, the electronic AOA (eAOA) is filed using Form INC-34. OPCs can adopt Table F of Schedule I to the Companies Act, 2013, which provides model articles for private companies limited by shares.

The eAOA for OPCs must include specific provisions relating to the nominee, including details of the nominated person, their consent, and the procedure for nominee succession.

The articles should address scenarios specific to single member companies, such as resolutions by written means, conduct of meetings when there is only one member, and provisions for increasing membership if the OPC later converts to a private limited company.

Registered Office Address: Proof and Requirements

Every OPC must have a registered office from the date of incorporation, as this address serves as the official address for all communications and legal notices. The registered office proof requirements include a utility bill (electricity, water, or gas bill) not older than two months, showing the address where the registered office will be situated.

The utility bill establishes that the premises exist and are operational.

Additionally, if the premises are owned by someone other than the company or its director, a No Objection Certificate (NOC) from the property owner consenting to the use of premises as registered office is required.

If rented, a rent agreement or lease deed must be provided along with the owner’s NOC. From July 2025, MCA V3 portal requires photographic documentation of the registered office with display board showing company name for certain filings, though this primarily affects post incorporation compliance.

Director and Nominee KYC Documents Checklist

Directors must provide identity proof, address proof, and a passport sized photograph. Acceptable identity proofs include PAN card (mandatory), passport, voter ID, or driving license. Address proof can be Aadhaar card, passport, driving license, voter ID, or utility bill not older than two months.

For directors who are not Indian residents, passport is mandatory, and documents may require apostille or notarization.

The nominee must provide similar documentation: identity proof (PAN, passport, voter ID, or Aadhaar), address proof (any of the above documents), and photograph. Additionally, the nominee must sign Form INC-3 providing consent to act as nominee.

All documents should be self attested and in PDF format for upload. Ensuring document consistency and proper attestation prevents verification delays during CRC processing.

Step 4: Filing SPICe+ Part B and AGILE-PRO-S Forms

SPICe+ Part B is the comprehensive incorporation application that triggers the actual company formation. This form consolidates multiple services that previously required separate applications, making it a one stop solution for new company registration.

Filing Part B initiates a cascade of linked forms including AGILE-PRO-S, eMOA (INC-33), eAOA (INC-34), and auto generated Form INC-9 declaration.

The Part B filing requires careful attention to detail, as errors can cause rejections requiring resubmission. All information entered must match supporting documents exactly. The form must be digitally signed by the proposed director(s) and certified by a practicing professional (Chartered Accountant, Company Secretary, or Cost Accountant) before submission.

SPICe+ Part B: Complete Incorporation Application

SPICe+ Part B captures all essential incorporation details including company name (approved through Part A or proposed simultaneously), registered office address, share capital structure (authorized and subscribed capital), details of directors (name, DIN if available, address, nationality), details of the subscriber/member (for OPC, single subscriber), and nominee details.

The form also captures business objects through NIC codes.

The form integrates a DIN application for directors who do not already have a Director Identification Number. Up to three directors can apply for DIN through SPICe+ Part B.

The subscriber details section captures shareholding information, and for OPCs, the sole member subscribes to the entire share capital.

Declaration sections require confirmation of compliance with all incorporation requirements and eligibility criteria.

Integrated Registrations: PAN, TAN, EPFO, ESIC and GST

One of the most significant advantages of SPICe+ is the integrated registration for multiple government numbers. The form automatically applies for Permanent Account Number (PAN) and Tax Deduction Account Number (TAN) from the Income Tax Department, eliminating separate applications.

These numbers are allotted along with the Certificate of Incorporation, enabling immediate tax compliance capability.

The AGILE-PRO-S form, linked to SPICe+ Part B, facilitates application for GSTIN (if the company requires GST registration), EPFO registration (for Employees Provident Fund), and ESIC registration (for Employees State Insurance). For Maharashtra incorporated companies, Profession Tax Registration is also integrated.

Additionally, the form facilitates opening a bank account in the company’s name by generating a DPIIT identification number accepted by banks for account opening purposes.

Professional Certification and Declaration Requirements

Every SPICe+ Part B form must be certified by a practicing professional, either a Chartered Accountant, Company Secretary, or Cost Accountant in whole time practice. The professional certifies that they have verified the documents and compliance requirements and that the incorporation application meets all statutory requirements.

This certification adds a layer of professional verification to the incorporation process.

The professional must have a valid certificate of practice and must digitally sign the form using their registered DSC. The declaration covers verification of subscriber identity, director eligibility, registered office validity, and compliance with naming guidelines.

False certification can attract professional misconduct proceedings against the certifying professional, ensuring due diligence in the verification process.

Step 5: Certificate of Incorporation and Post Registration Steps

Upon successful verification of the SPICe+ application, the Central Registration Centre processes the incorporation and issues the Certificate of Incorporation (COI). The COI is the birth certificate of the company, confirming its legal existence as a separate corporate entity from the date mentioned therein.

Along with the COI, the company receives its Corporate Identity Number (CIN), PAN, and TAN.

The COI is issued electronically and can be downloaded from the MCA portal. It bears the digital signature of the Registrar of Companies and contains essential details including company name, CIN, date of incorporation, and registered office state.

Upon issuance, the company is legally formed and can commence business activities, enter into contracts, and operate as a distinct legal entity.

ROC Verification and Approval Process

After SPICe+ Part B submission, the application enters the Central Registration Centre (CRC) queue for verification. The CRC, established to centralize incorporation processing, examines the application for compliance with statutory requirements, document completeness, and eligibility criteria.

The verification covers name availability, director eligibility, subscriber details, registered office proof, and professional certification.

If discrepancies or deficiencies are found, the CRC marks the application for resubmission with specific queries. The applicant must address these queries and resubmit within the prescribed time, typically fifteen days.

Common resubmission reasons include document mismatch, unclear scanned documents, incorrect NIC codes, or missing attachments. Upon satisfactory verification, the CRC approves the application and generates the Certificate of Incorporation.

Understanding the Certificate of Incorporation

The Certificate of Incorporation serves as conclusive evidence that all incorporation requirements have been complied with and that the company is duly registered under the Companies Act, 2013.

It contains the company name as registered, the unique Corporate Identity Number (CIN) that identifies the company in all official records, the category of company (One Person Company, Private Limited by Shares), and the date of incorporation.

The CIN is a 21 digit alphanumeric code containing information about the company type, state of registration, year of incorporation, ownership type, and a unique serial number. This number must be mentioned on all official documents, letterheads, invoices, and communications of the company.

The COI, along with PAN and TAN cards, forms the foundational identity documents of the newly incorporated OPC.

Opening a Current Bank Account for Your OPC

Opening a current bank account in the company’s name is an essential post-incorporation step, as the company cannot conduct financial transactions without a corporate bank account. The SPICe+ system generates a DPIIT identification number that facilitates expedited bank account opening.

Most banks accept online applications with the COI, PAN card, board resolution for account opening, and KYC documents of authorized signatories.

The board resolution authorizing bank account opening should specify the bank, branch, type of account, authorized signatories, and their powers (individual or joint operation). For OPCs with a single director, this resolution can be passed as a written resolution under Section 122 of the Companies Act, 2013.

Documents typically required include COI, MOA, AOA, PAN card of company and directors, address proof of company, and photographs of authorized signatories.

OPC Registration for Non Resident Indians (NRIs)

The 2021 amendments to the Companies (Incorporation) Rules opened significant opportunities for the Indian diaspora by permitting Non Resident Indians to form One Person Companies in India.

Prior to this amendment, the residency requirement effectively barred NRIs from utilizing the OPC structure, forcing them to either form private limited companies with partners or invest through other structures. The change recognizes the entrepreneurial potential of NRIs and simplifies their path to establishing businesses in India.

NRI promoted OPCs must navigate additional documentation requirements, particularly around document authentication for overseas applicants. Understanding these requirements is essential for smooth incorporation, as document deficiencies are a common cause of application rejections for NRI applicants.

The resident director requirement also remains a practical consideration that NRIs must address.

NRI Eligibility Under the Companies (Incorporation) Second Amendment Rules, 2021

The Companies (Incorporation) Second Amendment Rules, 2021 amended Rule 3 to permit NRIs to become members of OPCs, removing a significant barrier that existed since the OPC concept was introduced. This amendment was part of broader reforms to make India more attractive for business and investment by the Indian diaspora.

The change aligned with government initiatives to leverage the skills and capital of overseas Indians for domestic entrepreneurship.

Under the amended rules, Indian citizens who are NRIs can now incorporate OPCs without the 120 day residency requirement that applies to resident members. This means an NRI living abroad can form an OPC in India without needing to establish residency.

However, the nominee must still be an Indian citizen, and importantly, at least one director must be resident in India, maintaining operational presence requirements.

Major Changes Introduced by the 2021 Amendment

The 2021 Amendment brought three transformative changes specifically benefiting NRIs and OPCs generally.

First, it permitted NRIs to be sole members of OPCs, expanding the eligible pool significantly.

Second, it removed the mandatory conversion requirements that previously forced OPCs to convert upon crossing capital or turnover thresholds.

Third, it eliminated the two year waiting period for voluntary conversion to private limited company.

For NRIs specifically, the removal of member residency requirements was the key change. Under the previous dispensation, even an Indian citizen who had moved abroad would become ineligible to form an OPC after losing resident status.

The 2021 Amendment resolved this by focusing on citizenship rather than residency for member eligibility, though director residency requirements under Section 149(3) continue to apply to ensure local management accountability.

Citizenship vs Residency: Key Differences for NRIs

The distinction between citizenship and residency is crucial for understanding NRI eligibility. Citizenship refers to nationality, determined by passport and legal status as an Indian citizen. Residency refers to physical presence in India for specified periods.

An NRI is an Indian citizen who resides outside India for employment, business, or other purposes, but retains Indian citizenship.

For OPC purposes, the member must be an Indian citizen but need not be a resident. However, at least one director must be resident, having stayed in India for 182 days during the immediately preceding financial year.

This creates a practical requirement for NRIs to either spend significant time in India or appoint an India-resident co-director. The nominee must be an Indian citizen but does not have a residency requirement, providing flexibility in nominee selection.

Document Requirements for NRI OPC Registration

NRI applicants face additional documentation requirements compared to resident applicants, primarily around authentication of documents executed or issued abroad.

The MCA requires proper verification of identity and address for all incorporation participants, and for documents issued outside India, this verification takes the form of apostille certification or notarization by Indian consular authorities.

Proper documentation is critical for NRI applications, as document deficiencies are a leading cause of rejection or resubmission requests. Planning document preparation well in advance, including time for apostille processing, ensures smooth incorporation.

NRIs should also ensure their documents are consistent with their passport details, as any discrepancies trigger additional verification.

Apostille and Notarization for Foreign Documents

Documents issued outside India, including identity proofs, address proofs, and consent forms signed abroad, must be authenticated for use in Indian legal proceedings. For countries that are signatories to the Hague Apostille Convention, the documents must carry an apostille certificate issued by the competent authority of the country where the document was issued.

This apostille certifies the authenticity of the document for international use.

For countries not part of the Hague Convention, documents must be notarized by a Notary Public in that country and then authenticated by the Indian Embassy or Consulate. This embassy attestation serves the same purpose as an apostille, confirming document authenticity.

The authentication process can take one to three weeks depending on the country, so NRI applicants should plan accordingly and initiate document preparation early.

Resident Director Mandate: Continuing Requirement

Despite the liberalization of member eligibility for NRIs, the resident director requirement under Section 149(3) continues to apply to OPCs. This means every OPC, including those promoted by NRIs, must have at least one director who has stayed in India for at least 182 days during the immediately preceding financial year.

This requirement ensures local accountability and operational presence.

NRI promoters have two options to meet this requirement.

First, they can spend adequate time in India to meet the 182 day threshold themselves, serving as both member and resident director.

Second, they can appoint an India based individual as an additional director who meets the residency requirement.

The second option is more practical for NRIs who cannot spend extended periods in India, though it requires finding a trustworthy individual to serve as director.

Annual Compliance Requirements for One Person Companies

While OPCs enjoy reduced compliance burden compared to regular private limited companies, they are not exempt from statutory filings and governance requirements. The compliance framework for OPCs represents a balance between providing operational simplicity for single member entities and maintaining adequate regulatory oversight and transparency.

Understanding these requirements is essential for maintaining the company in good standing and avoiding penalties.

The annual compliance calendar for OPCs includes financial statement filing, annual return filing, auditor appointments, income tax filings, and various event based compliances. Missing these deadlines attracts additional fees and penalties, and persistent non compliance can lead to director disqualification and company strike off proceedings.

Proper compliance management is therefore critical for OPC operations.

Compliance Exemptions for OPCs Under the Companies Act, 2013

The Companies Act, 2013 and related rules provide several exemptions to OPCs, recognizing that certain compliance requirements designed for multi member companies are impractical or unnecessary for single member entities.

These exemptions reduce administrative burden while maintaining essential transparency and accountability requirements. Understanding these exemptions helps OPC operators focus on truly applicable compliances.

The exemptions cover areas including general meetings, board meetings, cash flow statements, and certain procedural requirements. However, these exemptions do not extend to fundamental requirements like financial statement preparation, audit, annual filings, and income tax compliance.

OPCs must carefully distinguish between exempted and applicable requirements to ensure proper compliance.

AGM Exemption Under Section 96(1)

Section 96(1) of the Companies Act, 2013 requires companies to hold Annual General Meetings, but OPCs are specifically exempted from this requirement.

Since an OPC has only one member, the concept of a “meeting” becomes redundant. Instead of AGM, the member can exercise all powers that would otherwise be exercised in general meetings through written resolutions recorded in the minutes book.

This exemption significantly simplifies governance for OPCs. There is no need to issue AGM notices, prepare AGM agendas, or maintain AGM minutes in the traditional sense.

The sole member can adopt financial statements, appoint auditors, and take other decisions that would normally require shareholder approval through written resolutions under Section 122. These resolutions must be dated, signed, and entered in the minutes book.

Cash Flow Statement Exemption Under Section 2(40)

The definition of “financial statement” under Section 2(40) of the Companies Act includes balance sheet, profit and loss account, cash flow statement, and notes to accounts. However, OPCs are exempt from the requirement to prepare a cash flow statement as part of their financial statements. This exemption recognizes that cash flow statements, while useful for multi stakeholder companies, add preparation burden without proportionate benefit for single member entities.

The exemption does not affect the requirement to prepare and file balance sheet, profit and loss account, and notes to accounts. OPCs must still maintain proper books of account under Section 128 and get their financial statements audited under Section 143.

The financial statements filed with ROC through Form AOC-4 will simply not include the cash flow statement for OPCs claiming this exemption.

Board Meeting Requirements: Relaxed Provisions

Regular private companies must hold board meetings at least four times a year with not more than 120 days gap between consecutive meetings. OPCs enjoy relaxed board meeting requirements, needing to hold only two board meetings per calendar year with at least ninety days gap between meetings.

This recognizes that frequent formal meetings may be impractical when the director and member are often the same person.

Further relaxation applies where the OPC has only one director, in which case the business can be transacted through resolutions by the sole director entered in the minutes book. The minutes must record the date, details of business transacted, and the director’s signature. Where there are multiple directors, regular board meeting procedures apply, though with the reduced frequency requirement.

Mandatory Annual Filings for OPC

Despite the exemptions, OPCs must comply with several mandatory annual filings with the Registrar of Companies. These filings ensure transparency and enable regulatory oversight of corporate affairs.

The two primary annual filings are Form AOC-4 for financial statements and Form MGT-7A for annual returns. Additionally, income tax returns must be filed with the Income Tax Department.

Filing these returns within due dates is critical, as delays attract additional fees of ₹100 per day of default.

Form AOC-4: Filing Financial Statements

Form AOC-4 is the prescribed form for filing financial statements with the Registrar of Companies under Section 137 of the Companies Act, 2013. The form includes the audited balance sheet, profit and loss account, director’s report, and auditor’s report for the financial year.

For OPCs, the normal due date is 180 days from the end of the financial year, which translates to September 27 for companies following the April-March financial year.

The financial statements must be audited by a statutory auditor before filing. The sole director must sign the financial statements and director’s report. Form AOC-4 must be digitally signed by the director and certified by a practicing Chartered Accountant or Company Secretary.

Required attachments include the auditor’s report under Section 143, director’s report under Section 134, and notes to accounts. The filing fee varies based on authorized capital, with an additional fee of ₹100 per day for late filing.

Form MGT-7A: Annual Return Filing for OPC

Form MGT-7A is the simplified annual return form specifically designed for OPCs and small companies, introduced through the Companies (Management and Administration) Amendment Rules, 2021.

This form requires less detailed information compared to the regular Form MGT-7 used by other companies. The annual return provides key information about the company’s directors, shareholders, share capital, and compliance status.

The due date for Form MGT-7A is 60 days from the date on which the annual general meeting should have been held, which for OPCs means 60 days from the deemed AGM date (September 30 for April-March FY companies), resulting in a November 29 deadline. For FY 2024-25, this deadline was extended to December 31, 2025.

The form requires the sole director’s digital signature and does not require Company Secretary certification, as OPCs are exempt from mandatory CS appointment.

Form ADT-1: First Auditor Appointment

Every company, including OPCs, must appoint a statutory auditor. The first auditor should be appointed by the board of directors within 30 days of incorporation.

The appointment must be intimated to the Registrar through Form ADT-1 within 15 days of the appointment. The first auditor holds office until the conclusion of the first annual general meeting or, for OPCs, until the period when the first AGM would have been held.

The auditor must be a practicing Chartered Accountant or a firm of Chartered Accountants. The auditor must provide written consent and a certificate confirming eligibility under Section 141 before appointment.

This consent is filed along with Form ADT-1. Failure to appoint an auditor within the prescribed time can attract penalties and also creates difficulties in filing annual returns, as unaudited financial statements cannot be filed with ROC.

Income Tax Return Filing: Form ITR-6 Requirements

OPCs, being companies, must file income tax returns using Form ITR-6, which is prescribed for companies other than those claiming exemption under Section 11 (charitable trusts). The due date for filing ITR-6 is September 30 of the assessment year for companies not requiring tax audit, and October 31 for companies requiring audit under Section 44AB of the Income Tax Act.

Since OPC financial statements must mandatorily be audited, the October 31 deadline typically applies.

The ITR-6 filing requires computation of total income, claiming of exemptions and deductions, calculation of tax liability, and reporting of financial information. OPCs must also comply with advance tax provisions if the expected tax liability exceeds ₹10,000, paying advance tax in quarterly installments.

TDS compliance on payments and TDS return filing are also mandatory based on the nature of transactions.

Compliance Calendar for Newly Incorporated OPCs

Newly incorporated OPCs must navigate a specific set of compliances in their first year of existence. These include immediate post incorporation requirements, first year filings, and establishing governance systems.

A clear compliance calendar helps ensure nothing is missed during the critical early period when the company is establishing its operations and compliance infrastructure.

The first financial year for a newly incorporated OPC can extend up to 18 months if incorporated on or after January 2 of any year, as per Section 2(41) of the Companies Act.

This extended first year provides additional time for establishing operations before the first compliance cycle begins. However, certain compliances like auditor appointment have fixed timelines from incorporation regardless of financial year duration.

Compliance Within 30 Days of Incorporation

Within 30 days of incorporation, the OPC must complete several critical setup activities. The most important is appointing the first statutory auditor under Section 139(6) and filing Form ADT-1 within 15 days of such appointment.

The board should also pass resolutions for adopting the common seal (if using one), authorizing bank account opening, and confirming the registered office situation.

If the registered office is different from the address mentioned in incorporation documents, Form INC-22 must be filed within 30 days of incorporation to notify the changed address.

The company should also obtain any business specific registrations required, such as GST registration (if not applied through SPICe+), professional tax registration (in applicable states), and industry specific licenses. Setting up the statutory registers required under the Companies Act should also begin in this period.

Compliance Within 180 Days of Financial Year End

The first 180 days after the financial year end trigger the annual compliance cycle. Financial statements must be prepared, audited, and filed through Form AOC-4 within this period. For OPCs, the due date is September 27 for companies following the April-March financial year.

The sole member should adopt the financial statements through written resolution, and the director’s report should be prepared covering all required disclosures under Section 134.

The statutory auditor must complete the audit and issue the audit report before the AOC-4 filing. Coordination with the auditor well in advance of due dates is essential to avoid last minute delays.

The Form MGT-7A for annual return is due 60 days after the deemed AGM date, giving additional time after AOC-4 filing. Both forms require the sole director’s digital signature and must be filed through the MCA portal.

Ongoing Annual Compliance Requirements

Beyond the annual filings, OPCs must maintain ongoing compliance throughout the year. Board meetings must be held at least twice per calendar year with at least 90 days gap. The DIR-3 KYC for directors must be filed annually by September 30 to maintain active DIN status.

Any changes in directors, registered office, share capital, or other company details must be notified to ROC within prescribed timelines through appropriate forms.

Tax compliances include quarterly advance tax payments (if applicable), monthly or quarterly TDS returns, annual income tax return, and GST returns (if registered). Statutory registers including register of members, register of directors, minutes books for board and general meetings, and register of charges must be maintained and updated.

Annual auditor reappointment or rotation must be done within the prescribed timeline each year.

Penalties for OPC: Non Compliance and Late Filing

Non-compliance with statutory requirements attracts penalties under the Companies Act, 2013 and the Income Tax Act, 1961. These penalties can be substantial and create additional liability for both the company and its directors.

Understanding the penalty framework helps emphasize the importance of timely compliance and provides incentive for maintaining proper compliance systems.

The penalty framework includes additional fees for late filing, fixed penalties for specific contraventions, and continuing penalties for ongoing defaults. In severe cases, persistent non-compliance can lead to director disqualification under Section 164(2) and company strike off under Section 248, effectively ending the company’s existence and creating personal liability for directors.

Additional Fees for Late Filing

The most common penalty for OPCs is the additional fee levied for late filing of annual forms with ROC. For Form AOC-4 and Form MGT-7A, the additional fee is ₹100 per day from the due date until the actual filing date.

This additional fee accrues continuously, and for significantly delayed filings, can amount to substantial sums exceeding the original filing fees many times over.

Penalties on the Company and Directors Under the Companies Act, 2013

Beyond additional fees, specific sections prescribe penalties for contraventions. Under Section 137, failure to file financial statements can attract a penalty of ₹10,000 on the company and ₹10,000 on every officer in default, with a continuing penalty of ₹100 per day during which the failure continues, subject to a maximum of ₹2,00,000 on the company and ₹50,000 on officers.

Similar penalties apply under Section 92 for failure to file annual returns.

More serious consequences arise from persistent non-compliance. Directors of companies that have not filed financial statements or annual returns for three continuous years can be disqualified under Section 164(2)(a), prohibiting them from being appointed as directors in any company for five years.

Additionally, companies that have not filed annual returns for two consecutive years or financial statements for two consecutive years can be struck off the register under Section 248, resulting in dissolution.

Taxation of One Person Companies

OPCs, being companies incorporated under the Companies Act, 2013, are taxed as domestic companies under the Income Tax Act, 1961. This means OPCs are subject to corporate tax rates rather than individual tax slabs, which creates both advantages and considerations for tax planning.

The corporate taxation framework provides certain benefits like the ability to claim director remuneration as expense, but also imposes compliance obligations like mandatory audit and advance tax.

Understanding the taxation framework is essential for OPC operators and their advisors to optimize tax efficiency while maintaining full compliance. The tax treatment affects business decisions including salary versus dividend distribution, timing of expenses and income, and choice of business structure. Proper tax planning from inception helps maximize the benefits of the OPC structure.

Corporate Tax Rates Applicable to One Person Companies

OPCs are taxed at corporate tax rates applicable to domestic companies. The applicable rate depends on total turnover in the previous year and any optional concessional regime elected by the company.

The standard rate structure provides different rates based on turnover threshold, and a separate concessional regime under Section 115BAA of the Income Tax Act offers a lower flat rate with certain conditions.

Tax liability calculation begins with computation of total income under the five heads of income, applying available deductions and exemptions, and then applying the applicable tax rate. Surcharge and cess are added to arrive at the final tax liability.

Advance tax must be paid if the expected tax liability exceeds ₹10,000, with quarterly installment deadlines on June 15, September 15, December 15, and March 15.

Standard Corporate Tax Rate: 25% for Turnover Up to ₹400 Crore

Domestic companies with total turnover or gross receipts up to ₹400 crore in the previous year are taxed at a concessional rate of 25% on their total income. Most OPCs fall within this threshold, making 25% the applicable base rate.

For companies with turnover exceeding ₹400 crore, the standard rate of 30% applies. These rates are applied to the total income computed after allowing all deductions and exemptions.

The 25% rate provides OPCs with a favorable taxation position compared to higher-income sole proprietors who might face the 30% individual tax rate plus surcharge.

However, the comparison is not straightforward, as individual proprietors can claim various deductions under Chapter VI-A not available to companies, and dividend distribution from OPCs faces additional tax implications in the hands of the member.

Section 115BAA: Optional 22% Tax Regime

Section 115BAA of the Income Tax Act introduced an optional concessional tax regime for domestic companies, offering a base rate of 22% (effective rate approximately 25.17% including surcharge and cess). OPCs can opt for this regime by filing Form 10-IC before the due date for filing the return of income for the year in which the option is exercised.

Once exercised, the option is irrevocable and applies to all subsequent years.

The Section 115BAA regime comes with conditions: the company cannot claim certain deductions including additional depreciation under Section 32(1)(iia) of the Income Tax Act, deductions under Section 33AB, 33ABA, 35, 35AD of the Income Tax Act, or Chapter VI-A deductions (except Section 80JJAA). The company also cannot set off brought forward losses attributable to these deductions. OPCs should evaluate whether the lower rate benefit outweighs the foregone deductions before opting for this regime.

Surcharge and Health & Education Cess

In addition to the base corporate tax rate, OPCs must pay surcharge and cess on the tax amount. For domestic companies with total income exceeding ₹1 crore but not exceeding ₹10 crore, a surcharge of 7% on tax applies.

For income exceeding ₹10 crore, the surcharge is 12%. For companies opting for Section 115BAA of the Income Tax Act, a flat surcharge of 10% applies regardless of income level.

Health and Education Cess at 4% is levied on the aggregate of tax and surcharge. This cess funds health and education initiatives and is not deductible for computing taxable income in subsequent years.

The effective tax rate for OPCs in the normal regime with turnover up to ₹400 crore works out to approximately 26% (25% tax + 7% surcharge on tax + 4% cess on aggregate), while Section 115BAA regime results in approximately 25.17% effective rate.

Tax Filing and Audit Requirements for OPC

Tax compliance for OPCs encompasses return filing, advance tax payments, TDS compliance, and mandatory tax audit. These obligations must be integrated into the company’s compliance calendar to avoid penalties and interest.

Unlike individual proprietors who may have simpler compliance, OPCs face the full corporate tax compliance framework.

The mandatory audit requirement for all companies, including OPCs, distinguishes corporate tax compliance from individual taxation. This audit provides assurance on the accuracy of financial statements and tax computations but also adds compliance cost and time requirements.

Planning the audit timeline well in advance of tax return due dates is essential.

Annual ITR-6 Filing Requirements

OPCs must file their income tax returns using Form ITR-6, the form prescribed for companies (other than companies claiming exemption under Section 11). The return must be filed electronically through the income tax portal, and digital signature of the authorized signatory is mandatory.

The return captures complete income computation, tax computation, and various schedules for specific income types and transactions.

The due date for ITR-6 filing is October 31 of the assessment year for companies subject to audit under Section 44AB of the Income Tax Act. Since OPCs must mandatorily get their accounts audited under the Companies Act, they effectively require tax audit as well, making October 31 the applicable deadline.

Late filing attracts penalty under Section 234F of ₹5,000 (or ₹1,000 if total income does not exceed ₹5 lakh), plus interest under Sections 234A, 234B, and 234C for late payment of taxes.

Advance Tax Payment and TDS Compliance

If the estimated tax liability for the year exceeds ₹10,000, the OPC must pay advance tax in quarterly installments: 15% by June 15, 45% by September 15, 75% by December 15, and 100% by March 15 of the financial year. Failure to pay advance tax as per these schedules attracts interest under Section 234C of the Income Tax Act. Additionally, interest under Section 234B of the Income Tax Act applies if total advance tax paid is less than 90% of assessed tax.

TDS compliance requires the OPC to deduct tax at source on specified payments including salaries, contractor payments, professional fees, rent, and interest. TDS returns must be filed quarterly (Form 26Q for non-salary payments, Form 24Q for salary payments), and TDS certificates must be issued to deductees.

The OPC must have a valid TAN (obtained through SPICe+) for TDS purposes. Non-compliance with TDS provisions attracts penalties and prosecution.

Tax Audit Under Section 44AB of Income Tax Act, 1961

Section 44AB of the Income Tax Act mandates tax audit for businesses with total sales, turnover, or gross receipts exceeding ₹1 crore in a financial year. For OPCs, this threshold is often not met in early years.

However, since OPCs must mandatorily get their accounts audited under Section 137 of the Companies Act, 2013, the statutory audit serves as the primary compliance requirement.

Where Section 44AB audit is also applicable (turnover exceeding ₹1 crore, or lower threshold of ₹10 crore for businesses maintaining books and having more than 95% digital transactions), the tax audit report in Form 3CA/3CD must be filed by September 30 of the assessment year.

The statutory auditor or a different Chartered Accountant can conduct the tax audit. The audit report provides detailed information to tax authorities and is subject to verification.

How to Convert OPC into a Private Limited Company?

As businesses grow, the single member structure of OPC may become limiting, necessitating conversion to a private limited company to accommodate additional shareholders, attract investment, or meet regulatory requirements.

The 2021 amendments significantly simplified this conversion by removing mandatory conversion requirements and allowing voluntary conversion at any time. Understanding the conversion procedure helps OPC operators plan their growth trajectory effectively.

Conversion to private limited company involves increasing the number of members to at least two, altering the constitutional documents, and filing prescribed forms with the Registrar of Companies.

The process maintains the company’s identity (same CIN) while changing its classification and enabling multi member ownership. This continuity ensures that contracts, licenses, and business relationships remain intact.

Voluntary Conversion Procedure from OPC into Private Limited Company

The voluntary conversion procedure under Section 18 of the Companies Act, 2013 read with Rule 6 of the Companies (Incorporation) Rules, 2014 allows OPCs to convert at any time without meeting turnover or capital thresholds.

The 2021 Amendment removed the two-year waiting period that previously restricted early conversion. This flexibility allows OPCs to convert based on business needs rather than regulatory triggers.

The conversion process involves multiple steps including board approval, member approval through special resolution, document alteration, and regulatory filings. Professional assistance is typically required to ensure proper compliance with all procedural requirements.

The timeline for conversion is approximately two to three weeks from initiation to receipt of the new Certificate of Incorporation reflecting the changed status.

Board Resolution and Shareholder Approval Requirements

The conversion process begins with a board meeting where the board of directors passes a resolution recommending the conversion and approving the alteration of MOA and AOA. The resolution should detail the reasons for conversion, the proposed changes to constitutional documents, and authorize the filing of necessary forms.

If the OPC has a single director, this can be done through a resolution by the sole director entered in the minutes book.

Following board approval, the sole member must pass a special resolution approving the conversion. For OPCs, this is done through a written resolution under Section 122 of the Companies Act, as there is no requirement to hold a general meeting.

The special resolution should approve the conversion from OPC to private limited company, the alteration of MOA and AOA, the induction of new member(s), and related matters. The resolution must be signed by the sole member and recorded in the minutes book.

Alteration of Memorandum of Association (MOA) and Articles of Association (AOA)

The MOA must be altered to remove the words “One Person Company” or “OPC” from the company name, as the converted entity will be a regular private limited company. The name clause should read “XYZ Private Limited” instead of “XYZ (OPC) Private Limited.”

The subscription clause must be amended to include the new subscriber(s) who are joining as additional members, with their details and share subscription particulars.

The AOA must be modified to remove all references to the nominee and the single-member structure. Provisions specific to OPCs under Section 122 of the Companies Act, such as written resolutions in lieu of meetings, should be amended to reflect multi-member governance.

The AOA should incorporate provisions for share transfer among multiple members, quorum requirements for meetings, and other governance matters applicable to private companies with multiple members.

Filing Form MGT-14 and Form INC-6 with ROC

Form MGT-14 must be filed within 30 days of passing the special resolution for conversion. This form registers the special resolution with the Registrar and should include a certified copy of the resolution and explanatory statement. The form must be digitally signed by the director and verified by a practicing professional.

Form INC-6 is the primary conversion application filed within 30 days of Form MGT-14 filing. This form captures details of the conversion including reasons, new member details, altered documents, and compliance certificates.

The form must be accompanied by the altered MOA and AOA, board resolutions, consent letters from new members and directors, Form DIR-12 for new directors (if any), and NOC from creditors (if applicable). Professional certification is required.

Required Documents for OPC to Private Limited Company Conversion

The documentation package for conversion includes: certified copies of board resolution and special resolution approving conversion; altered MOA showing new name and updated subscription clause with new member details; altered AOA removing OPC-specific provisions and including multi-member governance provisions; consent letter from new member(s) agreeing to subscribe to shares; identity and address proof of new member(s).

Additional documents include Form DIR-2 (consent to act as director) from any new directors being appointed, Form DIR-12 for director appointments, latest audited financial statements of the OPC, NOC from creditors if the company has outstanding secured loans, and any supplementary declarations or undertakings required by the Registrar.

The filing fee for Form INC-6 is based on the company’s authorized capital.

Conversion Timeline and ROC Approval Process

The conversion process typically takes two to three weeks from initiation to completion, assuming all documents are properly prepared and no queries arise from the ROC.