Wondering about the Advocate on Record Salary—how much can an AOR earn in the Supreme Court? This detailed salary guide breaks down real income ranges, from ₹12 lakh for new AORs to ₹1 crore+ for seniors, plus filing fees, drafting charges, appearance rates, and the secret strategies that separate top-earning AORs from the rest.

Table of Contents

How Much is the Advocate on Record’s Salary in the Supreme Court?

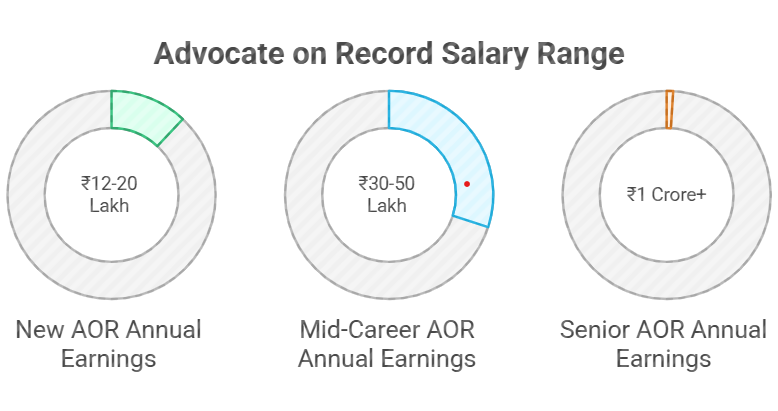

There are only 3,789 Advocates on Record in India. They earn anywhere between ₹12 lakh and ₹1 crore annually.

That’s an 8x income difference for the same qualification.

If you’re thinking about becoming an AOR or you’ve already qualified and are trying to understand your earning trajectory, this gap should fascinate and concern you in equal measure. Because here’s the uncomfortable truth: most advocates stumble into the lower end of this range without ever understanding why.

Picture this: Two advocates pass the AOR exam in the same year. Both are competent lawyers with decent High Court practices. Five years later, one is earning ₹25 lakh from Supreme Court work while maintaining their existing practice. The other has crossed ₹75 lakh and is getting more client inquiries than they can handle.

Same qualification. Same experience level. Wildly different outcomes.

I’ve spent years analyzing what separates high earning AORs from those who barely justify their qualification costs.

This guide breaks down the real numbers, not aspirational figures, but actual income data from practicing AORs. More importantly, you’ll understand the specific mistakes that cap income potential mistakes I’ve watched countless qualified AORs make in their first three years, permanently limiting their earning trajectory.

Whether you’re evaluating if the AOR exam is worth your investment, or you’re already qualified and wondering why your Supreme Court income isn’t growing as expected, the answers are in the economics, not just the law.

Let’s start with what you actually came here to find out.

Advocate on Record Salary Range Overview: ₹12 Lakh to ₹ 1 Crore+ Annually

Let’s talk numbers. According to data from practicing AORs and Supreme Court practice analysis, a new AOR typically earns between ₹12,00,000 to ₹20,00,000 annually, assuming you’re actively building your practice. This isn’t passive income; you’ll be filing cases, drafting petitions, and attending hearings regularly to hit these numbers.

Mid-career AORs with 10 years of practice comfortably earn ₹30-50 lakh annually. At this stage, you’ve built a referral network, established corporate client relationships, and your fees have increased substantially. You’re no longer chasing every case; clients are seeking you out, and you can be selective about the matters you take on.

Senior AORs with 15+ years of practice and a strong reputation regularly cross ₹1 crore in annual income. Some top practitioners earn ₹2-3 crore or more, especially those with specialized practices in constitutional law, taxation, or corporate matters. These are the advocates whose names appear in landmark Supreme Court judgments, and their billing rates reflect their expertise and track record.

The range is wide because your income as an AOR is based on case volume, fee rates, client type, and practice area. You control your earning potential through the quality of your work, your professional network, and your ability to build a sustainable Supreme Court practice.

Why Advocate on Record Salary Differs from Regular Supreme Court Advocates?

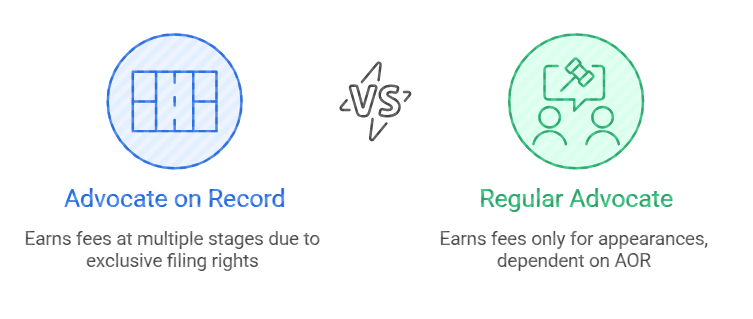

Here’s what many people don’t understand: not every advocate practicing in the Supreme Court is an AOR. In fact, according to the Supreme Court of India records, as discussed above, there are only around 3,789 registered AORs among India’s 20+ lakh advocates. This exclusivity is precisely why AOR salary structures differ dramatically from regular advocates appearing in the Supreme Court.

Regular advocates can appear in Supreme Court hearings and argue matters before the bench only with prior instructions of the Advocate on Record. They cannot even file petitions in their own name, sign vakalatnamas, or directly engage with the Supreme Court Registry. They must work through an AOR, which creates a fundamental difference in how money flows in Supreme Court practice.

Exclusive Filing Rights and Fee Structure

Your exclusive filing rights as an AOR mean you earn fees at multiple stages of every case. When a client approaches you to file a Special Leave Petition (SLP), you earn money for drafting the petition, filing it with the Registry, signing the vakalatnama, and then attending hearings. Non-AOR advocates miss out on the filing and signing fees entirely; they only get paid if they’re briefed for appearances.

Let me break down a typical case from an income perspective. A client needs an SLP filed in the Supreme Court. As an AOR, you charge ₹20,000 for drafting and filing the petition. That’s your base income for bringing the case onto the Supreme Court docket. When the matter comes up for hearing, you charge an additional ₹30,000 to 50,000 for your appearance. A non-AOR advocate working on the same case might only earn the appearance fee, and only if they’re specially briefed by the AOR.

The Supreme Court Rules, 2013, prescribes a fee schedule for AOR services, but the market rates are significantly higher.

Your filing rights also mean you’re the primary point of contact with the Supreme Court. All notices, orders, and correspondence come to you. This positions you as the case manager, not just a service provider, which justifies higher overall compensation compared to advocates who are merely briefed for specific tasks.

What Fees Do Advocates on Record Charge for Different Legal Services?

Understanding your potential AOR income requires breaking down the fee structure by service type. Each category has its own pricing dynamics based on complexity, your experience level, and client type.

I’ll walk you through exactly what you can charge for each service, from the day you become an AOR to senior practice levels. These figures are based on current market rates reported by practicing AORs and my analysis of Supreme Court practice economics. Keep in mind that these are ranges; your actual fees will depend on your negotiation skills, case complexity, and professional reputation.

H2: Signing Vakalatnama and Filing Fees

The Vakalatnama is your first income touchpoint in any Supreme Court matter. This is the document that authorizes you to represent a client before the Supreme Court, and your signature on it is mandatory; no case moves forward without an AOR signed vakalatnama. This exclusivity allows you to charge specifically for this service.

H3: Standard Advocate on Record Charges for Petition Filing (₹15,000-20,000)

As a new AOR, you’ll typically charge ₹10,000-15,000 just for signing the vakalatnama and completing the filing formalities with the Supreme Court Registry. This might seem like a lot for what appears to be a simple signature, but clients understand they’re paying for your qualification, your filing rights, and your responsibility as the advocate on record for the entire duration of the case.

This fee covers your interaction with the Registry, ensuring all procedural requirements are met, handling any defects pointed out by the Registry, and maintaining the case file. You’re essentially the case manager, and this filing fee reflects that ongoing responsibility. Many new AORs undercharge here, thinking they need to compete on price, but remember, there are only 3,789 AORs in India, and clients will pay fair rates for qualified practitioners.

Within 3-4 years of practice, your filing fees typically increase to ₹20,000 for standard matters. By the time you’re a senior AOR with 10+ years of experience, you might charge higher for signing and filing, depending on case complexity and client profile. Corporate clients, in particular, understand the value of an experienced AOR and don’t negotiate much on these fees.

H2: Drafting Charges

Drafting petitions for the Supreme Court is where significant income generation happens, especially as you gain experience. Unlike district court or High Court petitions, Supreme Court drafting requires mastery of specific procedures, citation styles, and legal reasoning that meets the apex court’s standards. Your drafting fees reflect this specialized skill.

H3: New Advocate on Record Drafting Charges (₹20,000-25,000 per Petition)

In your first 2-3 years as an AOR, you’ll charge ₹20,000-25,000 per petition for straightforward SLPs or writ petitions. This is for a complete draft, legal research, issue identification, ground formulation, precedent citations, and the actual petition drafting.

Your drafting income can be substantial even as a new AOR if you build the right network. Many High Court senior advocates need Supreme Court matters filed, but don’t have AOR qualification themselves. If you connect with just 3-4 such seniors who send you 2-3 cases per month each, that’s 6-12 petitions monthly at ₹20,000-25,000 each, ₹1.2-3 lakh per month just from drafting work for other lawyers.

The key is delivering quality drafts quickly. Supreme Court practice has tight timelines, and advocates who can turn around well drafted petitions within 48-72 hours build strong referral networks. Your drafting fee becomes recurring revenue as the same advocates return to you for every Supreme Court matter they handle.

H3: Mid-Career to Senior Advocate on Record Fees (₹75,000-2 Lakh+)

After 3-5 years of AOR practice, your drafting fees jump significantly. You’re now charging ₹50,000-75,000 for standard petitions and ₹1-2 lakh for complex constitutional, corporate, or tax matters. This isn’t arbitrary pricing; your track record, your understanding of Supreme Court practice, and your ability to craft persuasive legal arguments justify these rates.

Complex matters require extensive legal research, analysis of multiple precedents, and crafting sophisticated legal arguments. A constitutional writ petition challenging a legislative provision might take 40-50 hours of research and drafting work. At ₹1.5-2 lakh, you’re essentially charging ₹3,000-5,000 per hour, reasonable for specialized Supreme Court expertise.

Appearance Charges

Appearance fees are charged separately from drafting and filing fees. When your matter is listed for hearing before a Supreme Court bench, you attend and argue the case, and this service generates additional income. The frequency of hearings varies, some matters get heard and disposed of in a single appearance, while others require multiple visits over months or years.

Fresher Advocate on Record Appearance Fees (₹30,000-50,000)

As a new AOR, you’ll charge ₹30,000-50,000 per appearance for most matters. If the case requires extended arguments or multiple benches in a single day, you might charge ₹50,000. This is per appearance, not per case. If a matter is adjourned and comes up again next month, you charge appearance fees again.

These fees are structured considering your preparation time, travel to court (if you’re not Delhi-based), and the actual appearance time. Even a brief 2-minute mention before the bench requires you to be familiar with the case facts, latest developments, and be ready to respond to judicial queries. Clients understand this and accept appearance fee structures as standard in Supreme Court practice.

Virtual hearings since 2020 have made appearance fees more attractive, especially for non-Delhi AORs. You can now attend Supreme Court hearings from your home city, eliminating travel costs and time.

Senior Advocate on Record Hearing Fees (₹50,000-2 Lakh + per Appearance)

With 5-10 years of AOR experience, your appearance fees increase to ₹50,000-80,000 for standard hearings and ₹1 lakh for complex arguments or final hearings. You’re now known for your courtroom skills, judges recognize you, and clients specifically request your presence in court rather than briefing junior advocates.

Senior AORs with 15+ years often charge ₹1.5 lakh+ per appearance, especially for high stakes matters. These are advocates whose arguments can genuinely influence case outcomes, who have argued landmark cases, and whose strategic insights during hearings add significant value. At this level, you’re charging for expertise that comes from decades of Supreme Court practice, not just the appearance itself.

Some top tier AORs charge daily rates rather than per-appearance fees. For complex constitutional cases requiring week-long hearings, they might charge ₹2 lakh + per hearing. This is because of the high-value commercial disputes or major public interest litigation where the stakes justify premium legal representation.

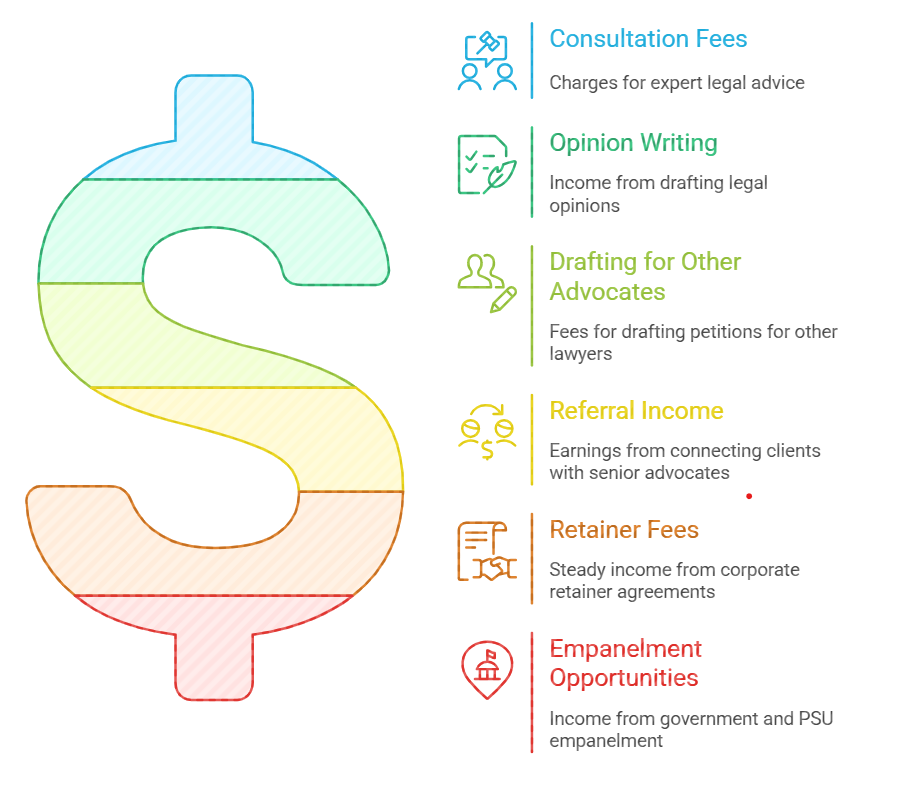

What Additional Revenue Streams boost Advocate on Record’s Salary?

Your AOR income isn’t limited to filing, drafting, and appearances. Once you establish your Supreme Court practice, several additional revenue streams emerge that can add ₹5-15 lakh or more to your annual income. These supplementary income sources are often overlooked by new AORs but become significant contributors to total compensation as your practice matures.

Consultation and Conference Fees

Consultation fees are charged when clients meet you to discuss legal strategy, case viability, or Supreme Court procedures. Even before a case is filed, clients pay for your expert opinion on whether their matter has merit for Supreme Court intervention. You typically charge ₹25,000-1,00,000 per consultation, including the travel charges if the lawyer is outside Delhi.

Opinion Writing and Legal Advisory Charges

Legal opinion writing is lucrative and doesn’t require court appearances. Corporates, law firms, and other advocates frequently need written opinions on Supreme Court jurisdictional issues, appealability of High Court orders, or interpretation of apex court judgments. You can assume that a new AOR may charge ₹5,000-15,000 per opinion, scaling to almost ₹50,000-1 lakh for complex opinions as the AOR gains experience.

These opinions can be prepared at your convenience, evenings, weekends, or during gaps in court work. They’re purely advisory and don’t create ongoing case responsibilities, making them ideal additional income with flexible time commitment.

Drafting for Other Advocates, Referral Income, and Retainer Fees

One of your biggest income multipliers is drafting Supreme Court petitions for other advocates who aren’t AORs. Many senior High Court advocates have Supreme Court matters but rely on AORs for drafting and filing. You may charge anywhere between ₹8,000-15,000 per petition for this service, lower than your direct client rates but with much higher volume and no client management overhead.

Referral income comes when you connect clients with senior advocates for arguments while retaining the AOR role. You might charge the client a coordination fee for arranging senior counsel.

Corporate retainer arrangements are the holy grail of steady AOR income. A company or law firm retains you for a fixed monthly/annual fee of ₹25,000 per month to ₹5 lakh per year to handle all their Supreme Court matters. You get predictable income, and they get priority attention and preferred rates. Even one good retainer client can stabilize your practice finances significantly.

Empanelment with the Supreme Court Legal Services Committee, Central Agency Section, Various PSUs and Banks

Empanelment opportunities provide steady case flow and reliable income. The Supreme Court Legal Services Committee maintains panels of AORs for legal aid matters. You get appointed to cases and receive government-prescribed fees. Central government agencies, Public Sector Undertakings (PSUs), and nationalized banks maintain AOR panels for their Supreme Court litigation.

Once empaneled, you receive a steady flow of government matters. The fee structure is fixed by government norms but payment is guaranteed and the case volume is consistent. The fees paid to junior panel advocates of the Insolvency and Bankruptcy Board of India for an effective argument are up to ₹40,000, for drafting/vetting charges, up to ₹30,000, and for other miscellaneous work, up to ₹20,000.

PSU and bank empanelment is particularly valuable because it provides credibility with private clients as well. When you’re an empaneled AOR for State Bank of India or BHEL, other corporate clients see this as validation of your capabilities. It’s both an income source and a reputation builder.

What Factors Affect an Advocate on Record Salary?

Your AOR income isn’t predetermined; it varies significantly based on factors within your control. Understanding these variables helps you make strategic decisions about practice area, client targeting, and geographic positioning. Let me walk you through the major factors that will determine whether you earn ₹12 lakh or ₹1 crore annually.

How Does Your Practice Area Impact Advocate on Record Salary?

Practice area specialization is probably the single biggest determinant of your long-term AOR income. Not all Supreme Court matters are created equal from a fee perspective; constitutional cases, corporate disputes, and tax litigation command premium fees, while routine civil matters have standardized, lower rates.

Constitutional Law Matters: High-Profile, Premium Fees

Constitutional law practice is where the highest fees and greatest professional recognition converge. Writ petitions challenging legislation, constitutional interpretation cases, and public interest litigation often involve fundamental rights, government policy, and significant public interest. Clients, whether corporates, NGOs, or individuals, pay premium rates for these matters.

You’ll charge ₹50,000-75,000 for drafting constitutional writ petitions as a mid-career AOR, and ₹1-2 lakh as a senior practitioner. Appearance fees for constitutional matters are similarly higher, ₹50,000-2 lakh + per hearing, depending on the expertise and experience. These cases also generate media attention, building your professional reputation and attracting more high-value clients.

The challenge with constitutional practice is that it requires deep expertise, stays updated with evolving constitutional jurisprudence, and demands sophisticated legal argumentation. But if you build this expertise, your income ceiling is essentially unlimited.

Tax and Corporate Litigation: Steady Corporate Salary

Tax and corporate litigation offers the best combination of high fees and steady case volume. Corporate clients litigate regularly in the Supreme Court, challenging tax assessments, corporate law provisions, regulatory orders, and commercial disputes. They pay well and provide repeat business, making this practice area ideal for building predictable annual income.

You charge ₹75,000-1.5 lakh for corporate/tax SLPs, and ₹75,000-1 lakh per appearance. More importantly, corporate clients often offer annual retainers, ₹10-20 lakh per year to be their preferred AOR for all Supreme Court matters. Three retainer clients plus regular case work can easily generate a ballpark figure of ₹50-80 lakh annually for a mid-career AOR.

Corporate clients also have different payment behavior than individual litigants; they pay on time, via bank transfer, and don’t negotiate much on fees if you deliver results. This makes corporate/tax practice more professionally manageable and financially predictable than other areas.

Civil, Criminal, and Family Law SLPs: Income Ranges

Civil, criminal, and family law matters constitute the bulk of Supreme Court filings, but typically involve individual litigants with more limited budgets. You may charge around ₹25,000-50,000 for drafting these SLPs as a new AOR, scaling to approximately ₹60,000-1.2 lakh with experience. Appearance fees range can be around ₹30,000 to ₹70,000, depending on the complexity of the case.

The advantage here is volume; there are far more civil and criminal matters than constitutional or corporate cases. If you build a practice handling 15-20 civil/criminal SLPs monthly at ₹40,000 average per case, you’re generating roughly ₹6-8 lakh monthly (₹72-96 lakh annually). Many successful AORs build profitable practices in these areas through volume and efficiency.

The downside is that individual clients are more price-sensitive, payment collection can be challenging, and the work is more routine. But for AORs who want consistent case flow without corporate client dependencies, civil/criminal practice offers reliable income potential.

Does Location Limit an Advocate on Record Salary Potential?

Location is a huge factor in AOR salary calculations, and it’s probably one of your biggest decision points. Should you relocate to Delhi for full-time Supreme Court practice, or maintain your current city and build a part-time Supreme Court practice? Both models work, but the income dynamics are completely different, and understanding them is crucial for realistic salary expectations.

Full-Time Delhi-Based Advocate on Record Salary Potential

If you move to Delhi and commit to full-time Supreme Court practice, your income ceiling is significantly higher than part time practice. Delhi-based AORs have daily access to the Supreme Court, easy in-person networking with other AORs and senior advocates, and can attend physical hearings without travel constraints. This translates directly into higher case volumes and better client relationships.

A full-time Delhi-based mid-career AOR (10+ years) typically earns around ₹30-50 lakh annually. You’re handling 8-12 active matters monthly, attending hearings 2-3 days per week, and your fees are roughly 20-30% higher than non-Delhi AORs because clients perceive greater accessibility and responsiveness. Corporate clients particularly prefer Delhi-based AORs for time-sensitive matters requiring urgent court access.

You can assume that Senior Delhi-based AORs (15+ years) regularly cross ₹1 crore annually. At this level, you’re selective about cases, have multiple corporate retainers, and your reputation means clients seek you out rather than you marketing your services. Delhi’s legal ecosystem, law firms, corporate houses, and senior advocates provide endless networking and referral opportunities that are harder to access from other cities.

The tradeoff is Delhi’s higher cost of living and overhead, chamber rent (around ₹30,000-80,000 monthly, depending on the area), staff salaries, and higher daily expenses. But if you’re serious about maximizing AOR income and building a truly high-value Supreme Court practice, Delhi residence is almost mandatory after your first 5-7 years of AOR qualification.

Part-Time Supreme Court Advocate on Record Salary While Maintaining High Court Practice

The more common path, especially initially, is maintaining your High Court practice while building Supreme Court work part-time. This is absolutely viable and financially sensible; you don’t abandon your existing client base and income while establishing your SC practice. Many successful AORs practice outside Delhi and visit for hearings 2-4 days monthly.

As a non-Delhi AOR, you can assume to earn ₹10+ lakh annually from Supreme Court work in your first 5 years while maintaining your High Court practice. You’re filing 3-5 SC petitions monthly, attending hearings via video or in-person visits, and your SC income supplements your existing practice rather than replacing it. This dual-practice model generates anywhere between ₹25 to 40 lakh total annual income.

Virtual hearings have been transformative for non-Delhi AORs. You can now attend Supreme Court hearings from your home city, eliminating travel costs and time. This makes part-time SC practice much more viable than pre-2020. Your income per case is slightly lower (clients pay less if you’re not physically present), but your margins are better because you have no Delhi overhead.

The challenge with part-time practice is scalability; you’ll hit an income ceiling of roughly ₹10-20 lakh from SC work unless you relocate. Clients eventually prefer AORs who can meet in person, attend urgent hearings immediately, and coordinate physically with seniors and other counsel. But for many advocates, earning an additional ₹20-30 lakh annually from SC work while maintaining their High Court practice is an excellent outcome without the disruption of relocation.

Calculating Your Potential Advocate on Record Salary: Real Scenarios

Let me show you exactly how AOR income calculations work with three realistic scenarios. These aren’t theoretical; they’re based on actual income patterns of practicing AORs at different career stages. You can use these models to project your own income based on the case volume and fee rates you’re targeting.

Conservative Model: 1 Filing + 5 Drafts + 2 Hearings per Month

This is a realistic target for a new AOR in your first 1-2 years, especially if you’re practicing part time from outside Delhi. You’re filing one matter monthly in your own name for a direct client, drafting 5 petitions monthly for other advocates, and attending 2 hearings (either your own cases or briefed appearances).

Monthly Advocate on Record Salary Calculation

Here’s the rough monthly income breakdown consider the following hypothetical situation:

- One direct client filing with drafting (₹20,000 + ₹15,000 = ₹35,000).

- Five drafting assignments for other lawyers at approximately ₹10,000 each (₹50,000).

- Two court appearances at approximately ₹35,000 each (₹70,000).

Total monthly income, one can assume to be around ₹1,55,000.

This is conservative because you’re not including consultations, retainers, or any additional income streams. You’re also using lower-end fee rates. But even at this conservative estimate, you’re generating a steady monthly income from diverse sources, reducing dependence on any single client or revenue stream.

Annual Advocate on Record Salary Projection

Actually, let me recalculate this, the monthly income of roughly ₹1,55,000 × 12 months = ₹18,60,000 annually, not ₹3-5 lakh. However, in your first year as an AOR, you won’t hit these volumes immediately. It takes 6-8 months to establish networks, get regular referrals, and build case flow. So realistically, in your first full year, you might earn ₹8-12 lakh from SC work as you’re ramping up.

By your second year, as these volumes stabilize, you’ll genuinely earn ₹15-20 lakh annually from this conservative model. This is part-time SC work; you’re still maintaining your High Court practice, which may generate another ₹25-40 lakh. So you can assume your total legal income to be in the range of ₹40-60 lakh annually, significantly more than pre-AOR levels.

Moderate Model: Mid-Career Advocate on Record with Established Practice

After 8-10 years as an AOR, you’ve established your practice, built a referral network, and your fees have increased. You’re now filing 2-3 matters monthly in your own name, drafting 8-10 petitions monthly (mix of direct clients and other lawyers), and attending 4-5 hearings monthly. Your per-case fees are also 40-50% higher than your initial rates.

Monthly Case Volume and Fee Structure

Let us consider an approximate monthly breakdown:

- Two direct client matters with drafting and filing (₹50,000 + ₹25,000 = ₹75,000 per case × 2 = ₹1,50,000).

- Eight drafting assignments at ₹15,000 average (₹1,20,000).

- Five appearances at ₹50,000 average (₹2,50,000).

- Two consultations at ₹8,000 (₹16,000).

An estimated total monthly income of ₹5,36,000.

You’re also likely receiving some retainer income at this stage, and even a small ₹5 lakh annual retainer from one corporate client adds ₹42,000 monthly to this calculation.

Annual Advocate on Record Salary Projection

Again, let me recalculate: ₹5,36,000 monthly × 12 = ₹64,32,000 annually from core case work. Add retainers (₹5-10 lakh), opinions and consultations (₹3-5 lakh), PSU cases (₹1-2 lakh), and your total Supreme Court income is approximately ₹73-81 lakh annually. If you’re practicing part-time, this is in addition to your High Court income.

So the projection of ₹12-20 lakh seems too conservative for this scenario. A more realistic “moderate model” for a mid-career AOR (3-5 years) is ₹25-35 lakh if part-time practice, or ₹60-80 lakh if full-time Delhi-based practice. At this career stage, you’re financially very comfortable, and your AOR qualification has clearly paid for itself many times over.

Ambitious Model: Senior Advocate on Record with Corporate Clients

This is the model for senior AORs (15+ years) with established corporate practices, strong referral networks, and the ability to charge premium rates. You’re highly selective about cases, focused on complex high-value matters, and your practice is structured around retainers and premium clients rather than volume.

Retainer Arrangements and Case Fees

Your income structure looks completely different at this level. You have 2-3 corporate retainer clients paying roughly ₹12-20 lakh annually each (₹36-60 lakh total retainer income). Beyond retainers, you selectively take 3-4 high value direct matters monthly, charging approximately ₹1.5-2.5 lakh per case for drafting and filing complex petitions (charging around ₹6-10 lakh monthly from direct cases).

You appear in court 6-8 times monthly, charging around ₹80,000-1.5 lakh per appearance, depending on matter complexity (charging around ₹6-10 lakh monthly from appearances). You write 2-3 opinions monthly, charging around ₹50,000-75,000 each (₹1-2 lakh monthly). You conduct approximately 4-5 consultations monthly at ₹15,000-20,000 per session (₹60,000-1 lakh monthly).

Annual Advocate on Record Salary Projection

Let’s calculate based on estimated figures:

- Retainer income (₹20-25 lakh annually)

- Direct case income (₹35-50 lakh annually from high-value matters)

- Appearance fees (₹25 lakh-30 lakh annually)

- Opinion writing (₹5-10 lakh annually)

- Consultations (₹3-5 lakh annually)

Total annual income would be in the range of ₹88 lakh-1.2 crore annually.

This is the ambitious but absolutely achievable model for senior AORs with strong practices. You’re in the top 10-15% of AORs by income, your name is recognized in Supreme Court circles, and clients seek you out for your expertise. At this level, you’re also training junior AORs in your chamber, which creates another income stream through their case referrals and shared fees.

What Separates Top Earning Advocates on Record from Others?

Top earning AORs share specific characteristics beyond years of practice.

First, they’ve specialized deeply; they’re known for constitutional law, or tax, or corporate litigation, not generalists. Clients pay premium rates for specialized expertise, and specialization makes you the go to AOR for specific matter types.

Second, they’ve invested heavily in relationships with corporate legal heads, law firms, senior advocates, and other AORs. Their case flow comes from referrals, not marketing, because they’ve built trust and delivered results consistently.

Third, they’re strategic about time management; they don’t take every case, they delegate routine work to juniors, and they focus their time on high-value matters and client relationships.

Fourth, they understand business development. They speak at conferences, write in legal journals, maintain updated websites and LinkedIn profiles, and position themselves as thought leaders. They recognize that AOR practice is both a legal expertise and a professional services business, and they invest in both dimensions. These behaviors compound over the years into dramatically higher income levels.

How Does Advocate on Record Salary Compare to Other Legal Career Paths?

Understanding AOR salary in isolation isn’t enough; you need context about how it compares to alternative legal careers. This helps you make an informed decision about whether pursuing an AOR qualification makes financial sense given your current career trajectory and income level.

Do Advocate on Records Earn More Salary Than High Court Seniors?

Yes.. This is one of the most striking income differentials in Indian legal practice. A senior High Court advocate with 10-15 years of practice typically earns roughly ₹30-75 lakh annually, depending on the city and practice area. A similarly experienced AOR earns ₹88 lakh-1.2 crore annually. That’s around 2x income difference at the same experience level.

Why such a large gap?

The Supreme Court handles higher-value matters, has a national client base rather than regional, and AORs benefit from exclusive filing rights that create multiple fee touchpoints per case. High Court seniors might charge around ₹25,000-50,000 per appearance, while AORs approximately charge ₹50,000-1.5 lakh and that’s after already earning filing and drafting fees.

Advocate on Record Salary Differential at Same Experience Levels

Let me give you specific comparisons.

At 8 years post qualification: A High Court senior might earn around ₹2-3 lakh monthly (₹24-36 lakh annually).

An AOR at the same 8 year mark earns roughly ₹4-5 lakh monthly (₹48 lakh-60 lakh annually).

The differential widens with experience, by year 15, High Court seniors plateau around ₹60-90 lakh annually, while senior AORs are at approximately ₹1.2 crore annually.

The income growth trajectory is steeper for AORs because the Supreme Court practice has higher leverage. One landmark Supreme Court case generates more income than five High Court matters. Corporate clients pay premium rates for Supreme Court representation. And AOR scarcity, only 3,789 nationwide maintain high fee rates without competitive price pressure.

Why Advocate on Records Earn 2-3x More Salary Than High Court Practitioners

The income multiple comes from structural advantages.

First, matter complexity: Supreme Court cases involve constitutional questions, cross-jurisdictional issues, and high commercial stakes. Clients understand they’re getting apex court expertise and pay accordingly.

Second, client quality: Supreme Court clients are typically corporates, high net worth individuals, or complex litigation funders with larger budgets than average High Court litigants.

Third, geographic advantage: The Supreme Court has pan-India jurisdiction, giving AORs a national client base. High Court practitioners are limited to their state, capping client pool size.

Fourth, exclusivity: The AOR exam barrier limits supply, maintaining fee rates. High Court practice has no similar barrier; any enrolled advocate can practice, creating price competition.

Advocate on Record Salary vs. Non-Advocate on Record Supreme Court Advocates

Even non-AOR advocates who practice regularly in the Supreme Court earn significantly less than AORs. They might brief cases, argue as senior counsel, and be highly skilled, but without an AOR qualification, they miss filing fees and vakalatnama charges. Their income is limited to appearance fees and brief fees paid by AORs.

A non-AOR senior advocate appearing regularly in the Supreme Court might earn around ₹60-90 lakh annually, but less than similarly experienced AORs who may earn around ₹1.2 crore. The filing rights are that valuable. Some non-AOR seniors deliberately choose not to pursue an AOR qualification because they prefer focusing purely on advocacy rather than case management, but they sacrifice significant income in that choice.

Independent Advocate on Record Practice vs. Corporate Law Firm Salary

This comparison is interesting because it contrasts entrepreneurial legal practice (independent AOR) with salaried legal employment (law firm). Both paths can be lucrative, but the income dynamics and risk profiles are completely different.

In-House Counsel Salary Comparison

Corporate in-house counsel in India earn fixed salaries ranging from ₹18-35 lakh annually for mid-level positions (10 years of experience). These are stable, predictable salaries with benefits, bonuses, and job security. However, income growth is capped by corporate salary structures and promotion timelines.

An independent AOR at similar experience levels earns a variable income of roughly ₹50 lakh annually (mid-career) to approximately ₹1.2 crore (senior). The income is less predictable, bad months happen, but the upside is unlimited. You’re not constrained by salary bands or promotion cycles. If you double your case volume or client quality, your income doubles immediately.

Law Firm Partner vs. Established Advocate on Record Practice Salary

Law firm partners in top tier Indian firms (Tier 1) earn ₹50 lakh-5 crore annually, while Tier 2-3 firm partners earn around ₹40 lakh-1.5 crore. These are impressive numbers, but the partnership track takes 10+ years, involves intense political navigation, and requires significant business development. Partners also face overhead sharing, associate salaries, and firm expenses reducing take-home income.

Established AORs (15+ years) with strong independent practices earn around ₹1.2 crore annually with much lower overhead. You might have 1-2 juniors rather than a large team, no expensive office space requirements, and you keep 100% of fee income rather than sharing with partners. The trade off is that you have no institutional brand or marketing support; you build your practice entirely on personal reputation.

Common Mistakes That Limit an Advocate on Record Salary Potential

Let me share the mistakes I see new and mid career AORs make that directly limit their income growth. These aren’t about legal skills; most AORs are technically competent. These mistakes are about business strategy, pricing psychology, and professional positioning. Avoiding these mistakes can increase your income by approximately 30-50% without working more hours.

Underpricing Your Services as a New Advocate on Record

The biggest mistake new AORs make is charging too little because they’re nervous about losing clients to more established AORs.

You think, “I’m new, I should charge less to be competitive.”

This is backward thinking. You’re one of 3,789 AORs in a country of 1.4 billion people and 15 lakh+ advocates. You’re not competing on price; you’re providing a scarce, specialized service.

Clients who choose AORs purely on the lowest price are exactly the clients you don’t want; they’ll be difficult, won’t value your work, and will dispute fees. When you charge ₹15,000 for drafting instead of ₹20,000, you’re not just losing ₹10,000 per case; you’re signaling low confidence in your abilities. Charge fair market rates from day one: ₹20,000-25,000 for drafting, ₹30,000 to 50,000 for appearances and ₹10,000-15,000 for filing.

Underpricing also makes scaling impossible. If you charge around ₹15,000 per draft, you need 40 drafts monthly to earn around ₹6 lakh monthly. That’s an unsustainable workload. If you charge around ₹25,000, you need only 24 drafts for the same income, much more manageable quality of work. Your pricing directly determines your quality of life and income ceiling.

Failing to Network and Build Referral Relationships

AOR practice runs on referrals, from other AORs, from High Court seniors, from corporate legal teams, from satisfied clients. If you’re waiting for clients to find you through random searches, you’ll struggle to build case volume. You need to actively network, and most new AORs don’t invest nearly enough time in this.

Attend Supreme Court Bar Association events. Introduce yourself to other AORs whose work you respect. Reach out to High Court seniors in your city who handle appellate work, and offer to draft their Supreme Court petitions at reasonable rates. Connect with corporate legal heads on LinkedIn. Write articles about Supreme Court practice and share them in legal communities. These networking activities feel like they’re not generating immediate income, but they’re building the referral relationships that will sustain your practice for decades.

I know AORs who spent their first year deliberately taking lower fees to build relationships with 5 to 6 senior High Court advocates who now send them 20-30 matters annually each. That early relationship investment now generates ₹40-60 lakh annually in referral income. Meanwhile, technically better AORs who didn’t network are struggling with inconsistent case flow.

Not Specializing in High Value Practice Areas

Trying to be a generalist AOR who handles everything, civil, criminal, tax, corporate, and constitutional, seems like a smart strategy to maximize case opportunities. In reality, it limits your income because you’re never the best choice for any specific matter type. Clients pay premium fees to specialists, not generalists.

Decide within your first 2-3 years whether you’re focusing on constitutional law, corporate/tax, or civil/criminal practice. Then build deep expertise in that area. Read every Supreme Court judgment in your specialization. Write about it. Speak about it. Become the AOR people think of when they have that specific type of matter. Your fees will increase dramatically when you’re known as “the constitutional law AOR” or “the tax specialist” rather than just “an AOR.”

Specialization also improves efficiency. When you handle similar cases repeatedly, your drafting is faster, your court arguments are sharper, and you spot winning strategies quickly. You can handle more cases in less time while charging higher fees, the ideal combination for income maximization.

Conclusion

The AOR salary landscape in India offers one of the most attractive income trajectories in legal practice. Starting from approximately ₹12-20 lakh in your first years, you can realistically build to roughly ₹30-50 lakh by mid-career and cross around ₹1 crore annually as a senior practitioner with the right strategy, specialization, and client relationships.

What makes AOR income unique is the multiple revenue streams, filing fees, drafting charges, appearance fees, retainers, consultations, and empanelment income. Each stream compounds with experience, and together they create a robust income even if one stream temporarily slows down. Your exclusive filing rights provide structural income advantages that no other legal qualification offers.

Geography matters, but virtual hearings have reduced location disadvantages significantly. Whether you’re full time Delhi-based or part time from another city, substantial AOR income is achievable. Your career stage, practice area focus, and client type matter more than location for long-term income potential.

The mistakes to avoid are clear: underpricing, insufficient networking, and lack of specialization. The strategies that work are equally clear: charge fair market rates from day one, invest heavily in referral relationships, and specialize in high value practice areas. Your AOR income is ultimately determined by the strategic choices you make about positioning, pricing, and professional development.

If you’re considering an AOR qualification, the financial case is compelling. The exam is challenging, the qualification requires dedication, but the income transformation justifies the investment many times over.

Frequently Asked Questions

How much does an Advocate on Record earn per case in India?

An AOR typically earns approximately ₹60,000-90,000 per case, including drafting, filing, and first appearance. This breaks down into ₹20,000-25,000 for drafting, ₹10,000-15,000 for filing and vakalatnama signing, and ₹30,000-50,000 per appearance. Complex cases can generate ₹1-2 lakh total through multiple hearings and premium rates.

What is the average monthly Advocate on Record salary for a new Advocate on Record?

A new AOR approximately earns ₹75k to 1 lakh monthly in the first year while building practice, scaling to roughly ₹1.5-2 lakh monthly by year two.

Can Advocate on Records earn a salary of ₹1 crore annually?

Yes, absolutely. Senior AORs with 15+ years of practice regularly earn around ₹1.2 crore annually. This requires corporate clients, retainer arrangements, specialization in high-value practice areas (constitutional, corporate, tax), and strong referral networks.

How much does the Advocate on Record charge for filing a petition in the Supreme Court?

AORs charge ₹₹10,000-15,000 for standard petition filing and vakalatnama signing as new practitioners. Depending on your experience, the fees can increase to approximately ₹50,000-1 lakh for filing complex matters. This is separate from drafting fees, which are charged additionally if you’re preparing the petition.

What are the Advocate on Record appearance fees in 2025?

Current appearance fees range from ₹30,000-50,000 for new AORs, ₹50,000-80,000 for mid-career practitioners, and ₹1.5 lakh+ for senior AORs with 15+ years. Complex constitutional or corporate matters command ₹2 lakh+ per appearance from top-tier AORs. Virtual hearing fees would be approximately 15-20% lower than physical appearances.

Is it possible to practice as an Advocate on Record without relocating to Delhi?

Yes, many AORs practice successfully from outside Delhi through part-time SC work. Virtual hearings make this easier.

How much additional Advocate on Record salary can I earn from Supreme Court Advocate on Record work alongside High Court practice?

A non-Delhi AOR can assume to earn ₹10+ lakh annually from Supreme Court work in their first 5 years while maintaining your High Court practice. This dual-practice model generates anywhere between ₹25 to 40 lakh total annual income.

What is the Advocate on Record salary difference between a 5-year Advocate on Record and a 15-year Advocate on Record?

A 5-year AOR typically earns ₹12-20 lakh annually. A 15-year senior AOR earns ₹1 crore + annually, depending on practice area and client quality.

Do corporate clients pay more salary to Advocate on Records than individual litigants?

Yes, significantly. Corporate clients pay roughly ₹75,000-2.5 lakh per petition versus ₹25,000-60,000 from individual litigants. Corporates also offer annual retainers (₹25,000 per month to ₹5 lakh per year), pay on time, and don’t negotiate fees extensively. They value reliability and expertise over price, making corporate practice more lucrative than individual-client-focused practice.

How does Advocate on Record salary compare to High Court senior advocate?

AORs earn almost 2x more than High Court seniors at similar experience levels. A senior High Court advocate with 10-15 years of practice typically earns roughly ₹30-75 lakh annually, depending on the city and practice area. A similarly experienced AOR earns ₹88 lakh-1.2 crore annually.

What is the fastest way to increase your Advocate on Record salary?

Specialize in high-value practice areas (constitutional, corporate, tax), build strong referral networks with High Court seniors and other AORs, secure 1-2 corporate retainer clients, charge market rates confidently from day one, and leverage virtual hearings to expand geographic client base without relocation costs.

Allow notifications

Allow notifications