Get a clear, realistic breakdown of Advocate on Record (AOR) Supreme Court Salary (fees) in India, from first year earnings to senior-level income. This guide explains fee structures, practice area variations, Delhi vs non-Delhi income differences, and the full cost-benefit of becoming an AOR. Perfect for lawyers planning their Supreme Court career path.

Table of Contents

If you’re considering pursuing the Advocate on Record designation, the first question on your mind is probably about money.

How much can you actually earn as an AOR? What’s the realistic income trajectory? And most importantly, is the financial investment worth it for your career stage?

Let me be direct with you: AOR income varies dramatically based on experience, specialization, location, and client profile. You’ll find fresh AORs earning ₹12-20 lakh annually, while senior practitioners with established reputations command ₹50 lakh or more. Some highly successful AORs even break the ₹1 crore annual barrier.

But these broad ranges don’t tell you what you really need to know. What will your income look like in year one? How quickly can you scale to mid level earnings? What factors separate the top earners from those struggling to establish practice?

This comprehensive guide answers all your salary questions with specific numbers, realistic timelines, and practical insights from practicing AORs.

I’ll break down income by experience level, explain the complete fee structure for different services, compare earnings across practice areas, and help you understand what drives income differences among AORs at the same experience level.

What is the Average Range of AOR Supreme Court Salary/Fees?

Before diving into detailed breakdowns, let me give you the complete income spectrum so you understand where AOR earnings fit in India’s legal profession.

The numbers I’m sharing come from analysis of practicing AORs, Bar Council of India survey data, and market research across different experience levels and practice areas.

Income Spectrum from ₹12 Lakh to ₹1 Crore + Annually

According to a Bar Council of India survey conducted in 2021, the average annual income of an AOR ranges from ₹20 lakh to ₹50 lakh. However, this average masks the significant variation across career stages and practice types.

Here’s the realistic income spectrum you need to understand.

Fresh AORs in their first 1-2 years typically earn ₹12-20 lakh if building practice from scratch. This might seem modest after the effort to become an AOR, but it’s just your starting point.

If you already have an established High Court practice before becoming an AOR, your income will be considerably higher because you can bring existing clients’ Supreme Court matters to your new practice.

Mid-level AORs with 10 years of Supreme Court practice typically earn ₹30-50 lakh from Supreme Court work alone. By this stage, you’ve developed referral relationships, established a reputation, and handle a steady matter flow. You command better fees, handle more complex cases, and spend less time on small matters.

Senior AORs with 15+ years of practice and a strong reputation regularly cross ₹1 crore in annual income and highly successful senior practitioners may earn substantially more, sometimes several crores per year. At this level, you’re a recognized expert, clients seek you out specifically, you can be selective about matters, and you command premium fees.

What you need to understand is that these income figures represent earnings from Supreme Court work specifically.

Many AORs maintain parallel High Court or trial court practices that generate additional income beyond these ranges. If you’re a successful High Court advocate who adds the AOR designation, your total income combines both practices, potentially reaching much higher total earnings.

Why AOR Supreme Court Salary Information is Critical for Your Career Decision?

Understanding AOR income realities isn’t just about curiosity; it’s about making one of the most important strategic decisions in your legal career.

The AOR designation requires significant investment of time, money, and effort. You need accurate financial information to evaluate whether this investment makes sense for your specific situation.

Here’s why precise salary information matters for your career planning.

First, you need to know if you can afford the transition period. Becoming an AOR involves one year of training where your earning capacity may be reduced, followed by the first year of practice, where income is modest while you establish yourself.

If you have financial obligations like home loans, family responsibilities, or educational expenses, you need to plan for 18-24 months of potentially lower income before your AOR practice stabilizes.

Second, you need a realistic breakeven analysis. What’s the total investment to become an AOR, including training period opportunity cost, examination and registration fees, Delhi office setup, clerk employment, and monthly operational expenses?

How long will it take to recover this investment through increased earnings? For someone earning ₹40 lakh annually in an established High Court practice, does transitioning to full time Supreme Court practice make financial sense, or should you pursue a hybrid model?

Third, you need to understand the income trajectory for different scenarios. If you’re a 28 year old junior advocate with 4 years of practice, your AOR income path looks very different from a 45 year old senior High Court advocate.

The younger advocate might start at ₹12-20 lakh but scale rapidly over the next decade. The senior advocate might immediately command higher fees due to existing reputation, but face different opportunity costs from reducing High Court practice.

Finally, you need a comparison with alternative career paths. How does AOR income compare with continuing High Court practice, joining a law firm as partner, moving to corporate in house roles, or pursuing Senior Advocate designation?

What’s the income potential in each path at 5 year, 10 year, and 15 year marks? Only with these comparisons can you make an informed choice aligned with your financial goals and career aspirations.

The salary information in this guide gives you the data you need for these critical calculations. I’ll show you not just what AORs earn, but how quickly you can expect income growth, what drives higher earnings, and what factors might limit your income potential.

This helps you make a strategic career decision rather than an emotional one based on the prestige of Supreme Court practice alone.

AOR Supreme Court Salary: Fee Structure:

Understanding the AOR fee structure is essential for calculating realistic income projections and for setting your own fees strategically when you begin practice.

Let me break down exactly what AORs charge for different services, how these fees vary by experience and complexity, and how these individual charges combine to create monthly and annual income.

What are AOR Filing and Drafting Fees?

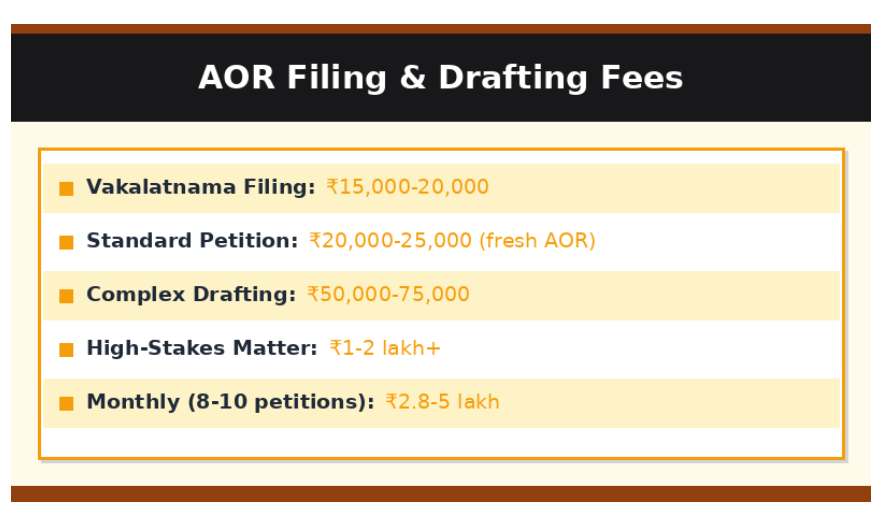

AORs generate substantial income from the filing and drafting services that only they can provide in the Supreme Court. These services form the foundation of AOR practice, and understanding the fee structure helps you price your services appropriately and understand income potential from this revenue stream.

For basic vakalatnama filing, which is the document appointing you as AOR on behalf of a client, typical charges range from ₹15,000-20,000. This might seem like a substantial fee for what appears to be an administrative document, but several factors justify this charge.

First, as an AOR, only you have the exclusive legal right to file this document in the Supreme Court, creating inherent value. Second, filing involves verifying client identity, ensuring proper execution, complying with Supreme Court Registry requirements, and bearing personal responsibility for accuracy.

Many fresh AORs charge toward the lower end (₹15,000) to attract initial matters and build relationships, while established practitioners command ₹20,000 or more for the same service based on reputation and demand. Some AORs bundle vakalatnama filing with initial petition filing as a package rather than charging separately, which I’ll discuss in the drafting section.

Petition drafting fees vary much more widely based on complexity, case type, and your experience level.

For standard petition drafting such as a straightforward Special Leave Petition (SLP) or writ petition, base fees typically start at ₹20,000-25,000 for fresh AORs. This covers drafting the main petition, preparing the required annexures list, drafting synopsis of arguments, and ensuring compliance with Supreme Court formatting and procedural requirements.

For complex matter drafting involving multiple legal issues, extensive case law research, voluminous documents, or sensitive constitutional questions, fees jump substantially to ₹50,000-75,000 or even higher.

For example, a constitutional challenge involving interpretation of multiple statutory provisions, requiring analysis of Supreme Court precedents and High Court decisions, with complicated factual background, would command premium drafting fees. Similarly, commercial or tax matters with crores of rupees at stake justify higher fees given the value to the client.

The drafting income stream is particularly important for fresh AORs because it provides steady, predictable revenue. Unlike court appearances which depend on hearing schedules and can be unpredictable, drafting work flows consistently from referral sources.

An AOR handling 8-10 petition drafting assignments monthly at average ₹35,000-50,000 each generates ₹2.8-5 lakh monthly from drafting alone, which forms a solid income base supplemented by appearance fees and other services.

How Much Do AORs Charge for Court Appearances?

Court appearance fees represent one of the most lucrative revenue streams for established AORs, often exceeding drafting income once you build reputation and client base.

Let me explain the typical fee structure for appearances and how this income source evolves with experience.

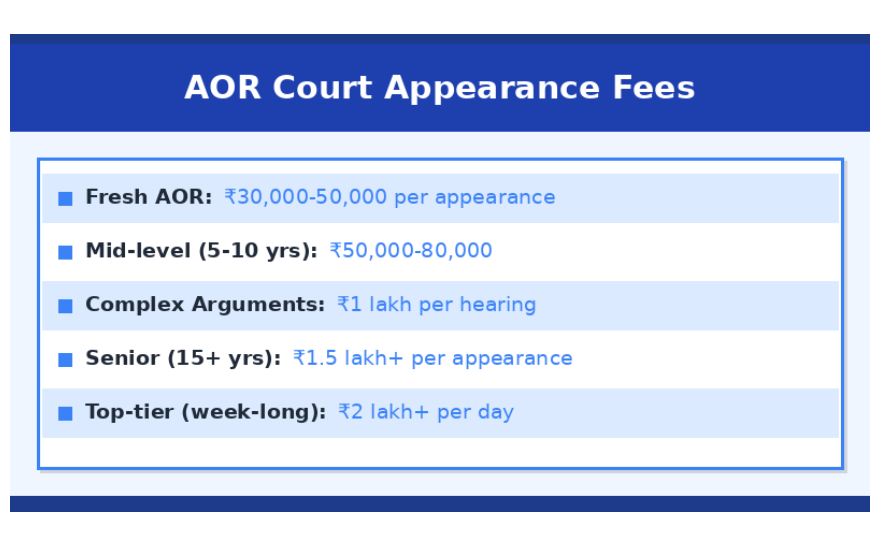

Fresher Advocate on Record Appearance Fees

As a new AOR, you’ll charge ₹30,000-50,000 per appearance for most matters. If the case requires extended arguments or multiple benches in a single day, you might charge ₹50,000. This is per appearance, not per case. If a matter is adjourned and comes up again next month, you charge appearance fees again.

These fees are structured considering your preparation time, travel to court (if you’re not Delhi-based), and the actual appearance time. Even a brief 2-minute mention before the bench requires you to be familiar with the case facts, latest developments, and be ready to respond to judicial queries. Clients understand this and accept appearance fee structures as standard in Supreme Court practice.

Virtual hearings since 2020 have made appearance fees more attractive, especially for non-Delhi AORs. You can now attend Supreme Court hearings from your home city, eliminating travel costs and time.

Senior Advocate on Record Hearing Fees

With 5-10 years of AOR experience, your appearance fees increase to ₹50,000-80,000 for standard hearings and ₹1 lakh for complex arguments or final hearings. You’re now known for your courtroom skills, judges recognize you, and clients specifically request your presence in court rather than briefing junior advocates.

Senior AORs with 15+ years often charge ₹1.5 lakh+ per appearance, especially for high stakes matters. These are advocates whose arguments can genuinely influence case outcomes, who have argued landmark cases, and whose strategic insights during hearings add significant value. At this level, you’re charging for expertise that comes from decades of Supreme Court practice, not just the appearance itself.

Some top tier AORs charge daily rates rather than per-appearance fees. For complex constitutional cases requiring week-long hearings, they might charge ₹2 lakh + per hearing. This is because of the high-value commercial disputes or major public interest litigation where the stakes justify premium legal representation.

How Does Your Practice Area Impact AOR Supreme Court Salary?

Your choice of practice area specialization dramatically impacts your income potential as an AOR. Different areas of Supreme Court practice offer very different combinations of case volume, fee levels, client types, and income trajectories.

Let me walk you through the income realities across major practice areas so you can make informed specialization decisions aligned with your financial goals.

Which Practice Areas Offer Highest AOR Income?

If income maximization is your primary goal, certain practice areas clearly offer better earning potential than others. However, higher income often comes with specific tradeoffs in terms of competition, required expertise depth, or work-life balance that you need to consider.

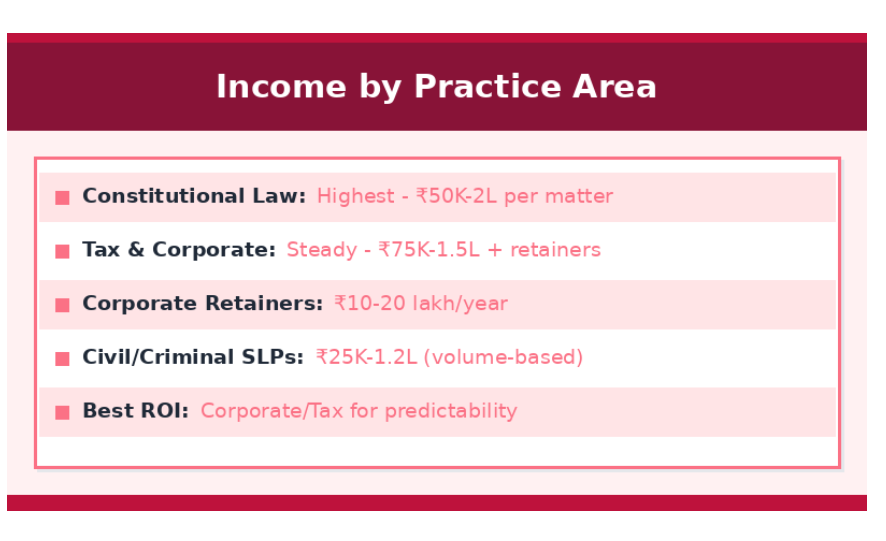

Constitutional Law Matters: High Profile, Premium Fees

Constitutional law practice is where the highest fees and greatest professional recognition converge. Writ petitions challenging legislation, constitutional interpretation cases, and public interest litigation often involve fundamental rights, government policy, and significant public interest. Clients, whether corporates, NGOs, or individuals, pay premium rates for these matters.

You’ll charge ₹50,000-75,000 for drafting constitutional writ petitions as a mid-career AOR, and ₹1-2 lakh as a senior practitioner. Appearance fees for constitutional matters are similarly higher, ₹50,000-2 lakh + per hearing, depending on the expertise and experience. These cases also generate media attention, building your professional reputation and attracting more high-value clients.

The challenge with constitutional practice is that it requires deep expertise, stays updated with evolving constitutional jurisprudence, and demands sophisticated legal argumentation. But if you build this expertise, your income ceiling is essentially unlimited.

Tax and Corporate Litigation: Steady Corporate Salary

Tax and corporate litigation offers the best combination of high fees and steady case volume. Corporate clients litigate regularly in the Supreme Court, challenging tax assessments, corporate law provisions, regulatory orders, and commercial disputes. They pay well and provide repeat business, making this practice area ideal for building predictable annual income.

You charge ₹75,000-1.5 lakh for corporate/tax SLPs, and ₹75,000-1 lakh per appearance. More importantly, corporate clients often offer annual retainers, ₹10-20 lakh per year to be their preferred AOR for all Supreme Court matters. Three retainer clients plus regular case work can easily generate a ballpark figure of ₹50-80 lakh annually for a mid-career AOR.

Corporate clients also have different payment behavior than individual litigants; they pay on time, via bank transfer, and don’t negotiate much on fees if you deliver results. This makes corporate/tax practice more professionally manageable and financially predictable than other areas.

Civil, Criminal, and Family Law SLPs: Income Ranges

Civil, criminal, and family law matters constitute the bulk of Supreme Court filings, but typically involve individual litigants with more limited budgets.

You may charge around ₹25,000-50,000 for drafting these SLPs as a new AOR, scaling to approximately ₹60,000-1.2 lakh with experience. Appearance fees range can be around ₹30,000 to ₹70,000, depending on the complexity of the case.

The advantage here is volume; there are far more civil and criminal matters than constitutional or corporate cases. If you build a practice handling 15-20 civil/criminal SLPs monthly at ₹40,000 average per case, you’re generating roughly ₹6-8 lakh monthly (₹72-96 lakh annually).

Many successful AORs build profitable practices in these areas through volume and efficiency.

The downside is that individual clients are more price-sensitive, payment collection can be challenging, and the work is more routine. But for AORs who want consistent case flow without corporate client dependencies, civil/criminal practice offers reliable income potential.

What Factors Affect AOR Supreme Court Salary?

Beyond experience level and practice area specialization, several other critical factors determine your actual income as an AOR. Understanding these factors helps you make strategic decisions to maximize earning potential and avoid common mistakes that limit income growth.

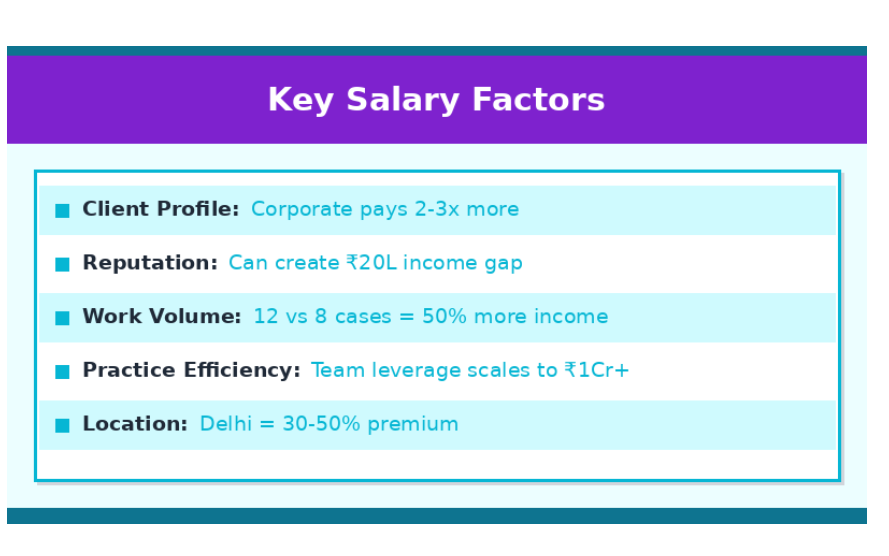

How Does Location Impact AOR Supreme Court Salary?

Geographic location is one of the most significant income factors for AORs, with Delhi-based practitioners enjoying substantial advantages over those based elsewhere in India.

Let me explain the realities of location-based income differences and strategies to optimize earnings regardless of your base location.

Delhi Based vs Outside Delhi Salary Difference

Delhi based AORs typically earn around 30-50% more than similarly experienced AORs practicing from outside Delhi, all other factors being equal.

This isn’t a small difference, it’s a substantial income gap that significantly affects your lifetime earnings and career trajectory. Understanding why this gap exists and what you can do about it is critical for career planning.

The income differential exists for several interconnected reasons.

First, Delhi based AORs have daily physical access to the Supreme Court, allowing them to attend hearings whenever matters are listed, handle urgent mentions or applications on short notice, personally interact with Registry officials to resolve filing issues, and maintain physical presence in Supreme Court chambers area where informal networking and referral relationships develop naturally.

Second, clients and referring advocates perceive Delhi based AORs as more accessible and reliable. When a High Court advocate needs to file an urgent application in the Supreme Court, they naturally prefer an AOR who can physically go to court tomorrow versus one who needs to travel from another city.

Third, Delhi based AORs benefit from superior networking opportunities. They attend Bar Association events, professional seminars, and social gatherings where referral relationships form organically. These soft factors translate directly into work flow and income.

Fourth, Delhi based AORs avoid the travel costs that outside Delhi practitioners bear. Every hearing requires flights, hotels, local transportation, and time away from family. These costs either reduce your net income if you absorb them or make your services more expensive if you pass them to clients. Neither option is ideal for income optimization.

The practical impact on income is substantial.

A full time Delhi-based mid career AOR typically earns around ₹30-50 lakh annually. You’re handling 8-12 active matters monthly, attending hearings 2-3 days per week.

As a non Delhi AOR, you can assume to earn ₹10+ lakh annually from Supreme Court work in your first 5 years while maintaining your High Court practice. You’re filing 3-5 SC petitions monthly, attending hearings via video or in-person visits, and your SC income supplements your existing practice rather than replacing it.

What Other Factors Determine Your AOR Supreme Court Salary?

Beyond location and the factors we’ve already discussed (experience and practice area), several additional variables significantly impact your earning potential. Strategic management of these factors can mean the difference between plateauing at modest income versus reaching top-tier earnings.

Client Profile, Reputation, Work Volume, and Practice Efficiency Impact

Your client profile dramatically affects both fees you can charge and income stability. Corporate clients generally pay 2-3 times higher fees than individual clients for similar matters and provide income stability through retainers and repeat work.

Government clients offer a mixed profile. They provide steady volume and reliable payment (though sometimes slow), but government fee structures can be constrained by regulations and budget considerations.

Central government departments and PSUs typically pay better than state governments. Government work provides income floor but rarely generates the premium fees that corporate clients offer.

Building a corporate heavy client base requires strategic positioning. You need to develop expertise in areas corporations care about like commercial disputes, IP matters, tax appeals, or regulatory challenges.

You must build relationships with corporate legal departments and law firms serving corporate clients. You should demonstrate business acumen and commercial understanding beyond pure legal expertise. You need to market your practice professionally through website, LinkedIn presence, published articles, and speaking engagements.

Reputation and track record create pricing power that directly translates to income. Two AORs with identical 8 years experience might earn ₹25 lakh versus ₹45 lakh annually based purely on reputation differences.

The higher earning AOR has built recognition through successful landmark cases, published thought leadership demonstrating expertise, speaking engagements at legal conferences or law schools, and active presence in bar associations and professional networks.

Building reputation requires intentional effort beyond just doing good legal work. You need to strategically take on matters that build visibility, even if they’re not the highest paying initially. Write case commentaries for legal journals and blogs to demonstrate expertise.

Speak at professional events where potential clients and referral sources attend. Leverage social media, particularly LinkedIn, to share insights and build professional brand. Success in high-profile matters should be communicated (appropriately and ethically) to your network.

Work volume directly determines income up to your capacity limit.

An AOR handling 8 matters monthly at average ₹50,000 per matter earns ₹4.8 lakh monthly (₹57.6 lakh annually). The same AOR handling 12 matters monthly at similar fees earns ₹7.2 lakh monthly (₹86.4 lakh annually). That’s 50% income difference driven purely by volume increase, assuming you maintain quality and client satisfaction.

Increasing work volume requires systematically expanding your referral network, building reputation that attracts inbound inquiries, and selectively accepting more matters as your systems improve.

The challenge is balancing volume growth against quality maintenance. Taking on too many matters relative to your capacity leads to quality decline, client dissatisfaction, and reputational damage that hurts long-term income even if it boosts short-term earnings.

Practice efficiency determines your income ceiling. As a solo practitioner working personally on every matter, you hit capacity limits around 10-12 substantial matters monthly depending on complexity. To scale beyond this ceiling and reach ₹75 lakh to ₹1 crore+ income, you need systems and team leverage.

Successful high earning AORs develop efficient practices through technology leverage like legal research databases, case management software, and document automation, junior associates who handle research, initial drafting, and routine communications, standardized processes for common tasks like petition formatting, Registry filing, and client communication, and clear delegation allowing them to focus time on high-value activities like court appearances, client strategy, and business development.

The top 10% of AOR earners distinguish themselves through combination of strategic factors.

They choose high-income specializations like constitutional, IP, or commercial practice. They cultivate corporate and government client bases rather than depending on individual clients. They invest in reputation building through thought leadership and professional visibility.

They develop practice efficiency through teams and systems. They’re typically Delhi-based or maintain strong Delhi presence. And they’re strategic about work volume, selectively taking on matters that enhance reputation and income rather than accepting everything.

Conversely, lower income AORs often make preventable mistakes. They treat AOR practice as passive credential rather than actively marketing services. They compete primarily on price rather than differentiation through expertise.

They fail to specialize, positioning themselves as generalists in competitive market. They neglect reputation building and remain invisible to potential clients and referral sources. They work as solo practitioners without systems or team, hitting income ceilings.

They accept every matter regardless of fit or value, leading to capacity constraints without commensurate income.

Is Becoming an AOR Financially Worth It?

The most important financial question isn’t what AORs earn, it’s whether the investment to become an AOR generates sufficient return to justify the time, money, and opportunity cost involved.

Let me walk you through a comprehensive cost-benefit analysis so you can make an informed decision based on your specific circumstances.

What is the Total Investment Required to Become AOR?

Before committing to the AOR path, you need to understand the complete financial investment required, including both direct costs and opportunity costs that many aspiring AORs underestimate until they’re already committed to the process.

Setup Costs, Training Period, Monthly Expenses

The direct costs of becoming an AOR are relatively modest. The examination fee is ₹750 and the registration fee after passing is ₹250, totaling just ₹1,000 in official fees.

These negligible direct costs aren’t the real investment concern.

The significant investment is in practice setup and operation during your first year while income is still building. You must maintain an office in Delhi within 16 kilometers of the Supreme Court, which typically costs ₹15,000-40,000 monthly depending on whether you rent independent office space or share chambers with other AORs.

For first year (12 months), office costs alone total ₹1.8-4.8 lakh.

You must employ a registered clerk at ₹15,000-25,000 monthly salary, adding another ₹1.8-3 lakh annually. Add professional equipment and technology such as laptop, printer, legal research subscriptions.

I’ll continue with a more concise approach:

The training period represents a major opportunity cost.

During your mandatory one-year training under a senior AOR, your earning capacity is typically reduced as you dedicate time to learning Supreme Court procedures rather than handling your own practice fully.

If you’re currently earning ₹40,000-60,000 monthly from High Court practice, reducing this by even 30-40% for training represents ₹1.5-3 lakh opportunity cost.

Adding these components, the total first-year investment typically ranges from ₹3-6 lakh depending on your choices regarding office location, clerk salary, and the extent to which you maintain existing practice during training.

This is substantial but manageable for most mid career advocates who have accumulated some savings.

Conclusion

Understanding AOR salary realities empowers you to make strategic career decisions rather than pursuing Supreme Court practice based on prestige alone. The income spectrum from ₹12-20 lakh for fresh AORs to ₹30-50 lakh for mid level practitioners, with potential to exceed₹1 crore for top performers, represents substantial earning potential in Indian legal practice.

The key insights for financial planning: expect challenging first year with modest income while establishing practice, anticipate significant income acceleration in years 2-5 if you execute strategically, choose practice area specialization based on your income goals and risk tolerance, recognize that Delhi location provides 30-50% income advantage over outside Delhi practice, and understand that highest earners combine smart specialization with corporate clients, strong reputation, and practice efficiency through teams and systems.

Your AOR decision should weigh the first-year investment against realistic income projections for your situation, considering your current income level and whether you’ll transition fully or pursue hybrid model.

For most advocates with 4-7 years of practice currently earning ₹15-30 lakh annually, AOR represents favorable ROI with breakeven in 2-3 years and substantial cumulative income gains over 5-10 years. For those earning ₹50+ lakh already, AOR makes more sense as supplement rather than replacement unless non financial factors drive your decision.

If you are ready to become an AOR, you can refer this guide on cracking the AOR exam and start your journey now.

Frequently Asked Questions

What is the starting salary of Advocate on Record in India?

Fresh AORs in their first year typically earn ₹12-20 lakh annually if building practice from scratch, though income varies significantly based on existing client relationships and practice base.

How much can experienced AORs earn annually?

You can realistically earn roughly ₹30-50 lakh after 10 years of practice and cross around ₹1 crore annually as a senior practitioner with the right strategy, specialization, and client relationships. Some top practitioners earn ₹2-3 crore or more, especially those with specialized practices in constitutional law, taxation, or corporate matters.

Do Delhi-based AORs earn more than those outside Delhi?

Yes, Delhi based AORs typically earn around 30-50% more than similarly experienced practitioners based outside Delhi due to better access, networking opportunities, and client perception factors.

Which AOR practice area pays the highest salary?

Constitutional law offers the highest income potential annually. You’ll charge ₹50,000-75,000 for drafting constitutional writ petitions as a mid-career AOR, and ₹1-2 lakh as a senior practitioner. Appearance fees for constitutional matters are similarly higher, ₹50,000-2 lakh + per hearing, depending on the expertise and experience. These cases also generate media attention, building your professional reputation and attracting more highvalue clients..

What are the typical fees AORs charge per court appearance?

As a new AOR, you’ll charge ₹30,000-50,000 per appearance for most matters. With 5-10 years of AOR experience, your appearance fees increase to ₹50,000-80,000 for standard hearings and ₹1 lakh for complex arguments or final hearings. Senior AORs with 15+ years often charge ₹1.5 lakh+ per appearance, especially for high stakes matters. For complex constitutional cases requiring week-long hearings, they might charge ₹2 lakh + per hearing.

How long does it take to earn ₹50 lakh annually as AOR?

Most AORs reach ₹50 lakh annual income after 10-12 years of practice, though this varies significantly based on specialization, location, client profile, and reputation-building efforts.

Can AORs earn income from retainers?

Yes, corporate and government retainers represent significant income streams for established AORs, ranging from ₹25,000 per month to ₹5 lakh per year annually depending on client size and scope of services covered.

What is the income difference between corporate and individual client practice?

Corporate focused AORs typically earn 2-3 times higher than those serving primarily individual clients, due to higher fee capacity, retainer arrangements, and matter complexity premium.

Is AOR salary better than High Court advocate income?

AOR income potential is generally higher than High Court practice for similarly experienced advocates.

What percentage of AORs earn above ₹1 crore annually?

Approximately 3-5% of practicing AORs earn above ₹1 crore annually, representing top-tier practitioners with 15+ years experience, strong specialization, corporate client base, and established reputation.

What are monthly expenses that reduce AOR net income?

Major monthly expenses include Delhi office rent (₹15,000-40,000), clerk salary (₹15,000-25,000), legal research subscriptions (₹5,000-10,000) and travel costs for outside Delhi AORs (₹25,000-35,000).

Can outside Delhi AORs earn as much as Delhi-based AORs?

Outside Delhi AORs rarely match Delhi based earnings due to structural disadvantages, but can partially bridge the gap through regular Delhi visits, virtual hearing leverage, strong reputation building, and strategic specialization in areas where physical presence matters less.

How does case volume affect AOR monthly salary?

Case volume directly determines income within capacity limits. An AOR handling 8 matters monthly at ₹50,000 average earns ₹4 lakh monthly, while handling 12 matters at similar fees earns ₹6 lakh monthly, representing 50% income difference purely from volume increase.

Allow notifications

Allow notifications