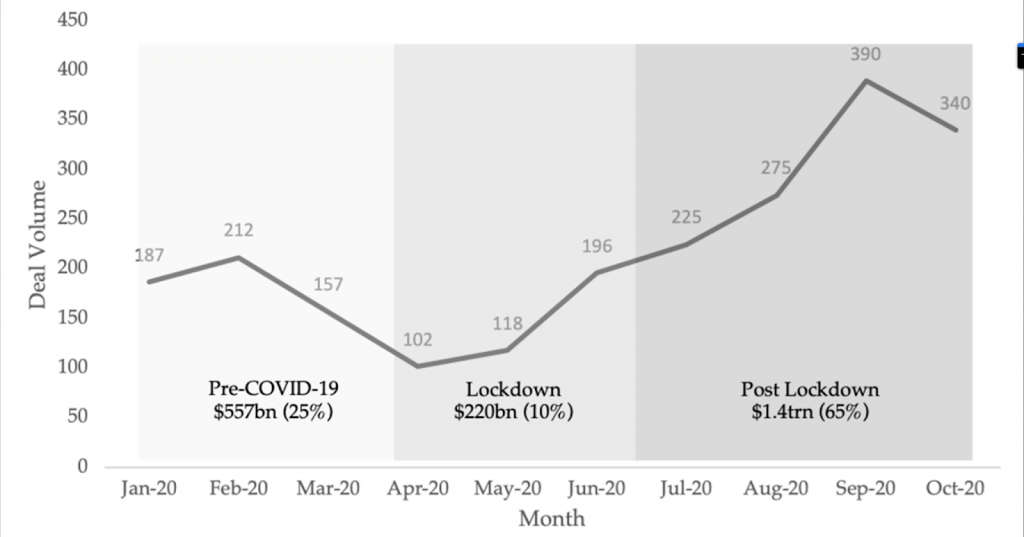

For many industries, the pandemic was like a death sentence. Everything closed and changed, and many companies could not adapt to the new normal. Many businesses failed to survive while the most agile companies benefited from the changes and thrived.

Many experts expected investments and M&A to slow down post-pandemic and given that a recession in the US may be looming, but the reality played out very differently.

Even if a business fails, or makes chronic losses, it does not make it completely useless. Often, such a business still retains resources and value chains that can be very useful to a fast-growing competitor or even a business in a different industry.

So while the business world was going through massive turbulence, merger and acquisitions activities reached a historical peak!

In other words, many businesses have chosen the path of mergers and acquisitions (M&A) as the best way to survive and emerge from the troughs of the pandemic.

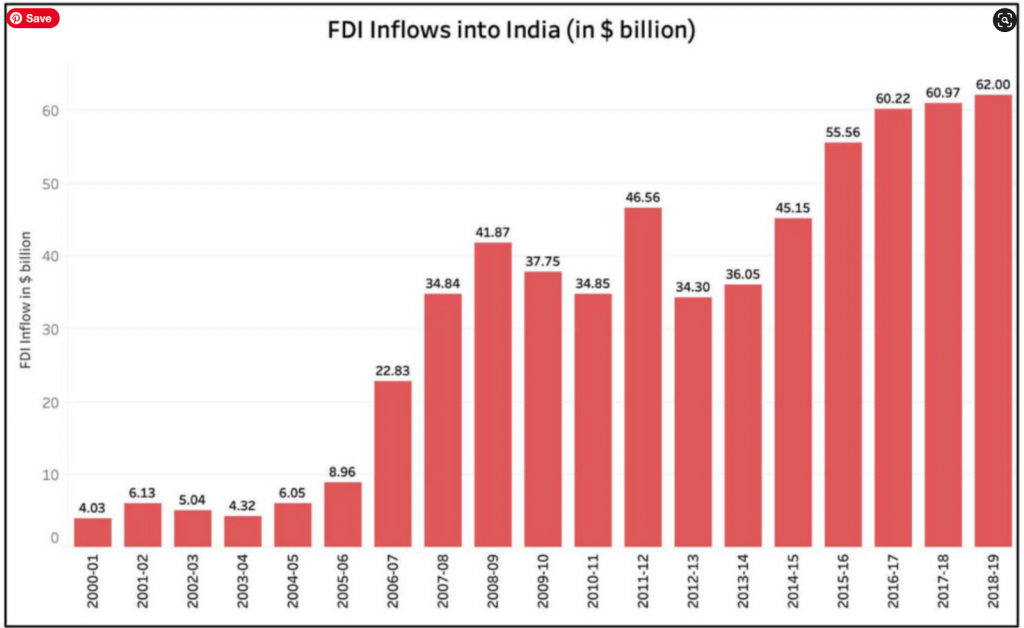

By the way, the Government announced recently that India is expecting USD 100 billion FDI into the country in the current financial year. This is incredible, given that in the recent past we felt good even if we attracted half of that!

While this graph shows the growth of FDI inflow into India over the years, you can also think of this as a graph that shows an increase in demand for investment and M&A lawyers.

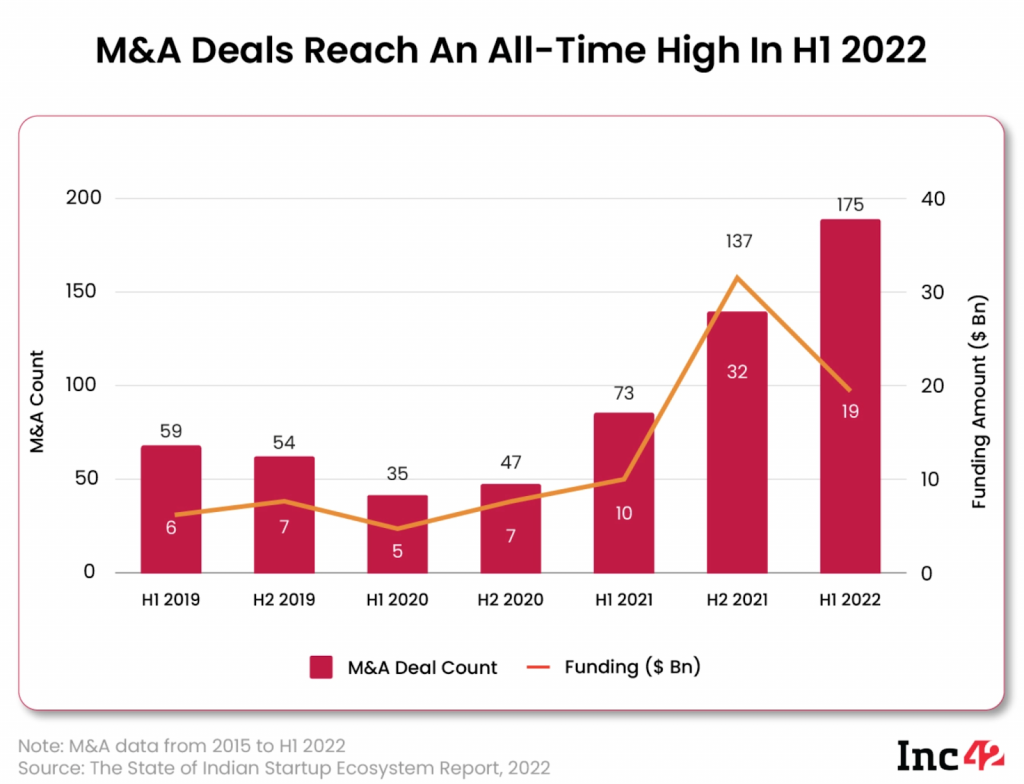

Ok, let’s look at M&A specifically.

Does this mean we now need more M&A lawyers to handle so many deals happening?

Absolutely.

Because none of this can happen without them.

This graph tells you that demand for M&A lawyers has been steadily growing. And if you believe that India’s economy will continue to grow, you come to the inevitable conclusion that demand for M&A and investment lawyers will continue to grow like this too!

What do these graphs mean for current M&A lawyers and investment lawyers?

- They are overworked

- They are expecting a lot more work ahead

- They are hiring

This reflects in stories like these:

Which is why this has become the best time to look at M&A and investment law as a highly lucrative and satisfying career prospect, and that is what our forthcoming bootcamp is all about, because no M&A activity, large or small, can be performed without M&A lawyers.

Alright, my goal is to give you some perspective before the bootcamp, so let’s do a deep dive.

As I was saying, 2021 saw a huge worldwide rise in merger, acquisition, and investment activities in comparison to pre-pandemic years, with North America taking the lead, followed by the Asia-Pacific region and Europe. An increased focus on cross-border deal making was also noted. And India Inc wasn’t far behind either, as we can see.

The Indian scenario

M&A activity in India hit a four-year high at USD 30.3 billion during January-March 2022, defying the global trend where deal-making fell compared to 2021, says a report by Refinitiv. As a Business Standard report says, “Deal activity grew by 5.6 percent year-on-year in value terms in Q1CY22, making it the highest first-quarter period since 2018, when it was $31.1 billion.”

In a December 2021 report titled ‘India M&A: Acquiring to Transform’, authors Karan Singh and Vikram Chandrashekhar, partners at the US management consultancy Bain & Company, have shown how the business disruption caused by Covid is driving Indian firms to transform their businesses through M&A, and asset sales. They claim that Indian M&A activity is nearing an all-time high, driven mostly by first-time buyers.

To quote directly from the report, “More companies are doing more deals than ever before. M&A volume is near its highest level ever (considering deals >$75 million), and M&A deals are more broad-based than ever – with more mid-sized deals, rather than the $5 billion-plus mega deals that drove activity in 2017–2019.”

The report also highlights an aspect I touched upon briefly above – more M&A activity is now focused on transformation rather than scale. Basically, this is what the industry calls ‘scope deals’, or acquisitions outside a company’s core business. “Scope and capability deals now account for four out of 10 transactions, often addressing disruptive themes, such as digital or renewables,” the report says. Acquisitions by leading digital firms have also increased significantly, adding to M&A deals.

Digital insurgents, or large, relatively new, disruptive digital players, are now buying to build scale rapidly, enter new geographies, newer areas of business, and deliver an omni-channel experience to customers.

The rapidly changing nature of M&A in India has thus drawn government intervention and increased regulatory scrutiny, so that larger entities cannot take control of smaller ones on unfair terms.

As early as July 2020, a McKinsey report had indicated that M&A would be crucial to India’s post-pandemic economic recovery, claiming that historically, too, “companies that pursued acquisitions and divestitures in a structured way tended to outperform their peers”.

As proof, the report cited the Asian financial crisis of 1997, the dot-com bubble of 2000, and the global financial crisis of 2008–09, and stated that companies that pursued acquisitions and divestiture performed significantly better than those that were “either too conservative or relied on one megadeal to recover”.

Post-pandemic importance of M&A – new trends

The pandemic saw a lot of restructuring of business models with a movement towards digitisation, and this had a game-changing influence on the way business transactions were conducted. Traditional in-person M&A deal processes became technology enabled, with parties having meetings and conducting business online. This made the process smoother and quicker.

Despite Covid’s shadow still looming, 2021 marked a record year for the M&A sector, generating more than USD 5 trillion in global volume – shattering previous records and signalling a remarkable turnaround from 2020, according to a report by Morgan Stanley, which you can read in full here.

With the way the pandemic impacted trade and business, it would not be unreasonable for companies to look outside their industry for M&A opportunities. As a result, different buyer attitudes came to the surface; private equity buyers showed more willingness to focus on growth, and pay higher multiples for it, while strategic buyers appear to have become more proactive in their M&A approach and aggressive in their valuations.

Evaluating the impact of the pandemic and management’s response to the initial shutdowns became important in anticipating how a target business would emerge from the pandemic. Private equity firms began spending more time investing in companies that are projected to grow significantly in the coming years.

These concerns changed the scope of M&A to include realignment, where businesses would rather focus on what performed well during the pandemic, and eliminate those that did not and are therefore unlikely to recover. Which brings us to another supporting M&A trend – divestiture, where companies saw the benefit of selling business units, in full or in part.

In the post-Covid world, M&A activity has undergone a change, and found a favourable environment in the form of positive government intervention, a visibly buyout stock market, and a relatively stable banking system.

Further, the massive need for domestic consolidation, especially in the Covid-hit sectors, and plenty of outbound investment opportunities for cash-rich Indian players, are positive factors for the M&A ecosystem.

Granted, 2022 has not been yet another record year. Rather, challenges such as rapidly accelerating inflation and interest rates, lower stock prices, and the deepening energy crisis caused by the Russia–Ukraine conflict have come to the surface, as this report by PwC shows.

Despite these challenges, the report claims, M&A will continue to play “an increasingly important role in corporate strategies – and there might even be better opportunities for investors to generate healthy returns in today’s environment, as valuations come down”.

In fact, the report quotes Brian Levy, Global Deals Industries Leader, PwC US as saying, “Now is not the time to sit on the sidelines, but to reassess – even reset – M&A strategy. I expect to look back at 2022 to find the successful dealmakers of tomorrow who will be defined as those who boldly execute on their M&A goals today and overcome the current market challenges.”

Shouldn’t you be part of this trend?

According to the global 2022 M&A Trends Survey by Deloitte, 92 percent of respondents expect deal volume to increase or stay the same over the next 12 months, while 54 percent of deal makers think the tightening regulatory environment will encourage more deal activity, as companies race to beat the implementation of more stringent regulations.

Whether you look at the domestic or international market, the pandemic period has been one of the most productive for the M&A sector. Tesla Inc chief Elon Musk acquired micro-blogging site Twitter for about USD 44 billion, while in India, aggressive M&A activity led to such mergers as PVR-Inox, HDFC-HDFC Bank, Larsen & Toubro Infotech and Mindtree, while the Adani Group is paying USD 6.4 billion to acquire Switzerland-based Holcim’s 63.1 percent stake in Ambuja Cements Ltd and 54.5 percent holding in ACC Ltd.

Can you imagine yourself as part of these headline-grabbing deals?

Can you see yourself and a team of fellow M&A and investment lawyers deciding operational and financial policies, negotiating transaction agreements, and offering advice on strategies and risks?

Do you realise how high the remuneration can be given these high deal values?

Join our Diploma Course in M&A, Institutional Finance and Investment Laws (PE and VC transactions).

We will be showing you how you can take the opportunity that the pandemic has created, and chart out a career that will place you among the movers and shakers of both Indian and global businesses.

For more useful updates on this and other subjects, please also join our Telegram channel.

Allow notifications

Allow notifications